- Home

- »

- Organic Chemicals

- »

-

Flocculants And Coagulants Market Size, Share Report, 2030GVR Report cover

![Flocculants And Coagulants Market Size, Share & Trends Report]()

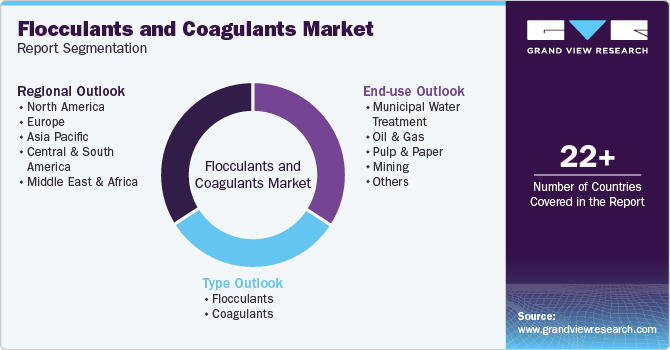

Flocculants And Coagulants Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Flocculants, Coagulants), By End-use (Municipal Water Treatment, Oil & Gas, Mining), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-342-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flocculants And Coagulants Market Trends

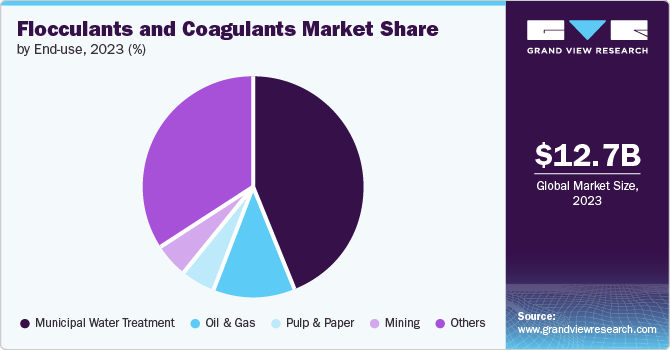

The global flocculants and coagulants market size was estimated at USD 12.73 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. This growth can be attributed to increasing demand for wastewater treatment, which has triggered the imposition of strict regulations by governments around the world. The increasing popularity of eco-friendly solutions in water treatment processes has also acted as a major driver for the global market.

The rapid industrialization and urbanization in emerging economies are leading to a significant increase in the demand for flocculants and coagulants. Countries in regions such as Asia-Pacific, Latin America, and Africa are experiencing substantial growth in industrial activities, which in turn is driving the need for effective water treatment solutions. The expansion of industries such as mining, oil and gas, and municipal water treatment in these regions is creating a robust market for flocculants and coagulants. For instance, the Chinese government’s stringent regulations on industrial effluents and the Indian government’s initiatives to improve water quality are propelling the market growth. In addition, the rising population and urbanization in these regions are increasing the demand for potable water, further driving the need for effective water treatment chemicals. Companies are expanding their presence in these emerging markets to capitalize on the growing opportunities and cater to the increasing demand.

Drivers, Opportunities & Restraints

Stringent environmental regulations play a significant role in driving the global market. Governments and regulatory bodies implement these regulations to ensure the protection of water bodies and the environment. Flocculants and coagulants are crucial in meeting these standards by facilitating the removal of pollutants and suspended solids from wastewater. For example, the U.S. EPA surface water treatment rule requires the removal or inactivation of pathogens like Giardia and Cryptosporidium from drinking water. Adequately designed treatment plants with coagulation, flocculation, sedimentation, and filtration processes are assigned specific removal credits for these pathogens.

Stringent environmental regulations also form an opportunity for the flocculent & coagulants industry in the form of advancement of water treatment technologies. The focus on meeting regulatory standards encourages research and development in the field of flocculants and coagulants. This leads to the exploration of innovative ways to improve the efficiency and effectiveness of treatment processes. For instance, bio-organic hybrid coagulants/flocculants have shown promise in pollutant removal during the treatment process.

One of the major restraints in the global market is the high cost associated with these chemicals. The production and procurement of flocculants and coagulants involve complex manufacturing processes and the use of specialized raw materials. This leads to higher production costs, which are ultimately passed on to the consumers. The high cost of these chemicals can pose a challenge, especially for small-scale industries and developing countries with limited financial resources. As a result, some industries may opt for alternative treatment methods or lower-cost alternatives, impacting the demand for flocculants and coagulants.

