- Home

- »

- Homecare & Decor

- »

-

Garbage Bags Market Size, Share And Growth Report, 2030GVR Report cover

![Garbage Bags Market Size, Share & Trends Report]()

Garbage Bags Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Low Density Polyethylene, High Density Polyethylene, Linear Low-density Polyethylene), By Size, By End-use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-336-4

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Garbage Bags Market Summary

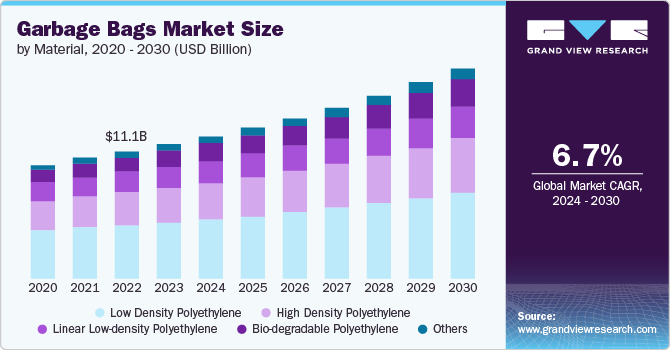

The global garbage bags market size was estimated at USD 11,713.0 million in 2023 and is projected to reach USD 18,273.5 million by 2030, growing at a CAGR of 6.7% from 2024 to 2030. Garbage bags are made from polyethylene, and are durable, lightweight, and secure, making them popular across retail, institutional, and industrial sectors.

Key Market Trends & Insights

- The garbage bags market of Asia Pacific emerged and accounted for a revenue share of around 34.54% in the year 2023.

- The U.S. garbage bags market is expected to grow at a CAGR of 5.7% from 2024 to 2030.

- By material, the low density polyethylene garbage bags accounted for a revenue share of 42.50% in the year 2023.

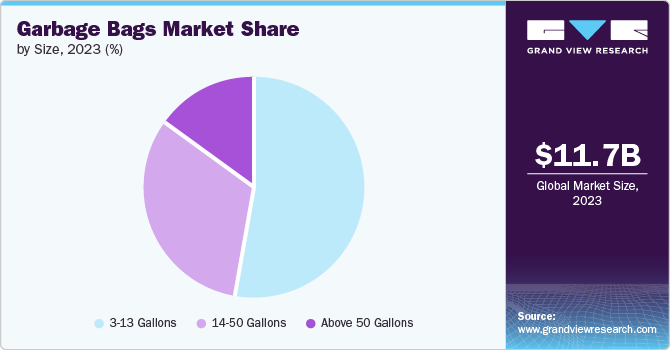

- By size, the 3-13 gallons garbage bags accounted for a revenue share of around 53.05% in the year 2023.

- By end-use, the household segment accounted for a revenue share of around 58.70% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11,713.0 Million

- 2030 Projected Market Size: USD 18,273.5 Million

- CAGR (2024-2030): 6.7%

- Asia Pacific: Largest market in 2023

Growing concerns about hygiene and environmental cleanliness are expected to drive the adoption of garbage bags. The rise in urbanization has led to increased waste generation, which is projected to boost garbage bag usage. According to the World Bank, annual waste production is anticipated to grow by 70% from 2016 levels, reaching 3.40 billion tonnes by 2050. These factors suggest a positive growth trajectory for the market in the coming years.

Manufacturers and consumers are facing fluctuating prices due to material supply issues and restrictions on plastic bags. The COVID-19 pandemic has caused variability in raw material and trash bag prices. Although the initial impact on trash bag manufacturers was minimal, lockdowns have led to supply chain disruptions, raw material shortages, labor shortages, and price fluctuations, all of which can affect production. These challenges highlight the industry's ongoing difficulties in maintaining stable production and pricing.

Modern consumer habits have also significantly influenced the demand for garbage bags. The rise of e-commerce and home delivery services has led to an increase in packaging waste. As consumers order more products online, the volume of packaging materials, including plastic and cardboard, that need to be disposed of has surged. This has directly increased the use of garbage bags to manage the disposal of these materials.

Moreover, the trend towards convenience and single-use products has exacerbated waste generation. Items such as disposable diapers, sanitary products, and various single-use plastics contribute to the growing waste stream, necessitating reliable and sturdy garbage bags. The Food and Agriculture Organization (FAO) reports that approximately one-third of food produced for human consumption is lost or wasted globally, amounting to about 1.3 billion tons per year. This food waste often ends up in garbage bags, further driving their demand.

