- Home

- »

- Plastics, Polymers & Resins

- »

-

Flame Retardant Market Size & Share, Industry Report, 2033GVR Report cover

![Flame Retardant Market Size, Share & Trends Report]()

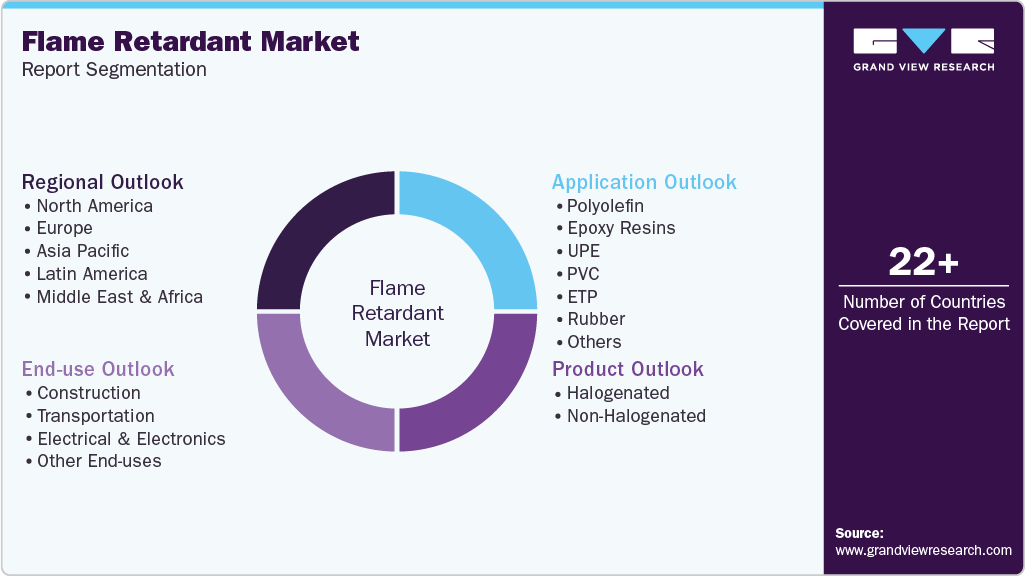

Flame Retardant Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Halogenated, Non Halogenated), By Application (Polyolefin, Epoxy resins, UPE), By End Use (Construction, Transportation, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-281-5

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flame Retardant Market Summary

