Food Emulsifiers Market Size, Share & Trends Analysis Report By Product, By Application, By Source (Animal, Plant), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-372-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Food Emulsifiers Market Size & Trends

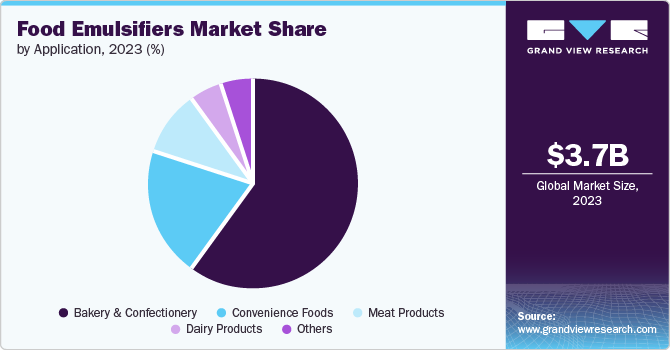

The global food emulsifiers market size was valued at USD 3.67 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. As consumers opt for more processed and convenience foods, there is a higher need for emulsifiers to enhance the texture, mouthfeel, and overall appearance of these products. Emulsifiers improve processed foods' quality and sensory experience, making them more appealing to consumers.

These additives offer benefits in product stability, texture enhancement, and fat reduction. With consumers increasingly seeking healthier and more appealing food options, emulsifiers help meet these preferences by improving the overall quality of food products and extending their shelf life. Rapid urbanization, rising disposable incomes, and shifting dietary patterns fuel the demand for a wide range of processed and packaged food and beverage products. It, in turn, is creating lucrative opportunities for food emulsifier manufacturers to cater to the evolving needs of the industry.

The emphasis on natural and clean-label ingredients in food products is influencing the growth of the food emulsifier market. As consumers seek healthier and more natural alternatives, there is a growing preference for emulsifiers derived from natural sources such as plant-based lecithin and other natural emulsifying agents. This shift towards clean-label products prompts manufacturers to develop innovative emulsifiers that meet the clean-label criteria, thus driving the market growth.

Furthermore, developing emulsifiers with improved performance attributes, such as stability under different processing conditions and compatibility with other ingredients, bolsters market growth and fosters innovation in the food industry. These advancements enable manufacturers to create novel products with enhanced sensory appeal and extended shelf-life, driving the demand for food emulsifiers.

Product Insights

Mono, di-glycerides & derivatives dominated the market and accounted for a revenue share of 46.9% in 2023. Mono, di-glycerides, and their derivatives offer various functional benefits in food applications. They act as emulsifying agents that help mix ingredients that would otherwise separate, improving product consistency and quality. With changing lifestyles and increasing urbanization, there has been a significant shift towards convenience foods. These products often require emulsifiers to improve texture, stability, and shelf life, driving the demand for mono and di-glycerides in the food industry.

Stearoyl lactylates is anticipated to register the fastest CAGR of 5.0% over the forecast period. These emulsifiers are compatible with a wide range of ingredients and can be used in different food products, such as baked goods, dairy products, sauces, dressings, and more. This versatility makes stearoyl lactylates a popular choice among food manufacturers looking to improve product quality and consistency while meeting consumer demands for clean-label ingredients.

Application Insights

The bakery and confectionery segment dominated the market in 2023. The rising trend of indulgence and premiumization in the bakery and confectionery sector fuels the demand for innovative, high-quality products. Food emulsifiers are crucial in improving the sensory attributes of baked goods and confectioneries, such as mouthfeel, creaminess, and overall eating experience. As consumers seek unique flavors and textures in their sweet treats, manufacturers increasingly use emulsifiers to meet these demands.

Convenience food is anticipated to register the fastest CAGR over the forecast period. Consumers' changing lifestyles and hectic schedules have led to an increasing demand for ready-to-eat and easy-to-prepare food options. Convenience food products such as frozen meals, instant soups, and snack items require the use of emulsifiers to maintain stability, texture, and shelf-life. As the demand for such convenience foods continues to rise, the need for food emulsifiers to ensure product quality and consistency is growing substantially.

Source Insights

The animal segment accounted for the largest market revenue share in 2023. Animal-derived emulsifiers possess unique characteristics that make them highly effective in stabilizing and enhancing the texture of various food products. For instance, egg yolk lecithin is widely used as an emulsifier in bakery products due to its ability to improve dough elasticity and shelf life. These functional benefits have contributed to food manufacturers' increased adoption of animal-based emulsifiers.

The plant segment is expected to register the fastest CAGR during the forecast period. Consumers are becoming more health-conscious and seeking products with natural ingredients, leading to a rising demand for plant-based emulsifiers in the food industry. Plant-based emulsifiers are perceived as healthier alternatives to synthetic emulsifiers, as they are derived from natural sources such as fruits, vegetables, and seeds. This shift towards clean-label products drives food manufacturers to incorporate plant-based emulsifiers into their formulations to meet consumer demands for transparency and sustainability.

