- Home

- »

- Plastics, Polymers & Resins

- »

-

Fire Fighting Chemicals Market Size & Trends Analysis Report, 2033GVR Report cover

![Fire Fighting Chemicals Market Size, Share & Trends Report]()

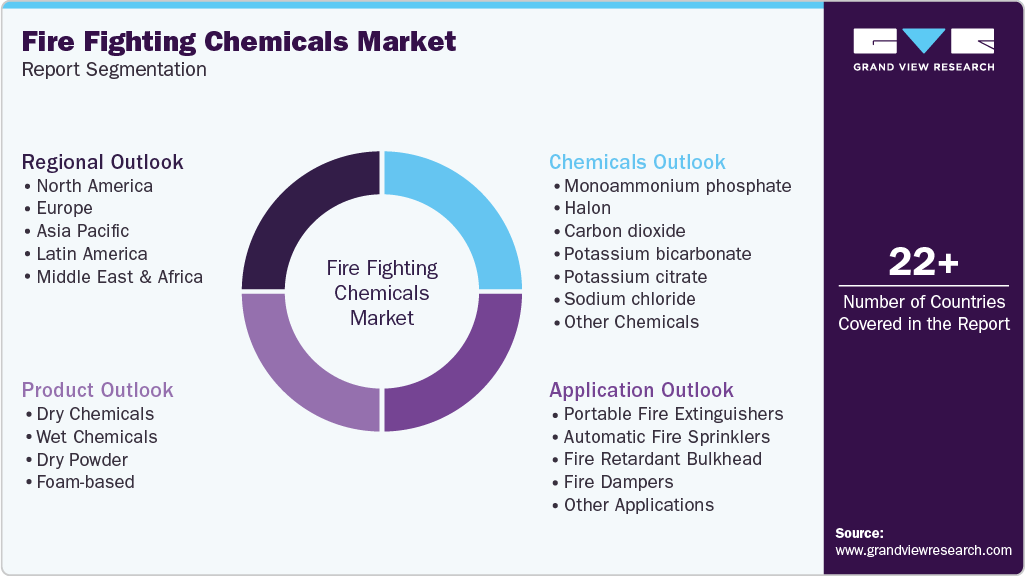

Fire Fighting Chemicals Market (2026 - 2033) Size, Share & Trends Analysis Report Product (Dry Chemicals, Wet Chemicals), By Application (Portable Fire Extinguishers, Automatic Fire Sprinklers), By Chemicals, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-529-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Fighting Chemicals Market Summary

