- Home

- »

- Plastics, Polymers & Resins

- »

-

Fluorosilicone Rubber Market Size And Share Report, 2030GVR Report cover

![Fluorosilicone Rubber Market Size, Share & Trends Report]()

Fluorosilicone Rubber Market (2025 - 2030) Size, Share & Trends Analysis Report By Manufacturing Process (Compression Molding, Extrusion), By End Use (Automotive, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-336-1

- Number of Report Pages: 182

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluorosilicone Rubber Market Size & Trends

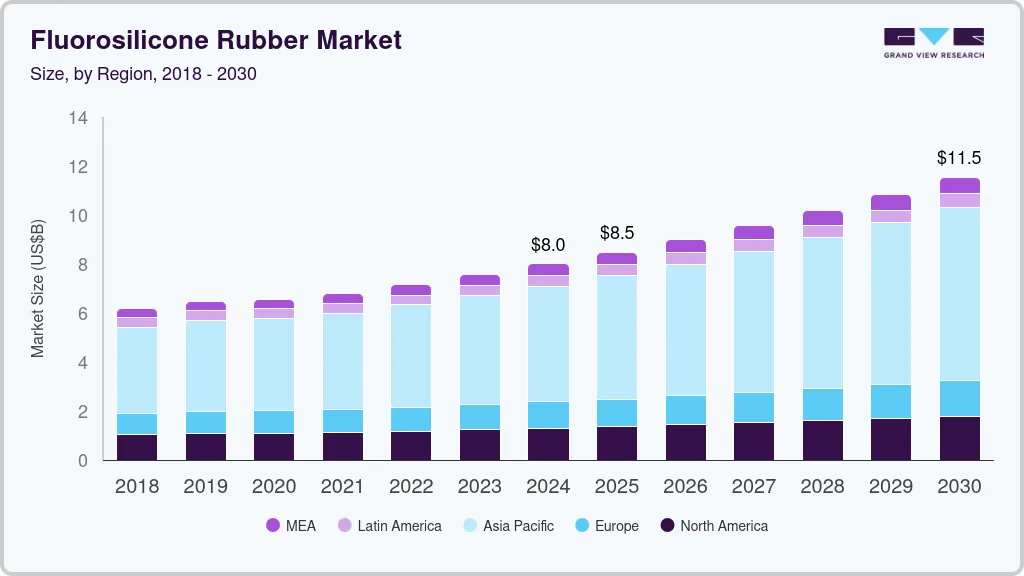

The global fluorosilicone rubber market size was estimated at USD 8,019.9 million in 2024 and is expected to expand at a CAGR of 6.3% from 2025 to 2030. Fluorosilicone rubber, known for its excellent resistance to extreme temperatures, chemicals, and fuel, is highly valued in industries such as automotive, aerospace, and industrial manufacturing. This material's ability to maintain its mechanical properties and performance in harsh environments makes it a preferred choice for seals, gaskets, and hoses in demanding applications.

The development of new formulations and processing technologies will likely enhance the performance and reduce the costs of fluorosilicone rubber, making it more accessible for a broader range of applications. As industries seek more durable and high-performance materials, the market is poised for sustained growth and innovation.

One of the primary drivers of the market is the increasing demand from the automotive sector. As the automotive industry continues to innovate with electric and hybrid vehicles, the need for high-performance materials that can withstand varied and harsh conditions grows. Similarly, the aerospace industry relies heavily on fluorosilicone rubber for components exposed to extreme temperatures and aggressive fluids. Furthermore, the industrial sector benefits from this material's durability and longevity, particularly in applications involving fuel exposure, oils, and chemicals.

Despite its advantages, the market faces challenges, including the high cost of production and the need for specialized processing techniques. These factors can limit the adoption of fluorosilicone rubber, particularly in cost-sensitive applications. However, ongoing research and development efforts are focused on improving the material's cost-efficiency and expanding its application range. Opportunities also exist in emerging markets and new applications, such as in medical devices and wearable technology, where the unique properties of fluorosilicone rubber can offer significant benefits.

Manufacturing Process Insights

Compression molding held the market with the largest revenue share of 47.73% in 2023. This process is highly adaptable, creating components in various shapes and sizes, from small O-rings to large gaskets and seals. Compression molding is especially beneficial for applications requiring thick, durable parts, as the method ensures uniformity and minimizes internal stresses within the material. The resulting fluorosilicone rubber products exhibit outstanding resistance to extreme temperatures, chemicals, and aging, making them ideal for demanding environments in the automotive, aerospace, and industrial sectors.

