- Home

- »

- Distribution & Utilities

- »

-

Floating LNG Power Vessel Market Size, Share Report, 2030GVR Report cover

![Floating LNG Power Vessel Market Size, Share & Trends Report]()

Floating LNG Power Vessel Market (2023 - 2030) Size, Share & Trends Analysis Report By Vessel Type (Power Barge, Power Ship), By Component, By Power Output, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-143-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global floating LNG power vessel market size was estimated at USD 728.02 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.9% from 2023 to 2030. The insufficient power generation infrastructure in developing nations, reduced pollution levels, and the manifold advantages associated with these floating liquefied natural gas (LNG) power vessels are expected to drive the product demand over the forecast period. Natural gas is considered a cleaner and more environmentally friendly energy source compared to coal and oil, largely due to its lower carbon emissions and reduced air pollution. This eco-friendly attribute aligns with global efforts to combat climate change and reduce the environmental impact of energy production, thus driving the demand for the product across the world.

The increasing demand for natural gas as a primary source of energy extends across various sectors, including power generation, industrial processes, and residential consumption. On a global level, the rising preference towards greener energy alternatives has positioned floating LNG power vessels as a crucial facilitator, enabling the efficient extraction, liquefaction, and distribution of natural gas from offshore reserves to meet the escalating demand while simultaneously contributing to a more sustainable energy future.

According to the U.S. Energy Information Administration, the U.S. witnessed a substantial increase in natural gas demand by 43% increase from 2012 to 2022, which includes both domestic consumption and gross exports. A remarkable growth of 116% was observed in the Gulf Coast states of Louisiana and Texas. This growth was primarily attributed to the rising need for feed gas, used in the liquefaction process for LNG exports. The growing demand for natural gas represents a pivotal driver for floating LNG power vessels in the current energy landscape.

As per the U.S. Energy Information Administration, in June 2023, the demand for natural gas was primarily fueled by increased usage in electric power generation. This was mainly due to two factors, namely the shift from coal to natural gas, and the growing demand for air conditioning. Specifically, in the Midwest, the overall demand for natural gas witnessed a substantial 35% increase from 2012 to 2022.

This significant growth was attributed to a more than doubling of natural gas consumption in the electric power sector during the same period. Similarly, in the Northeast, natural gas demand observed a notable 36% increase between 2012 and 2022, primarily propelled by increased usage in the electric power sector. These trends lead to the need for flexible and efficient solutions such as floating LNG power vessels to meet the rising demand for liquefied natural gas in various regions, especially where onshore infrastructure is limited or economically challenging to develop.

The market for hybrid fuel-powered marine generators is witnessing a notable escalation in demand. This positive outlook is attributed to several key factors, including reduced maintenance expenses and a decreased level of environmentally harmful emissions. Furthermore, stringent government regulations of emissions have intensified the drive toward hybrid fuel solutions. The amalgamation of these advantages and regulatory requirements has significantly amplified the demand for hybrid fuel-powered marine generators. Consequently, this has opened a strategic opportunity for manufacturers operating within the industry, thus expected to benefit the market growth over the forecast period.

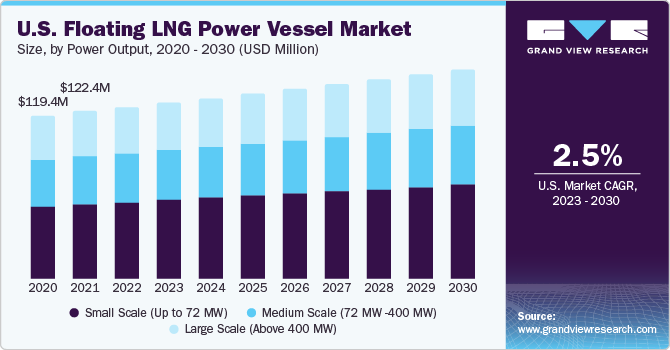

Power Output Insights

Based on power output, the market is segmented into small-scale (up to 72 MW), medium-scale (72 MW - 400 MW), and large-scale(above 400 MW). The small-scale (up to 72 MW) segment recorded the largest market share of over 44.0% in 2022 owing to its versatility and mobility. Small-scale vessels are more versatile and mobile than their larger counterparts. They are easily transported and deployed to remote or hard-to-reach locations, including islands, coastal areas, and regions with limited infrastructure.

