- Home

- »

- Consumer F&B

- »

-

Food Acidulants Market Size, Share & Growth Report, 2030GVR Report cover

![Food Acidulants Market Size, Share & Trends Report]()

Food Acidulants Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Citric Acid, Malic Acid, Acetic Acid), By Application (Bakey & Confectionery, Beverages, Meat Industry), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-231-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Acidulants Market Summary

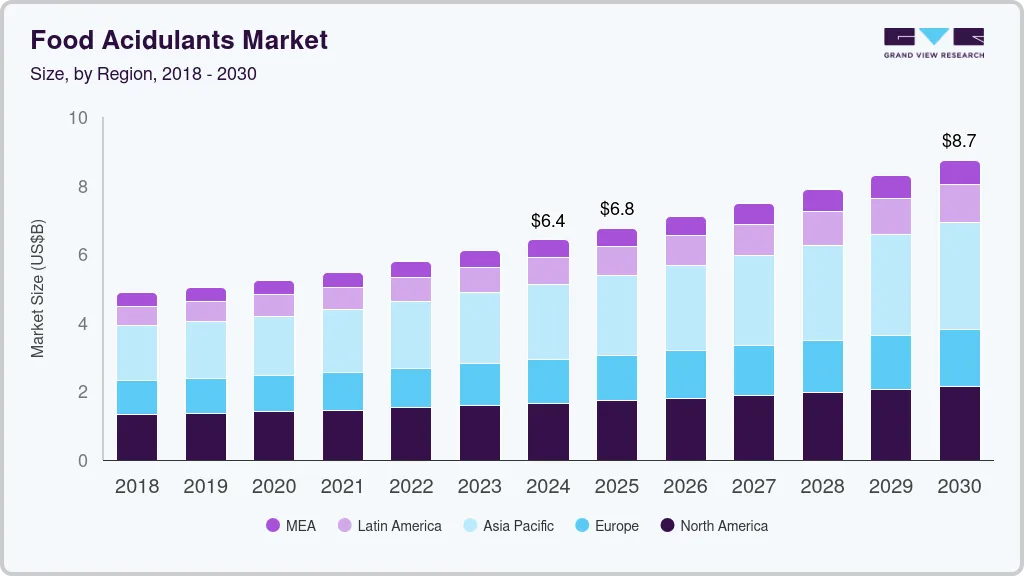

The global food acidulants market size was estimated at USD 6.42 billion in 2024 and is projected to reach USD 8.74 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. Food acidulants like citric acid, lactic acid, and malic acid are frequently added to processed foods and beverages as additives.

Key Market Trends & Insights

- The food acidulants market in Asia Pacific held the largest revenue share of 34.03% in 2023.

- The India food acidulants market is expected to grow significantly over the forecast period.

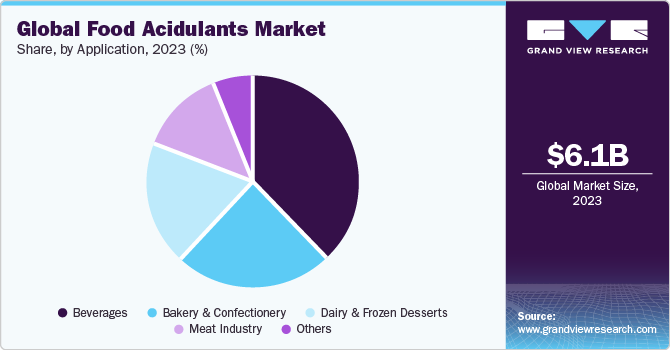

- By application, the beverages segment held the largest share of 38.57% in 2023.