The calendaring segment is expected to grow at the fastest CAGR during the forecast period. Calendering is a process that involves passing fluorosilicone rubber through rollers to produce thin sheets or films. This method is particularly beneficial for applications that require uniform thickness and smooth surfaces, such as membranes, liners, and coatings. Calendered fluorosilicone rubber is extensively used in industries that demand high chemical and temperature resistance, including electronics and industrial manufacturing. Extrusion is a prominent manufacturing process of fluorosilicone rubber. It involves forcing the material through a die to create long continuous shapes like tubes, profiles, and gaskets. This process is highly efficient for producing large quantities of uniform products, making it ideal for industries requiring consistent and extensive components.

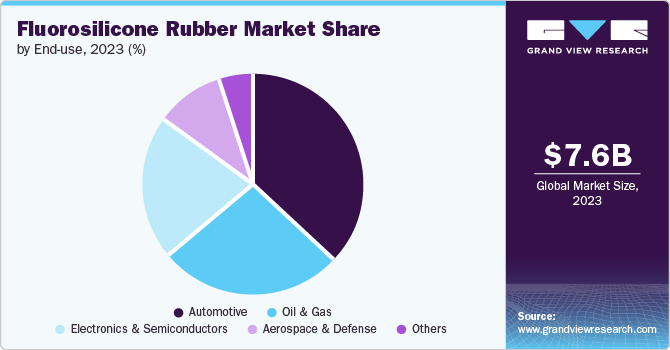

End Use Insights

Based on end use, the automotive industry held the largest revenue share of 37.40% in 2023. The automotive sector is a major consumer, utilizing fluorosilicone rubber for its excellent resistance to extreme temperatures and chemical exposure. This material is used to manufacture seals, gaskets, and hoses that must perform reliably under harsh conditions. With the advent of electric and hybrid vehicles, the demand for high-performance materials like fluorosilicone rubber is expected to grow, driven by the need for components that can withstand the unique stresses of these new technologies.

Industrial manufacturing also heavily relies on fluorosilicone rubber for a range of applications. The material's robustness and long-term stability make it suitable for industrial equipment and machinery operating in challenging conditions. Fluorosilicone rubber is commonly found in seals, gaskets, and O-rings within chemical processing plants, oil and gas facilities, and other industrial environments where exposure to harsh chemicals and extreme temperatures is routine.

Regional Insights

Asia Pacific dominated the global fluorosilicone rubber market and accounted for largest revenue share of over 58.12% in 2023. The Asia Pacific region is also experiencing rapid growth, with increasing industrial activities and investments in the automotive and aerospace sectors. Countries like China, Japan, and India are emerging as significant players, contributing to the overall expansion of the market.

North America Fluorosilicone Rubber Market Trends

The fluorosilicone rubber market in North America is expected to grow lucratively over the forecast period and is characterized by robust demand driven by advanced industrial sectors, particularly the automotive and aerospace industries. The region's strong focus on technological innovation and stringent regulatory standards for performance and safety contribute to the widespread adoption of high-quality materials like fluorosilicone rubber. In addition, the presence of leading manufacturers and a well-established supply chain infrastructure support the market growth. Investments in research and development further enhance the material's applications, ensuring its continued relevance and expansion across various industries.

U.S. Fluorosilicone Rubber Market Trends

The fluorosilicone rubber market in the U.S. stands out as a key player in the global market, benefiting from its extensive industrial base and a strong emphasis on technological advancements. The automotive sector, with its shift towards electric and hybrid vehicles, significantly drives the demand for fluorosilicone rubber due to its superior resistance to extreme conditions. Furthermore, the aerospace industry's focus on safety and performance fuels the need for reliable materials. Government regulations promoting environmental sustainability and the push for innovative materials also contribute to the market's growth, positioning the U.S. as a major consumer and innovator in this field.