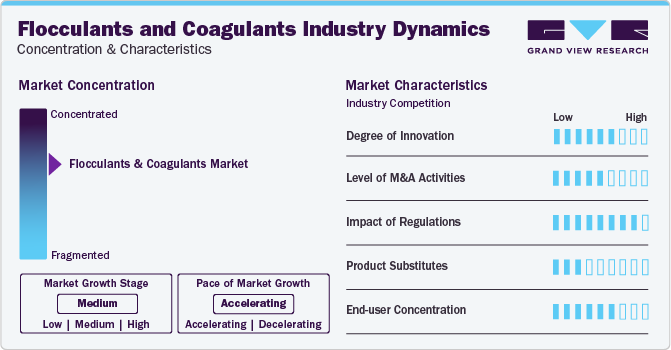

Market Concentration & Characteristics

The market concentration of the global market is relatively high, with a few key players dominating the industry. Major companies such as Kemira, BASF SE, Ecolab Inc. and Solenis hold significant shares due to their comprehensive product portfolios and extensive distribution networks. These companies invest heavily in research and development to innovate and improve their product offerings, which helps them maintain a competitive edge. The high market concentration is also driven by mergers and acquisitions, which allow these firms to achieve economies of scale and expand their presence in the industry.

Innovation is a critical factor influencing market concentration. Companies that invest in developing advanced and sustainable products can differentiate themselves and capture larger market shares. For example, the shift towards natural and biodegradable coagulants and flocculants has created opportunities for companies that can offer these eco-friendly alternatives.

The presence of product substitutes, such as alternative water treatment technologies (e.g., membrane filtration, and advanced oxidation processes), can pose a challenge to the industry. These substitutes may offer different advantages, such as lower operational costs or higher efficiency for specific contaminants, potentially reducing the reliance on traditional flocculants and coagulants.

Type Insights

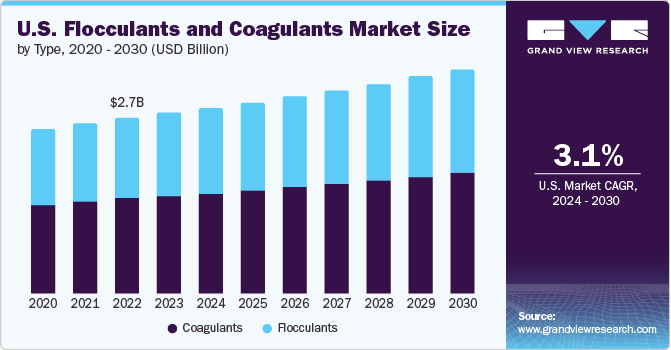

Based on type, the coagulants segment led the market with the largest revenue share of 53.0% in 2023. Coagulants are chemical substances used to facilitate the aggregation of particles in a liquid, leading to the formation of larger particles known as flocs. These flocs can then be easily separated from the liquid through sedimentation, filtration, or flotation. The primary characteristic of coagulants is their ability to neutralize the charges on particles suspended in water, which prevents the particles from repelling each other and allows them to come together.

Coagulants are extensively used in wastewater treatment processes. In drinking water treatment, coagulants help remove turbidity, organic matter, and pathogens, ensuring the water is safe for consumption. For instance, aluminum sulfate is widely used in municipal treatment plants to clarify liquid by removing suspended solids and reducing the levels of organic contaminants. Industrial wastewater, which often contains a variety of contaminants, benefits significantly from coagulation processes to meet regulatory discharge standards. For example, ferric chloride is commonly used in industrial treatment to precipitate and remove heavy metals.

Flocculants are chemical substances that promote the aggregation of fine particles suspended in a liquid, forming larger flocs that can be easily separated. The primary characteristic of flocculants is their ability to bridge the particles together, creating larger and denser flocs. Flocculants can be classified into two main types: inorganic and organic. Inorganic flocculants, such as aluminum sulfate and ferric chloride, are commonly used due to their effectiveness and cost-efficiency. Organic flocculants, including polyacrylamide and its derivatives, are often used when specific conditions or higher performance is required.

End-use Insights

Based on end use, the municipal water treatment segment led the market with the largest revenue share of 43.75% in 2023. Municipal water treatment plays a crucial role in ensuring the provision of safe and clean drinking water to communities. Coagulants and flocculants are essential components of the treatment process, helping to remove impurities and suspended particles from the water. These chemicals aid in the clarification and disinfection of water, ensuring it meets regulatory standards and is safe for consumption.