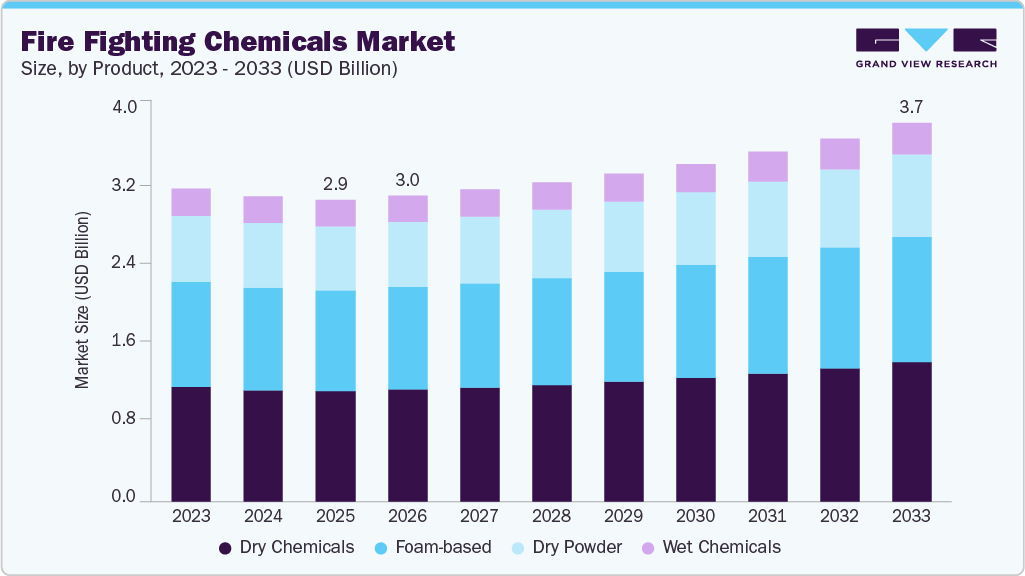

The global fire fighting chemicals market size was estimated at USD 2,940.4 million in 2024 and is projected to reach USD 3,694.7 million by 2033, growing at a CAGR of 4.6% from 2026 to 2033. The market is primarily driven by tightening fire safety regulations across industrial, commercial, and residential infrastructure, coupled with rising investments in high-risk assets such as oil & gas facilities, chemical plants, airports, data centers, and marine vessels.

Key Market Trends & Insights

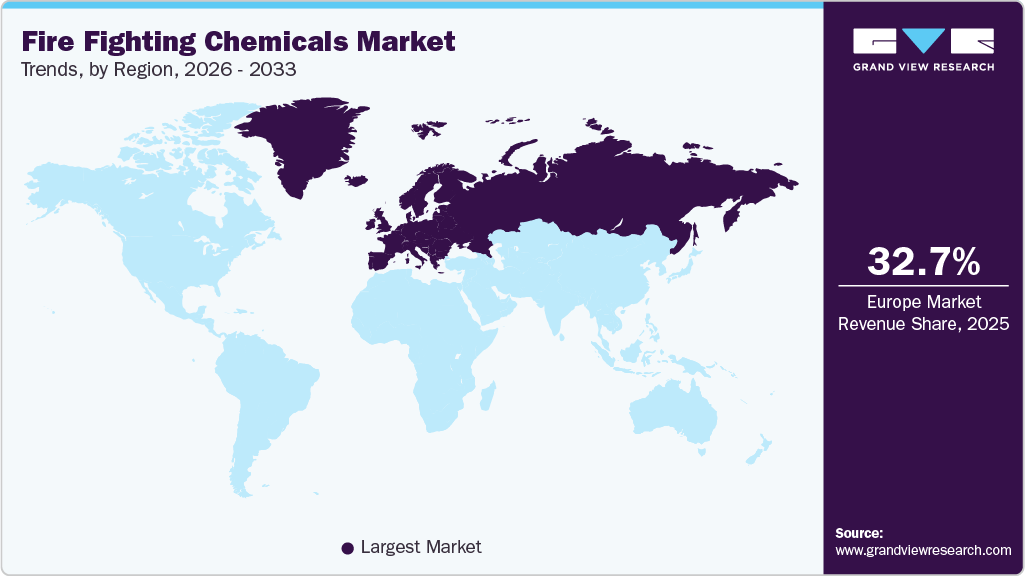

- Europe dominated the fire fighting chemicals market with the largest revenue share of 32.7% in 2025.

- The U.S. fire fighting chemicals market dominated the North American market with a 60.9% share in 2025.

- By product, dry powder is expected to grow at the fastest CAGR of 3.4% from 2026 to 2033 in terms of revenue.

- By product, the dry chemicals segment held the largest revenue share of 36.7% in 2025 in terms of value.

- By application, the portable fire extinguishers segment held the largest revenue share of 30.0% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 2,940.4 Million

- 2033 Projected Market Size: USD 3,694.7 Million

- CAGR (2026-2033): 3.1%

- Europe: Largest market in 2025

Mandatory installation of portable fire extinguishers, automatic sprinkler systems, and specialized fire suppression solutions in accordance with international standards (NFPA, EN, ISO) is sustaining demand for dry chemicals, foam-based agents, and clean extinguishing chemicals such as monoammonium phosphate and carbon dioxide. The accelerating global transition toward environmentally sustainable and fluorine-free firefighting solutions presents a strong growth opportunity for manufacturers investing in next-generation foam concentrates, clean agents, and non-toxic dry powders.Increasing retrofit demand for automatic fire suppression systems in aging infrastructure, particularly in Europe and North America, is expected to drive replacement sales of compliant chemicals. In parallel, expanding industrialization and infrastructure development in the Asia Pacific, the Middle East, and Africa are creating long-term demand for cost-effective fire suppression chemicals, while value-added services such as system integration, maintenance chemicals, and specialized application-specific formulations offer avenues for revenue differentiation and margin expansion.

