- Home

- »

- Catalysts & Enzymes

- »

-

Food Enzymes Market Size, Share, Industry Report, 2033GVR Report cover

![Food Enzymes Market Size, Share & Trends Report]()

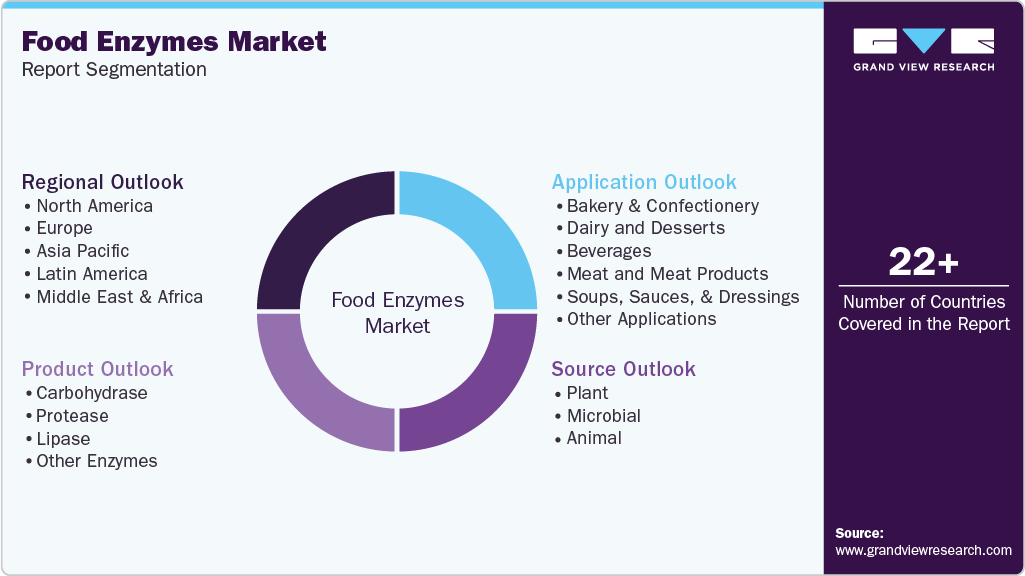

Food Enzymes Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Carbohydrase, Protease, Lipase), By Source (Plant, Microbial, Animal), By Application (Bakery And Confectionery, Dairy And Desserts, Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-847-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2026

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Enzymes Market Summary

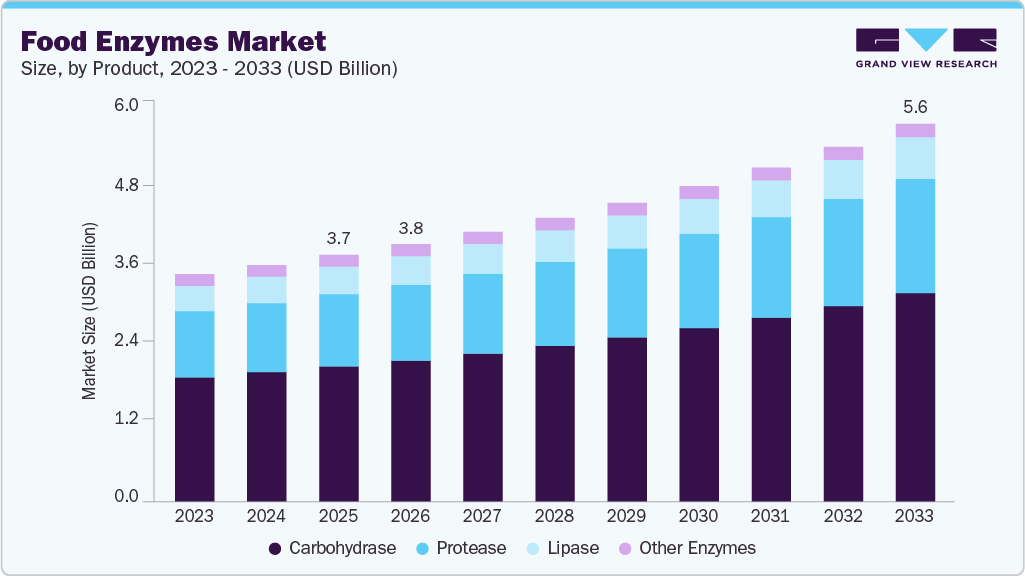

The global food enzymes market size was estimated at USD 3,668.1 million in 2025 and is projected to reach USD 5,618.73 million, growing at a CAGR of 5.6% from 2026 to 2033. The market is expanding as food producers seek efficient ways to improve quality, consistency, and processing outcomes.

