- Home

- »

- Advanced Interior Materials

- »

-

Gasket & Seal Materials Market Size, Industry Report, 2030GVR Report cover

![Gasket And Seal Materials Market Size, Share & Trends Report]()

Gasket And Seal Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Rubber, Metal), By End-use, By Region (North America, Asia Pacific, Europe, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-548-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gasket & Seal Materials Market Trends

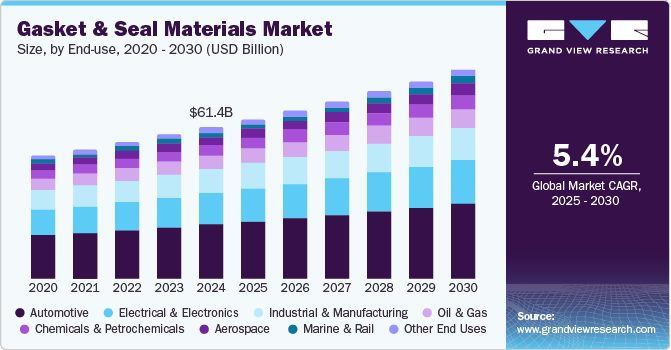

The global gasket & seal materials market size was estimated at USD 61.35 billion in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2030. The growth is driven by the rising demand for high-performance sealing solutions across industries such as automotive, Electrical & Electronics, oil & gas, and manufacturing. The automotive sector, in particular, plays a crucial role in market expansion due to the increasing focus on vehicle efficiency, emission reduction, and enhanced durability. As internal combustion engines operate under extreme temperature and pressure conditions, advanced gasket and seal materials are required to prevent leaks and ensure engine reliability. The rise of electric vehicles (EVs) has further fueled demand for specialized sealing solutions that provide thermal management, electrical insulation, and enhanced safety.

The expansion of the oil & gas and chemical processing industries is another key driver, as these sectors require high-quality sealing materials to withstand extreme temperatures, pressures, and corrosive environments. Stringent safety regulations mandate the use of durable gaskets and seals to prevent leaks and maintain system integrity, particularly in pipelines, refineries, and storage facilities. Additionally, the power generation industry, including conventional and renewable energy sectors, is witnessing increased adoption of gasket and seal materials in turbines, boilers, and transmission systems, contributing to the growth of the gasket and seal materials industry.

Technological advancements in material science, including the development of high-performance elastomers, fluoropolymers, thermoplastics, and metal-reinforced sealing solutions, have significantly improved the durability and efficiency of gaskets and seals. The increasing use of advanced composites and nanomaterials has enhanced resistance to heat, chemicals, and mechanical stress, reducing maintenance costs and extending product life cycles. Moreover, regulatory policies promoting the adoption of environmentally friendly materials have encouraged manufacturers to develop sustainable and non-toxic alternatives, further boosting market expansion.

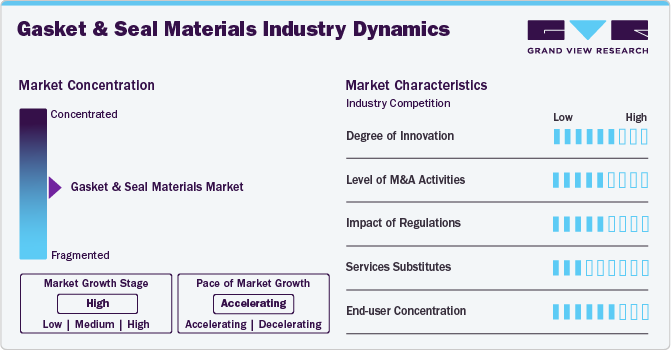

Market Concentration & Characteristics

The global gasket & seal materials market exhibits a moderate to high level of market concentration, with a mix of established multinational corporations and regional players competing for market share. Innovation plays a crucial role in shaping the market, as companies continuously invest in research and development to enhance material performance, durability, and environmental compliance. Advances in elastomers, thermoplastics, and metal-reinforced materials have led to the development of high-performance sealing solutions capable of withstanding extreme temperatures, high-pressure conditions, and aggressive chemical environments. The integration of smart sealing technologies, such as self-healing gaskets and sensor-equipped seals, is also gaining traction, particularly in industries where real-time monitoring and predictive maintenance are essential for operational efficiency.

