- Home

- »

- Clothing, Footwear & Accessories

- »

-

Fishing Apparel & Equipment Market Size Report, 2030GVR Report cover

![Fishing Apparel And Equipment Market Size, Share & Trends Report]()

Fishing Apparel And Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Category (Apparel, Footwear, Equipment), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-472-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fishing Apparel And Equipment Market Summary

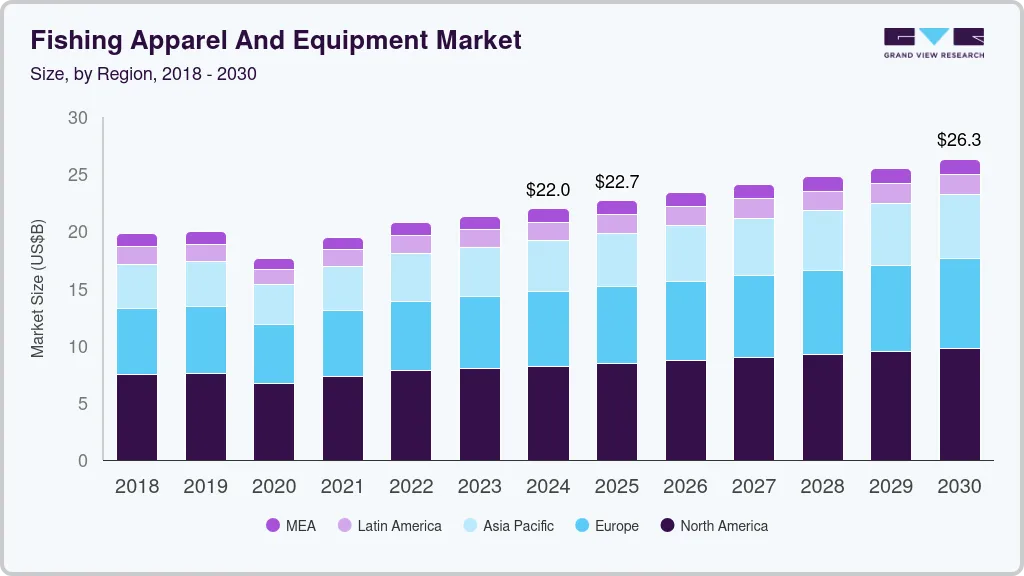

The global fishing apparel and equipment market size was estimated at USD 21.96 billion in 2024 and is projected to reach USD 26.32 billion by 2030, growing at a CAGR of 3.0% from 2025 to 2030. The market is experiencing significant growth, driven by several key factors and trends. One of the primary reasons for this expansion is the rising popularity of recreational fishing.

Key Market Trends & Insights

- North America held the largest revenue share in 2023 at 36.40%

- Asia Pacific region is expected to grow at the fastest CAGR of 3.8% from 2024 to 2030.

- By category, fishing equipment accounted for a revenue share of 93.60% in 2023.

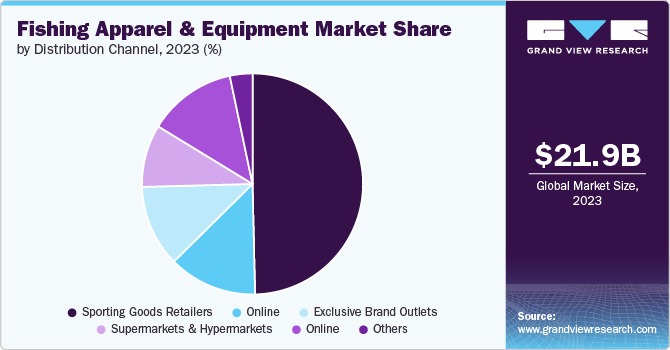

- By distribution channel, sales through sporting goods retailers accounted for a revenue share of 57.04% in 2023 in the market.

