- Home

- »

- Organic Chemicals

- »

-

Gelatin Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Gelatin Market Size, Share & Trends Report]()

Gelatin Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Bovine, Porcine, Poultry, Marine, Others), By Application, By Function (Stabilizer, Thickener, Gelling Agent, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-110-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gelatin Market Summary

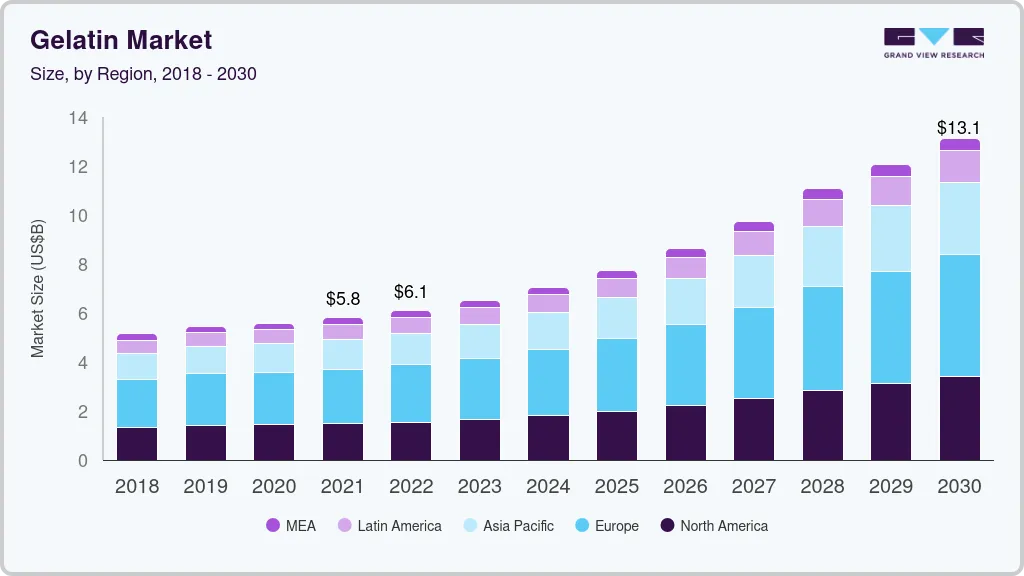

The gelatin market size was valued at USD 7.05 billion in 2024 and is projected to reach USD 13.14 billion by 2030, growing at a CAGR of 11.1% from 2025 to 2030. The gelatin market is on a robust growth trajectory, driven by its diverse applications across pharmaceuticals, nutraceuticals, and the food industry, expansion in cosmetics and personal care, coupled with shifting consumer preferences and the influence of social media.

Key Market Trends & Insights

- Europe dominated the market with the highest revenue share of 38.3% in 2024.

- The Germany is growing steadily, driven by strong demand across food, pharmaceutical, and wellness sectors.

- In terms of source, bovine sourced gelatin segment accounted for the largest market revenue share of 35.1% in 2024.