The market has witnessed a steady increase in mergers and acquisitions, with major players strategically acquiring specialized material manufacturers to expand their product portfolios and strengthen their market presence. Regulatory frameworks play a significant role in influencing material selection, with stringent environmental and safety regulations driving the adoption of sustainable and non-toxic gasket and seal materials. The market faces limited service substitutes, as alternative sealing technologies such as adhesive bonding and welding cannot fully replace the functionality of gaskets and seals in many industrial applications. End-use concentration remains high in key sectors such as automotive, Electrical & Electronics, oil and gas, power generation, and industrial manufacturing, with growing demand from emerging industries such as renewable energy and electric vehicles further shaping the market’s future trajectory.

End-use Insights

The automotive segment dominated the market and accounted for the largest revenue share of 35.73% in 2024, driven by the continuous evolution of vehicle technologies and stringent performance standards. Gaskets and seals are essential components in automobiles, used to prevent fluid and gas leakage and ensure the integrity and efficiency of engine, transmission, exhaust, and braking systems. With the increasing production of vehicles globally, particularly in emerging economies, the demand for high-performance gasket and seal materials has risen significantly to meet the requirements of modern automotive designs.

The aerospace segment is expected to grow at the fastest CAGR of 6.3% over the forecast period. Gaskets and seals are essential components in aerospace applications, where they are used to prevent fluid and gas leakage in engines, hydraulic systems, fuel systems, and airframes. The demand for materials that can withstand extreme temperatures, high pressure, and corrosive environments is particularly high in this industry, thereby creating significant opportunities for advanced sealing materials such as high-performance elastomers, composites, and metal alloys.

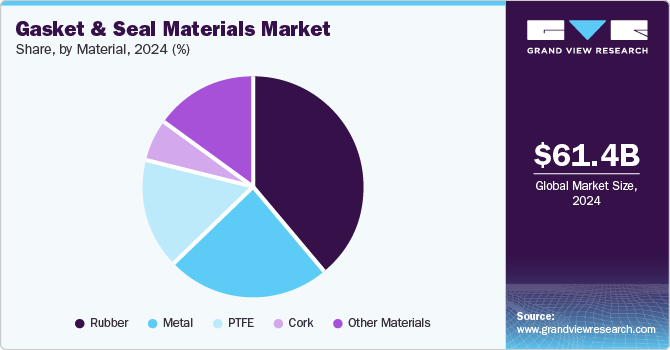

Material Insights

The rubber segment led the market and accounted for the largest revenue share of 40.0% in 2024, driven by its versatile properties and widespread applicability across various end-use industries. Rubber materials, including natural rubber, silicone, nitrile, EPDM, and neoprene, offer excellent flexibility, elasticity, and resistance to compression sets, making them highly effective in sealing applications. Their ability to maintain integrity under varying temperatures, pressures, and chemical exposures enhances their suitability for dynamic sealing environments, thereby boosting their demand in the automotive, aerospace, industrial machinery, and electronics sectors.

The PTFE segment is expected to grow at the fastest CAGR of 5.7% over the forecast period, driven by PTFE’s exceptional chemical resistance, low friction properties, and high thermal stability. These attributes make PTFE an ideal material for use in demanding industrial applications where exposure to aggressive chemicals, high temperatures, and extreme pressure conditions is common. Industries such as chemical processing, oil and gas, pharmaceuticals, and food and beverage processing extensively utilize PTFE-based gaskets and seals to ensure reliable sealing performance and operational safety in corrosive environments.

Regional Insights

The growth of the North America gasket & seal materials industry is primarily driven by technological advancements, strong demand from the automotive and electrical & electronics industries, and the increasing adoption of advanced manufacturing processes. The region's emphasis on fuel efficiency, emission control, and safety regulations has led to the development of next-generation sealing materials with improved durability and resistance to extreme conditions. Additionally, the expanding oil and gas sector, particularly in the U.S. and Canada, continues to drive demand for high-quality gaskets and seals that ensure leak prevention and operational safety in harsh environments.

U.S. Gasket & Seal Materials Market Trends

The U.S. gasket & seal materials industry is influenced by the well-established industrial base, stringent regulatory standards, and increasing R&D investments. The country’s strong automotive sector, particularly in electric and hybrid vehicles, has boosted the demand for high-performance sealing materials that enhance vehicle efficiency and safety. Additionally, the U.S. electrical & electronics and defense industries require specialized gasket and seal solutions for high-temperature and pressure-sensitive applications. The growing renewable energy sector, particularly wind and solar power, is further driving the need for advanced sealing solutions in energy storage and transmission infrastructure.