- By type, the citric acid segment held a major revenue share of about 62% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 6.42 Billion

- 2030 Projected Market Size: USD 8.74 Billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2023

They not only give foods a sour taste but also enhance & alter flavors & sweetness, as well as adjust the pH of foods and beverages. As consumer preferences shift towards unique flavor profiles, the tart and sour notes provided by these acidulants are becoming more sought after, meeting consumers' evolving tastes. The widespread use of food acidulants in everyday processed foods is fueling their demand, with phosphoric acid being a key player found in various products. This acid can be found in popular carbonated beverages like colas and lemon-lime sodas, adding to their refreshing taste.It is also common in condiments, such as ketchup and BBQ sauce, enhancing their tanginess and overall flavor. Furthermore, the use of phosphoric acid in processed meats and canned soups helps regulate pH levels and extend shelf life, making these products safer and more appealing to consumers. These factors collectively contribute to the growth and positive impact on the global market. Acidulants play a crucial role in various applications, offering functionalities like imparting tartness, intensifying flavor, and extending shelf life by regulating pH, which controls the growth of microorganisms. According to a 2023 survey by Ayana Bio, a plant cell technology company, 34% of Americans choose ultra-processed foods because of their longer shelf life.

Acidulants, such as sodium citrate, potassium citrate, and citric acid, not only modify flavor profiles but also enhance the stability and shelf life of food products. This property of acidulants contributes significantly to their demand, as consumers seek products that last longer without compromising on taste or quality. The American Heart Association (AHA) reports that a majority of Americans prefer less sodium in their food, with over half actively seeking more control over their sodium intake. This has led to a drive to limit sodium, particularly in manufactured foods. Potassium citrate, a popular acidulant, is extensively used to formulate low-sodium foods, catering to this growing consumer demand.

This trend is a key driver behind the increasing usage of potassium citrate and, consequently, the growth of the acidulants market. The rapid growth of the meat & seafood industries significantly contributes to the expansion of the food acidulants sector. Over the past 50 years, the global meat demand has increased and has more than tripled with current annual production reaching over 350 million tons, as reported by Our World in Data in December 2023. Lactic acid plays a crucial role in quality assurance programs for meat & poultry slaughter lines, due to its potent antimicrobial properties. By inhibiting the growth of harmful microbes, lactic acid extends the shelf life of freshly slaughtered meat, aligning with the industry's need for effective preservation methods.

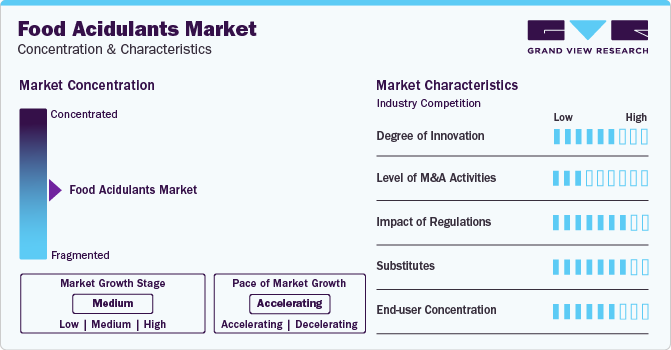

Market Concentration & Characteristics

The food acidulants market exhibits a moderate degree of innovation, with ongoing research focused on developing new product formulations and enhancing existing ones. Innovations aim to meet evolving consumer preferences, such as clean-label products, as well as improve functionality, efficiency, and sustainability in food processing.

Regulations play a crucial role in this market, ensuring the safety and quality of products. They often dictate the types and quantities of acidulants that can be used in food products, influencing formulation decisions. Compliance with these regulations is essential for market entry and maintaining consumer trust, driving manufacturers to innovate and develop products that meet regulatory standards.

The end-user concentration in the market is diverse, including the food and beverage industry, pharmaceuticals, cosmetics, and animal feed sectors. Each sector utilizes acidulants for various purposes, such as flavor enhancement, pH control, and preservation. The market's broad end-user base contributes to its stability and continuous growth.