The primary purpose of coagulation and flocculation in municipal water treatment is to remove of suspended particles and impurities. These particles can include sediment, organic matter, bacteria, viruses, and other contaminants. By promoting the aggregation of these particles into larger flocs, coagulants, and flocculants facilitate their removal through sedimentation or filtration processes. This results in clearer and cleaner water that is visually appealing and safe for consumption.

The oil and gas industry often generates large volumes of wastewater that require treatment before disposal or reuse. Flocculants and coagulants play a crucial role in the treatment of oil and gas-produced liquid, helping to remove contaminants and facilitate the separation of oil and solids from the wastewater. These chemicals aid in the efficient and cost-effective treatment, ensuring compliance with environmental regulations and minimizing the impact on water resources.

The mining industry often generates large volumes of wastewater and requires effective treatment methods to minimize environmental impact and comply with regulatory standards. Flocculants and coagulants play a crucial role in the treatment of mining wastewater, aiding in the removal of suspended solids, heavy metals, and other contaminants. These chemicals facilitate the separation of solids from water, allowing for the safe disposal or potential reuse of the treated product.

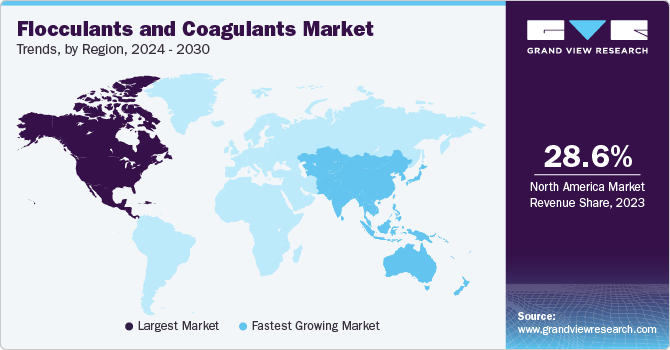

Regional Insights

North America dominated the flocculants & coagulants market with a revenue share of 28.60% in 2023. The market is driven by the presence of significant key players and strict government regulations. The oil and gas industry's growth has led to increased demand for flocculants and coagulants, particularly due to the use of shale gas in the United States market. In addition, the region's large industrial infrastructure provides a boost to the industry.

U.S. Flocculants And Coagulants Market Trends

The flocculants & coagulants market in U.S. held the largest market share of 77.5% in North America in 2023. The country's robust industrial infrastructure, extensive oil & gas industry and the presence of key market players contribute to the market's growth. For instance, in the municipal water treatment sector, the U.S. relies on the use of coagulants and flocculants to ensure compliance with water quality standards.

Europe Flocculants And Coagulants Market Trends

The flocculants & coagulants market in Europe is expected to grow at a significant CAGR during the forecast period. The market is influenced by the implementation of stringent environmental regulations for wastewater treatment and the limited availability of freshwater resources. The region is characterized by the presence of key manufacturers and a growing emphasis on sustainable water management practices.

Germany flocculants and coagulants market held the largest market share of Europe in 2023 and is mainly driven by the presence of key manufacturers and a growing emphasis on sustainable water management practices.

The flocculants and coagulants market in UK is expected to grow at a significant CAGR from 2024 to 2030. The UK's market is characterized by increasing demand in water treatment plants and other industrial applications, reflecting the importance of these chemicals in ensuring water quality and environmental compliance.

Asia Pacific Flocculants And Coagulants Market Trends

The flocculants and coagulants market in Asia Pacificwas the second-largest regional market in 2023. Asia Pacific has emerged as a key source of clean water resources, leading to a rise in demand for flocculants and coagulants. The region's industry is projected to experience further growth between 2024 and 2030. The increasing application of coagulants in wastewater treatment and the pharmaceutical industry is expected to contribute to market expansion. Countries such as China, Japan, India, and others are driving the market growth in the Asia Pacific region.

The China flocculants and coagulants market is estimated to grow at a significant CAGR from 2024 to 2030. In China, the market is witnessing significant growth, driven by the increasing application of coagulants in wastewater treatment and the pharmaceutical industry.

The flocculants and coagulants market in India is expected to grow at a significant CAGR during the forecast period, due to rising demand for these chemicals in water and wastewater treatment, as well as in the textile and manufacturing industries.

Central & South America Flocculants And Coagulants Market Trends

The flocculants and coagulants market in Central & South America is anticipated to witness at a significant CAGR from 2024 to 2030. The market is witnessing impressive growth due to rapid industrialization, population growth, and urbanization. The region's focus on sustainable water management practices has led to increased demand for these chemicals in water treatment and purification processes.