Key Market Trends & Insights

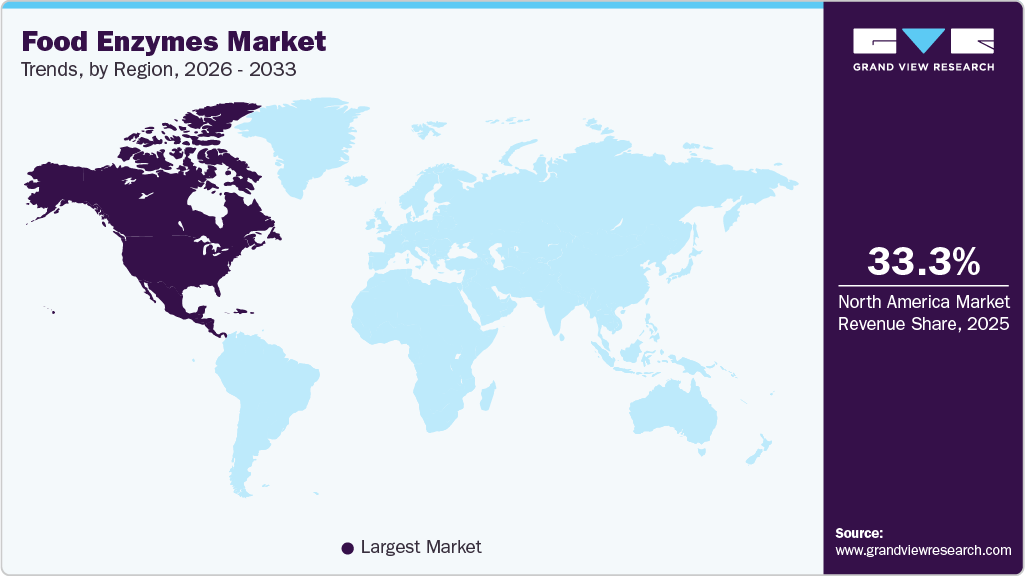

- The North America food enzymes market held the largest global revenue share of 33.3% in 2025.

- The U.S. food enzymes industry led North America with the largest share in 2025.

- Based on product, the protease segment is projected to record the fastest CAGR of 6.1% from 2026 to 2033.

- Based on source, the microbial segment dominated the market, accounting for a revenue share of 62.0% in 2025.

- Based on application, the dairy and desserts segment is expected to grow at the fastest CAGR of 6.4% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 3,668.1 Million

- 2033 Projected Market Size: USD 5,618.7 Million

- CAGR (2026-2033): 5.6%

- Largest Region: North America

Enzymes enable precise biochemical reactions that enhance texture, flavor, yield, and shelf stability while reducing waste, making them essential to modern food manufacturing systems. The growth of the food enzymes industry is closely tied to the transformation of global food production practices. Manufacturers are under pressure to deliver uniform products at scale while managing raw material variability and cost efficiency. Enzymes offer targeted functionality, enabling producers to control processing steps such as fermentation, coagulation, and hydrolysis with greater accuracy. This improves output reliability while lowering energy usage and processing time. As food supply chains become more complex and competitive, enzymes are increasingly viewed as performance tools rather than optional processing aids.

Changing consumer expectations also play a central role in market expansion. Demand for improved taste, cleaner ingredient labels, and plant-based or specialty foods has encouraged manufacturers to reformulate products without compromising sensory quality. Enzymes enable these changes by replacing chemical treatments and supporting natural processing routes. In dairy, bakery, beverage, and plant-based foods, enzyme solutions help maintain product appeal while meeting regulatory and consumer scrutiny. This alignment between consumer perception and technical functionality continues to reinforce enzyme adoption across food categories.

The market is further shaped by progress in fermentation science and strain development, which has improved enzyme specificity, stability, and yield. Producers can now tailor enzymes for precise applications, allowing broader use across diverse food matrices. Strategic investments, acquisitions, and capacity expansions by major enzyme companies signal long-term confidence in demand. As sustainability, efficiency, and product differentiation remain central to food industry strategies, food enzymes are positioned as a foundational component supporting both innovation and operational resilience.

