- Home

- »

- Next Generation Technologies

- »

-

Food Technology Market Size, Share & Growth Report 2030GVR Report cover

![Food Technology Market Size, Share & Trends Report]()

Food Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Food Science, Supply Chain), By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-128-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Technology Market Summary

The global food technology market size was estimated at USD 172.66 billion in 2022 and is projected to reach USD 354.94 billion by 2030, growing at a CAGR of 9.9% from 2023 to 2030. The growing need to automate and digitize the food supply chain drives the market’s growth.

Key Market Trends & Insights

- Asia Pacific dominated the market in 2022, with a revenue share of over 31.0%.

- North America is expected to grow at a considerable CAGR of 7.7%.

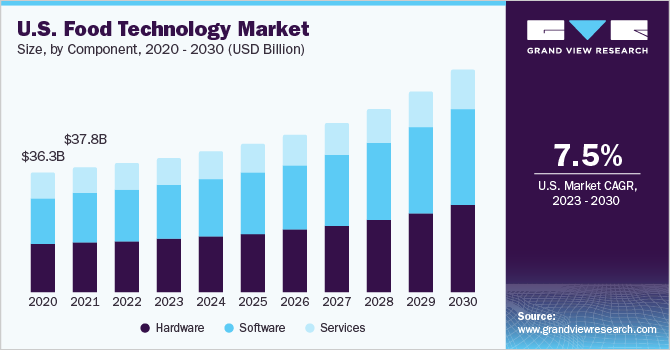

- By component, the hardware segment dominated the market in 2022 with a revenue share of over 42.0% in 2022.

- By application, the food science segment dominated the food tech market, with a revenue share of more than 26.0% in 2022.

- By industry, the fish, meat, and seafood segment dominated the food tech market in 2022

Market Size & Forecast

- 2022 Market Size: USD 172.66 Billion

- 2030 Projected Market Size: USD 354.94 Billion

- CAGR (2023-2030): 9.9%

- Asia Pacific: Largest market in 2022

Moreover, growing investments and advancements in technology boost market growth. Food tech is an application of food science to improve various stages of the food industry, such as processing, packaging, distribution, and usage. Market players use technologies such as Artificial Intelligence (AI), big data, and the Internet of Things (IoT). Adopting such technologies helps improve operations across the food value chain, making it more sustainable and efficient.

Market trends in recent years include personalized diets, food traceability, and automation, among others. For instance, supermarkets use blockchain to trace whether chicken meat is sourced from antibiotic-free poultry. Robotics offers benefits to the food industry, such as the ability to function in challenging work environments and handling diverse and delicate products across the industry. In April 2023, Aniai, Inc., a South Korea-based robotic kitchen company, announced the launch of Alpha Grill, a cooking robot. The cooking robot is automation- and AI technology-enabled and designed for cooking burgers. With this launch, the company aimed to improve its food service operations.

Food tech solutions are being rapidly adopted in North America, a region with many market players. Moreover, the region has a developed technological infrastructure, and growing investments in advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) in the region bode well for market growth. The market is fragmented, with many established and new companies addressing various needs across the value chain. The market players are adopting strategies such as product development, partnerships, and collaborations to gain a competitive edge.

COVID-19 Impact

The COVID-19 pandemic posed significant challenges across the food supply chain, including production, processing, and transportation & logistics. Lockdown and social distancing norms disrupted food processing industries due to labor shortages. Hence, the pandemic accelerated technology adoption to address these challenges. For instance, robotics in the food service sector saw significant growth as restaurants looked to address labor shortages. In June 2020, DADAWAN, a Netherlands-based restaurant, used robots to serve customers after re-opening. The company aimed to maintain social distancing and minimize the risk of virus spread.

The pandemic accelerated e-commerce and online food delivery as people stayed home due to lockdowns and social distancing norms. The pandemic shifted consumer behavior, and retailers were required to improve their online fulfillment capabilities as consumers discovered the benefits of online shopping. Food delivery apps saw rapid adoption during the pandemic as restaurants were shut down and needed to meet consumer demand. Labor shortages due to the pandemic accelerated the adoption of automation technologies across the supply chain, including delivery.

Component Insights

In terms of component, the market is classified into hardware, software, and services. The hardware segment dominated the market in 2022 with a revenue share of over 42.0% in 2022. The segment is anticipated to grow at a CAGR of 9.5% throughout the forecast period. Hardware includes various devices across the food value chain, such as voice assistants, cooking robots, and self-ordering kiosks, among others, at restaurants, and robots and drones for delivering. Moreover, IoT sensors can help minimize wastage by monitoring temperature. The need to meet regulatory compliance, improve customer experience, and improve efficiency across the supply chain is driving segment growth.

The software segment is anticipated to grow at the fastest CAGR of 11.1% over the forecast period. Software includes various solutions, such as food and grocery delivery apps, restaurant reservations platforms, chatbots, and Warehouse Management Systems (WMS), among others. A WMS can help provide end-to-end visibility and greater control, improving inventory accuracy and optimizing warehouse space. Companies are using advanced technologies such as generative AI to improve their software offerings for the industry. For instance, in March 2023, Tastewise, an Israel-based company, announced the launch of TasteGPT, a conversational chatbot. The chatbot uses generative AI technology and offers real-time dish, product, and menu recommendations. Growing innovation in software solutions and rising adoption of food delivery platforms drive segment growth.

