- Home

- »

- Power Generation & Storage

- »

-

Flow Battery Market Size & Share, Industry Report, 2030GVR Report cover

![Flow Battery Market Size, Share & Trends Report]()

Flow Battery Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Redox, Hybrid), By Material (Vanadium, Zinc Bromine), By Storage (Large-scale, Small-scale), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-137-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flow Battery Market Summary

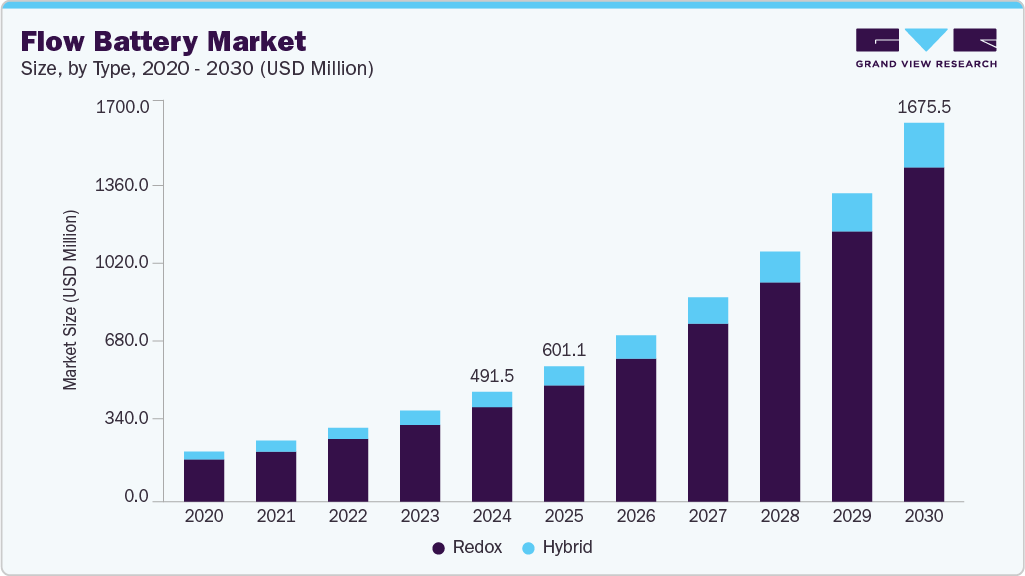

The global flow battery market size was valued at USD 491.5 million in 2024 and is projected to reach USD 1,675.54 million by 2030, growing at a CAGR of 22.8% from 2025 to 2030. The rising global demand for energy storage systems is the primary driver of market growth.

Key Market Trends & Insights

- Asia Pacific flow battery market dominated the market with the largest revenue share of 47.7% in 2024.

- The U.S. flow battery market held the largest share in 2024.

- By type, the redox segment dominated the market with the largest revenue share of 85.6% in 2024.