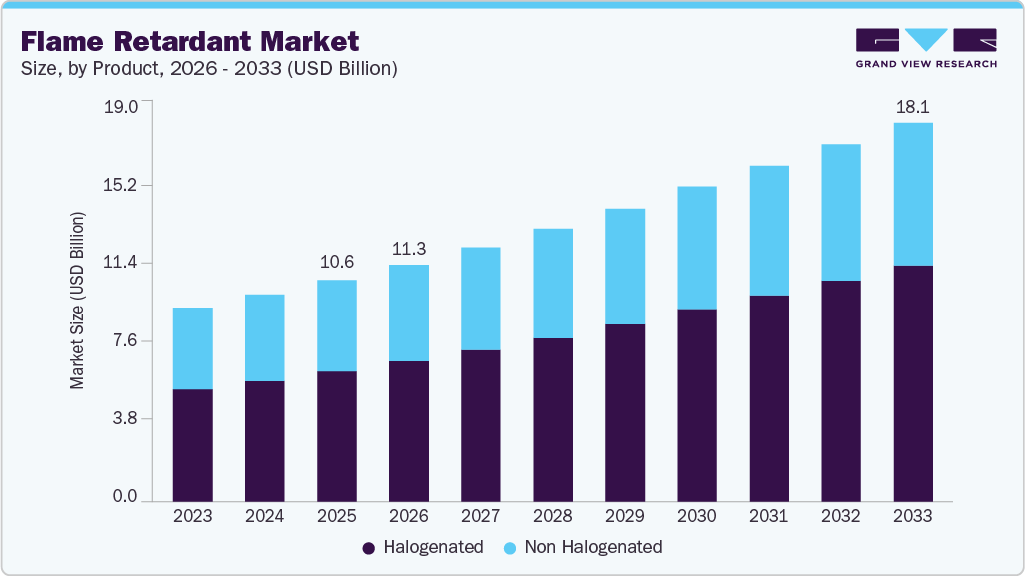

The global flame retardant market size was estimated at USD 10,559.2 million in 2025 and is projected to reach USD 18,098.1 million by 2033, growing at a CAGR of 6.9% from 2026 to 2033. The market continues to expand due to increasing emphasis on fire safety regulations and standards across residential, commercial, and industrial sectors.

Key Market Trends & Insights

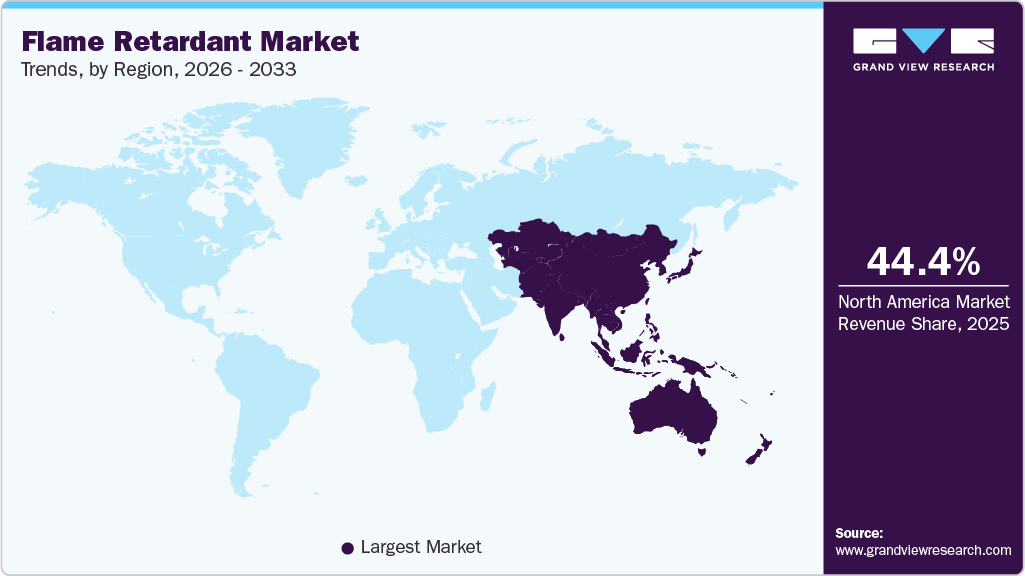

- Asia Pacific dominated the global flame retardant market with the largest revenue share of 44.4% in 2025.

- The flame retardant industry in the U.S. is expected to grow at a substantial CAGR of 6.6% from 2026 to 2033.

- By product, the non-halogenated segment held the highest market share of 58.9% in 2025 in terms of revenue.

- By application, the polyolefin is expected to grow at a significant CAGR of 7.6% from 2026 to 2033 during the forecast period.