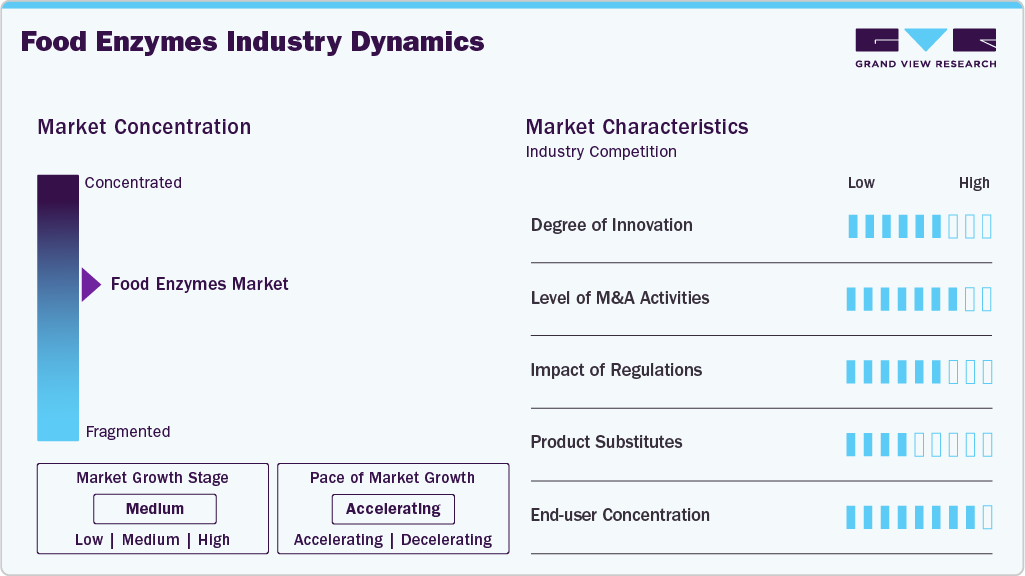

Market Concentration & Characteristics

The food enzymes market shows a concentrated structure shaped by a small number of global producers alongside a wide base of specialized and regional suppliers. Large companies dominate through broad product portfolios, strong research capabilities, and long-standing relationships with food manufacturers. Their ability to deliver consistent quality, technical support, and customized solutions creates high entry barriers and reinforces their influence across major food processing segments.

At the same time, the market for food enzymes remains dynamic due to continuous innovation and application-driven demand. Smaller producers focus on niche enzymes, regional food preferences, or specific processing challenges, allowing them to coexist with larger players. The market is characterized by strong customer collaboration, strict regulatory oversight, and a high emphasis on performance reliability.

Product Insights

The carbohydrase segment held the largest share of the food enzymes industry in 2025, accounting for 54.7% of total revenue, driven by its broad functional use across food processing applications. These enzymes support starch breakdown, sugar release, and fiber modification, making them indispensable in baking, brewing, beverage production, and dairy alternatives. Their consistent performance in improving process efficiency, texture control, and fermentation outcomes has reinforced their widespread industrial adoption.

The protease segment is projected to record the fastest growth, with a CAGR of 6.1% from 2026 to 2033, as food manufacturers increasingly focus on protein optimization. Proteases enable controlled protein hydrolysis, improving texture, flavor development, and digestibility in dairy, meat, and plant-based foods. Their relevance continues to expand as high-protein formulations and alternative protein products gain prominence across global food markets.

Source Insights

The microbial segment dominated the food enzymes market in 2025, accounting for 62.0% of total revenue, due to its scalability, consistency, and wide applicability across food processing operations. Enzymes produced through microbial fermentation offer high purity and stable performance, making them suitable for baking, dairy, beverages, and starch processing. Their production efficiency and adaptability to different formulations have made microbial sources the preferred choice for large-scale and specialized food manufacturers.

The animal segment is expected to grow at the fastest CAGR of 6.3% from 2026 to 2033, driven by continued demand for traditional and highly specific enzyme functionalities. Animal-derived enzymes, such as chymosin, are valued for their precision in applications such as cheese production. Ongoing refinement of extraction and processing methods has supported broader acceptance while maintaining performance characteristics required for specialized food applications.