Europe Gasket & Seal Materials Market Trends

In Europe, the gasket & seal materials industry growth is driven by stringent environmental regulations, advancements in material science, and strong demand from the automotive and industrial machinery sectors. The region’s focus on sustainability has led to the development of eco-friendly and high-performance sealing materials that comply with REACH and RoHS regulations. The shift towards electric mobility and green energy solutions is further influencing market dynamics as manufacturers seek sealing solutions that enhance efficiency and reduce maintenance costs. Additionally, the region’s well-established Electrical & Electronics and defense industries contribute to the demand for durable and heat-resistant gasket and seal materials.

Germany gasket & seal materials market is projected to witness growth during the forecast period. Germany, as a leading industrial and automotive manufacturing hub, plays a crucial role in driving the market growth. The country’s focus on engineering excellence and technological innovation has led to the development of high-performance sealing solutions for automotive, electrical & electronics, and industrial applications. The shift towards electric vehicles and the implementation of stringent emission norms are driving the demand for advanced gasket and seal materials that enhance fuel efficiency and reduce environmental impact. Furthermore, Germany’s strong presence in chemical processing and power generation industries continues to support market growth.

Asia Pacific Gasket & Seal Materials Market Trends

Asia Pacific dominated the gasket & seal materials industry and accounted for the largest revenue share of about 44.82% in 2024, driven by rapid industrialization, growing infrastructure development, and the expanding automotive and manufacturing sectors. Countries such as China, India, and Japan are witnessing increased demand for high-performance gasket and seal materials in automotive production, construction machinery, and energy applications. Government initiatives promoting industrial automation and technological advancements in material science are further accelerating market growth. Additionally, the rising demand for energy-efficient solutions and compliance with stringent safety regulations are prompting industries to adopt advanced sealing materials to enhance operational reliability.

China gasket & seal materials market is expected to witness growth over the forecast period. China, as the largest manufacturing hub in the region, is a key market growth driver fueled by the booming automotive, electrical & electronics, and industrial machinery industries. The country’s strong presence in electric vehicle (EV) production has increased the need for high-performance gaskets and seals that offer thermal stability and electrical insulation. Furthermore, China’s investments in petrochemical and energy sectors, including renewable energy projects, are driving the adoption of durable and chemically resistant sealing solutions. Strict government policies aimed at reducing emissions and improving product quality standards are also influencing market growth, encouraging manufacturers to develop eco-friendly and high-performance sealing materials.

Central & South America Gasket & Seal Materials Market Trends

Growth of the gasket & seal materials industry in Central & South America a is fueled by the growing automotive production, expanding oil and gas sector, and increasing industrialization. Countries such as Brazil and Mexico are experiencing a rise in demand for durable and high-temperature-resistant sealing materials in manufacturing and energy industries. The region’s focus on improving infrastructure and modernizing industrial processes is also contributing to market expansion. Additionally, government initiatives to strengthen domestic manufacturing capabilities and attract foreign investments are encouraging the adoption of high-quality gasket and seal materials across various applications.

Middle East & Africa Gasket & Seal Materials Market Trends

The Middle East & Africa gasket & seal materials industry growth is driven by the strong demand from the oil and gas, power generation, and construction sectors. The region’s vast oil reserves necessitate the use of high-performance sealing solutions to prevent leakages and ensure operational safety in extreme conditions. Additionally, the increasing investments in renewable energy projects, particularly solar and wind power, are creating new opportunities for gasket and seal material manufacturers. Infrastructure development and industrial expansion in countries such as Saudi Arabia, the UAE, and South Africa are also contributing to market growth as industries seek durable and efficient sealing solutions to enhance productivity and compliance with international safety standards.

Key Gasket And Seal Materials Company Insights

Some of the key players operating in the market include Trelleborg Group and Freudenberg Sealing Technologies.

-

Trelleborg Group is a global player in engineered polymer solutions, specializing in sealing and damping technologies for various industries. The company operates across multiple sectors, including automotive, Electrical & Electronics, oil and gas, and industrial manufacturing. Its product offerings in the gasket and seal materials market include elastomer-based sealing solutions, thermoplastic gaskets, and advanced composite materials designed for high-performance applications. Trelleborg’s innovations focus on enhancing durability, chemical resistance, and sustainability, ensuring compliance with stringent industry regulations.