Application Insights

In terms of application, the market is classified into food science, kitchen & restaurant tech, delivery, supply chain, and others segments. The food science segment dominated the food tech market, with a revenue share of more than 26.0% in 2022. The segment is expected to grow at a CAGR of 10.3% over the forecast period. Food science includes companies involved in food processing and those developing new products and ingredients. Growing demand for alternative proteins is driving the segment’s growth. Moreover, increasing investments in food science startups boost the segment’s growth. In March 2023, Shiru, Inc., a U.S.-based company, announced the launch of OleoPro, a plant-based fat ingredient. The company’s proprietary technology platform, Flourish, was used for developing the ingredient. The platform leverages Artificial Intelligence (AI) to generate insights for unique plant proteins.

The delivery segment is anticipated to grow at the fastest CAGR of 11.0% over the forecast period. The delivery segment includes on-demand delivery of food products. Changing consumer preferences are driving restaurants to adopt a hybrid operating model. On-demand delivery offers consumers convenience and comfort, as they have many options and can order them from their homes. Dark kitchens, used only for food delivery applications, are seeing a rise in demand.

Industry Insights

In terms of industry, the market is classified into fish, meat, seafood, fruits and vegetables, grain and oil, dairy products, beverages, bakery and confectionery, and others. The fish, meat, and seafood segment dominated the food tech market in 2022 with a revenue share of more than 19.0% and is anticipated to witness the highest CAGR of 11.4% during the forecast period. The fish, meat, and seafood industry significantly contributes to the overall food & beverage sector. According to the U.S. Department of Agriculture (USDA), in 2021, the meat processing sector was the largest component in terms of value added in the U.S. food sector at 22.2%. Moreover, the increasing demand for frozen and alternative meat drives the segment’s growth.

The dairy products segment is anticipated to grow at a considerable CAGR of 10.9% over the forecast period. Dairy products such as milk, ice cream, butter, and cheese are temperature-sensitive and must be kept in a temperature-controlled environment. They must also be monitored for avoiding spoilage and extending their shelf life. For instance, monitoring solutions can help maintain the quality of dairy products by alerting operators when the environmental conditions are not maintained, helping them take corrective actions. Xsense Ltd, an Israel-based cold chain monitoring solution provider, offers Xsense System, an IoT-based cold chain monitoring system, and serves the dairy industry. The need to preserve the quality of dairy products across the supply chain is driving the segment’s growth.

Regional Insights

In terms of region, Asia Pacific dominated the market in 2022, with a revenue share of over 31.0%. The regional market is expected to grow at the fastest CAGR of 12.0% throughout the forecast period. Asia Pacific makes up a significant portion of the global population. According to the United Nations Population Fund (UNFP), Asia Pacific comprises about 60% of the global population. Moreover, the e-commerce sector is witnessing significant growth in the region. The COVID-19 pandemic accelerated the adoption of on-demand food delivery platforms in the region. The region has a presence of numerous companies operating in the market, such as India-based Swiggy, Australia-based Mr Yum, and Singapore-based NEXT GEN FOODS PTE. LTD. A high population and rapid e-commerce penetration drive the market's growth in Asia Pacific.

North America is expected to grow at a considerable CAGR of 7.7%. North America has a highly developed technology infrastructure and the presence of numerous market players. Major U.S. restaurant chains, such as Starbucks Coffee Company and Chipotle, are using automation tools, such as robotic grills, to cut labor costs and improve their profit margins. The growing investments in the Research and Development (R&D) of advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), in the region present significant growth opportunities for the market.

Key Companies & Market Share Insights

The market is highly fragmented, with numerous local and international players, and is likely to witness high competition with new entrants. Some prominent players in the market include Delivery Hero SE, HelloFresh SE, Swiggy, Flytrex Inc., TRAX IMAGE RECOGNITION, CUBIQ FOODS, LUNCHBOX, Miso Robotics, Carlisle Technology, and Nymble (Epifeast Inc.), among others. These players are adopting strategies such as partnerships and collaborations to innovate and launch new products. For instance, in March 2023, CUBIQ FOODS and Cargill, Incorporated, a U.S.-based company, announced a partnership to provide novel fats to plant-based food. The companies aimed to meet the demand for healthier ingredients with this partnership. Some prominent players in the global food technology market include:

-

Delivery Hero SE

-

HelloFresh SE

-

Swiggy

-

Flytrex Inc.

-

TRAX IMAGE RECOGNITION

-

CUBIQ FOODS

-

LUNCHBOX

-

Miso Robotics

-

Carlisle Technology

-

Nymble (Epifeast Inc.)

Food Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 183.54 billion

Revenue forecast in 2030

USD 354.94 billion

Growth rate

CAGR of 9.9% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Delivery Hero SE; HelloFresh SE; Swiggy; Flytrex Inc.; TRAX IMAGE RECOGNITION; CUBIQ FOODS; LUNCHBOX; Miso Robotics; Carlisle Technology; Nymble (Epifeast Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global food technology market report based on component, application, industry, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food Science

-

Kitchen & Restaurant Tech

-

Delivery

-

Supply Chain

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Fish, Meat, and Seafood

-

Fruits and Vegetables

-

Grain and Oil

-

Dairy Products

-

Beverages

-

Bakery and Confectionery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food technology market size was estimated at USD 172.66 billion in 2022 and is expected to reach USD 183.54 billion in 2023.

b. The global food technology market is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 354.94 billion by 2030.

b. Asia Pacific dominated the food technology market with a share of over 31.0% in 2022. This is attributable to a large population and growing e-commerce penetration in the region.

b. Some key players operating in the food technology market include Delivery Hero SE, HelloFresh SE, Swiggy, Flytrex Inc., TRAX IMAGE RECOGNITION, CUBIQ FOODS, LUNCHBOX, Miso Robotics, Carlisle Technology, and Nymble (Epifeast Inc.).

b. Key factors driving the market growth include changing consumer preferences and the growing need to digitize and automate the food supply chain.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.