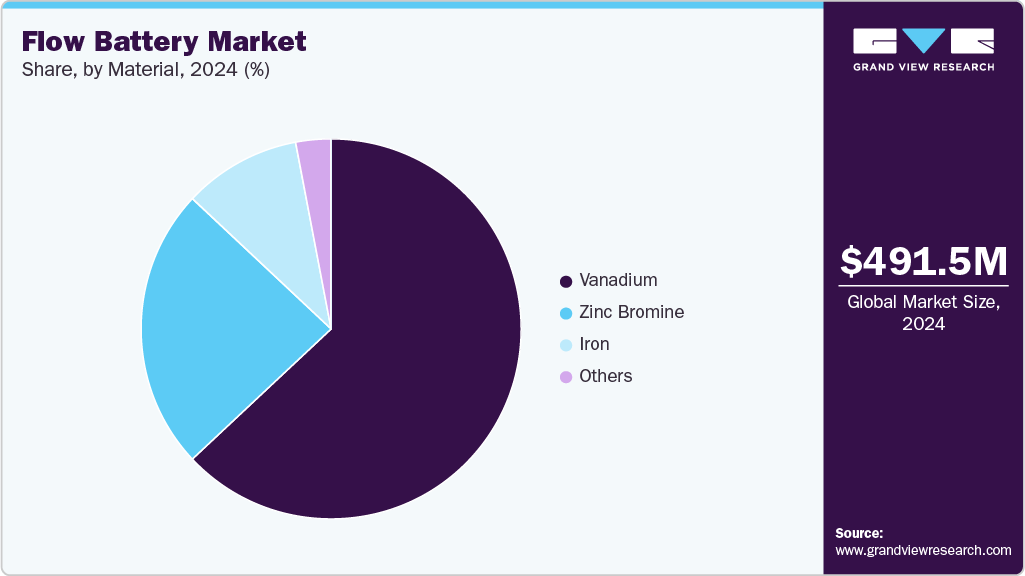

- By material, the vanadium segment held the largest revenue share in 2024.

- By storage, the large-scale segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 491.5 Million

- 2030 Projected Market Size: USD 1,675.54 Million

- CAGR (2025-2030): 22.8%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

According to the U.S. Department of Energy, the global energy storage market is projected to exceed 2,500 GWh by 2030. In addition, the growing number of electric vehicle (EV) charging stations worldwide is fueling market expansion.A flow battery is a rechargeable energy storage system in which an electrolyte flows through one or more electrochemical cells connected to reservoirs or tanks. These batteries are primarily used in stationary markets and are typically aqueous-based. Flow batteries are particularly well-suited for storing energy from renewable sources, such as wind and solar. They enable the efficient storage of surplus energy generated during periods of high production for use during low-production or high-demand times. This capability helps stabilize the grid and enhance the reliability of renewable energy sources. Flow batteries also provide backup power during outages. They can be rapidly deployed, offering continuous power for extended durations, making them valuable for critical infrastructure and grid operators.

The demand for flow batteries is growing due to their numerous advantages over conventional batteries. Key benefits include scalability, long cycle life, low maintenance, sustainability, energy arbitrage, and peak shaving. Their increasing use in EV charging stations is driven by their rapid charging capabilities, scalability, energy cost optimization, and environmental sustainability. However, the high cost of manufacturing and installation remains a major challenge. Flow batteries are expensive compared to other energy storage technologies, such as lead-acid and lithium-ion batteries, potentially hindering market growth.

In February 2025, Stryten Energy LLC, announced an agreement signed by Stryten Critical E-Storage LLC (one of its affiliates) with Largo Clean Energy Corp. (LCE), a subsidiary of Largo Inc., to form Storion Energy, LLC. This JV will deliver price-competitive vanadium electrolyte using a unique leasing model to drive the adoption and rapid commercialization of Vanadium Redox Flow Batteries.

Type Insights

The redox segment dominated the market with the largest revenue share of 85.6% in 2024. This is due to its wide range of application areas. Most of the flow batteries used in various industries are vanadium flow batteries, which are redox flow batteries. The operation of a flow battery is primarily based on redox reactions, which stand for reduction-oxidation reactions. Flow batteries are often interchangeably referred to as redox flow batteries (RFBs) due to the chemical reactions involved in their operation.

In December 2022, Enerox GmbH (CellCube), a renowned company operating in vanadium redox flow batteries (VRFB), and North Harbour Clean Energy PTY (NHCE), an Australian company specializing in clean energy storage, entered into a strategic agreement. This agreement aims to build a manufacturing and assembly line for VRFB in Eastern Australia.

The hybrid segment is anticipated to grow at a significant CAGR of 18.8% over the forecast period, attributed to its versatility and potential for cost-effective energy storage solutions. Hybrid flow batteries, such as zinc-bromine, iron-chromium, and zinc-cerium batteries, utilize different materials for the anode and cathode, allowing for tailored performance in diverse applications. Their ability to provide long-duration storage while offering scalability and efficiency makes them highly attractive for industries looking for reliable energy solutions.

