- Home

- »

- Consumer F&B

- »

-

Fruits & Vegetables Market Size And Share Report, 2030GVR Report cover

![Fruits & Vegetables Market Size, Share & Trends Report]()

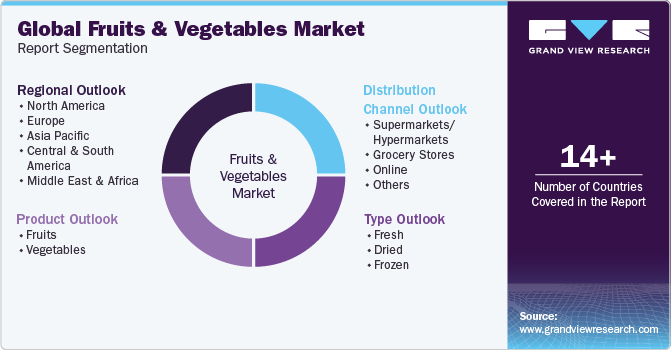

Fruits & Vegetables Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fruits, Vegetables), By Type (Fresh, Dried), By Distribution Channel (Supermarkets/Hypermarkets, Grocery Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-258-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fruits & Vegetables Market Summary

The global fruits & vegetables market size was estimated at USD 733.87 billion in 2023 and is projected to reach USD 1,018.12 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. Consumers, especially millennials and working professionals, are increasingly opting for online grocery shopping owing to its advantages, including convenience and doorstep delivery.

Key Market Trends & Insights

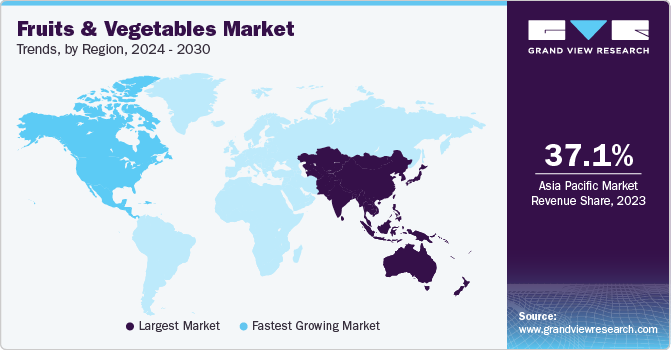

- Asia Pacific dominated the fruits & vegetables market with the revenue share of over 37.07% in 2023.

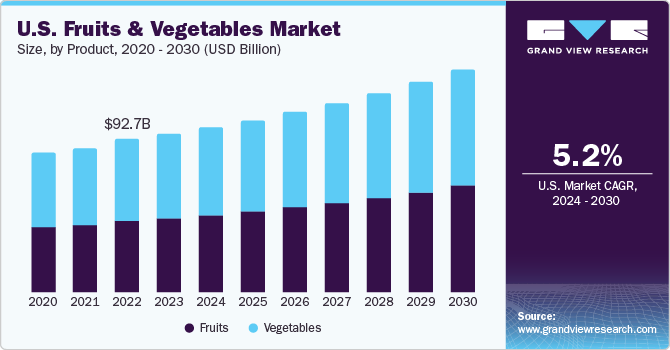

- The fruits and & vegetables market in the U.S. is expected to grow at a the fastest CAGR of 5.2% from 2024 to 2030.

- Based on type, the fresh fruits accounted segment led the market with the for alargest revenue share of 81.0% in 2023.

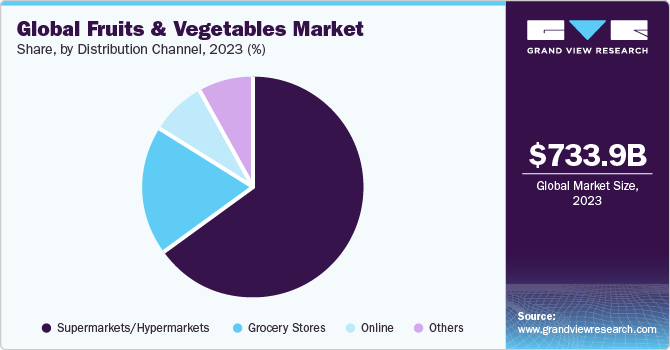

- Based on distribution channel, the sales through supermarkets/hypermarkets segment accounted for the largest revenue share of 65.4% in 2023.