The market faces significant challenges from evolving environmental and regulatory scrutiny, particularly related to fluorinated firefighting foams (PFAS-based AFFF), halon agents, and certain chemical residues linked to environmental persistence and health risks. Compliance with region-specific bans, phase-outs, and disposal requirements is increasing operational costs for manufacturers and end users while creating uncertainty around product portfolios. Furthermore, volatility in raw material prices for specialty chemicals, coupled with complex certification and approval processes for new formulations, can delay commercialization timelines and constrain margins, especially for small and mid-sized suppliers.

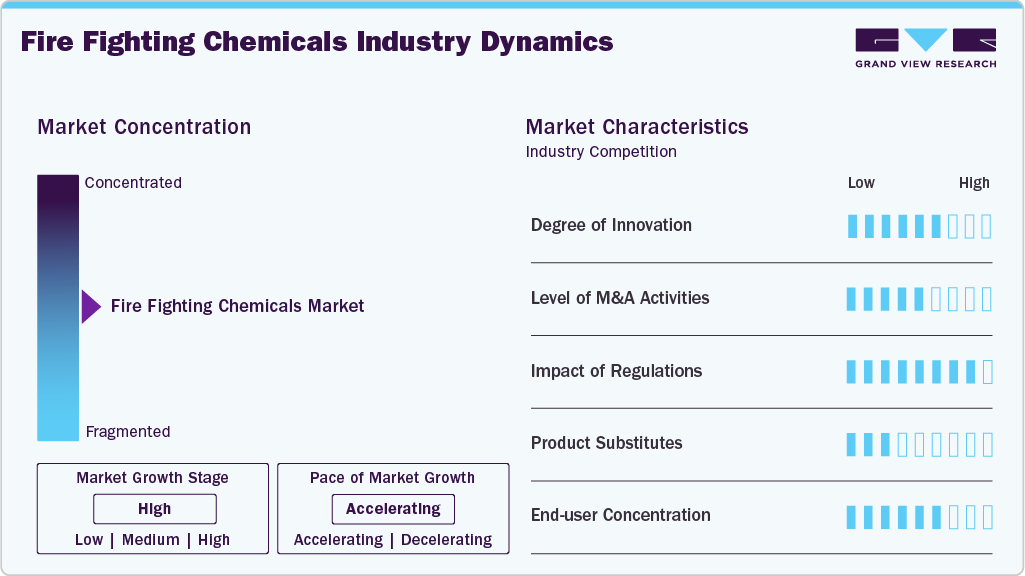

Market Concentration & Characteristics

The global fire fighting chemicals industry is moderately consolidated, characterized by the presence of multinational fire protection and specialty chemical companies alongside regional and niche suppliers. Key players such as Johnson Controls International plc, 3M, Solvay S.A., Linde plc, Angus Fire, and Perimeter Solutions maintain strong competitive positions through diversified product portfolios covering foam-based agents, dry chemicals, clean agents, and gas-based suppression solutions. Competition is driven by product reliability, regulatory and certification compliance (NFPA, UL, EN, ISO), and the ability to deliver integrated solutions across portable extinguishers, automatic fire suppression systems, and high-risk industrial applications.

Competitive dynamics are increasingly shaped by regulatory compliance and product innovation, particularly the shift away from PFAS-based foams and legacy halon agents. Market leaders are accelerating investments in fluorine-free formulations, clean-agent technologies, and retrofit-compatible solutions to protect installed bases and address evolving environmental standards. Regional players such as Foamtech Antifire Company, Fire Safety Devices Pvt. Ltd., and Safequip Pty Ltd. compete on cost efficiency and localized service capabilities, especially in emerging markets. Overall, differentiation is shifting from price-based competition toward sustainability, compliance readiness, and value-added service offerings.