Material Insights

The vanadium segment held the largest revenue share in 2024, propelled by its robust performance, chemical reliability, and system efficiency. Most flow batteries incorporate vanadium as an electrolyte material. Vanadium redox flow batteries (VRFBs) are commonly utilized in grid energy storage systems. Due to their unique design and characteristics, these flow batteries have garnered attention as a promising energy storage technology. The major factors contributing to their predominant use in flow batteries include a wide range of oxidation states, high chemical stability, lower cost compared to hybrid electrolytes, absence of cross-contamination, abundance, environmental compatibility, recyclability, and commercial availability, among other advantages.

In March 2025, Sumitomo Electric introduced a new vanadium redox flow battery (VRFB) with a 30-year lifespan. It offers up to 10 hours of storage across three system versions.

The zinc bromine segment is expected to be the fastest-growing segment from 2025 to 2030. Zinc bromine flow batteries are the second-most common flow batteries. Zinc and bromine are more abundant; thus, the cost of zinc-bromine flow batteries is slightly lower than that of vanadium flow batteries. Increasing grid/utility sector demand is expected to propel the segment's growth over the forecast period. Zinc and bromine are more environmentally friendly materials than vanadium, and recycling zinc-bromine batteries is more straightforward. Zinc-bromine batteries are less prone to corrosion issues than vanadium flow batteries, improving reliability.

Storage Insights

The large-scale segment accounted for the largest revenue share in 2024. This can be attributed to the scalability of large-scale batteries over their smaller counterparts. Flow batteries often benefit from economies of scale; as the system size increases, the cost per unit of energy capacity decreases. Consequently, they are more cost-effective for larger installations where the increased capacity and longer cycle life can justify the initial investment. Large-scale flow batteries are extensively utilized within the grid and utility sector, offering various benefits, such as grid stability, mitigation of fluctuations, renewable energy generation, and provision of power during peak demand. In September 2024,India’s Delectrick Systems launched a 10MWh vanadium flow battery-based energy storage system for large-scale and utility-scale projects.

The small-scale segment is projected to grow significantly during the forecast period due to the growing demand for decentralized and reliable energy storage solutions. Increasing adoption of residential, commercial, and remote applications drives interest in compact flow battery systems that offer safety, low maintenance, and long cycle life.

Application Insights

The grid/utility segment held the largest market share in 2024. This dominance can be attributed to various factors, including the flow battery’s pivotal role in grid integration, supporting grid resilience, reducing energy transmission expenses, realizing environmental advantages, and offering remarkable scalability. Flow batteries provide a reliable and efficient means of storing electrical energy. They can absorb excess electricity when supply exceeds demand and release it when needed, thereby helping stabilize the electrical grid.

This is crucial for maintaining grid reliability, especially when integrating intermittent renewable energy sources like solar and wind. Flow batteries are effective at peak shaving and ultimately support grid infrastructure.

The commercial & industrial segment is anticipated to grow at the fastest CAGR over the forecast period, propelled by rising energy demands, increased focus on sustainability, and the need for cost-effective power backup solutions. Flow batteries offer long-duration storage, scalability, and enhanced safety, making them ideal for commercial buildings, manufacturing units, and data centers.

Regional Insights

North America flow batterymarket is expected to witness the fastest CAGR of 24.0% from 2025 to 2030 due to increasing deployments in grid applications and rising demand for long-duration energy storage solutions. Flow batteries, known for their scalability and long cycle life, are well-suited for utility-scale energy storage, enhancing grid stability and supporting the integration of renewable energy sources.

U.S. Flow Battery Market Trends

TheU.S. flow battery market held the largest share in 2024, owing to strategic industry partnerships and significant investments in manufacturing. In September 2023, Honeywell partnered with ESS Tech, Inc. to accelerate the deployment of iron flow battery (IFB) energy storage systems.

Europe Flow Battery Market Trends

Europe flow battery market is anticipated to experience significant expansion during the forecast period, fueled by technological advancements and growing integration with renewable energy sources. Flow batteries offer long-duration energy storage, enhancing grid stability and ensuring a dependable power supply. This capability supports global transitions toward cleaner, more sustainable energy systems while contributing to the accelerated growth of the flow battery industry.