-

Freudenberg Sealing Technologies is a prominent manufacturer of sealing solutions, offering a wide range of high-quality gaskets and seals for automotive, industrial, and energy applications. The company’s portfolio includes elastomer seals, PTFE-based gaskets, and metal-reinforced sealing solutions designed for extreme temperature and pressure conditions. Freudenberg’s focus on material innovation and digitalization has led to the development of smart sealing technologies that enhance performance and efficiency in critical applications.

Parker Hannifin Corporation and ERIKS NV are some of the emerging participants in the gasket & seal materials market.

-

Parker Hannifin Corporation is a global leader in motion and control technologies, providing advanced sealing and gasket solutions for various industries. The company offers a comprehensive range of sealing products, including O-rings, hydraulic seals, metal gaskets, and custom-engineered solutions for Electrical & Electronics, automotive, and industrial sectors.

-

ERIKS NV is a specialized industrial service provider offering a broad range of sealing and gasket solutions for industrial maintenance and manufacturing applications. The company’s product lineup includes rubber gaskets, PTFE-based seals, metal-reinforced sealing components, and custom-engineered solutions designed to meet specific operational requirements.

Key Gasket And Seal Materials Companies:

The following are the leading companies in the gasket & seal materials market. These companies collectively hold the largest market share and dictate industry trends.

- Trelleborg Group

- Freudenberg Sealing Technologies

- Parker Hannifin Corporation

- ERIKS NV

- ElringKlinger Kunststofftechnik GmbH

- Saint-Gobain Performance Plastics

- BRUSS Sealing Systems GmbH

- Dimer Group

- John Crane

- Klinger Holding

Recent Developments

- In October 2022, The Erith Group, a specialist in high-performance sealing solutions, commenced the production of industrial seals and gaskets at its manufacturing facility in Ras Al Khaimah, serving customers worldwide.

Gasket And Seal Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 64.67 billion

Revenue forecast in 2030

USD 84.11 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

Regional scope

North America; Europe; Asia Pacific: Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia

Key companies profiled

Trelleborg Group; Freudenberg Sealing Technologies; Parker Hannifin Corporation; ERIKS NV; ElringKlinger Kunststofftechnik GmbH; Saint-Gobain Performance Plastics; BRUSS Sealing Systems GmbH; Dimer Group; John Crane; Klinger Holding

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gasket And Seal Materials Market Report Segmentation

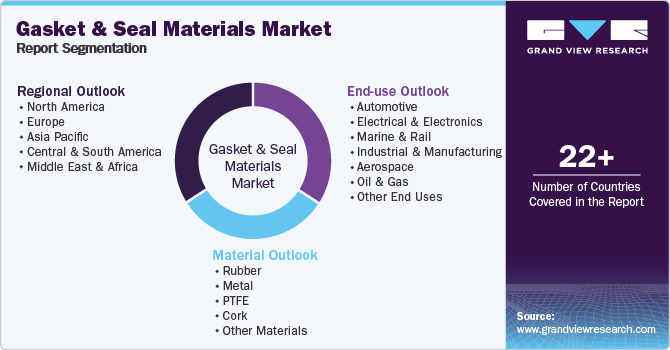

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gasket & seal materials market report based on material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Rubber

-

Metal

-

PTFE

-

Cork

-

Other Materials

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Marine & Rail

-

Industrial & Manufacturing

-

Aerospace

-

Oil & Gas

-

Chemicals & Petrochemicals

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global gasket & seal materials market size was estimated at USD 61.35 billion in 2024 and is expected to reach USD 64.67 billion in 2025.

b. The gasket & seal materials market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 84.11 billion by 2030.

b. The rubber segment led the market and accounted for the largest revenue share of 40.0% in 2024, driven by its versatile properties and widespread applicability across various end-use industries.

b. Trelleborg Group, Freudenberg Sealing Technologies, Parker Hannifin Corporation, ERIKS NV, ElringKlinger Kunststofftechnik GmbH, Saint-Gobain Performance Plastics, BRUSS Sealing Systems GmbH, Dimer Group, John Crane, and Klinger Holdingare prominent companies in the Gasket & Seal Materials market.

b. The key factors driving the gasket and seal materials market include rising demand for high-performance sealing solutions in automotive, aerospace, and industrial applications and advancements in material technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.