Product Insights

The dry chemicals segment dominated the global market, accounting for the largest revenue share of 36.7% in 2025, primarily due to its broad applicability, cost-effectiveness, and strong adoption across portable fire extinguishers and fixed suppression systems. Dry chemical agents, particularly monoammonium phosphate and potassium bicarbonate, based formulations, are widely used for Class A, B, and C fires, making them the preferred choice across industrial, commercial, and residential settings. Their long shelf life, ease of storage, minimal maintenance requirements, and proven extinguishing efficiency have supported sustained procurement by end users, especially in manufacturing facilities, warehouses, transportation hubs, and emerging economies where affordability and reliability remain key purchasing criteria.

Foam-based, wet chemical, and dry powder segments complement the market by addressing application-specific fire risks and regulatory requirements. Foam-based agents continue to see strong demand in high-risk environments such as oil & gas, aviation, marine, and chemical processing, driven by their effectiveness in suppressing flammable liquid fires, although the transition toward fluorine-free formulations increasingly shapes growth. Wet chemicals are primarily deployed in commercial kitchens and food-processing facilities due to their superior performance against Class K fires, supporting steady niche growth. Meanwhile, dry powders are favored for specialized industrial applications, including metal and electrical fires, where conventional agents are ineffective.

Application Insights

The portable fire extinguishers segment captured the largest revenue share of 30.0% in 2025, driven by mandatory installation requirements across residential, commercial, industrial, and transportation infrastructure. Portable extinguishers represent the first line of defense against incipient fires and are widely adopted due to their low cost, ease of deployment, and compatibility with multiple firefighting chemicals, including dry chemicals, dry powders, carbon dioxide, and wet chemical agents. Regular inspection, refilling, and replacement cycles mandated by fire safety regulations further support recurring demand, particularly in public buildings, manufacturing facilities, warehouses, hospitality establishments, and commercial complexes.

Other application segments cater to specialized and large-scale fire protection requirements. Automatic fire sprinkler systems continue to witness steady growth, supported by increasing construction activity, stricter building codes, and rising adoption in high-occupancy and high-value facilities such as data centers, logistics hubs, and industrial plants. Fire retardant bulkheads and fire dampers play a critical role in passive fire protection by preventing flame and smoke propagation in marine vessels, offshore platforms, tunnels, and large commercial buildings, sustaining demand for specialized chemical formulations and coatings. Other applications, including fixed gas suppression systems and customized industrial solutions, address niche safety requirements where rapid suppression and minimal collateral damage are critical.