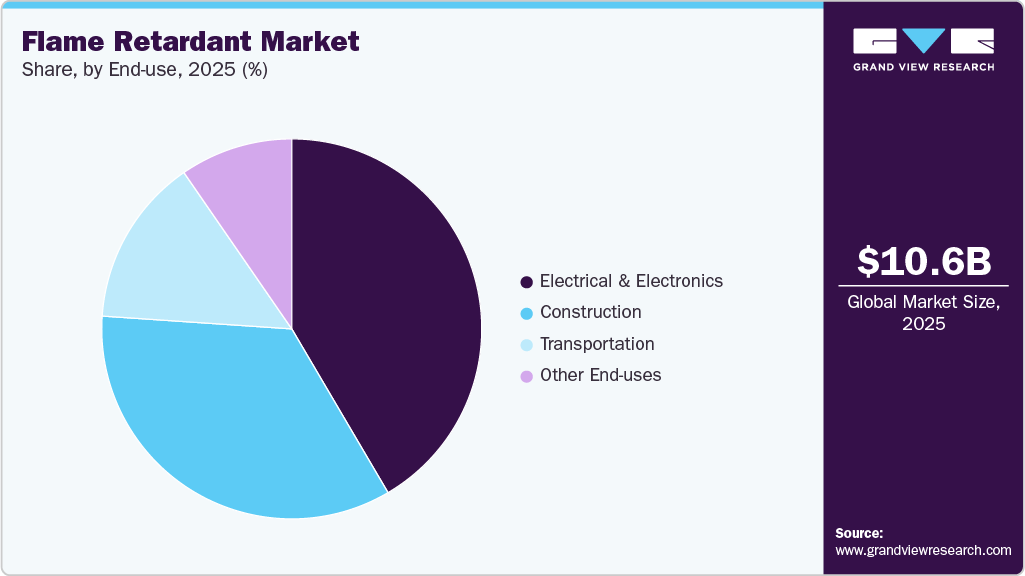

- By end use, the electrical and electronics segment held the highest market share of 41.5% in 2025, in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 10,559.2 Million

- 2033 Projected Market Size: USD 18,098.1 Million

- CAGR (2026-2033): 6.9%

- Asia Pacific: Largest Market in 2025

Governments and regulatory authorities worldwide have introduced stricter safety requirements mandating the incorporation of flame-retardant materials in applications such as building insulation, electronic housings, automotive components, and textiles. Another significant growth driver for the flame retardant industry is the expansion of the construction and infrastructure sector, especially in emerging economies across the Asia Pacific and the Middle East. Flame retardants are widely used in construction materials, including wiring cables, insulation foams, paints, and coatings, to minimize fire-related risks in residential and commercial environments. Rapid urbanization and government-backed smart city initiatives have further increased the use of flame retardant products, particularly in energy-efficient building designs that must comply with international fire safety standards.

The electrical and electronics industry also represents a significant demand hub for flame retardants, driven by the increasing adoption of consumer electronics, electric vehicles (EVs), and renewable energy technologies. Flame retardants play a vital role in printed circuit boards (PCBs), connectors, and casings, mitigating electrical fires caused by heat buildup. The global movement toward lightweight and compact electronic components has strengthened the demand for halogen-free and environmentally friendly flame retardant solutions, including phosphorous-based and aluminum hydroxide variants that provide fire protection without harmful emissions.

Additionally, the market is gaining traction from technological advancements and sustainability-driven developments. Rising environmental consciousness and regulatory restrictions on conventional halogenated flame retardants have accelerated the shift toward bio-based and non-halogenated alternatives that deliver similar fire resistance with enhanced recyclability and lower environmental impact. Companies are increasing their investments in research and development to enhance compatibility across various polymers and composites, thereby supporting compliance with circular economy principles. Collectively, these factors, such as regulatory oversight, industry expansion, innovation, and sustainability priorities, continue to strengthen the positive growth outlook for the global market.