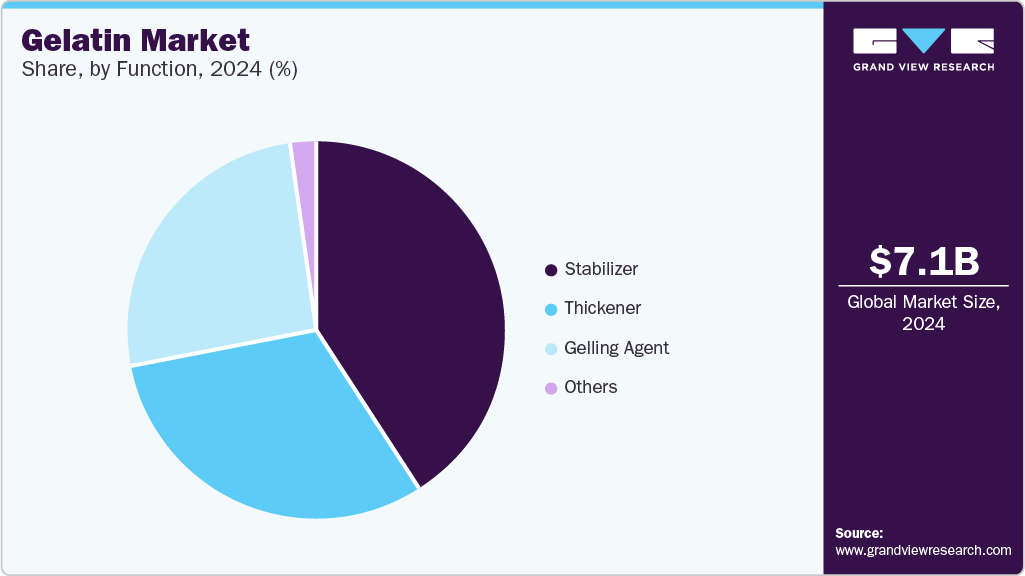

- In terms of function, the stabilizer application segment dominated the gelatin industry in 2024.

- In terms of application, the food & beverages (F&B) segment held the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.05 Billion

- 2030 Projected Market Size: USD 13.14 Billion

- CAGR (2025-2030): 11.1%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The global gelatin market is experiencing significant growth, driven by several key trends and opportunities. The growing consumer demand for transparency and natural ingredients has significantly increased the use of gelatin in food and beverage products. Gelatin, derived from natural animal sources, serves as a clean-label gelling and thickening agent, aligning with the clean-label movement that favors products free from artificial additives and preservatives. This trend is driven by consumers' preference for simpler, more natural formulations and has led manufacturers to incorporate gelatin to meet these expectations.

Gelatin prices are influenced by the cost of raw materials, primarily sourced from slaughterhouses, and vary by region. The increasing demand from sectors like food & beverages and healthcare is driving a moderate rise in raw material costs. To meet this demand, new application facilities are being established in countries such as the U.S. and India. Improvements in supply chain management and increased application capacities are expected to stabilize gelatin prices in the near future.

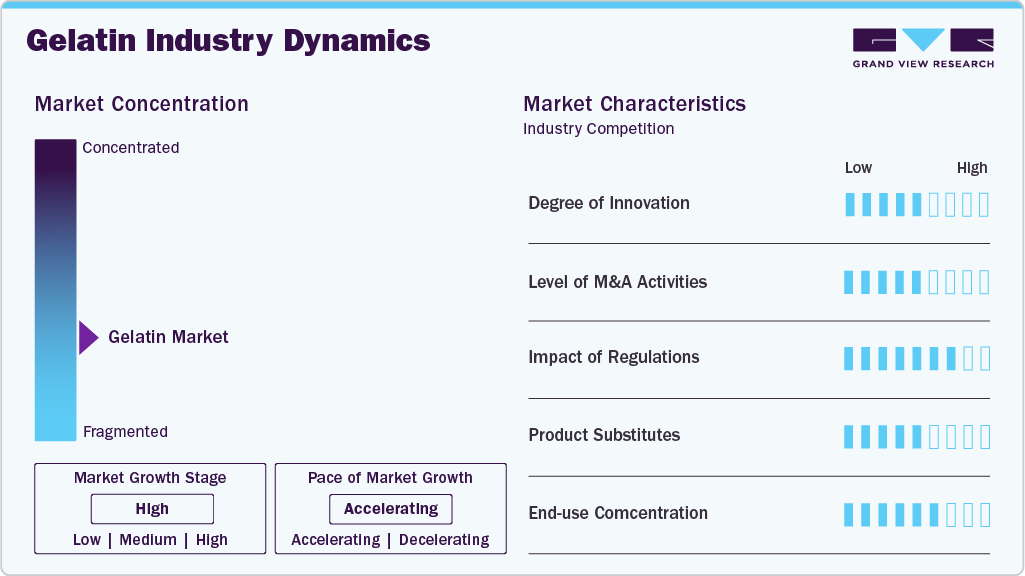

Market Concentration & Characteristics

The gelatin market growth is high and the market growth is accelerating. The market is characterized by a moderate degree of innovation, driven by a combination of health-conscious consumer behavior, technological advancements in production, and a shift towards ethical and sustainable practices. These drivers are reshaping the industry, leading to the development of new products and production methods that align with evolving consumer preferences and global sustainability goals.