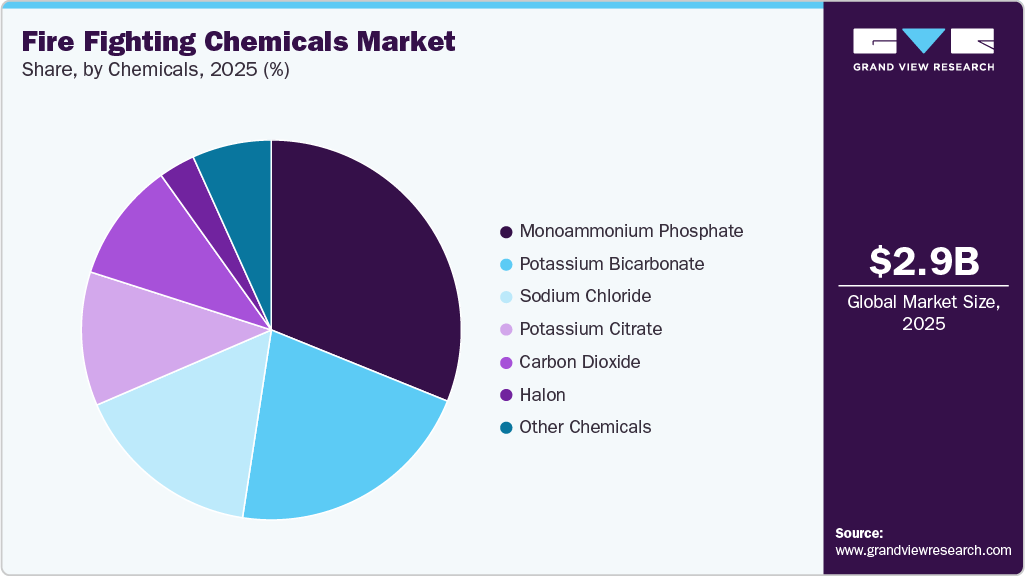

Chemicals Insights

The monoammonium phosphate (MAP) segment held the largest revenue share of 31.1% in 2025, driven by its widespread use as the primary extinguishing agent in multipurpose dry chemical fire extinguishers. MAP is highly effective across Class A, B, and C fires, offering rapid flame knockdown, surface smothering, and interruption of chemical chain reactions, which makes it a preferred solution across industrial, commercial, and residential applications. Its favorable cost-to-performance ratio, long storage life, and compatibility with portable fire extinguishers and fixed suppression systems have supported large-scale adoption, particularly in manufacturing plants, warehouses, transportation infrastructure, and public buildings where compliance with fire safety codes mandates multipurpose fire protection solutions.

Other chemical segments address specific fire suppression needs and evolving regulatory requirements. Halon agents, while historically dominant in aviation and mission-critical facilities, continue to generate limited revenues from maintenance and replacement demand, although global phase-out regulations constrain their use. Carbon dioxide remains a key agent for electrical rooms, data centers, and industrial enclosures due to its clean extinguishing properties and absence of residue, supporting stable demand despite safety considerations in occupied spaces. Potassium bicarbonate and potassium citrate are widely used in dry chemical formulations for Class B and C fires, particularly in industrial and oil & gas applications, due to their superior flame inhibition efficiency. Sodium chloride and other specialty chemicals serve niche applications such as metal fires and customized suppression systems.

Regional Insights

Europe accounted for the largest share of 32.7% in 2025, driven by stringent fire safety regulations, high enforcement of building and industrial safety codes, and accelerated replacement demand for environmentally compliant firefighting chemicals. Strong regulatory oversight, particularly related to PFAS phase-outs and halon restrictions, has pushed end users toward advanced dry chemicals, fluorine-free foams, and clean agents across industrial, commercial, and transportation infrastructure. The region’s mature construction base and focus on asset protection continue to sustain recurring demand from retrofit and system upgrade projects.

Germany Fire Fighting Chemicals Market Trends

The fire fighting chemicals market in Germany represents a key market within Europe, supported by its large industrial base, advanced manufacturing sector, and strict adherence to fire safety and environmental standards. Demand is driven by extensive use of dry chemicals and clean agents across automotive manufacturing, chemical processing, logistics facilities, and public infrastructure. Germany also plays a critical role in technology adoption, with strong emphasis on certified, environmentally compliant fire suppression chemicals and integrated fire protection systems.

North America Fire Fighting Chemicals Market Trends

The fire fighting chemicals market in North America captured 26.8% of the global market in 2025, supported by well-established fire safety regulations, high penetration of automatic fire suppression systems, and consistent replacement demand for portable fire extinguishers. The region benefits from strong institutional and industrial spending, particularly across data centers, oil & gas facilities, commercial buildings, and transportation infrastructure. Regulatory scrutiny on PFAS-based foams is accelerating the transition toward fluorine-free alternatives, shaping product innovation and procurement decisions.

The U.S. fire fighting chemicals marketdominated the North American market with a 60.9% share in 2025, driven by extensive regulatory frameworks enforced by agencies such as NFPA and OSHA, along with high awareness of fire safety compliance. Strong demand from commercial real estate, industrial manufacturing, aviation, and critical infrastructure has sustained large-scale adoption of dry chemicals, foam-based agents, and clean suppression systems. Ongoing investments in data centers and infrastructure modernization continue to support long-term market growth.

Asia Pacific Fire Fighting Chemicals Market Trends

The fire fighting chemicals market in the Asia Pacific accounted for 24.6% of the global market in 2025, driven by rapid urbanization, industrial expansion, and increasing enforcement of fire safety norms across emerging economies. Growth is supported by rising construction activity, expansion of manufacturing facilities, and improving safety awareness, particularly in China, India, and Southeast Asia. Cost-effective dry chemicals and dry powders dominate demand, while the adoption of advanced foam-based and clean agent solutions is gradually increasing in high-value applications.