The market has seen a moderate level of merger and acquisition (M&A) activity in recent years. These activities are driven by companies seeking to expand their product portfolios, enter new markets, or achieve economies of scale. For example, Cargill, Inc., and Croda struck a deal in December 2021 for Cargill, Inc. to purchase most of Croda's Performance Technologies and Industrial Chemicals (PTIC) division. The agreement was aimed at enhancing Cargill, Inc.'s footprint in high-growth bio-based markets in Asia, the U.S., and Europe.

Application Insights

The beverages segment held the largest share of 38.57% in 2023. Acidulants play a crucial role in beverages, providing formulators with a versatile tool to enhance flavor profiles, balance sweetness, and mask unpleasant tastes. In addition, they can help maintain pH, improve stability, and reduce costs, making them invaluable in creating well-rounded and appealing beverages. With increasing soft drink consumption globally, the product usage in beverages is set to increase. For instance, the U.S. has some of the highest rates of soda consumption in the world, with each individual consuming an estimated 154 liters per year, according to data from the World Population Review for 2024.

The demand for food acidulants in the dairy & frozen desserts industry is expected to register the fastest CAGR of 5.8% during the forecast period. Acidulants like citric acid can be added to ice cream and gelato as an emulsifying agent to aid in preventing fat separation or to caramel-based sauces to prevent the crystallization of sugar. As consumers seek more diverse and indulgent flavors in dairy and frozen desserts, acidulants will play a crucial role in meeting these demands.

Type Insights

The citric acid segment held a major revenue share of about 62% in 2023. Citric acid has emerged as one of the most prevalent ingredients in the food and beverage industry. Cargill Inc.’s IngredienTracker consumer research consistently indicates that citric acid has a positive impact on consumer purchases, second only to rosemary extract. Known for its ability to enhance flavor without leaving any aftertaste, citric acid is widely used in beverages, powdered drink mixes, candies, jams, and jellies. Its growing popularity underscores its significance in the food acidulants industry, where it is recognized for its flavor-enhancing properties and versatility across various product categories.

The malic acid segment is projected to register the fastest CAGR of 6.8% from 2024 to 2030. The demand for malic acid is poised to rise due to its unique properties and versatile applications. As a great alternative to citric acid, malic acid offers a persistent, pleasant tart flavor that complements sweeteners and enhances fruit flavors. Its good buffering properties make it resistant to pH changes, and it can also act as a color enhancer. In addition, malic acid is cost-effective, allowing for the use of smaller quantities compared to citric acid, making it an attractive option for a wide range of food and beverage products, including sour confectionery, desserts, preserves, flavored beers, and more.

Regional Insights

North America accounted for the second-largest share of 26% of the global revenue in 2023. The rising consumption of processed and convenience foods in North America is driving the demand for food acidulants. Also, innovations in processed food product formulation are expected to favor the rising demand for food acidulants in the North America regional market.

U.S. Food Acidulants Market Trends

The U.S. food acidulants market is projected to grow at a CAGR of 4.2% from 2024 to 2030. The food service sector, including restaurants, cafeterias, and catering services, is experiencing robust growth in the country. Also, stringent regulations related to food safety in the U.S. oblige food service providers and manufacturers to comply with regulatory requirements, which provides confidence to consumers, facilitating market growth by fostering trust.

Asia Pacific Food Acidulants Market Trends

The food acidulants market in Asia Pacific held the largest revenue share of 34.03% in 2023. The region's large population and rising disposable incomes are driving increased consumption of processed foods and beverages, which use acidulants for flavor enhancement and preservation. In addition, the growing food & beverage industry in countries like China and India is fueling product demand.

The India food acidulants market is expected to grow significantly over the forecast period. A report by the World Health Organization finds that despite a decline in the share of ultra-processed foods in India from 43% in 2011 to 36% in 2021, the demand for processed foods is rising, driven by factors, such as increasing disposable incomes, rapid urbanization, and changing lifestyles. Size and growth differ by the five major categories in ultra-processed food products. Chocolate and sugar confectionery accounted for the maximum share, In terms of retail sales value, during 2011 - 2021, followed by convenience & ready-made food products. The beverages category was in the third position till 2019; however, the salty snacks category occupied its position in 2021.