The gelatin market is experiencing a moderate to high level of mergers and acquisitions (M&A) activity, indicating a strategic consolidation trend among key industry players, driven by market expansion, product portfolio diversification, and technological advancements. These strategic mergers and acquisitions are reshaping the gelatin market, enabling companies to enhance their capabilities, expand their market reach, and meet the evolving demands of consumers. For instance, in August 2024, Zydus Lifesciences acquired a 50% stake in Sterling Biotech from Perfect Day Inc., forming a 50:50 joint venture. This collaboration aims to transition Sterling Biotech's focus towards producing fermented, animal-free proteins, catering to the growing demand for sustainable and ethically sourced nutrition.

The degree of product substitution in the gelatin market is high, driven by increasing consumer demand for plant-based, ethical, and clean-label alternatives to traditional animal-derived gelatin. As more individuals adopt vegan and vegetarian lifestyles, the demand for animal-free gelling agents has surged. Plant-based substitutes such as agar-agar, pectin, and carrageenan offer similar gelling, thickening, and stabilizing properties, making them ideal for a wide range of applications in the food and beverage industry.

The level of impact of regulations in the gelatin industry is high and is governed by a comprehensive set of regulations across the U.S., Europe, and globally, ensuring safety, quality, and ethical standards in its production and use. In the U.S., the Food and Drug Administration (FDA) classifies gelatin as a "Generally Recognized As Safe" (GRAS) substance for food applications, provided it meets specific purity and safety criteria. In Europe, the European Food Safety Authority (EFSA) and the European Medicines Agency (EMA) oversee the regulation of gelatin. Globally, the Codex Alimentarius Commission, a joint body of the United Nations Food and Agriculture Organization (FAO) and the World Health Organization (WHO), sets international food safety standards, including those for gelatin.

Source Insights

Bovine sourced gelatin accounted for the largest market revenue share of 35.1% in 2024. The growing utilization of bovine-based gelatin in various food and beverage applications is a significant factor contributing to its increased demand. Additionally, the global surge in the consumption of dietary supplements, driven by consumers' shifting preferences towards healthier and protein-rich diets, is expected to propel market growth further. This trend underscores the expanding role of gelatin in enhancing application offerings across multiple industries.

The marine sourced gelatin segment is expected to register the fastest CAGR over the forecast period. Fish gelatin, derived from sustainable marine byproducts, offers an eco-friendly alternative to traditional bovine and porcine gelatins, aligning with the increasing consumer demand for sustainable and ethical ingredients. Its hypoallergenic properties make it suitable for individuals with dietary restrictions, including halal, kosher, and pescatarian diets, thereby expanding its market appeal. The growing health consciousness among consumers has led to a surge in demand for collagen-rich products, as fish gelatin is recognized for supporting joint health, enhancing skin elasticity, and promoting overall wellness.

Application Insights

The Food & Beverages (F&B) segment held the largest market revenue share in 2024. The increasing global demand for a diverse range of food and beverage applications, including desserts, functional foods, functional beverages, confectionery items, and meat applications, is significantly influencing market dynamics. This surge is primarily driven by evolving consumer preferences that prioritize health-conscious choices, indulgent experiences, and culturally diverse options. Consumers are increasingly seeking foods that not only satisfy their taste buds but also contribute to their overall well-being. This has led to a rise in functional foods and beverages that offer additional health benefits beyond basic nutrition.

The healthcare application segment is expected to register significant growth during the forecast period. Gelatin is used in the healthcare industry to manufacture capsules, emulsions, syrups, and tablets. Gelatin is increasingly favored by manufacturers for capsule application due to its unique properties, including film-forming ability, thermo-reversible gelling, and adhesiveness. These characteristics enhance the stability and integrity of capsules, ensuring effective delivery of active pharmaceutical ingredients. Moreover, gelatin is approved by the U.S. Food and Drug Administration (FDA) for use in pharmaceutical and healthcare applications, underscoring its safety and efficacy in drug delivery systems.

