- Home

- »

- Conventional Energy

- »

-

Gas Turbine Market Size & Share, Industry Report, 2033GVR Report cover

![Gas Turbine Market Size, Share & Trends Report]()

Gas Turbine Market (2026 - 2033) Size, Share & Trends Analysis Report By Capacity (<=200 MW, >200 MW), By End Use (Industrial, Power & Utility), By Technology (Combined Cycle, Open Cycle), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-225-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gas Turbine Market Summary

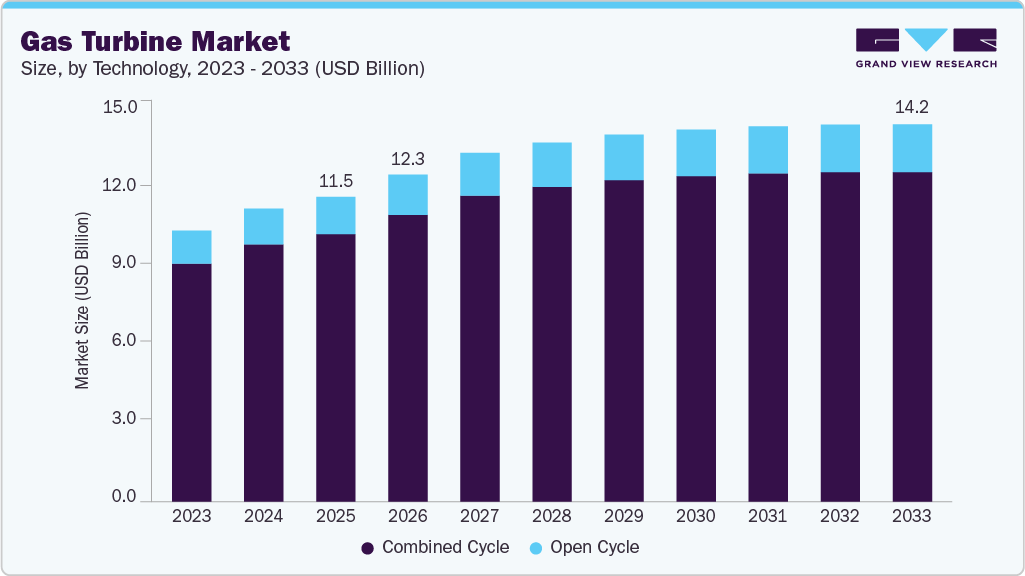

The global gas turbine market size was estimated at USD 11.46 billion in 2025 and is projected to reach USD 14.19 billion by 2033, growing at a CAGR of 2.1% from 2026 to 2033. A gas turbine operates by heating a mixture of fuel and ambient air to high temperatures, producing mechanical power through rotating turbine blades that subsequently drive a generator to produce electricity.

Key Market Trends & Insights

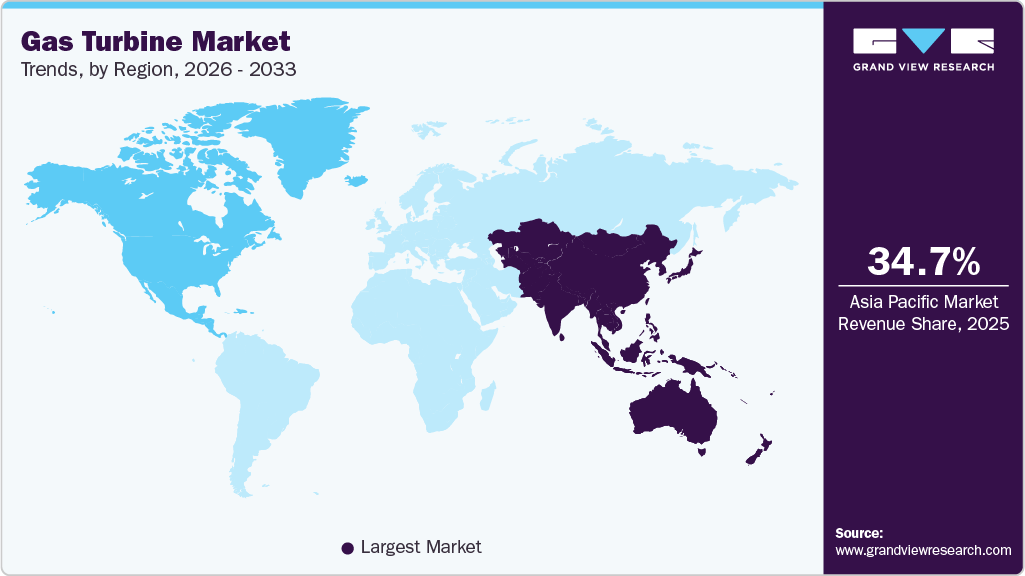

- Asia Pacific dominated the gas turbine market with the largest revenue share of 34.7 % in 2025.