- Based on product, the vegetables accounted segment led the market with the largest for a revenue share of 53.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 733.87 billion

- 2030 Projected Market Size: USD 1,018.12 billion

- CAGR (2024-2030): 5.0%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

To meet growing demand, many services are broadening their content offerings, including original programming and live sports. Additionally, targeted advertising is becoming increasingly advanced, as services utilize data and analytics to provide viewers with highly personalized ad experiences. As a result, the market is expected to continue to grow and evolve in the coming years. Online grocery shopping allows customers to order fresh produce from the comfort of their homes, eliminating the need for time-consuming trips to physical stores. This convenience especially appeals to older adults with mobility issues who prefer to avoid crowded shopping environments.The growing popularity of online grocery shopping & delivery services drives product purchases. Meal kit delivery is another addition to grocery delivery that is gaining popularity among health-conscious consumers, as they provide many combinations of fruits & vegetables based on the consumers’ requirements. These meal kits are mainly popular among millennials and Generation X, among people who live alone. Moreover , according to an analysis conducted by the United States Department of Agriculture (USDA), in 2021, the retail market in Canada is characterized by maturity, consolidation, and a robust demand for produce. The report highlights that a select group of leading retailers dominates the Canadian grocery landscape, collectively accounting for a substantial 76% of the market share.

Millennials are the main consumers of fruits and vegetables in the U.S. due to their increased digital presence. Online retailers adopt strategies like providing huge discounts and cashback, which is expected to attract this demographic over the forecast period. Frequent snacking among millennials and their concerns about the costs has havemade online stores an attractive alternative.

The popularity of trendy diets and superfoods has significantly impacted the consumption patterns of fruits and vegetables across the globe. Consumers are increasingly prioritizing their health and well-being and adopting dietary trends that highlight the significance of nutrient-dense plant-based foods. Superfoods like kale, blueberries, avocados, and acai berries, known for their exceptional nutritional profiles, have become dietary staples. Moreover, diverse diet trends, such as Mediterranean and plant-based diets, emphasize the pivotal role of fruits and vegetables in maintaining health and preventing diseases.

As sustainability concerns gain traction, the lower environmental footprint of plant-based options aligns with the environmental-conscious consumers. The influence of social media, the availability of a wider range of produce, and a growing awareness of functional foods all contribute to the increased incorporation of fruits and vegetables into daily meals.

With the rise in obesity rates in countries including the U.S. and growing awareness of the benefits of a healthy diet, consumers have been steadily shifting toward fresh foods and healthier options over the past ten years. Younger demographics tend to be drawn to trendy diets like raw food and paleo diets that emphasize the health advantages of fresh produce. Furthermore, elderly people tend to have good eating habits due to health issues. Therefore, baby boomers are also a key consumer group for fresh produce.

In additionally, fruits are promoted as a healthy option to sweet snacks like cookies and cakes because snacking is common throughout many age groups and is also one of the main contributors to obesity in the general population, coupled with a sedentary lifestyle. In addition, as a means of maintaining their health, consumers who wanted to boost their nutrient consumption focused on "superfoods,” which boosted the market for fruits and vegetables because items like avocados have high vitamin and fiber content.

Vegetarians & vegans primarily rely on consumption of fruits and vegetables to meet their nutritional requirements. Moreover, several non-vegetarians are becoming aware of the benefits of eating less meat and have started to focus on incorporating fruits & vegetables into their diet to increase their fiber intake and have healthier meals.

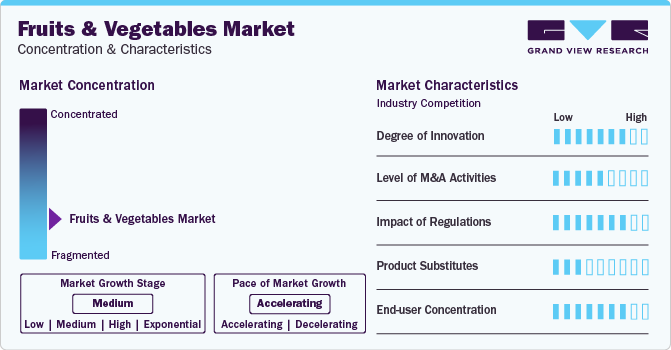

Market Concentration & Characteristics

The market demonstrates a low to medium degree of innovation. Players are introducing post-harvest technologies and bimolecular research tools or "omics" to efficiently gather and assess mass information at molecular, enzyme, and genetic levels influence the market. Moreover, precision agriculture technologies, such as drones, satellite imagery, and sensors, monitor crop health, optimize irrigation, and detect pest and disease outbreaks. These tools improve yield, reduce resource usage, and enhance crop management.

Regulations play a crucial role in shaping the fruits & vegetables global market. The U.S. FDA established a voluntary consultation process with GM crop developers to review the determination of “substantial equivalence” before the crop is marketed. This included assessing the toxicity and allergen of the gene product and the plant itself.