The Brazil flocculants and coagulants market is estimated to grow at a significant CAGR over the forecast period. The market in the country is witnessing impressive growth due to rapid industrialization, population growth, and urbanization. The country's focus on sustainable water management practices has led to increased demand for these chemicals in water treatment and purification processes.

Middle East & Africa Flocculants And Coagulants Market Trends

The flocculants & coagulants market in Middle East & Africa is experiencing rapid industrialization, population growth, and urbanization, leading to increased wastewater generation and the need for effective water treatment solutions. The region's focus on sustainable management practices has contributed to the impressive growth of the industry.

The Saudi Arabia flocculants and coagulants market is expected to grow at a lucrative CAGR during the forecast period, due to the country's focus on sustainable water management practices has contributed to the impressive growth of the market, reflecting the growing significance of these chemicals in the region's industrial landscape.

Key Flocculants And Coagulants Company Insights

The market is characterized by the dominance of a few globally established players, including Kemira, BASF SE, Ecolab Inc., Evoqua Water Technologies LLC, and Solenis LLC (US). These key players have a significant market share and play a pivotal role in shaping the competitive landscape of the industry. The industry is witnessing strategic partnerships, collaborations, and joint ventures among major players to enhance their market presence and expand their product offerings.

-

Kemira is a global chemical company that offers various solutions for water-intensive industries. In the flocculant and coagulant market, Kemira provides a wide range of products and services, including coagulants, flocculants, scale inhibitors, biocides, and other specialty chemicals under the polymers for water treatment segment

-

BASF offers a comprehensive range of products and solutions for various industries, including water treatment. The company's portfolio includes coagulants and flocculants under mining solutions segment that are used in wastewater treatment, sludge treatment, and other applications

IXOM, Syensqo and Buckman are some of the emerging players operating in the global market.

-

IXOM Operations Pty Ltd. is an emerging player in the marketspace and offers a wide range of chemical solutions for water treatment, including coagulation and flocculation chemicals. The company provides products that are NSF-certified for use in drinking water treatment, emphasizing their commitment to quality and safety

-

Buckman provides a wide range of chemical solutions for water treatment, including coagulants and flocculants in their product portfolio. Their focus on innovation and commitment to sustainable chemical solutions position them as an emerging player in the industry

Key Flocculants And Coagulants Companies:

The following are the leading companies in the flocculants and coagulants market. These companies collectively hold the largest market share and dictate industry trends.

- Kemira

- BASF SE

- Ecolab Inc.

- Solenis

- Syensqo

- Feralco AB

- IXOM

- Buckman

- Kurita-GK Chemical Co., LTD.

- Evoqua Water Technologies LLC

Recent Developments

-

In April 2024, Gradiant, a solutions provider for wastewater treatment announced the launch of CURE chemicals product line. The product line would include more than 300 formulations including coagulants and flocculants used in water treatment processes

-

In July 2022, Evoqua Water Technologies made a purchase of EPICOR, Inc., a prominent manufacturer known for its expertise in producing ion exchange resin and resin/fiber mixtures specifically designed for the energy sector. This strategic move has bolstered Evoqua's Integrated Solutions and Services segment, enabling the company to enhance its capabilities and better serve customers in the power market

Flocculants And Coagulants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.18 billion

Revenue forecast in 2030

USD 16.61 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Kemira; BASF SE; Ecolab Inc.; Solenis; Syensqo; Feralco AB; IXOM; Buckman; Kurita-GK Chemical Co., LTD; Evoqua Water Technologies LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flocculants And Coagulants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flocculants & coagulants market report based on type, end-use and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flocculants

-

Coagulants

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal Water Treatment

-

Oil & Gas

-

Pulp & Paper

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flocculants and coagulants market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 16.61 billion by 2030

b. North America dominated the flocculants and coagulants market with a share of 28.6% in 2023. This is attributable to the presence of significant key players and strict government regulations. Additionally, the region's large industrial infrastructure provides a boost to the flocculants & coagulents industry.

b. Some key players operating in the flocculants and coagulants market include Kemira, BASF SE, Ecolab Inc., Solenis, Syensqo, Feralco AB, IXOM, Buckman, Kurita-GK Chemical Co., LTD. and Evoqua Water Technologies LLC

b. Key factors that are driving the market growth include increasing demand for wastewater treatment triggered by imposition of strict regulations by governments around the world. Increasing popularity of eco-friendly solutions in water treatment processes has also acted as a major driver for the global flocculants & coagulants market.

b. The global flocculants and coagulants market size was estimated at USD 12.73 billion in 2023 and is expected to reach USD 13.18 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.