Governments and regulatory bodies are also playing a pivotal role in this transition. Bans on single-use plastics in various regions have led to a higher adoption of garbage bags as an alternative for waste disposal. For instance, the European Union’s directive to reduce the consumption of lightweight plastic carrier bags has boosted the demand for thicker, reusable garbage bags. Similarly, several states in the USA, including California and New York, have implemented stringent regulations to minimize plastic waste, indirectly increasing the demand for garbage bags that comply with these new standards.

Material Insights

The low density polyethylene garbage bags accounted for a revenue share of 42.50% in the year 2023. The demand for Low-density Polyethylene (LDPE) in the market is rising due to its flexibility, durability, and resistance to tearing and puncturing, making it ideal for various uses. LDPE enables the production of thinner yet stronger bags, reducing material usage and costs. Its recyclability aligns with growing environmental concerns, prompting the development of eco-friendly options.

The bio-degradable polyethylene garbage bags are projected to grow at a CAGR of 8.7% over the forecast period of 2024 - 2030. The demand for biodegradable polyethylene in the market is increasing due to heightened environmental awareness and the push for sustainable solutions. Consumers are seeking alternatives that reduce plastic pollution and support eco-friendly practices. Regulatory policies in regions like the EU and US banning single-use plastics are accelerating this shift.

Size Insights

The 3-13 gallons garbage bags accounted for a revenue share of around 53.05% in the year 2023. The demand for 3-13 gallon size garbage bags is increasing due to their versatility and suitability for household use. These sizes fit most kitchen and office bins, making them ideal for daily waste disposal needs. The trend towards smaller households and apartments has driven the need for compact waste solutions. According to the U.S. Census Bureau, the average household size has decreased, leading to more demand for smaller garbage bags.

The 14-50 gallons garbage bags is projected to grow at a CAGR of 7.4% over the forecast period of 2024 - 2030 owing to their capacity to handle larger volumes of waste, making them ideal for commercial, industrial, and outdoor use. These sizes are popular in settings like offices, restaurants, and construction sites where substantial waste is generated. Moreover, the rise in events, public gatherings, and community clean-up initiatives also contributes to this demand.

End-use Insights

The household segment accounted for a revenue share of around 58.70% in 2023. Growing urbanization and smaller living spaces drive the need for efficient waste management solutions. Rising disposable incomes and improved living standards lead to higher consumption, generating more household waste. Innovations in trash bag design, such as odor control and drawstring features, enhance their appeal. Additionally, heightened environmental awareness is driving demand for eco-friendly and biodegradable options.

The commercial segment is estimated is projected to grow at a CAGR of 7.3% over the forecast period of 2024 - 2030 owing to increased waste generation in hospitals, schools, offices, and other large facilities. Institutions require durable, high-capacity garbage bags to manage substantial waste volumes efficiently. With heightened hygiene and sanitation standards, especially post-COVID-19, the need for reliable waste containment solutions has intensified.

Distribution Channel Insights

The B2C channel accounted for a revenue share of around 62.92% in 2023. Promotions, discounts, and bulk-buy options available in hypermarket and supermarket stores attract cost-conscious consumers. The trend of one-stop shopping for all household needs further drives this demand. Additionally, the increasing adoption of private label brands in hypermarkets and supermarkets offers consumers more affordable options. Enhanced in-store marketing and strategic product placements also play a crucial role in boosting sales. The expansion of these retail chains, especially in emerging markets, supports the growing demand for garbage bags.

The B2B channel segment is estimated is projected to grow at a CAGR of 7.8% over the forecast period of 2024 - 2030. Increased commercial and industrial activities generate higher volumes of waste, necessitating efficient disposal solutions. Regulatory pressures and compliance requirements drive businesses to adopt reliable and eco-friendly garbage bags. Bulk purchasing options and long-term contracts provide cost-effective solutions for large-scale waste management needs.

Regional Insights

The garbage bags market of North America held 26.89% of the global revenue in 2023. The region's growing population and urbanization drive increased household and commercial waste generation. Secondly, stringent waste management regulations and environmental awareness prompt consumers and businesses to opt for reliable and eco-friendly trash bag solutions. With a population of over 330 million, the country generates vast amounts of waste. According to the Environmental Protection Agency (EPA), the United States produced 292.4 million tons of municipal solid waste in 2018, equating to about 4.9 pounds of waste per person per day.

