- Home

- »

- Biotechnology

- »

-

Gene Amplification Technologies Market Size Report, 2030GVR Report cover

![Gene Amplification Technologies Market Size, Share & Trends Report]()

Gene Amplification Technologies Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology, By Downstream Applications, By Sample Type, By Product, By End Use, By Region, And Segment Forecast

- Report ID: GVR-4-68039-570-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gene Amplification Technologies Market Summary

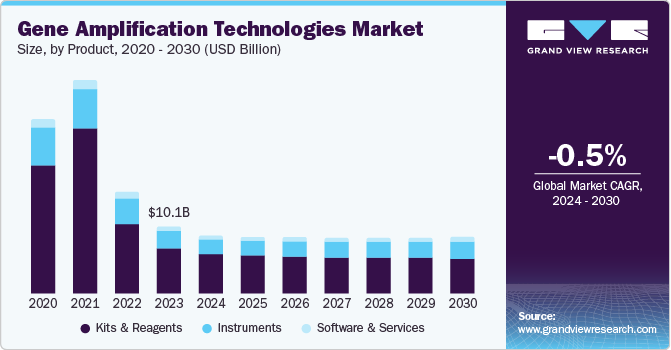

The global gene amplification technology market size was valued at USD 10.13 billion in 2023 and is projected to reach USD 8.63 billion by 2030, declining at a CAGR of -0.5% from 2024 to 2030. The increasing demand for research and development in molecular diagnostics, genomics, biological research, and genetic testing is a major driver of market expansion.

Key Market Trends & Insights

- North America dominated the gene amplification technologies market in 2023.

- The gene amplification technologies market in the U.S. dominated the market with a share of 84.2% in 2023.

- By application, the diagnostics and pharmaceutical segment captures the largest revenue share of 72.7% in 2023.

- By sample type, the cell lines segment held the largest revenue share of 39.8% in 2023.

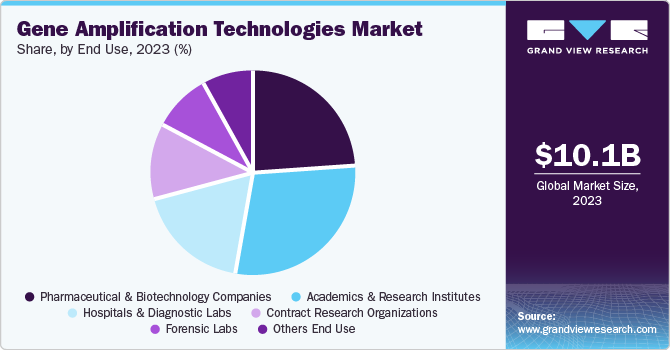

- By end use, the Academic and Research Institutes segment captured the largest revenue share of 26.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.13 Billion

- 2030 Projected Market Size: USD 8.63 Billion

- CAGR (2024-2030): -0.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The continued creation of multiple diagnostic tests utilizing different gene amplification techniques for COVID-19 has additionally boosted the market.

The market is significantly driven by the rapidly growing field of advanced DNA replication technologies. Due to advancements in technology in loop-mediated amplification, alternatives such as Nucleic Acid Sequence Based Amplification (NASBA), Rolling Circle Amplification (RCA), and Loop-Mediated Isothermal Amplification (LAMP) have been thoroughly researched.

These methods are gaining more popularity as they require no expensive thermal cyclers, have fast amplification rates, and can easily multiply from a single cell. These factors are anticipated to boost the utilization of products available in this market and in turn enhance the natural revenue generation.Product Insights

The kits and reagents segment accounted for the largest revenue share of 68.1% in 2023. The segment growth is anticipated to be boosted during the forecast period by the increasing demand for kits and reagents in molecular diagnostics and genomics research, along with a multitude of companies providing a variety of kits, media, and reagents. Due to the extensive use of PCR-based amplification, numerous companies provide PCR instruments. Due to the rising use of gene amplification technologies, companies in the market are concentrating on launching innovative new products in this sector.

Software & services is expected to register the fastest CAGR of 2.2% during the forecast period. The gene amplification technologies software & services sector is expected to grow further due to the growing complexity of gene amplification techniques, higher need for personalized medicine, improvements in bioinformatics and cloud computing, and regulatory mandates. Advanced gene amplification methods such as next-generation sequencing (NGS) produce large volumes of data that necessitate complex software for analysis and understanding. Effective software solutions are vital for the management and organization of extensive datasets, guaranteeing data integrity and accessibility.

Technology Insights

The Polymerase Chain Reaction (PCR)-bases amplification segment accounted for the largest share of 72.0% in 2023. The widespread utilization of PCR technology in various end-use applications is responsible for this. In addition, various technological challenges associated to PCR technology have encouraged the advancement and adoption of alternative technologies such as Loop-Mediated Isothermal Amplification (LAMP) and Multiple Displacement Amplification. Eiken Chemical Co., Ltd. and HiberGene Diagnostics are among the companies that have developed new tests for identifying the SARS-CoV-2 virus, utilizing LAMP technology.