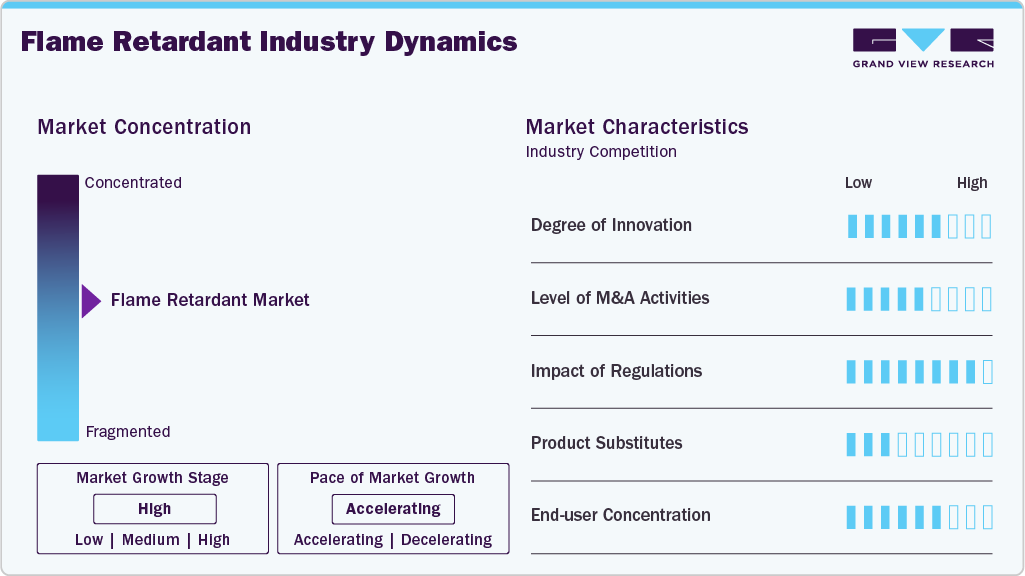

Market Concentration & Characteristics

The flame retardant market exhibits a moderate to high degree of concentration, with several leading global companies overseeing production and distribution. Key participants, including Albemarle Corporation, Lanxess AG, Clariant International, ICL Group Ltd., and BASF SE, command notable market shares, backed by strong R&D expertise, integrated supply networks, and broad product portfolios.

These companies prioritize creating advanced, non-halogenated solutions to align with environmental regulations and address rising demand for sustainable material options. The market’s entry barriers remain high owing to capital-intensive manufacturing operations, rigorous safety certifications, and strict regulatory compliance standards, collectively restricting new entrants and favoring established chemical manufacturers.

From a market perspective, the flame retardant industry is technology-focused and highly regulation-dependent, with demand primarily shaped by end-use sectors such as construction, electronics, automotive, and textiles. Formulation advancements, performance improvements, and adherence to eco-labeling criteria drive product differentiation.

The shift toward environmentally friendly flame retardants, particularly phosphorus, nitrogen, and mineral-based variants, is reshaping competitive dynamics and influencing new product development strategies. Additionally, long-term collaborations between raw material suppliers and downstream manufacturers ensure a reliable supply and provide tailored solutions. Overall, the market continues to maintain steady growth, with an increasing emphasis on safety, sustainability, and regulatory compliance, reinforcing its essential role in modern industrial applications.

Product Insights

The non-halogenated segment led the flame retardant market, accounting for the largest revenue share of 58.9% in 2025. This can be attributed to the increasing regulatory restrictions on halogen-based compounds and the rising demand for environmentally safe alternatives. These retardants, primarily phosphorus, nitrogen, and mineral-based formulations, provide effective flame resistance with reduced smoke generation and lower toxic gas release. They are widely utilized in electronics, construction materials, and automotive components to comply with strict fire safety and sustainability requirements.

The halogenated segment is projected to grow steadily during the forecast period. This category includes compounds based on bromine and chlorine, recognized for their strong flame suppression efficiency and cost advantages. These materials are commonly used in electronics, textiles, and plastic components where a high level of flame resistance is essential. However, increasing environmental and health concerns regarding toxic emissions during combustion have resulted in regulatory limitations and a gradual shift in the market toward non-halogenated alternatives.

Application Insights

The polyolefin segment led the flame retardant industry, accounting for the largest revenue share of 26.0% in 2025. The rising demand for materials such as polypropylene (PP) and polyethylene (PE), used in wires, cables, and construction components, supports this growth. Flame retardants improve the thermal stability and fire resistance of these polymers while maintaining their mechanical strength. The move toward halogen-free formulations in polyolefin applications is driven by stringent safety and environmental standards, particularly in the electrical and building-related sectors.