Market Size & Forecast

- 2024 Market Size: USD 21.96 Billion

- 2030 Projected Market Size: USD 26.32 Billion

- CAGR (2025-2030): 3.0%

- North America: Largest Market in 2023

More people are engaging in fishing as a leisure activity, viewing it as a way to relax, enjoy the outdoors, and bond with family and friends. As participation increases, the demand for specialized apparel and equipment that enhance the fishing experience naturally rises. The growing interest in fishing as a hobby and sport fuels market demand.Technological advancements in fishing equipment also play a crucial role in attracting consumers. Innovations like lightweight, durable fishing rods, precision reels, and advanced tackle boxes have made fishing gear more efficient and user-friendly. These products offer improved performance and help anglers achieve better results, making them more appealing to beginners and experienced fishermen. In addition, eco-friendly and sustainable fishing gear is becoming more popular as environmentally conscious consumers seek products made from recycled or sustainable materials. This shift aligns with the growing global emphasis on conservation and sustainability.

Fishing apparel has also evolved to meet the specific needs of anglers, with features such as UV protection, moisture-wicking fabrics, and waterproof designs. Consumers are drawn to specialized clothing that ensures comfort and safety during long hours outdoors in various weather conditions. The rise of competitive and sports fishing further boosts this demand as participants seek professional-grade apparel and gear to improve their tournament performance. Social media and online communities of fishing enthusiasts also contribute to market growth, as peer recommendations and shared experiences encourage others to invest in high-quality products.

In addition, safety and comfort remain key motivators for consumers interested in fishing apparel and equipment. Products designed to protect anglers from the elements, such as sun-blocking hats, water-resistant jackets, and breathable boots, are increasingly in demand. The combination of functionality, enhanced performance, and the overall improvement of the fishing experience is why many consumers take an active interest in investing in quality apparel and equipment for fishing activities.

Category Insights

Fishing equipment accounted for a revenue share of 93.60% in 2023. More people are engaging in fishing as a leisure activity, driving demand for quality fishing gear. As fishing has become a popular way to enjoy nature, unwind, and spend time with family, consumers invest more in fishing equipment to enhance their experience. Developing lightweight, durable, high-performance fishing gear, such as precision reels and advanced rods, attracts consumers. These innovations improve efficiency and success rates, encouraging anglers to upgrade or purchase new equipment.

Fishing apparel is expected to grow at a CAGR of 2.6% from 2024 to 2030. Anglers are increasingly seeking specialized apparel that provides protection from the elements, such as UV-blocking shirts, waterproof jackets, and moisture-wicking clothing. These features ensure comfort and safety during long hours outdoors, making functional fishing apparel highly desirable.As more people participate in fishing as a leisure activity, the demand for apparel that enhances the experience has grown. Consumers, from casual hobbyists to serious anglers, want apparel that improves their comfort and performance while fishing.

Distribution Channel Insights

Sales through sporting goods retailers accounted for a revenue share of 57.04% in 2023 in the market. Sporting goods retailers often offer a broad selection of fishing gear and apparel, catering to beginners and experienced anglers. Shoppers can find everything from basic supplies to high-end, specialized equipment in one place, making it convenient for customers to meet all their fishing needs. Many sporting goods retailers have knowledgeable staff who can provide expert advice on the best fishing gear and apparel for different conditions and skill levels. Consumers value this personalized assistance, which helps them make informed purchasing decisions.

Sales through online channels are expected to grow with a CAGR of 3.8% from 2024 to 2030. Shopping for fishing gear online allows consumers to browse a wide variety of products from the comfort of their homes at any time. This is particularly appealing to people who may not have easy access to physical stores or prefer the convenience of home delivery. Online channels often offer a more extensive selection of fishing apparel and equipment than traditional stores. Consumers can easily compare different brands, models, and prices, giving them more options to find the specific gear that meets their needs.

Regional Insights

North America fishing apparel and equipment market accounted for a revenue share of 36.40% in 2023. Fishing is one of North America's most popular outdoor activities, with more people taking up the sport for relaxation and leisure. As participation grows, so does the demand for quality fishing apparel and equipment to enhance the overall experience. North American consumers are drawn to innovations in fishing gear, such as lightweight, high-performance rods, precision reels, and durable tackle. These advancements improve the fishing experience, prompting anglers to invest in better equipment.