Europe Fluorosilicone Rubber Market Trends

The fluorosilicone rubber market in Europe is propelled by the region's commitment to high-quality manufacturing and environmental standards. The automotive industry, a cornerstone of the European economy, extensively uses fluorosilicone rubber in advanced vehicle components that require durability and resistance to harsh conditions. The aerospace sector also demands these materials for critical applications. In addition, Europe's strong focus on sustainability and regulatory compliance drives developing and adopting advanced materials. Collaborative efforts among industry players and continuous investment in research and development further strengthen the market's growth and innovation potential.

Asia Pacific Fluorosilicone Rubber Market Trends

The fluorosilicone rubber market in the Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The automotive industry in APAC, particularly in China and India, is booming, with a growing demand for high-performance materials that can withstand extreme conditions. Similarly, the aerospace industry in Japan and South Korea continues to advance, requiring durable and reliable materials like fluorosilicone rubber. In addition, the region's rising focus on technological innovation and improving production capabilities further propels the market. Government initiatives supporting industrial growth and favorable economic conditions also play a crucial role in driving the demand for fluorosilicone rubber across various applications in APAC.

Key Fluorosilicone Rubber Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Dow Corning Corporation, Wacker Chemie AG, Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., and Elkem Silicones. These companies are recognized for their extensive product portfolios, advanced technological capabilities, and strong global presence. Their continuous investment in research and development enables them to innovate and improve the performance characteristics of fluorosilicone rubber, catering to the evolving needs of various industries.

Key Fluorosilicone Rubber Companies:

The following are the leading companies in the fluorosilicone rubber market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Wacker Chemie AG

- Momentive

- James Walker

- Rogers Corporation

- Shin-Etsu Chemical Co., Ltd

- Shanghai Fluoron Chemicals

- STOCKWELL ELASTOMERICS, INC

- Shanghai 3F New Materials Co., Ltd

- NUSIL

- Primasil Silicones Limited

- Hangzhou Fine Fluorotech Co., Ltd

Recent Developments

-

In May 2024, KCC Corporation completed its acquisition of Momentive Performance Materials Group, fully integrating Momentive into KCC and exiting minority shareholder SJL Partners, LLC.

-

In September 2023, Fluoron Inc. introduced large-diameter heat-shrinkable fluoropolymer wraps and jackets, designed to enhance performance and safety in aerospace insulation and curing processes. These wraps provide low friction, extreme temperature resistance, and superior environmental durability, making them ideal for high-stakes applications in the aerospace industry.

-

In October 2022, Trelleborg acquired Minnesota Rubber & Plastics, enhancing its capabilities in the polymer solutions sector and expanding its portfolio in the market. This strategic acquisition aims to leverage both companies' strengths to drive innovation and market growth.

Fluorosilicone Rubber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8,019.9 Million

Revenue forecast in 2030

USD 11,535.2 Million

Growth rate

CAGR of 6.3% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Manufacturing process, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Dow; Wacker Chemie AG; Momentive; James Walker; Rogers Corporation; Shin-Etsu Chemical Co., Ltd; Shanghai Fluoron Chemicals; STOCKWELL ELASTOMERICS, INC; Shanghai 3F New Materials Co., Ltd; NUSIL; Primasil Silicones Limited; Hangzhou Fine Fluorotech Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluorosilicone Rubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fluorosilicone Rubber market report based on manufacturing process, end use, and region:

-

Manufacturing Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Compression Molding

-

Extrusion

-

Liquid Injection Molding

-

Calendaring

-

3D Printing

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Oil & Gas

-

Electronics & Semiconductors

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fluorosilicone rubber market size was estimated at USD 7.62 billion in 2023 and is expected to reach USD 8.02 billion in 2024.

b. The global fluorosilicone rubber market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 11.54 billion by 2030.

b. Asia Pacific emerged as the largest regional segment and accounted for 58.12% of the market in 2023, owing to region's rising focus on technological innovation and improving production capabilities.

b. Some of the key players operating in this industry include Dow, Wacker Chemie AG, Momentive, James Walker, Rogers Corporation, Shin-Etsu Chemical Co., Ltd, Shanghai Fluoron Chemicals, STOCKWELL ELASTOMERICS, INC, Shanghai 3F New Materials Co., Ltd, NUSIL, Primasil Silicones Limited, and Hangzhou Fine Fluorotech Co., Ltd, among others

b. One of the primary drivers of the fluorosilicone rubber market is the increasing demand from the automotive sector. As the automotive industry continues to innovate with electric and hybrid vehicles, the need for high-performance materials that can withstand varied and harsh conditions grows.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.