The ETP segment is anticipated to grow strongly during the forecast period. The market is supported by increasing use of materials such as polyamides (PA), polycarbonate (PC), and acrylonitrile butadiene styrene (ABS) in electrical, automotive, and electronic components. Flame retardants enhance the heat resistance and safety performance of these polymers when exposed to high operating temperatures. With the expansion of electric vehicles and smart electronic devices, demand for halogen-free and high-performance flame retardants in ETP applications continues to rise.

End Use Insights

The electrical and electronics segment accounted for the largest revenue share of 41.5% in 2024. Flame retardants are essential for improving the fire safety of circuit boards, connectors, casings, and wiring components. These additives help reduce the risk of electrical fires caused by overheating or short circuits while preserving material strength and insulation performance. The rising production of consumer electronics, electric vehicles, and renewable energy systems is increasing the demand for advanced, halogen-free flame-retardant solutions. This segment is also shaped by strict global standards such as UL94 and IEC 60695, which govern fire performance and safety requirements.

The construction segment is projected to grow at the fastest CAGR of 7.2% during the forecast period. The increasing demand for fire-safe building materials, including insulation panels, cables, coatings, and structural plastics, drives growth. Flame retardants are added to enhance fire resistance, reduce smoke generation, and prevent flame spread in residential and commercial buildings. Strict building safety regulations and energy efficiency standards in regions such as North America and Europe further contribute to the expansion of this segment.

Regional Insights

The Asia Pacific flame retardant market accounted for the largest revenue share of 44.4% in 2025. This growth is supported by rapid industrialization, expanding urban infrastructure, and strong demand from construction, electronics, and automotive sectors. Countries such as China, Japan, and South Korea dominate both production and consumption, backed by large manufacturing bases and an increasing regulatory focus on fire safety.

China Flame Retardant Market Trends

The China flame retardant market leads Asia Pacific, with a revenue share of 44.1% in 2025. The country is the largest global producer and consumer of flame retardants, supported by its strong electronics and construction industries. Government programs focused on industrial safety and sustainable manufacturing are also encouraging the wider adoption of advanced flame retardant technologies.

North America Flame Retardant Market Trends

Strict fire safety regulations and increasing adoption of halogen-free formulations across electronics, transportation, and building materials support the North America flame retardant industry. The United States remains a major contributor due to its strong research and development capabilities, as well as the rising demand for sustainable flame-retardant solutions.

U.S. Flame Retardant Market Trends

Continuous technological advancements, regulatory oversight, and increasing demands from the automotive and electronics industries drive the growth of the United States flame retardant industry. The increasing focus on halogen-free and environmentally compliant materials continues to influence product development and reshape the market landscape across key applications.

Europe Flame Retardant Market Trends

Europe’s flame retardant industry is influenced by environmental regulations such as REACH and RoHS, which are encouraging the shift toward non-halogenated and bio-based alternatives. Demand remains strong in the automotive, electrical, and construction sectors, with countries such as Germany and France prioritizing material advancements and recyclability.

The Germany flame retardant market represents one of the most developed markets in Europe, supported by its robust automotive, electrical, and construction industries. The country places strong emphasis on non-halogenated and environmentally friendly flame-retardant formulations to meet strict EU safety and environmental requirements. German manufacturers lead in polymer integration and material engineering, creating high-performance flame-retardant systems that deliver fire resistance along with recyclability and long-term durability.

Latin America Flame Retardant Market Trends

The Latin America flame retardant industry is growing steadily, supported by urban development initiatives and increasing industrial activity in Brazil and Mexico. Rising awareness of fire safety and the implementation of international building standards are encouraging the use of flame-retardant materials in infrastructure projects and consumer products.

Middle East and Africa Flame Retardant Market Trends

In the Middle East and Africa, the growth of the flame retardant industry is primarily driven by the expansion of construction and transportation projects, particularly in the Gulf countries. Increasing investments in commercial infrastructure and electrical systems are driving the gradual adoption of fire-safe materials across the region.