Asia Pacific Flow Battery Market Trends

Asia Pacific flow battery market dominated the market with the largest revenue share of 47.7% in 2024, attributed to the high adoption of flow batteries in major economies such as China, Australia, and Japan. The use of these batteries is rapidly increasing in these countries, particularly in utility, industrial, and commercial applications. In addition, various government investments in flow battery technologies are expected to further propel market growth. For instance, in August 2023, the Australian government invested USD 24 million in its local flow battery industry.

China flow batterymarket accounted for the largest share in the regional market in 2024. The rising demand for reliable energy storage solutions, along with the country’s commitment to sustainable energy, is accelerating the adoption of flow batteries, driving market expansion.

Key Flow Battery Company Insights

Some of the key companies in the flow battery industry include ESS Tech, Inc.; Redox One; WattJoule Corporation; Invinity Energy Systems; and Sumitomo Electric Industries, Ltd.

-

Redox One offers large-scale, long-duration energy storage solutions utilizing Iron-Chromium Redox Flow Battery (Fe-Cr RFB) technology. Its system provides safe, sustainable, and cost-effective energy storage, with a design life exceeding 25 years and unlimited cycling capability.

-

Sumitomo Electric Industries, Ltd. provides a wide range of products across five core sectors: Automotive, Info communications, Electronics, Environment and energy, and Industrial Materials. Its offerings include wiring harnesses, optical fibers, semiconductor materials, power cables, and cutting tools.

Key Flow Battery Companies:

The following are the leading companies in the flow battery market. These companies collectively hold the largest market share and dictate industry trends.

- ESS Tech, Inc.

- Redox One

- WattJoule Corporation

- Invinity Energy Systems

- Largo Inc.

- Primus Power

- Sumitomo Electric Industries, Ltd.

- CellCube Energy Storage GmbH

- Redflow Ltd.

- VRB ENERGY

- Elestor

- Jena Flow Batteries GmbH

- Lockheed Martin Corporation

- EverFlow

- Stryten Energy

- ViZn Energy Systems

Recent Developments

-

In April 2025,XL Batteries, in partnership with Stolthaven Terminals, commissioned its first grid-scale organic flow battery at the Houston facility. This project marks the commercial debut of XL Batteries' patented water-based battery technology, highlighting a shift toward safer chemistries.

-

In December 2024, Salgenx, a division of Infinity Turbine LLC, introduced a saltwater redox flow battery. This innovative solution provides a sustainable, cost-effective alternative to lithium-ion batteries for grid-scale energy storage.

Flow Battery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 601.08 million

Revenue forecast in 2030

USD 1,675.54 million

Growth Rate

CAGR of 22.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in KWh, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, storage, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Norway; The Netherlands; China; Japan; India; Australia; Thailand; South Korea; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; and South Africa; UAE.

Key companies profiled

ESS Tech, Inc.; Redox One; WattJoule Corporation; Invinity Energy Systems; Largo Inc.; Primus Power; Sumitomo Electric Industries, Ltd.; CellCube Energy Storage GmbH; Redflow Ltd.; VRB ENERGY; Elestor; Jena Flow Batteries GmbH; Lockheed Martin Corporation; EverFlow; Stryten Energy; and ViZn Energy Systems.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Flow Battery Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global flow battery market report based on type, material, storage, application, and region:

-

Type Outlook (Volume, KWh; revenue, USD Million, 2018 - 2030)

-

Redox

-

Hybrid

-

-

Material Outlook (Volume, KWh; Revenue, USD Million, 2018 - 2030)

-

Vanadium

-

Zinc Bromine

-

Iron

-

Others

-

-

Storage Outlook (Volume, KWh; Revenue, USD Million, 2018 - 2030)

-

Large-scale

-

Small-scale

-

-

Application Outlook (Volume, KWh; Revenue, USD Million, 2018 - 2030)

-

Grid/utility

-

Commercial & Industrial

-

EV Charging Stations

-

Residential

-

-

Regional Outlook (Volume, KWh; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.