Function Insights

The stabilizer application segment dominated the gelatin industry in 2024. Gelatin's significant market share in the food industry is primarily due to its emulsifying properties, which facilitate the stable blending of oil and water phases in various applications. Additionally, gelatin enhances the texture of foods by imparting smoothness and body, contributing to a more appealing mouthfeel. It also ensures uniform consistency throughout the application and effectively retains flavor compounds within dispersions, thereby preserving taste integrity. These functional attributes make gelatin an ideal stabilizer in applications such as ice cream, margarine, spreads, dairy items, salad dressings, and mayonnaise, where texture, stability, and flavor retention are paramount.

The gelling agent application segment is expected to register the fastest CAGR over the forecast period. The gelling agent market, with gelatin as a prominent component, is experiencing robust growth, driven by several key factors. Consumers are increasingly favoring natural ingredients, leading to a surge in demand for gelatin in food, beverages, and personal care applications. Advancements in pharmaceutical applications, such as drug encapsulation and tissue engineering, further bolster the market. Additionally, regulatory support and safety approvals enhance consumer confidence, facilitating broader adoption across various industries. Collectively, these drivers position the gelatin gelling agent market for sustained expansion in the coming years.

Regional Insights

The North America gelatin market is experiencing robust growth, driven by several key factors across various industries. The increasing consumer preference for natural and clean-label ingredients has boosted the demand for gelatin in food and beverage products, as it serves as a natural gelling and thickening agent. Additionally, the rising popularity of functional foods and nutraceuticals, particularly collagen supplements for skin and joint health, has expanded gelatin’s applications in the pharmaceutical and dietary supplement sectors.

U.S. Gelatin Market Trends

The U.S. gelatin market is experiencing strong growth, driven by rising demand across the health, food, and personal care sectors. Health-conscious consumers are increasingly turning to gelatin-based functional foods and collagen supplements for joint, skin, and gut health. In the cosmetics industry, gelatin’s natural, film-forming properties make it a popular ingredient in multifunctional beauty products, particularly among diverse consumer groups. Additionally, the clean label movement is fueling demand for transparent, natural ingredients, prompting manufacturers to expand their gelatin product offerings.

Europe Gelatin Market Trends

Europe dominated the market with the highest revenue share of 38.3% in 2024. This dominance is primarily attributed to the robust demand from key end-use industries, including cosmetics, food and beverages, and healthcare. The region’s gelatin consumption is notably high in countries such as Germany, France, and the United Kingdom, driven by their well-established manufacturing sectors and a strong presence of major companies like Gelita AG, Prowico, and Biogel AG.

The Germany gelatin market is growing steadily, driven by strong demand across food, pharmaceutical, and wellness sectors. Gelatin is a key ingredient in Germany’s thriving confectionery industry, especially in gummy candies and marshmallows, contributing to substantial market revenue. In the pharmaceutical and nutraceutical sectors, gelatin is widely used for capsule production due to its excellent film-forming and adhesive properties. German consumers’ increasing preference for natural, clean-label products further supports gelatin demand. Additionally, advancements in production technology are enhancing gelatin quality and customization, helping manufacturers meet diverse industry needs.

Asia Pacific Gelatin Market Trends

The Asia Pacific region is expected to register the highest CAGR over the forecast period and is experiencing robust growth, driven by several key factors. The region’s expanding pharmaceutical and food industries are significant contributors, with gelatin serving as a vital component in capsules, tablets, and various food applications. Technological advancements, including the adoption of ultrasound- and microwave-assisted extraction methods, have enhanced application efficiency and sustainability. Additionally, the exploration of alternative sources such as fish scales and prawn shells has diversified raw material availability. Cultural integration and consumer awareness also play a role, as gelatin has a long history in traditional Asian cuisines and medicine. Regulatory support ensures the safety and quality of gelatin applications, fostering consumer confidence. These combined factors position Asia-Pacific as a dynamic and rapidly expanding market for gelatin.