- The gas turbine industry in the U.S. is expected to grow at a significant CAGR over the forecast period.

- By technology, the combined cycle segment led the market with the largest revenue share of 87.7% in 2025.

- Based on capacity, the >200 MW segment accounted for the largest market revenue share in 2025.

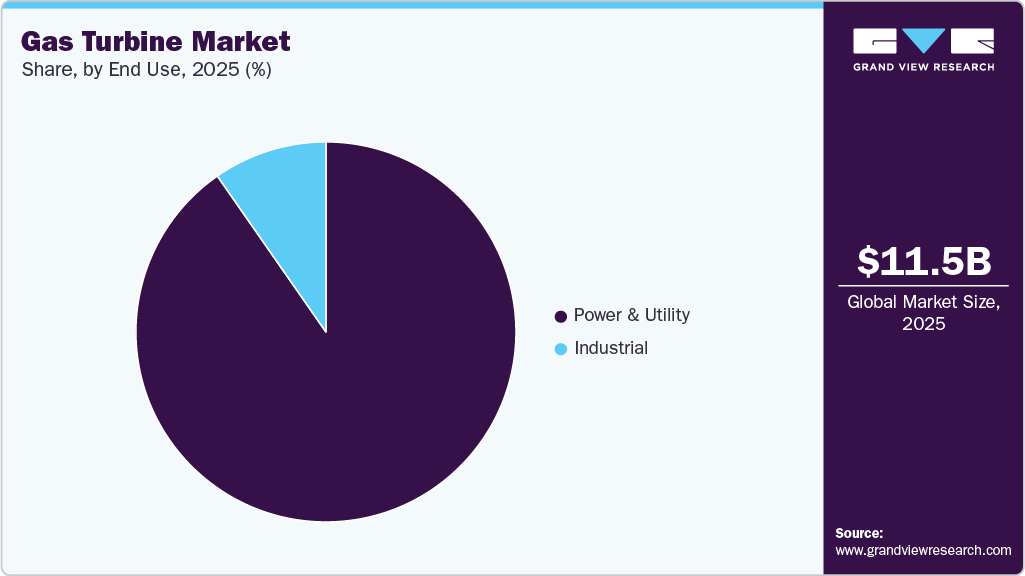

- Based on end use, the power & utility segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.46 Billion

- 2033 Projected Market Size: USD 14.19 Billion

- CAGR (2026-2033): 2.1%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

Continued technological progress in the energy sector and increasing adoption of distributed power systems are major factors fostering market expansion. Rising government support for cleaner generation technologies aimed at reducing CO₂ emissions is also strengthening demand across the industrial gas turbine industry.

Gas turbines remain extensively used for power generation, where combined cycle configurations are preferred over simple cycle systems due to their higher efficiency and lower operating costs. Combined Heat and Power (CHP) plants exemplify this capability, producing electricity while simultaneously delivering mechanical drive. The ongoing transition from coal-based to gas-based power generation in countries such as the U.S., Japan, India, and China, along with policy incentives promoting gas-fired capacity additions, continues to drive market growth globally.

Drivers, Opportunities & Restraints

The global gas turbine industry continues to advance on the back of rising demand for reliable, flexible, and low-emission power generation solutions, particularly in regions shifting from coal to cleaner energy sources. Utilities and governments are increasing investments in gas-based infrastructure to support decarbonization efforts and provide stability where renewable integration remains uneven. The rapid start-up capability and load-following flexibility of gas turbines make them essential for grid balancing, especially as wind and solar penetration grow. Continuous improvements in turbine efficiency and the expansion of combined-cycle installations are further accelerating adoption across both utility and industrial applications, including the evolving aero derivative gas turbine industry.

Emerging opportunities stem from the development of hydrogen-ready turbines, hybrid systems integrating gas and renewables, and digital advancements such as predictive maintenance tools and high-temperature materials that reduce lifecycle costs. Increasing electrification in developing economies and rising interest in decentralized energy systems are also opening new avenues for deployment. However, the gas turbine industry continues to face constraints such as volatile natural gas prices, tightening emissions regulations, and the high capital intensity of large-scale projects. Lengthy development timelines and policy uncertainties in certain regions remain additional challenges to widespread expansion.

Capacity Insights

The >200 MW segment led the market with the largest revenue share of 67.5% in 2025, and is expected to retain strong momentum throughout the forecast period. Growing global electricity demand driven by rapid urbanization, population expansion, and the transition from coal to gas-fired generation in major economies continues to support the deployment of large-capacity turbines. Their ability to provide efficient baseload and peak-load support alongside increasing renewable penetration further reinforces their adoption. These large units also generate substantial aftermarket requirements, contributing to the continued expansion of the gas turbine MRO market as operators prioritize performance optimization and lifecycle cost reduction.

