- Home

- »

- Advanced Interior Materials

- »

-

Fluid Dispensing Equipment For Semiconductors & Electronics Market Report, 2030GVR Report cover

![Fluid Dispensing Equipment For Semiconductors & Electronics Market Size, Share & Trends Report]()

Fluid Dispensing Equipment For Semiconductors & Electronics Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Manual, Semi-automatic, Automatic), By Application (LED-Automobile, Semiconductor), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-117-0

- Number of Report Pages: 168

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global fluid dispensing equipment for semiconductors & electronics market size was valued at USD 3.03 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The market is expected to be driven by the growing demand for semiconductors and electronics products globally. In the semiconductor industry, fluid dispensing equipment technology is used to deposit precise and controlled micro-volumes of thermally & electrically conductive pastes, adhesives, and encapsulants.

Increasing investments and initiatives by various governments worldwide to establish a strong service provider for semiconductor fabrication are expected to present a major opportunity for fluid dispensing equipment manufacturers. Precision dispensing technology offers cost savings in chip production. Precision fluid dispensing also helps reduce waste generation by ensuring that the exact amount of material is dispensed at the exact location during chip fabrication. Precision fluid dispensing also allows high-quality production of chips, which are further inspected using optical instruments measuring the thickness of the deposited layer.

According to the Centre for Security and Technology and the Semiconductor Industry Association, the U.S. accounted for roughly 60% of the global private R&D spending on semiconductors and 25% of the total semiconductor consumption. The U.S. has decided to invest USD 52.7 billion in subsidies for the U.S. semiconductor industry from 2021 to 2026 as part of the CHIPS Act. Thus, the growing semiconductor demand is expected to propel the fluid dispensing equipment market over the forecast period.

Semiconductor production begins with the precise application of microfluid onto the surface of bulk chips or silicon wafers before proceeding to the manufacturing stage. A highly precise dispenser should securely bind two conducting points. This process permits chips to transmit electricity and communicate with one another once completed. Fluid dispensing equipment further helps to keep moisture from getting to the microchip and corroding it. This is especially critical when the chip is in contact with the environment, such as when it is stored in an electronic device or near an electrical source.

Manufacturers are spending extensively on R&D in order to introduce more advanced fluid dispensing equipment. This includes advancements in dispensing technology, control systems, and process optimization software. Companies can use automated fluid dispensing equipment to dispense, solder, and check the outcome of the entire process without any physical labor. This allows them to develop more reliable products at a lower manufacturing cost.

NSW Automation is involved in the development of high-precision micro-dispensing technology such as the SD1-X Automated Intelligent Micro-dispenser. This precision wafer-level dispensing mass production system supports micro-dispensing, underfill, and coating. Its major features are a 12-inch wafer support, granite platform, temperature control, SMEMA compliance, full automation configurability, and compatibility with various dispensing equipment.

Application Insights

The semiconductor application segment led the fluid dispensing equipment market for semiconductors & electronics and accounted for 41.2% of the global revenue share in 2022. Semiconductors/chips, or semis, are employed in various types of products, including medical equipment, computers, appliances, gaming hardware, and smartphones. Fluid dispensing is a crucial process in electronic manufacturing as this equipment is used to combine electronic boards through the dispensing process.

In addition, fluid dispensing equipment with a variety of pumps or valves offers a crucial step in ensuring semiconductor packages are secured from heat, electrostatic discharge, mechanical damage, and RF emission. Owing to the equipment’s advantages such as fluid dispensing accuracy, speed, and reliability, it is extensively deployed in the semiconductor manufacturing process. According to the Semiconductor Industry Association, the worldwide semiconductor market grew from USD 555.9 billion in 2021 to USD 574.1 billion in 2022. Thus, the growing semiconductor industry, coupled with various benefits offered by fluid dispensing equipment, is expected to drive market demand.

Underfill dispensers are extensively used in semiconductor packaging to apply underfill material to fill the gap between a semiconductor chip and its substrate, such as a printed circuit board or package substrate. Owing to the benefits of underfill materials such as mechanical support and stress relief and improved reliability and durability of the semiconductor package, there is a high adoption of this particular equipment in the semiconductor industry.

The MEMS sensor segment is anticipated to witness a CAGR of 4.7% over the forecast period. MEMS sensors are miniature devices that combine mechanical and electrical components on a single chip, enabling them to sense and measure various physical parameters such as acceleration, pressure, temperature, and motion. Fluid dispensing equipment is used in various stages of MEMS sensor fabrication to apply precise and controlled amounts of materials for assembly, bonding, and packaging. These aforementioned factors are anticipated to propel market demand over the forecast period.