U.S. Fishing Apparel And Equipment Market Trends

The fishing apparel and equipment market in the U.S. is growing. There has been a broader trend toward outdoor activities and nature-based recreation across the U.S. and Canada, especially since the pandemic. This has increased demand for fishing apparel that offers protection from the elements, such as UV-blocking shirts, waterproof jackets, and functional footwear.

Asia Pacific Fishing Apparel And Equipment Market Trends

The fishing apparel and equipment market in Asia Pacific is expected to grow at a CAGR of 3.8% from 2024 to 2030. With economic growth in many Asia Pacific countries, disposable incomes are rising, allowing consumers to spend more on outdoor hobbies like fishing. This has led to higher demand for premium and technologically advanced fishing gear and apparel that offer better comfort and performance. Countries like Japan, China, and Australia are seeing a rise in recreational fishing as a leisure activity in the Asia Pacific. As more people take up fishing for relaxation and outdoor adventure, the demand for fishing apparel and equipment increases to enhance their experience.

Europe Fishing Apparel And Equipment Market Trends

The fishing apparel and equipment market in Europe is expected to grow at a CAGR of 3.3% from 2024 to 2030. The popularity of adventure tourism and outdoor sports in Europe has spurred an increased interest in fishing as part of outdoor excursions. Tourists and locals alike are investing in performance-driven fishing apparel that offers protection from changing weather conditions and lightweight, portable equipment suited for travel.

Key Fishing Apparel And Equipment Company Insights

The market is characterized by dynamic competitive dynamics shaped by factors including category innovation, regional category capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective, quality categories.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies also focus on raising consumer awareness of the ambiguity of the types used while strictly adhering to international regulatory standards.

Key Fishing Apparel And Equipment Companies:

The following are the leading companies in the fishing apparel and equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Simms Fishing Products

- Pure Fishing, Inc.

- AFTCO (American Fishing Tackle Company)

- Columbia Sportswear Company

- Mustad Fishing

- Shimano Inc.

- Rapala VMC Corporation

- Grundéns USA Ltd.

- Cabela's (Bass Pro Shops)

- Patagonia, Inc.

Fishing Apparel And Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.67 billion

Revenue forecast in 2030

USD 26.32 billion

Growth rate (Revenue)

CAGR of 3.0% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Simms Fishing Products; Pure Fishing, Inc.; AFTCO (American Fishing Tackle Company); Columbia Sportswear Company; Mustad Fishing; Shimano Inc.; Rapala VMC Corporation; Grundéns USA Ltd.; Cabela's (Bass Pro Shops); Patagonia, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fishing Apparel And Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fishing apparel and equipment market report based on category, distribution channel, and region.

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Hats

-

Jackets

-

Waders

-

Others

-

-

Footwear

-

Equipment

-

Rods, Reels, and Components

-

Lines and Leaders

-

Lures, Flies, and Artificial Baits

-

Hooks, Sinkers & Terminal Tackle

-

Depth Finders & Fish Finders

-

Creels, Strings, and Landing Nets

-

Other

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fishing apparel and equipment market size was estimated at USD 21.97 billion in 2023 and is expected to reach USD 22.62 billion in 2024.

b. The global fishing apparel and equipment market is expected to grow at a compounded growth rate of 3.0% from 2024 to 2030 to reach USD 27.08 billion by 2030.

b. Fishing apparel are expected to growth with a CAGR of 2.6% from 2024 to 2030. The growing popularity of outdoor activities has led to an increased focus on fashionable, durable, and multi-purpose outdoor clothing. Many anglers now prefer apparel that combines style with functionality, increasing demand for versatile fishing wear that can be used in a variety of settings.

b. Some key players operating in fishing apparel and equipment market include Simms Fishing Products, Pure Fishing, Inc., AFTCO (American Fishing Tackle Company), Columbia Sportswear Company and others.

b. Key factors that are driving the market growth include rising recreational activities and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.