The ≤200 MW segment is projected to register at the fastest CAGR of 3% over the assessment period. Its compact footprint, lower installation complexity, and ease of maintenance make it suitable for distributed generation, industrial facilities, and offshore energy environments where power-to-weight ratios are critical. The segment’s rising use in the oil & gas sector for mechanical drive and onsite power applications is also accelerating demand, supporting related growth opportunities in the gas turbine oil market through increasing lubricant and operational fluid requirements.

Technology Insights

The combined cycle segment led the market with the largest revenue share of 87.7% in 2025, maintaining its position as the dominant technology type throughout the forecast period. Its strong adoption is attributed to higher fuel efficiency, reduced transmission losses, and the ability to achieve overall system efficiencies ranging between 60% and 80%. Growing regulatory pressure on coal-fired generation, favorable natural gas prices, and the increasing need to stabilize renewable-heavy grids continue to accelerate the deployment of combined cycle gas turbines. Their ability to provide rapid cycling and operational flexibility has further supported demand, contributing to expansion across the gas turbine services market as operators seek enhanced performance and lower lifecycle costs.

The open cycle segment is projected to register at the fastest CAGR of 2.5% over the forecast period, driven by its lower upfront cost, shorter start-up times, and suitability for peak-load and emergency power applications. Open-cycle systems are widely used in regions that require quick-response generation capacity to complement intermittent renewable sources. Their relatively simple configuration also makes them attractive for industrial facilities and remote operations where fast deployment and operational agility are critical. Continued policy support for cleaner fuels and improvements in turbine firing temperatures are expected to further strengthen the growth prospects of open-cycle installations.

End Use Insights

The power & utility segment led the market with the largest revenue share of 84.2% in 2025, retaining its position as the dominant End Use category. Rising electricity demand resulting from global urbanization, population growth, and the transition to cleaner generation technologies continues to support the adoption of gas turbines in utility-scale applications. Governments and grid operators are increasingly prioritizing efficient, low-emission generation assets to enhance system reliability, a trend also reflected in the European gas turbine industry, where decarbonization targets remain a key focus. Although long-term demand remains positive, some market participants remain cautious due to natural gas price volatility and uncertainties surrounding future regulatory frameworks.

The industrial segment is projected to register at the fastest CAGR of 2.8% over the forecast period. Expanding activity in heavy industries, including chemicals, glass, cement, pharmaceuticals, and metals, continues to drive the need for dependable onsite power and mechanical drive solutions. Stricter emissions regulations are also encouraging industrial facilities to shift from diesel and coal-based systems to cleaner gas turbine technologies. Favorable natural gas pricing and the operational flexibility offered by small and mid-sized turbines further strengthen adoption in a wide range of industrial environments.

Regional Insights

The gas turbine market in North America is anticipated to grow at the fastest CAGR during the forecast period. The large-scale infrastructure upgrades and the growing emphasis on cleaner power generation are key drivers of the market growth. The region is witnessing a shift from coal-fired plants, with gas turbines offering a dependable and lower-emission alternative to support baseload and peaking power needs. Federal incentives, supportive regulatory frameworks, and rising integration of renewable energy sources encourage utilities to invest in flexible gas-based solutions. In addition, ongoing developments in combined-cycle plants and improvements in grid reliability fuel demand for advanced gas turbines capable of enhancing efficiency, reducing emissions, and supporting the evolving energy mix.

Asia Pacific Gas Turbine Market Trends

Asia Pacific dominated the global gas turbine market with the largest revenue share of 34.7% in 2025. Large-scale capacity additions in power generation and rising industrialization in China, India, and South Korea are major drivers of the Asia Pacific (APAC) gas turbine industry. Regional governments increasingly prioritize cleaner alternatives to coal, with gas turbines serving as a flexible and lower-emission solution to support growing electricity demand. Ongoing infrastructure development, favorable energy diversification policies, and strong investments in combined-cycle power plants further accelerate market expansion. In addition, APAC's robust engineering and manufacturing capabilities, along with the presence of key industry players, reinforce the region's critical role in shaping global gas turbine advancements.

Europe Gas Turbine Market Trends

The gas turbine market in Europe is driven by the region’s commitment to decarbonization and the strategic role of gas as a transitional fuel in the shift toward net-zero emissions. The European Union’s energy policies, including the Green Deal and REPowerEU plan, support the integration of flexible, low-carbon technologies, such as gas turbines, to stabilize grids amid rising renewable energy penetration. Combined-cycle gas turbine (CCGT) plants are gaining momentum due to their high efficiency and lower emissions. Furthermore, increasing investments in hydrogen-ready turbines and repurposing existing infrastructure for cleaner fuels are creating new growth avenues. The presence of established OEMs and advanced R&D capabilities also positions Europe as a hub for next-generation turbine innovation.