A lid-sealing dispenser is a device used in the manufacturing process of MEMS sensors to apply a sealing material to the sensor package or lid. From the perspective of MEMS sensor manufacturing, the lid sealing dispenser is an automated equipment used to precisely dispense adhesives, epoxies, or other sealing materials onto the sensor package. The dispenser ensures accurate and uniform application of the sealing material, which is crucial for creating a hermetic seal to protect the MEMS sensor from external contaminants and moisture.

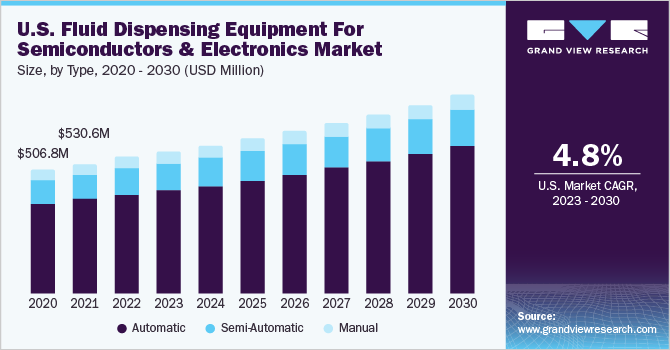

Type Insights

The automatic fluid dispensing equipment segment led the market and accounted for 72.8% of the global revenue share in 2022. Automatic fluid dispensing equipment finds applications in a wide range of industries, including semiconductor, camera/sensor assembly, electronics, LED-automobile, pharmaceutical, and medical device production, among others. In addition, automatic fluid dispensers in LED-automobile manufacturing significantly enhance production efficiency, reduce material waste, and ensure the consistency and quality of fluid deposition on LED-automobile components.

A manual fluid dispenser accurately dispenses liquid but requires manual interaction from users to initiate dispensing and adjust dispensing settings. It usually costs around USD 30 to over USD 1,500. These dispensers offer precise control over the dispensing process, allowing operators to apply fluids with accuracy and consistency. They are also relatively cost-effective and well-suited for smaller production volumes or applications that require flexibility and manual control. Owing to the aforementioned characteristics, the segment is expected to grow steadily in the coming years.

Semi-automatic fluid dispensing equipment bridges the gap between manual and fully automated dispensing equipment. It offers a level of automation that enhances precision and productivity while allowing operator control and flexibility. Semi-automatic dispensers are commonly used in industries where consistent and controlled dispensing of fluids is essential. Semi-automatic dispensers are equipped with programmable dispensing parameters, timers, and foot pedals, which enable consistent and repeatable dispensing. These features are expected to boost the product adoption.

Regional Insights

Asia Pacific region dominated the market in 2022 by accounting for a revenue share of 50.9%, owing to the advancing semiconductor and automotive industries in the region. According to the Semiconductor Industry Association, Taiwan, South Korea, Japan, and China accounted for 72% of the global semiconductor production in 2022, with the industry’s previous manufacturing hubs such as the U.S. and Japan focusing on the highly profitable countries for exporting their products.

On the other hand, Central & South America is witnessing high automotive production owing to lower interest rates and improving consumer confidence. The growing automobile industry in the region is expected to drive the demand for LEDs for safety purposes, thereby driving the demand for fluid dispensing equipment over the forecast period.

The market for fluid dispensing equipment covers a wide range of industries, including automotive, electronics, semiconductor, and MEMS sensors. The demand for precise and automated dispensing processes in these industries is expected to be a key driver for market expansion. Manufacturers in North America are increasingly adopting advanced automation and robotics to improve production efficiency and product quality. Fluid dispensing equipment plays a critical role in automated assembly lines, enabling precise and consistent dispensing of adhesives, sealants, lubricants, and other fluids.

The need for controlled applicators and robotic dispensing systems has increased as a result of legislative interventions supporting sustainable and renewable products in the transportation sector in Europe. Due to increasing funding and technology harmonization offered by governments of various area-member countries for conducting automation research and development operations, the region has become one of the world's top producers of motor vehicles. The industry is expected to benefit from this in the long run.