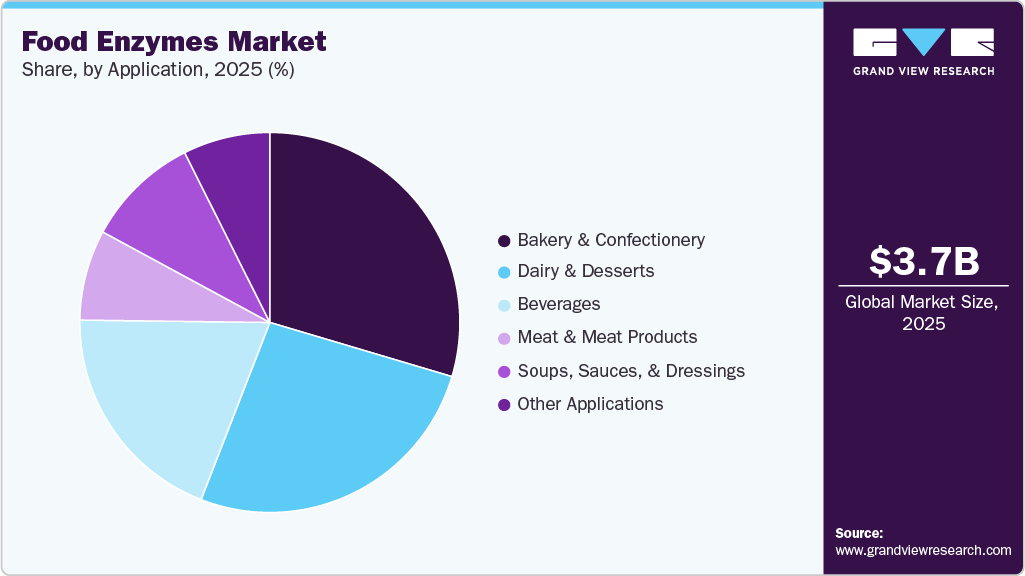

Application Insights

The bakery and confectionery segment led the food enzymes industry in 2025, accounting for 29.6% of revenue, driven by the high volume of baked goods and confectionery products produced globally. Enzymes are widely used to improve dough handling, volume, crumb structure, and shelf stability while maintaining consistent product quality. Their role in optimizing production efficiency and supporting formulation flexibility has sustained strong demand across industrial and artisanal baking operations.

The dairy and desserts segment is expected to grow at the fastest CAGR of 6.4% from 2026 to 2033, as manufacturers focus on improving texture, flavor development, and processing efficiency. Enzymes support cheese ripening, lactose modification, and protein functionality, enabling product differentiation across traditional and emerging dairy formats. Rising demand for premium, functional, and alternative dairy desserts continues to reinforce enzyme adoption within this segment.

Regional Insights

North America held the largest share of the food enzymes market in 2025, accounting for a revenue share of 33.3% in 2025, reflecting the region’s strong base of industrial food producers and advanced processing practices. Widespread use of enzymes to improve product consistency, efficiency, and quality across multiple food categories has reinforced steady demand. The presence of established suppliers and continuous innovation has further strengthened regional market leadership.

U.S. Food Enzymes Market Trends

The U.S. held over 74.6% revenue share of the North America food enzymes market in 2025. The U.S. food enzymes industry is shaped by a highly industrialized food sector that emphasizes efficiency, consistency, and product differentiation. Enzym. es are widely used in bakery, dairy, beverages, and processed foods to support large-scale production and formulation innovation. Strong regulatory clarity, advanced fermentation capabilities, and close collaboration between enzyme suppliers and food manufacturers continue to support sustained market demand across diverse applications.

Asia Pacific Food Enzymes Market Trends

Asia Pacific is projected to grow at the fastest CAGR of 6.2% from 2026 to 2033, driven by expanding food production activities and shifting consumption patterns. Increased focus on processed foods, dairy products, and bakery items has driven the adoption of enzymes to enhance performance and scalability. Ongoing investments in food processing capabilities continue to support rapid regional market growth.

The China food enzymes market is expected to grow, driven by the rapid modernization of its food processing industry and growing demand for consistent product quality. Expansion of bakery, dairy, and convenience food manufacturing has increased reliance on enzymes to improve efficiency and scalability. Domestic production capacity, combined with rising technical expertise and government support for food-processing innovation, has strengthened the use of enzymes across industrial food applications.

Europe Food Enzymes Market Trends

Strict food quality standards and a strong preference for natural processing solutions influence the Europe food enzymes industry. Enzymes are commonly used to improve functionality while supporting cleaner ingredient declarations across bakery, dairy, and beverage products. The region benefits from long-established enzyme producers, strong research capabilities, and a tradition of fermented foods, which collectively reinforce consistent adoption of enzymes across both traditional and emerging food categories.

Latin America Food Enzymes Market Trends

The growing role of processed foods and beverages in regional diets supports the Latin America food enzymes industry. Enzymes are increasingly adopted to improve shelf stability, texture, and yield in bakery, dairy, and beverage production. The availability of high-quality agricultural raw materials and the gradual expansion of industrial food manufacturing have encouraged the use of enzymes to improve processing reliability and product consistency.

Middle East & Africa Food Enzymes Market Trends

The Middle East and Africa market for food enzymes is shaped by rising demand for packaged foods and increasing investment in local food processing facilities. Enzymes are used to enhance production efficiency and adapt formulations to regional taste preferences and climate conditions. Growth in bakery and dairy processing, along with efforts to strengthen food security and reduce imports, continues to support the gradual expansion of the regional market.