Regional Insights

The North America food emulsifiers market is anticipated to grow significantly over the forecast period. The growing trend of clean labels and organic food products contributes to expanding the food emulsifier market in North America. As consumers become more conscious of the ingredients in their food, there is an increasing demand for emulsifiers that meet clean-label criteria and are derived from natural sources. This shift towards clean-label products is driving the adoption of food emulsifiers that align with the region's health-conscious consumers' preferences.

U.S. Food Emulsifiers Market Trends

The U.S. food emulsifiers market was identified as a lucrative country in 2023 The busy lifestyles of consumers, coupled with rising consumer spending on packaged foods, have propelled the consumption of convenience products, which, in turn, is anticipated to leverage the usage of emulsifiers over the coming years. This trend aligns with the need for convenient meal solutions and is expected to drive the demand for food emulsifiers in the U.S.

Europe Food Emulsifiers Market Trends

The Europe food emulsifiers market held a substantial market share in 2023. Consumers in Europe are becoming more health-conscious and are actively seeking products with clean labels that contain natural and recognizable ingredients. Food emulsifiers play a crucial role in achieving the desired texture and consistency in clean-label products, driving their adoption in the food industry.

The UK food emulsifiers market is expected to grow significantly over the forecast period. Consumers in the UK seek food products with longer shelf lives, fueling the demand for food emulsifiers that can help stabilize and preserve these items. As the population becomes more health-conscious, manufacturers are under pressure to create products with added benefits, leading to a rise in "free-from" launches that utilize emulsifiers.

Asia Pacific Food Emulsifiers Market Trends

The Asia Pacific food emulsifiers market accounted for the largest market revenue share of 28.8% in 2023. The increasing demand for convenience and premium food products, rapid urbanization, and the growing popularity of veganism across countries such as China and Japan are expected to drive the demand for emulsifiers and food processing ingredients in the region.

The China food emulsifiers market is expected to grow rapidly in the coming years. The increasing popularity of bakery products in China, driven by the rising trend of ‘snacking-on-the-go’ and the emergence of Western-style bakeries in second and third-tier cities, is boosting the demand for food emulsifiers, especially in baked goods where emulsifiers play a crucial role in enhancing texture and taste.

Key Food Emulsifiers Company Insights

Some of the key companies in the food emulsifiers market include Cargill, Incorporated, Palsgaard, Ingredion, and Ricken Vitamin CO., LTD. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Cargill, Incorporated. offers a wide range of food emulsifiers such as Soya Lecithin, Diacylglycerol (DAG), Polyglycerol Polyricinoleate (PGPR), Distilled Monoglycerides. These emulsifiers are designed to enhance food products' quality, functionality, and sensory attributes while meeting regulatory requirements and consumer preferences.

-

ADM offers a diverse range of food emulsifiers for various applications in the food industry. These emulsifiers are plant-based and label-friendly, providing consistent, cost-effective solutions for achieving food products' desired texture and stability. The company's quality emulsifiers are designed to ensure even blending and mixing, act as release agents for clean separation, help disperse proteins and other materials in aqueous systems, and serve as a nutritional source.

Key Food Emulsifiers Companies:

The following are the leading companies in the food emulsifiers market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated.

- Palsgaard

- Ingredion

- Ricken Vitamin CO., LTD.

- Corbion

- ADM

- Kerry Group

- BASF SE

- DuPont

Recent Developments

-

In August 2024, Palsgaard expanded its food emulsifier manufacturing capabilities by inaugurating a new emulsifier factory in Malaysia. The factory, with a production capacity of 20,000 metric tons (MT), underscores the company's dedication to meeting the growing demand for emulsifiers in the food industry, particularly in the Asia-Pacific region.

Food Emulsifiers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.79 billion |

|

Revenue forecast in 2030 |

USD 4.87 billion |

|

Growth Rate |

CAGR of 4.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, source, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Germany, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, UAE, and South Africa |

|

Key companies profiled |

Cargill Incorporated.; Palsgaard; Ingredion; Ricken Vitamin CO., LTD.; Corbion; ADM; Kerry Group; BASF SE; DuPont. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Food Emulsifiers Market Report Segmentation

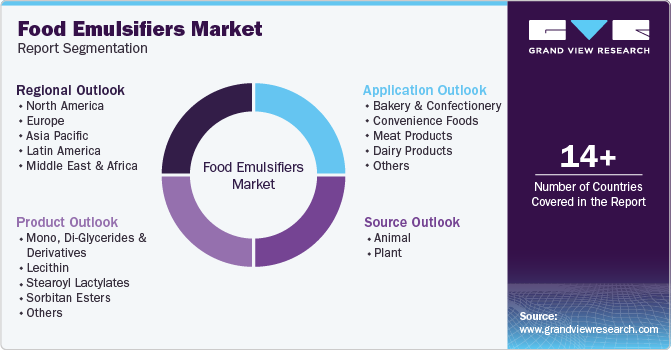

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food emulsifiers market report based on product, application, source, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mono, Di-Glycerides & Derivatives

-

Lecithin

-

Stearoyl Lactylates

-

Sorbitan Esters

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal

-

Plant

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery & Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."