China’s gelatin industry is experiencing rapid growth, driven by strong demand in the health, food, and personal care industries. Rising consumer interest in wellness, especially among younger and urban populations, is fueling the popularity of collagen-based supplements and functional foods that support beauty-from-within and digestive health. In cosmetics, gelatin is gaining traction as a natural ingredient aligned with traditional Chinese preferences for herbal and holistic skincare solutions. Additionally, growing regulatory support for clean label and health-focused formulations is encouraging local brands to highlight gelatin’s natural origin.

Key Gelatin Company Insights

Some of the key companies in the gelatin industry include GELITA AG, Rousselot, PB Leiner, STERLING GELATIN, Weishardt Holding SA, and others. Organizations have been tactically implementing various expansion plans such as mergers and acquisitions, strengthening of online presence, application enhancement, and new application launches to gain a competitive advantage.

-

GELITA AG is a leading global manufacturer of gelatin and collagen peptides, serving industries such as food, pharmaceuticals, health & nutrition, and cosmetics. GELITA maintains a strong presence in the gelatin industry through strategic initiatives like application innovations and global expansions.

-

Rousselot stands as a global leader in collagen-based solutions, offering a comprehensive range of gelatin and collagen applications tailored for the food, health and nutrition, biomedical, and pharmaceutical sectors. Rousselot has established a robust presence worldwide, providing innovative and high-quality ingredients that meet the evolving needs of these industries.

Key Gelatin Companies:

The following are the leading companies in the gelatin market. These companies collectively hold the largest market share and dictate industry trends.

- GELITA AG

- Rousselot

- PB Leiner

- STERLING GELATIN

- Weishardt Holding SA

- Junca Gelatines SL

- Nitta Gelatin, Inc.

- PAN Biotech GmbH

- Shanghai Al-Amin Biosource Co., Ltd.

- Tessenderlo Group

Recent Developments

-

In May 2024, GELITA launched OptiBar, a collagen peptide-based ingredient designed for high-protein, sugar-free cereal and protein bars. This application enables bars to contain up to 60% protein while maintaining a soft, indulgent texture, addressing consumer demand for healthier snack options. OptiBar also serves as a sugar-free binder, facilitating clean-label formulations with claims like 'low sugar' and 'sugar-free'.

-

In August 2024, Zydus Lifesciences acquired a 50% stake in Sterling Biotech from Perfect Day Inc., forming a 50:50 joint venture. This partnership aims to shift Sterling Biotech's focus towards producing fermented, animal-free proteins, catering to the growing demand for sustainable and ethically sourced nutrition.

-

In December 2021, Juncà Gelatines was acquired by Lapi Gelatine and Dispro Invest, forming a European hub for gelatin and collagen applications. This strategic move aims to enhance application capabilities and expand market reach.

Gelatin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.75 billion

Revenue forecast in 2030

USD 13.14 billion

Growth Rate

CAGR of 11.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, function, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Portugal; The Netherlands, Switzerland, Poland, China, Japan, India, Indonesia, Vietnam, Thailand, Philippines, Brazil, Ecuador, Peru, Bolivia, Chile, Argentina, South Africa, Saudi Arabia, Turkey, UAE, Qatar, Israel

Key companies profiled

GELITA AG; Rousselot; PB Leiner; STERLING GELATIN; Weishardt Holding SA; Junca Gelatines SL; Nitta Gelatin, Inc.; PAN Biotech GmbH; Shanghai Al-Amin Biosource Co., Ltd.; Tessenderlo Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gelatin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the gelatin industry report based on source, application, function, and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Porcine

-

Poultry

-

Marine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Foods & Beverages

-

Functional Foods

-

Meat Processing

-

Functional Beverages

-

Dietary Supplements

-

Confectionery

-

Desserts

-

-

Healthcare

-

Cosmetics

-

Others

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Stabilizer

-

Thickener

-

Gelling Agent

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Portugal

-

The Netherlands

-

Switzerland

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Vietnam

-

Thailand

-

Philippines

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Ecuador

-

Peru

-

Bolivia

-

Chile

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

UAE

-

Qatar

-

Israel

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.