Key Food Enzymes Company Insights

The two key dominant manufacturers in the market are Novozymes A/S (now operating as Novonesis) and International Flavors & Fragrances Inc. (IFF).

-

Novozymes, now part of Novonesis, is widely recognized for its deep expertise in enzyme innovation and fermentation science. The company focuses on developing enzyme solutions that enhance efficiency, quality, and functionality across food processing applications, including baking, dairy, beverages, and plant-based foods. Its strength lies in application-driven research, close technical collaboration with food manufacturers, and a strong emphasis on sustainability and precision biology. Through continuous development of highly specific and stable enzymes, the company supports process optimization, cleaner formulations, and consistent product performance across global food systems.

-

International Flavors & Fragrances Inc. holds a strong position in the food enzymes market through its integrated biosciences capabilities. The company combines enzyme technology with formulation expertise to address complex challenges in texture, flavor development, and processing efficiency. Its portfolio supports a wide range of applications, including dairy, bakery, beverages, and alternative proteins. IFF’s focus on innovation, fermentation-based solutions, and customer-oriented development enables tailored enzyme applications that align with evolving food trends and manufacturing requirements, reinforcing its influence across the global food processing landscape.

Key Food Enzymes Companies:

The following key companies have been profiled for this study on the food enzymes market

- Novozymes A/S / Novonesis

- International Flavors & Fragrances Inc. (IFF)

- DSM‑Firmenich AG

- BASF SE

- Kerry Group plc

- Associated British Foods plc (AB Enzymes)

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme Inc.

- Biocatalysts Ltd.

- Enzyme Development Corporation

Recent Developments

-

In May 2025, BRAIN Biotech completed the buyout of Breatec B.V., opened a new European production site near Eindhoven, and expanded its Baking Application Center, strengthening its enzyme-based baking solutions and marking a key development in the food enzyme market.

-

In July 2025, Lallemand Bio-Ingredients acquired French enzyme producer Solyve, strengthening its food and beverage enzyme portfolio. The deal enhances capabilities in high-performance enzymes for winemaking, juice, vegetable processing, and plant-based food sectors, marking a key market development.

-

In September 2025, Kemin Industries acquired CJ Youtell Biotech, CJ Bio’s enzymes and fermentation subsidiary, enhancing its global enzyme and fermentation capabilities and marking a strategic development in the food enzymes and bioprocessing market.

Food Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,827.6 million

Revenue forecast in 2033

USD 5,618.7 million

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; India; South Korea; Saudi Arabia; South Africa

Key companies profiled

Novozymes A/S / Novonesis; International Flavors & Fragrances Inc. (IFF); DSM‑Firmenich AG; BASF SE; Kerry Group plc; Associated British Foods plc (AB Enzymes); Advanced Enzyme Technologies Ltd.; Amano Enzyme Inc.; Biocatalysts Ltd.; Enzyme Development Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Enzymes Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global food enzymes market report based on product, source, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Carbohydrase

-

Protease

-

Lipase

-

Other Enzymes

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Plant

-

Microbial

-

Animal

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Bakery and Confectionery

-

Dairy and Desserts

-

Beverages

-

Meat and Meat Products

-

Soups, Sauces, and Dressings

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food enzymes market size was valued at USD 3,668.1 million in 2025 and is expected to reach USD 3,827.6 million in 2026.

b. The global food enzymes market is expected to grow at a compound annual growth rate of 5.6% from 2026 to 2033, reaching USD 5,618.7 million by 2033.

b. The carbohydrase segment held the largest share of the food enzymes market in 2025, accounting for 54.7% of total revenue, driven by its broad functional use across food processing applications. These enzymes support starch breakdown, sugar release, and fiber modification, making them indispensable in baking, brewing, beverage production, and dairy alternatives. Their consistent performance in improving process efficiency, texture control, and fermentation outcomes has reinforced their widespread industrial adoption.

b. Some of the key players operating in the food enzymes Market include Novozymes A/S / Novonesis, International Flavors & Fragrances Inc. (IFF), DSM-Firmenich AG, BASF SE, Kerry Group plc, Associated British Foods plc (AB Enzymes), Advanced Enzyme Technologies Ltd., Amano Enzyme Inc., Biocatalysts Ltd., Enzyme Development Corporation.

b. The food enzymes market is expanding as food producers seek efficient ways to improve quality, consistency, and processing outcomes. Enzymes enable precise biochemical reactions that enhance texture, flavor, yield, and shelf stability while reducing waste, making them essential to modern food manufacturing systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.