Key Flame Retardant Company Insights

Some of the key players operating in the market include Albemarle Corporation, BASF SE, and ICL.

- BASF SE is a global chemical manufacturing company with operations across the Asia Pacific, North America, Central and South America, Europe, and the Middle East & Africa. The company functions through six business segments, which include chemicals, materials, industrial solutions, surface technologies, agricultural solutions, and nutrition and care. The chemicals segment covers petrochemicals and intermediates. The materials segment consists of performance polymers and monomers. The industrial solutions segment offers performance chemicals along with dispersions and pigments. The agricultural solutions segment provides products for farming, landscape management, and pest control. The nutrition and care segment is divided into nutrition, health, and care. The company supplies a broad portfolio of surfactants to various industries, including textiles, paints and coatings, home care, and food processing.

Key Flame Retardant Companies:

The following are the leading companies in the flame retardant market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Albemarle Corporation

- ICL Group

- LANXESS

- CLARIANT AG

- Italmatch Chemicals S.p.A.

- Huber Engineered Materials

- DSM

- THOR

- Nabaltec AG

- FRX Innovations

- DuPont

Recent Developments

- In January 2022, Huber Engineered Materials completed the acquisition of MAGNIFIN Magnesiaprodukte GmbH and Co KG (MAGNIFIN). The product portfolio previously offered by MAGNIFIN, represented by Martinswerk GmbH, has now been fully integrated into Huber's strategic business unit, Fire Retardant Additives (FRA). This integration strengthens Huber's range of smoke suppressants, halogen-free fire retardants, and specialized aluminum oxides, significantly enhancing the company’s global market presence.

Flame Retardant Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11,312.1 million

Revenue forecast in 2033

USD 18,098.1 million

Growth rate

CAGR of 6.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Albemarle Corporation; ICL Group; LANXESS; CLARIANT AG; Italmatch Chemicals S.p.A.; Huber Engineered Materials; DSM; THOR; Nabaltec AG; FRX Innovations; DuPont

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flame Retardant Market Report Segmentation

This report forecasts the volume & revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global flame retardant market report based on product, application, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Halogenated

-

Brominated

-

Chlorinated Phosphates

-

Antimony Trioxide

-

Other Halogenated Products

-

-

Non-Halogenated

-

Aluminum Hydroxide

-

Magnesium Dihydroxide

-

Phosphorus Based

-

Other Non-halogenated Products

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Polyolefin

-

Epoxy Resins

-

UPE

-

PVC

-

ETP

-

Rubber

-

Styrenics

-

Other Applications

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Construction

-

Transportation

-

Electrical & Electronics

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flame retardants market size was estimated at USD 10,559.2 million in 2025 and is expected to reach USD 11,312.1 million in 2026.

b. The global flame retardants market is expected to grow at a compound annual growth rate of 6.9% from 2026 to 2033 to reach USD 18,098.1 million by 2033.

b. The non-halogenated segment dominated the flame retardants market in 2025, accounting for 58.9% of the total share, driven by increasing regulatory restrictions on halogenated formulations and a growing preference for environmentally friendly and low-toxicity alternatives. Superior performance characteristics such as effective fire resistance, lower smoke generation, reduced corrosivity, and improved thermal stability have supported strong adoption across building & construction, electronics, automotive, and electrical applications.

b. Some of the key players operating in the market include Albemarle Corporation, ICL, LANXESS, CLARIANT, Italmatch Chemicals S.p.A., Huber Engineered Materials, BASF SE, THOR, DSM, FRX Innovations, and DuPont.

b. The flame retardants market is primarily driven by rising demand from the building & construction, electrical & electronics, automotive, textiles, and industrial manufacturing sectors, supported by rapid urbanization, infrastructure development, and increasing safety standards. The growing adoption of non-halogenated and environmentally compliant flame retardant solutions driven by stringent fire safety regulations, sustainability mandates, and the need for reduced smoke toxicity and improved thermal performance, continues to accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.