There are no substitutes that can replicate the nutrients and flavors of fruits and vegetables. As a result, the threat of substitution is low. However, consumers have access to a wide range of imported fruits and vegetables, which can serve as substitutes for domestic varieties. Moreover, processed foods and alternative diets can serve as substitutes for fresh fruits and vegetables, especially if they are perceived as more convenient or cost-effective.

Product Insights

The vegetables accounted segment led the market with the largest for a revenue share of 53.0% in 2023. The increasing adoption of vegan diets has fueled the demand for a diverse range of vegetables as a primary source of nutrition. Growing interest in diverse cuisines, with a strong emphasis on vegetables, has led to an increased demand for a wide variety of vegetables in the market. In additionally, the use of vegetables as key ingredients in the food processing industry for products like frozen vegetables, soups, and ready-to-eat meals has contributed to market growth.

The fruits market segment is expected to grow with atthe fastesta CAGR of 5.2% from 2024 to 2030. Growing awareness regarding the health benefits of consuming fruits as they are rich in vitamins, minerals, and antioxidants, has driven an increased demand for fruits. Moreover, the development of innovative fruit-based products, such as smoothies, juices, and fruit snacks, has expanded the market and attracted consumers looking for convenient and tasty options. Furthermore, frozen fruits have gained significant popularity in the region, both among consumers as they are convenient and can be easily used in making smoothies.

Type Insights

Based on type, the fresh fruits fruits and vegetables accounted segment led the market with the for alargest revenue share of 81.0% in 2023. The coronavirus outbreak had a significant impact on the consumption of fresh fruits and vegetables in the region. While the availability of these products faced challenges due to logistical and transport restrictions, there was a concurrent surge in demand for fresh fruits and vegetables. This increase in demand was driven by consumers who, in response to the pandemic, heightened their focus on maintaining a healthy diet and incorporating more fresh produce into their meals, opting for these options over processed or frozen foods.

The dried fruits segment is expected to grow at the fastest CAGR of 6.4% during the forecast period. A consistent increase in the consumption of dried fruits and vegetables has been observed, driven by a growing demand for healthier snack options. Dried fruits and vegetables have gained popularity due to their convenience, portability, and extended shelf life compared to fresh produce. In addition, the rising trend of plant-based diets has contributed significantly to this segment's growth. According to an article from the Alliance for Science, as of January 2022, approximately 10% of American adults aged 18 and older identified as vegan or vegetarian. This shift in dietary preferences has led many consumers to reduce their meat consumption and seek alternative sources of nutrition and protein. Dried vegetables and fruits have emerged as a quick and cost-effective way to incorporate plant-based protein and essential nutrients into meals.

Distribution Channel Insights

Based on distribution channel, the Sales through supermarkets/hypermarkets segment accounted forled the market with the largest a revenue share of 65.4% in 2023. Several key factors contribute to consumers' preference for shopping for fruits and vegetables at hypermarkets and supermarkets. These factors include convenience, pricing, product availability, and brand recognition. Hypermarkets and supermarkets offer a comprehensive shopping experience, allowing consumers to find a wide range of products, including fruits and vegetables, all in one location. In additionally, these establishments often provide lower prices on fruits and vegetables compared to other retailers, thanks to their substantial purchasing power and economies of scale.

The Sales through online channels segmentare isexpected to grow with atthe fastesta CAGR of 11.5% during the forecast periodfrom 2024 to 2030. Online platforms play a crucial role in providing consumers with access to a diverse range of fruits and vegetables, including seasonal and specialty produce that might not be readily available in their local physical stores. The significance of online fruit and vegetable purchases became even more apparent in the wake of the viral outbreak of COVID-19, which resulted in temporary and permanent closures of physical distribution channels. In response to these challenges, the sale of fruits and vegetables through e-commerce portals and online grocery stores experienced a notable surge in and after 2020.

Regional Insights

The fruits & vegetables market in North America is expected to grow with at a the fastest CAGR of 5.1% from 2024 to 2030. Consumers in North America are increasingly prioritizing the intake of fresh fruits and vegetables as they dedicate more resources to maintaining a healthy lifestyle. Millennials continue to be the dominant purchasers of fruits and vegetables in the region, largely owing to their significant online presence. Online retailers are employing tactics such as substantial discounts and cashback incentives to appeal to this demographic, a trend expected to persist in the foreseeable future.

U.S. Fruits & Vegetables Market Trends

The fruits and & vegetables market in the U.S. is expected to grow at a the fastest CAGR of 5.2% from 2024 to 2030. Increasing shift among consumers toward fresh, health-conscious food choices, driven by the escalating obesity rates and a growing awareness of the benefits of nutritious diets. Younger age groups are particularly inclined toward trendy diets such as raw food and paleo, which place a strong emphasis on the health advantages of consuming fresh produce.