Latin America Gas Turbine Market Trends

The gas turbine market in the Latin America is anticipated to grow at a significant CAGR during the forecast period. The region’s increasing focus on energy diversification and the modernization of aging power infrastructure drives the Latin American market. As countries invest in cleaner, more flexible power generation sources to support economic growth and grid stability, gas turbines are gaining traction due to their reliability and lower emissions compared to traditional thermal plants. The growing integration of intermittent renewables, such as solar and wind, boosts demand for gas turbines as a complementary, quick-start power solution. In addition, supportive government policies and regional efforts to attract private investment in energy infrastructure further encourage the deployment of gas-based technologies throughout Latin America.

Middle East & Africa Gas Turbine Market Trends

The gas turbine market in the Middle East and Africa (MEA) is driven by the region’s rising demand for reliable power generation and efforts to diversify energy portfolios. While oil and gas remain dominant, many countries are investing in gas-fired power plants as a cleaner, more efficient alternative to traditional thermal generation. Gas turbines play a crucial role in meeting peak demand and stabilizing grids, particularly in conjunction with the increasing deployment of renewable energy sources. Government-led infrastructure programs, energy security strategies, and investments in combined-cycle and cogeneration plants further propel market growth. The region’s abundant natural gas reserves and focus on industrial expansion support sustained demand for advanced turbine technologies.

Key Gas Turbine Company Insights

Some of the key players operating in the gas turbine industry include Ansaldo Energia, Bharat Heavy Electricals Ltd., Centrax Gas Turbines, General Electric, Kawasaki Heavy Industries, Ltd., among others. These companies are actively focusing on technological advancements, expanding their product portfolios, and forming strategic alliances to cater to the growing demand for efficient power generation.

Key Gas Turbine Companies:

The following are the leading companies in the gas turbine market. These companies collectively hold the largest Market share and dictate industry trends.

- Ansaldo Energia

- Bharat Heavy Electricals Ltd. (BHEL)

- Centrax Gas Turbines

- General Electric (GE)

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions

- Mitsubishi Power, Ltd.

- OPRA Turbines

- Siemens Energy

- Solar Turbines Inc.

Recent Developments

- In February 2025, Siemens Energy announced the expansion of its gas turbine manufacturing operations in Houston, Texas. The new facility aims to enhance the production of advanced, high-efficiency gas turbines tailored for combined cycle and peaking power applications. This strategic move supports the growing demand for flexible and lower-emission power generation solutions, particularly as utilities transition toward cleaner energy mixes. The expansion is also expected to create approximately 400 skilled jobs and strengthen domestic manufacturing capabilities in the U.S. gas turbine sector.

Gas Turbine Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.29 billion

Revenue forecast in 2033

USD 14.19 billion

Growth rate

CAGR of 2.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, Volume in MW, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, Volume forecast, competitive landscape, growth factors, and trends

Segments covered

Capacity, end use, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Ansaldo Energia; Bharat Heavy Electricals Ltd. (BHEL); Centrax Gas Turbines; General Electric (GE); Kawasaki Heavy Industries, Ltd.; MAN Energy Solutions; Mitsubishi Power, Ltd.; OPRA Turbines; Siemens Energy; Solar Turbines Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Turbine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global gas turbine market report based on the capacity, end use, technology and region.

-

Capacity Outlook (Capacity, MW; Revenue, USD Million, 2021 - 2033)

-

<=200 MW

-

>200 MW

-

-

End Use Outlook (Capacity, MW; Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Power & Utility

-

-

Technology Outlook (Capacity, MW; Revenue, USD Million, 2021 - 2033)

-

Combined Cycle

-

Open Cycle

-

-

Regional Outlook (Capacity, MW; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Power & Utility was the largest end-use segment in the gas turbine market owing to the deployment of a number of large-capacity power projects.

b. Some of the key vendors of the global Gas Turbine market include Siemens Energy, ABB Ltd., General Electric, Schneider Electric, and Eaton Corporation, among others.

b. The global gas turbine market size was estimated at USD 11.46 billion in 2025 and is expected to reach USD 12.29 billion in 2026.

b. The global gas turbine market is expected to grow at a compound annual growth rate of 2.1% from 2026 to 2033 to reach USD 14.19 billion by 2033.

b. The key factors driving the Gas Turbine market include rapidly expanding renewable energy sources such as solar and wind. These require reliable and efficient transformers to manage voltage regulation and ensure stable power transmission.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.