Medium-scale power output vessels are well-suited to regions with moderate energy demand. Growing or stable energy requirements in these areas drive the need for medium-scale power output vessels to provide a reliable source of power. Furthermore, large-scale power output vessels serve as base-load power providers, ensuring grid stability by offering a continuous and substantial power supply. They play a critical role in balancing supply and demand on a grid.

Component Insights

Based on component, the market is segmented into power generation systems and power distribution systems. The power generation system segment is further bifurcated into gas turbine & IC engine and steam turbine & generator. Gas turbines and internal combustion (IC) engines are used as power generation systems to provide electricity for various onboard operations. Besides, gas turbines are known for their reliability, making them suitable for continuous power generation on LNG vessels.

The power distribution system segment is further segmented into transformer and switchboard. In the floating LNG power vessel, transformers are employed to step up or down the voltage of the electrical power according to the requirements. Moreover, switchboards allow operators to control the flow of electrical power to different parts of the vessel. They provide the capability to connect or disconnect various loads, which is crucial for managing power distribution effectively.

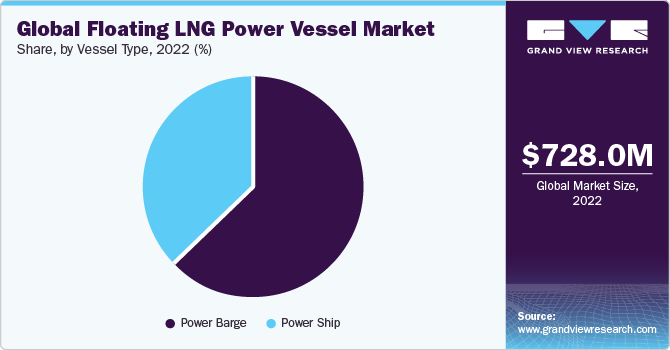

Vessel Type Insights

Based on vessel type, the market is segmented into power barge and power ship. The power barge segment held the largest market share of over 62.0% in 2022. Power barge vessels offer quick deployment and flexibility. They can be rapidly moved to different locations, positioning them as preferable for providing power in remote or rapidly changing energy demand scenarios. Hence, its benefit of rapid deployment is expected to increase product demand over the forecast period.

Power ship vessels offer a self-contained power generation solution mainly in remote and off-grid areas. They are capable of tapping into nearby energy sources, such as LNG or natural gas, to provide consistent and affordable electricity to communities and industries. In addition, it can be connected to the existing power grid to supplement electricity supply during peak demand periods, preventing blackouts and ensuring a stable power supply for industries and households. Hence, its ability to supplement grid capacity and provide off-grid power solutions is expected to increase the demand for the product during the forecast period.

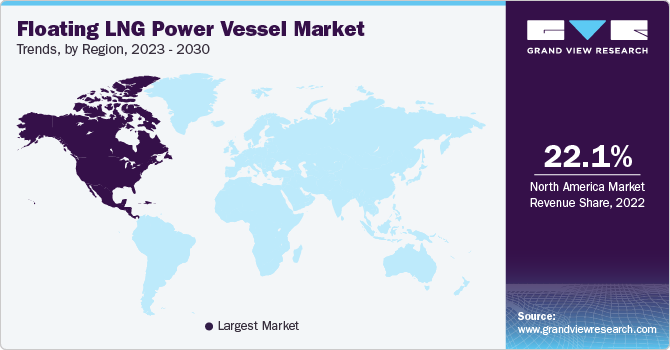

Regional Insights

North America led the global market with a share of 22.12% of the global revenue. North America, particularly the U.S. and Canada, possesses significant natural gas reserves. The demand for floating LNG power vessels is driven by the availability of natural gas resources in a region. Furthermore, the region has a substantial and growing demand for energy, including electricity generation. Floating LNG power vessels can be a flexible and efficient way to meet this demand, thus benefiting the market growth over the forecast period.