Asia Pacific Fruits & Vegetables Market Trends

Asia Pacific accounted for adominated the fruits & vegetables market with the revenue share of over 37.07% in 2023. The fast-paced lifestyle in the fruits and vegetables Asia Pacific market in Asia Pacific is driven by factors such as increasing health consciousness, changing consumer preferences, and growing demand for organically produced products. The presence of a large consumer base in China, India, and Japan for fruits and vegetables serves as a significant driver for regional demand in the fruits and vegetables market. Furthermore, the Asia Pacific region, being both the largest producer and consumer of fresh vegetables, plays a pivotal role in propelling overall market growth.

Key Fruits & Vegetables Company Insights

The global fruits & vegetables market is characterized by the presence of a few well-established players such as Dole Food Company, Inc., Fresh Del Monte Produce, Inc., General Mills Inc., Sunkist Growers, Inc., Berry Global Inc., Naturipe Farms, LLC, Grimmway Farms, Sysco Corporation, Tanimura & Antle Fresh Foods, Inc., and Chiquita Brands International, Inc. The market players face intense competition from each other as some of them are among the top fruit & vegetable manufacturers with diverse product portfolios for fruits & vegetables. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both, regional and international consumers.

Key Fruits & Vegetables Companies:

The following are the leading companies in the fruits & vegetables market. These companies collectively hold the largest market share and dictate industry trends.

- Dole Food Company, Inc.

- Fresh Del Monte Produce, Inc.

- General Mills Inc.

- Sunkist Growers, Inc.

- Berry Global Inc.

- Naturipe Farms, LLC

- Grimmway Farms

- Sysco Corporation

- Tanimura & Antle Fresh Foods, Inc.

- Chiquita Brands International, Inc.

Recent Developments

-

In January 2023, Dole Food Company, Inc. announced the launch of a sweeter, juicier, and more aromatic golden pineapple, meeting consumer demand for an improved pineapple-eating experience. The pineapples are available at select supermarkets in the U.S. and Canada. The new fruit is sustainably grown in Costa Rica and has the perfect balance of sweet and tart sensations.

-

In January 2023, Dole Food Company, Inc. announced that some of its subsidiaries had entered into an agreement to sell Dole’s Fresh Vegetables Division to an affiliate of Fresh Express Incorporated, a wholly owned subsidiary of Chiquita Holdings. The division comprises operations related to the processing and sale of whole produce like iceberg, romaine, leaf lettuces, cauliflower, broccoli, celery, asparagus, artichokes, green onions, sprouts, radishes, and cabbage, as well as salads.

-

In July 2022 Fresh Del Monte Produce, Inc. collaborated with Stord-a cloud supply chain company- to utilize the latter’s cloud supply chain solution and Del Monte’s cold storage infrastructure. This collaboration will satisfy the company’s requirement for temperature and humidity-controlled logistics.

Fruits & Vegetables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 761.56 billion

Revenue forecast in 2030

USD 1,018.12 billion

Growth rate (Revenue)

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Dole Food Company, Inc.; Fresh Del Monte Produce, Inc.; General Mills Inc.; Sunkist Growers, Inc.; Berry Global Inc.; Naturipe Farms; LLC, Grimmway Farms; Sysco Corporation; Tanimura & Antle Fresh Foods, Inc.; Chiquita Brands International, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fruits & Vegetables Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global fruits & vegetables market report on the basis ofbased on product, type, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fruits

-

Vegetables

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fresh

-

Dried

-

Frozen

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Grocery Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The popularity of trendy diets and superfoods has significantly impacted the consumption patterns of fruits and vegetables across the globe. Consumers are increasingly prioritizing their health and well-being and adopt dietary trends that highlight the significance of nutrient-dense plant-based foods.

b. The global fruits & vegetables market size was estimated at USD 733.87 billion in 2023 and is expected to reach USD 761.56 billion in 2024.

b. The global fruits & vegetables market is expected to grow at a compounded growth rate of 5.0% from 2024 to 2030 to reach USD 1,018.12 billion by 2030.

b. Asia Pacific dominated the global fruits & vegetables market with a share of 37.07% in 2023. The fruits and vegetables market in Asia Pacific is driven by factors such as increasing health consciousness, changing consumer preferences, and growing demand for organically produced products.

b. Some key players operating in white spirits market include Dole Food Company, Inc., Fresh Del Monte Produce, Inc., General Mills Inc., Sunkist Growers, Inc., Berry Global Inc., Naturipe Farms, LLC, Grimmway Farms, Sysco Corporation, Tanimura & Antle Fresh Foods, Inc., Chiquita Brands International, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.