Nucleic Acid Sequence Based Amplification is projected to grow at the fastest CAGR of 1.4% over the forecast period due to its high sensitivity and specificity, possibility of work at a constant temperature, flexibility of the technique, short time to complete the reaction, compatibility with robotic systems and new areas of usage. Nucleic Acid Sequence Based Amplification provides high sensitivity and specificity that allows using this technique for identification of low concentrations of target nucleic acids in different samples. These characteristics make Nucleic Acid Sequence Based Amplification particularly suitable for such applications as, for instance, the detection of infectious diseases, genetic testing, or cancer.

Application Insights

The Diagnostics and Pharmaceutical segment captures the largest revenue share of 72.7% in 2023. This is due to diagnostic tests for genetic diseases and disorders often utilize gene amplification techniques. These technologies are also used in the early identification and management of patients by assisting in early recognition of cancer and other conditions. Moreover, the increasing need for personalized care and specific medications is also contributing to the revenue increase in this sector.

The forensic and paternity testing segment is expected to register the fastest CAGR of 2.1% during the forecast period due to improved precision and sensitivity, broadening use cases, technological progress, growing crime levels, legal and regulatory demands, and government funding. Technological advancements have resulted in the creation of more compact gene amplification tools, facilitating the ability to perform tests at crime scenes or in distant areas. This allows for quick analysis at the location, speeding up investigations and enhancing the effectiveness of law enforcement.

Sample Type Insights

The cell lines segment held the largest revenue share of 39.8% in 2023. This can be attributed to the wide availability of products for amplification using cell line samples. These kits are available at low prices and are easy to use, thereby increasing their usage in the market. The development of more robust and reliable cell lines has expanded their applications in gene amplification research and diagnostics. These advancements have led to increased efficiency and reproducibility in experiments, driving the growth of the cell lines segment.

Agricultural & food sample is projected to grow at the fastest CAGR over the forecast period. Gene amplification techniques are used for genetic modification and analysis in agricultural biotechnology, leading to the development of crops with improved traits such as yield, resistance to pests and diseases, and nutritional value. The growing adoption of agricultural biotechnology is driving the demand for gene amplification technologies in this sector.

End Use Insights

The Academic and Research Institutes segment captured the largest revenue share of 26.8% in 2023. Academic and research institutions lead in essential research, advancing gene amplification technologies and their uses. These organizations are essential for progressing scientific knowledge and comprehension, aiding in the general growth of the discipline. Educational institutions have the duty of teaching and preparing future scientists and researchers in gene amplification technologies. Investing in education is leading to the development of a talented workforce, which is fueling advancement and expansion in the market.

The forensic labs segment is projected to grow at the second largest revenue share of 24.9% in 2023. DNA evidence is becoming more widely acknowledged as an effective tool for resolving crimes, offering robust and dependable evidence in legal proceedings. This growing dependence is fueling the need for forensic labs and their services, leading to the expansion of the sector. Governments are dedicating resources to improve forensic science infrastructure and provide training to strengthen law enforcement agencies' capacities. This investment is fueling the expansion of forensic labs by boosting demand and easing the uptake of new technologies.

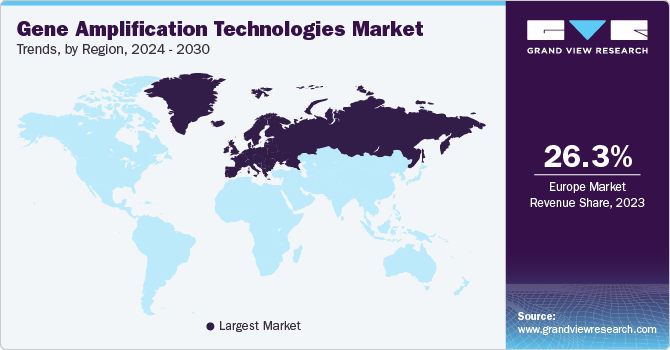

Regional Insights

North America dominated the gene amplification technologies market in 2023. The increasing need for gene amplification technologies in this area can be attributed to its hosting of some of the largest biotechnology and pharmaceutical companies globally. Also, another contributing factor to the growth of market revenue in this region is the support of government programs that aid in biotechnology Research & Development (R&D). Additionally, the region is anticipated to experience growth in market revenue due to substantial investments in genomics research and the demand for personalized treatment options.

U.S. Gene Amplification Technologies Market Trends

The Gene Amplification Technologies market in the U.S. dominated the market share with a share of 84.2% in 2023 due to the increasing popularity of molecular diagnostics for cancer presence of major market players and highly developed healthcare infrastructure in this region. The U.S. government's growing financial support for medical research and infrastructure is expected to drive the growth of the gene amplification technologies market in the country, leading to significant advancements in genomics within the healthcare sector.