U.S. Garbage Bags Market Trends

The U.S. garbage bags market is expected to grow at a CAGR of 5.7% from 2024 to 2030. The market is characterized by the presence of major players like Glad, Hefty, and Simplehuman, which continuously innovate to meet consumer needs. The trend towards sustainable living has led to the introduction of eco-friendly garbage bags made from recycled materials or designed to be compostable. For example, Glad's ForceFlexPlus Recycled garbage bags are made from 50% recycled plastic, catering to environmentally conscious consumers.

Asia Pacific Garbage Bags Market Trends

The garbage bags market of Asia Pacific emerged and accounted for a revenue share of around 34.54% in the year 2023. Increasing environmental awareness and regulatory initiatives are driving the adoption of eco-friendly and biodegradable garbage bags in the region. Major manufacturers are investing in production facilities and distribution networks to cater to this growing market. The proliferation of retail channels, including hypermarkets, supermarkets, and online platforms, also facilitates easier access to garbage bags for consumers across the Asia Pacific.

Europe Garbage Bags Market Trends

Europe garbage bags market is projected to grow at a CAGR of 5.8% from 2024 to 2030. The growing awareness among consumers about sustainability and the environmental impact of plastic waste is influencing purchasing decisions. According to market analyses, the European market is expanding as consumers and businesses prioritize products that minimize environmental harm. Innovations in trash bag materials and designs, such as compostable and recyclable options, cater to these preferences.

Key Garbage Bags Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Garbage Bags Companies:

The following are the leading companies in the garbage bags market. These companies collectively hold the largest market share and dictate industry trends.

- Pack-It BV

- Kemii Garbage Bag Co. Ltd

- Cosmoplast Industrial Company LLC( Harwal Group of Companies)

- Luban Packing LLC

- Hefty(Reynolds Consumer Products LLC)

- International Plastics Inc.

- Novolex

- Novplasta s.r.o.

- Terdex GmbH

- Berry Global Inc.

Recent Developments

-

In November 2023, Reynolds Consumer Products has announced that their Hefty Ultra Strong Fabuloso Scented tall kitchen garbage bags have been honored as a 2022 New Product Pacesetter. This recognition comes from Circana's 28th annual report, which highlights outstanding new product introductions across various industries including food, beverage, and non-food sectors.

-

In August 2022, Balenciaga has introduced a new collection titled 'bin bags,' drawing inspiration from the design of traditional garbage bin liners. As part of this line, the French fashion house has released a pouch that echoes the distinctive aesthetic of these everyday utility items.

Garbage Bags Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.38 billion

Revenue forecast in 2030

USD 18.27 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, size, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Pack-It BV; Kemii Garbage Bag Co. Ltd; Cosmoplast Industrial Company LLC( Harwal Group of Companies); Luban Packing LLC; Hefty(Reynolds Consumer Products LLC); International Plastics Inc.; Novolex; Novplasta s.r.o.; Terdex GmbH; Berry Global Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

\Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Garbage Bags Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global garbage bags market based on material, size, end-use, distribution channel, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low Density Polyethylene

-

High Density Polyethylene

-

Linear Low-density Polyethylene

-

Bio-degradable Polyethylene

-

Others

-

-

Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

3-13 Gallons

-

14-50 Gallons

-

Above 50 Gallons

-

-

End-use Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Household

-

Commercial

-

Hospitality & Food Service

-

Institutional

-

Retail

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets/ Supermarkets

-

Convenience Stores

-

Departmental Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The garbage bags market was estimated at USD 11.71 billion in 2023 and is expected to reach USD 12.38 billion in 2024.

b. The garbage bags market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 18.27 billion by 2030.

b. Asia Pacific dominated the garbage bags market, with a share of over 34.54% in 2023. Rapid urbanization and industrialization are driving the regional market's growth.

b. Some of the key players operating in the garbage bags market include Pack-It BV, Kemii Garbage Bag Co. Ltd, Cosmoplast Industrial Company LLC( Harwal Group of Companies), Luban Packing LLC, Hefty(Reynolds Consumer Products LLC), International Plastics Inc., Novolex, Novplasta s.r.o., Terdex GmbH, and Berry Global Inc

b. Key factors that are driving the garbage bags market growth include the growing concerns about hygiene and environmental cleanliness, the Increasing demand for easily disposable and eco-friendly garbage bags, and awareness regarding environmentally sustainable products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.