Central & South America Food Acidulants Market Trends

The food acidulants market in Central & South America is set to expand at a CAGR of 5.8% from 2024 to 2030. The product demand in this region is expected to increase due to factors, such as rising soda consumption. Based on data from the World Population Review for 2024, as compared to other countries across the globe, Argentina has the most soda consumption (approximately 155 liters per person) annually. Soda is a popular beverage in the area due to higher-income households and the warm weather.

Key Food Acidulants Company Insights

The market is highly fragmented with the presence of numerous top and regional companies across major economies. Multinational companies, such as Cargill, Inc.; Tate & Lyle; ADM; and Jungbunzlauer Suisse AG focus on offering a wide range of high-quality acidulants, investing in research and development for innovative products, providing excellent customer service, and ensuring competitive pricing strategies to compete in the market.

Key Food Acidulants Companies:

The following are the leading companies in the food acidulants market. These companies collectively hold the largest market share and dictate industry trends.

- Tate & Lyle

- Brenntag North America, Inc.

- Univar Solutions LLC

- ADM

- Jungbunzlauer Suisse AG

- Cargill, Incorporated

- Hawkins Watts Ltd.

- Corbion

- Bartek Ingredients Inc.

- FBC Industries

Recent Developments

-

In March 2023, Univar Solutions LLC announced its acquisition by Apollo Funds. The companies entered into a definitive merger agreement, which valued Univar Solutions LLC at about USD 8.1 billion. The transaction also featured a minority investment by Abu Dhabi Investment Authority‘s wholly-owned subsidiary

-

In November 2021, Tate & Lyle built a new biomass boiler at its Santa Rosa, Brazil plant, where acidulants are produced. The purpose was to decrease greenhouse gas (GHG) emissions, enhance efficiency, and lower water usage. As a result, the local community and plants benefitted from improved air quality

-

In July 2021, Tate & Lyle agreed to sell a controlling stake in a new company, NewCo, which included its Primary Products business in North America and Latin America, along with its interests in the Almidones Mexicanos S.A. de C.V. and DuPont Tate & Lyle Bio-Products Company, LLC joint ventures, to KPS Capital Partners, LP. This deal resulted in Tate & Lyle and KPS each holding 50% ownership of NewCo. After the transaction, NewCo comprised Tate & Lyle's Primary Products business in North America and Latin America, which included the acidulants plants located in Santa Rosa, Brazil and Dayton, Ohio & Duluth, Minnesota (both U.S.)

Food Acidulants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.76 billion

Revenue forecast in 2030

USD 8.74 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

Tate & Lyle; Brenntag North America, Inc.; Univar Solutions LLC; ADM; Jungbunzlauer Suisse AG; Cargill, Inc.; Hawkins Watts Ltd.; Corbion; Bartek Ingredients Inc.; FBC Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Acidulants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the food acidulants market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Citric Acid

-

Acetic Acid

-

Lactic Acid

-

Phosphoric Acid

-

Malic Acid

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bakery & Confectionery

-

Beverages

-

Dairy & Frozen Desserts

-

Meat Industry

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

- Brazil

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food acidulants market size was estimated at USD 6.11 billion in 2023 and is expected to reach USD 6.42 billion in 2024.

b. The global food acidulants market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 8.74 billion by 2030.

b. Asia Pacific dominated the food acidulants market with a share of 34.03% in 2023. The region's large population and rising disposable incomes are driving increased consumption of processed foods and beverages, which use acidulants for flavor enhancement and preservation.

b. Some key players operating in the food acidulants market include Tate & Lyle; Brenntag North America, Inc.; Univar Solutions LLC; ADM; Jungbunzlauer Suisse AG; Cargill, Incorporated; Hawkins Watts Limited; Corbion; Bartek Ingredients Inc.; FBC Industries

b. Consumers are increasingly seeking natural and clean-label food and beverage products, which has led to a shift away from synthetic additives and preservatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.