Key Companies & Market Share Insights

To obtain a competitive edge in the market, major corporations are concentrating on strategic activities such as mergers & acquisitions, joint ventures, collaborations, facility expansions, and product launches. In March 2022, TECHCON (Dover Corporation) introduced the TS9800 Series Jet Valve dispensing system. The TS9800 system comprises the Piezo-actuated Jet Valve TS9800 and the Smart Controller TS980. To increase speed and accuracy throughout the dispensing process, the TS9800 Jet Valve replaces pneumatic jet valves and other contact dispensing technologies with piezo and non-contact jetting technology.

In March 2022, Graco Inc. launched the Graco PR-X solution, a meter, mix, and dispense system for two-component adhesive and sealant applications. The PR-X is ideal for applications requiring precision fluid dispensing, as it provides improved control and repeatability while dispensing dots, beads, and other patterns to ensure specifications are met. Some prominent players in the global fluid dispensing equipment for semiconductors & electronics market include:

-

Nordson Corporation

-

PROTEC CO., LTD

-

NSW Automation

-

ITW

-

Musashi Engineering, Inc.

-

GPD Global

-

FISNAR

-

Henkel Corporation

-

TECHNON (Dover Corporation)

-

INTERTRONICS

-

Valco Cincinnati, Inc.

-

Dymax

-

ViscoTec Pumps and Dosing Technology GmbH

-

Graco Inc.

-

Shenzhen Tensun Precision Equipment Co., Ltd.

-

IVEK Corporation

-

Mycronic

Fluid Dispensing Equipment For Semiconductors & Electronics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.17 billion

Revenue forecast in 2030

USD 4.59 billion

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; Australia; South Korea; Thailand; Vietnam; Malaysia; Philippines; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Nordson Corporation; PROTEC CO., LTD; NSW Automation; ITW; Musashi Engineering, Inc.; GPD Global; FISNAR; Henkel Corporation; TECHCON (Dover Corporation); INTERTRONICS; Valco Cincinnati, Inc.; Dymax; ViscoTec Pumps and Dosing Technology GmbH; Graco Inc.; Shenzhen Tensun Precision Equipment Co., Ltd.; IVEK Corporation; Mycronic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluid Dispensing Equipment For Semiconductors & Electronics Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global fluid dispensing equipment for semiconductors & electronics market report on the basis of type, application, and region:

-

Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Manual

-

Semi-Automatic

-

Automatic

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

LED-Automobile

-

Solder/Silver Paste

-

Chip Encapsulation

-

-

SemiconductorFlux dispensing

-

Underfill

-

Encapsulation (DAM&FILL)

-

Chiplet Corner/Edge bond

-

SIP GAP filling

-

Solder Paste dispensing

-

-

MEMS sensor

-

Underfill

-

Silver Epoxy

-

Lid sealing

-

Wire coating

-

Solder Paste

-

-

Camera/Sensor module assembly

-

Underfill

-

Encapsulation

-

Chip Edge bond

-

Active alignment (LHA)

-

Silver epoxy

-

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Australia

-

Malaysia

-

Vietnam

-

Philippines

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fluid dispensing equipment for semiconductors & electronics market size was estimated at USD 3.03 billion in 2022 and is expected to be USD 3.17 billion in 2023.

b. The gglobal fluid dispensing equipment for semiconductors & electronics market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 4.59 billion by 2030.

b. Asia Pacific region dominated the market in 2022 by accounting for a share of 50.9% of the market owing to growing semiconductor and automotive industries in the region. According to the Semiconductor Industry Association, Taiwan, South Korea, Japan, and China accounted for a 72% of the global semiconductor production in 2022, with its previous manufacturing hubs such as the U.S. and Japan focusing on the highly profitable countries for exporting their products.

b. Some of the key players operating in the fluid dispensing equipment for semiconductors & electronics market include Nordson Corporation, PROTEC CO., LTD, NSW Automation, ITW, Musasi Engineering, Inc., GPD Global, FISNAR, Henkel Corporation, TECHNON (Dover Corporation) (Dover Corporation), INTERTRONICS, Valco Cincinnati, Inc., Dymax, ViscoTec Pumps and Dosing Technology GmbH, Graco Inc., Shenzhen Tensun Precision Equipment Co., Ltd., IVEK Corporation, Mycronic.

b. The market is expected to be driven by growing demand for semiconductors and electronics products globally. For instance, in the semiconductor industry, fluid dispensing equipment technology is used to deposit precise and controlled micro-volumes of thermally and electrically conductive pastes, adhesives, and encapsulants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.