Europe Gene Amplification Technologies Market Trends

Europe Gene Amplification Technologies market in the Europe dominated the market share with share of 26.3% in 2023 due to the abundance of leading manufacturers of gene amplification technologies. Furthermore, the market revenue growth of this region is anticipated to be boosted by government programs backing biotechnology R&D and increasing demand for personalized treatment in the upcoming forecast period.

UK Gene Amplification Technologies market is expected to grow rapidly in the coming years due to rapid evolution of DNA sequencing technologies in the recent years. The research and development or in other words the scientific study conducted in the UK has been remarkable and impressive due to presence of many universities and research centers of world class. The UK government offer a massive support for research and development across different fields such as the life sciences and biotechnology. The NHS is one of the most extensive and oldest healthcare systems globally, and for that reason, the healthcare requirement for diagnostic tools and technology is high.

Asia Pacific Gene Amplification Technologies Market Trends

Asia Pacific is anticipated to experience rapid growth during the forecast period due to supportive government efforts to enhance healthcare infrastructure. Growing research in genomics and molecular diagnostics, along with the abundant skilled workforce, have contributed to market expansion in developing countries such as China and India. In addition, the growth of market revenue in this region is anticipated to be driven by higher investments in R&D and healthcare infrastructure, as well as the increasing availability of skilled labor and affordable manufacturing options in countries such as China and India.

China Gene Amplification Technologies marketheld a substantial market share in 2023. There is an anticipated increase in the demand for whole genome amplification in China during the expected timeframe. The rise of the industry is due to the higher occurrence of different illnesses and the increasing demand for genetic research in the nation. The government in China is expected to increase the need for whole genome amplification through the implementation of beneficial healthcare projects.

Key Gene Amplification Technologies Company Insights

Some key companies in the gene amplification technologies market include QIAGEN, New England Biolabs, Illumina Inc, and others. The operating entities are taking different strategic measures such as mergers & acquisitions, licensing, and partnerships to improve their market position. In the last few years, there have been significant mergers and acquisitions in the market.

-

Illumina, Inc. creates, produces, and sells comprehensive systems for analyzing genetic differences and biological processes on a large scale. The Company offers an extensive range of products and services catering to sequencing, genotyping, and gene expression markets for genomic research centers, pharmaceutical companies, academic institutions, and biotechnology companies.

-

4basebio functions as a biotechnology company. The Company creates gene therapy technologies and solutions. 4basebio specializes in researching and advancing nanoparticles for delivering nucleic acids without using viruses.

Key Gene Amplification Technologies Companies:

The following are the leading companies in the gene amplification technologies market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- New England Biolabs

- Illumina Inc.

- Yikang Gene

- Bio-Rad Laboratories

- Silicon Biosystems

- Merck KGaA

- Promega Corporation

- Takara Bio Inc.

- Danaher Corporation

- 4basebio AG

- LGC Group

- Vazyme Biotech Co. Ltd.

- MyBioSource

Recent Developments

-

In June 2024, Bio-Rad Laboratories, Inc. has introduced the ddSEQTM Single-Cell 3' RNA-Seq Kit and Omnition v1.1 analysis software for single-cell transcriptome and gene expression research.

-

In April 2024, Takara Bio USA, Inc., has introduced the Shasta Single-Cell System . This system is an automated NGS solution that is high-throughput, with validated chemistries and user-friendly bioinformatics tools. It allows for the discovery of new biomarkers for oncology research.

Gene Amplification Technologies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.87 billion

Revenue forecast in 2030

USD 8.63 billion

Growth Rate

CAGR of -0.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment coverage

Technology, application, sample type, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Denmark, Sweden, Norway, China, India, Australia, Japan, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Companies profiled

QIAGEN; New England Biolabs; Illumina Inc.; Yikang Gene; Bio-Rad Laboratories, Inc.; Menarini Silicon Biosystems; Merck KGaA; Promega Corporation; Takara Bio Inc.; Danaher Corporation; 4basebio; LGC Limited; Vazyme Biotech Co. Ltd.; MyBioSource.com.

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gene Amplification Technologies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gene amplification technologies market report based on technology, downstream application, sample type, product, end use and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR-based Amplification

-

Loop-mediated Isothermal Amplification

-

Nucleic-Acid Sequence Based Amplification

-

Strand Displacement Amplification

-

Multiple Displacement Amplification

-

Rolling Circle Amplification

-

Ramification Amplification

-

Others Technology

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics and pharmaceutical

-

Forensic and paternity testing

-

Agricultural and food safety

-

Others Application

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Lines

-

Agricultural & Food Samples

-

Body Fluids

-

Tissue

-

Others Sample Type

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Kits and Reagents

-

Software & Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academics & Research Institutes

-

Hospitals & Diagnostic Labs

-

Contract Research Organizations

-

Forensic Labs

-

Others End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Japan

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East Africa(MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.