The Asia Pacific region has been experiencing significant economic growth, leading to an increased demand for energy. Floating LNG power vessels offer a flexible and relatively quick solution to meet this growing energy demand, thus driving the demand for the product during the forecast period.

Key Companies & Market Share Insights

Major players are undertaking different strategies such as product launches, mergers, joint ventures, acquisitions, and geographical expansions. For instance, In January 2023, GasgridFinland integrated the LNG Floating Storage and Regasification Unit (FSRU) Model into their gas transmission network, marking the launch of the country's inaugural FSRU-based terminal situated in the strategically positioned deep harbor of Inkoo. During the operation at full capacity, this vessel can securely store approximately 68,000 metric tonnes of liquefied natural gas (LNG), equivalent to a substantial 1,050 GWh of energy. This achievement represents a major milestone in enhancing Finland's energy infrastructure and enabling commercial operations in the LNG sector.

Key Floating LNG Power Vessel Companies:

- Waller Marine Inc.

- Karpowership

- MODEC, Inc.

- Chiyoda Corporation

- WISON

- Sevan SSP

- Hyundai Heavy Industries

- IHI Corporation

- Mitsui O.S.K. Lines

- Mitsubishi Heavy Industries

Floating LNG Power Vessel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 756.03 million

Revenue forecast in 2030

USD 923.52 million

Growth rate

CAGR of 2.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vessel type, component, power output, region

Region scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Southeast Asia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Waller Marine Inc.; Karpowership; MODEC, Inc.; Chiyoda Corporation; WISON; Sevan SSP; Hyundai Heavy Industries; IHI Corporation; Mitsui O.S.K. Lines; Mitsubishi Heavy Industries

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

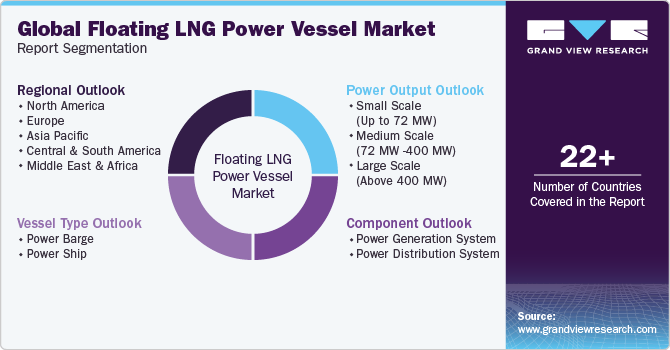

Global Floating LNG Power Vessel Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global floating LNG power vessel market report based on vessel type, component, power output, and region:

-

Vessel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Barge

-

Power Ship

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation System

-

Gas Turbine & IC Engine

-

Steam Turbine & Generator

-

-

Power Distribution System

-

-

Power Output Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Scale (Up to 72 MW)

-

Medium Scale (72 MW -400 MW)

-

Large Scale (Above 400 MW)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global floating LNG power vessel market size was estimated at USD 728.02 million in 2022 and is expected to reach USD 756.03 million in 2023.

b. The global floating LNG power vessel market is expected to witness a compound annual growth rate of 2.9% from 2023 to 2030 to reach USD 923.52 million by 2030.

b. Power Brage accounted for the largest vessel type segment in 2022 and is expected to grow at a CAGR of more than 3.0% over the forecast period.

b. Kawasaki Heavy Industries Ltd, Wartsila Oyj Abp, Chiyoda Corp, Wison Group, and Karadeniz Holding are the major companies operating in the Floating LNG Power Vessel Market.

b. Factors such as a notable surge in demand through sea routes and flourishing import & export have boosted the demand for fuel in the marine industry and henceforth, drive the demand for the LNG power vessel market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.