China fire fighting chemicals market held the largest share of 37.3% within Asia Pacific in 2025, supported by its vast industrial base, large-scale infrastructure development, and expanding commercial construction sector. Regulatory mandates and widespread industrial deployment drive strong demand for portable fire extinguishers and dry chemical agents. Additionally, increasing investments in transportation hubs, energy facilities, and high-rise buildings are accelerating the adoption of automatic fire suppression systems and specialized firefighting chemicals.

Middle East & Africa Fire Fighting Chemicals Market Trends

The fire fighting chemicals market in the Middle East & Africa is driven by investments in oil & gas, petrochemicals, power generation, aviation, and large-scale infrastructure projects. Demand for foam-based agents and dry powders is particularly strong in high-risk industrial environments, while regulatory adoption is improving across commercial buildings and public infrastructure. However, market penetration remains lower than in developed regions; ongoing urban development and safety standard upgrades present long-term growth opportunities.

Latin America Fire Fighting Chemicals Market Trends

The fire fighting chemicals market in Latin America represents a developing yet steadily growing market, driven by infrastructure investments, industrial modernization, and the gradual strengthening of fire safety regulations. Demand is largely concentrated in portable fire extinguishers and dry chemical agents due to cost sensitivity and widespread use across commercial and industrial facilities. Brazil and Mexico act as key demand centers, while growth opportunities exist in mining, oil & gas, and commercial construction sectors.

Key Fire Fighting Chemicals Company Insights

Key players, such as Johnson Controls International plc, Perimeter Solutions, Solvay S.A., 3M, Foamtech Antifire Company, and DIC Corporation, are dominating the market.

Solvay S.A.

-

Solvay S.A. is a global specialty chemicals company with a strong presence in the firefighting chemicals ecosystem through its advanced materials and chemical solutions used in flame retardancy, fire suppression formulations, and high-performance industrial applications. The company leverages its expertise in specialty polymers, fluorochemicals, and inorganic compounds to support fire safety requirements across industrial manufacturing, transportation, electronics, and energy sectors. Solvay’s focus on innovation, regulatory compliance, and sustainable chemistry positions it as a key supplier of high-value chemical inputs rather than finished extinguishing systems, enabling it to benefit from growing demand for environmentally compliant and high-performance fire protection solutions worldwide.

Key Fire Fighting Chemicals Companies:

The following are the leading companies in the fire fighting chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Controls International plc

- Perimeter Solutions

- Solvay S.A

- 3M

- Foamtech Antifire Company

- DIC Corporation

- Linde plc

- Angus Fire

- Fire Safety Devices Pvt. Ltd.

- Safequip Pty Ltd.

Global Fire Fighting Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2,984.5 million

Revenue forecast in 2033

USD 3,694.7 million

Growth rate

CAGR of 3.1% from 2026 to 2033

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, chemicals, application, region

Regional scope

North America; Europe; Asia Pacific; MEA; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Johnson Controls International plc; Perimeter Solutions; Solvay S.A; 3M; Foamtech Antifire Company; DIC Corporation; Linde plc; Angus Fire; Fire Safety Devices Pvt. Ltd.; Safequip Pty Ltd

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Fighting Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global fire fighting chemicals market report based on product, chemicals, application, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Dry Chemicals

-

Wet Chemicals

-

Dry Powder

-

Foam-based

-

-

Chemicals Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Monoammonium phosphate

-

Halon

-

Carbon dioxide

-

Potassium bicarbonate

-

Potassium citrate

-

Sodium chloride

-

Other Chemicals

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Portable Fire Extinguishers

-

Automatic Fire Sprinklers

-

Fire Retardant Bulkhead

-

Fire Dampers

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global fire fighting chemicals market size was estimated at USD 2,940.4 million in 2025 and is expected to reach USD 2,984.5 million in 2026.

b. The fire fighting chemicals market is expected to grow at a compound annual growth rate of 3.1% from 2026 to 2033 to reach USD 3,694.7 million by 2033.

b. The dry chemicals segment dominated the market with a 36.7% revenue share in 2025 due to its broad applicability across Class A, B, and C fires, cost effectiveness, and widespread use in portable fire extinguishers and fixed suppression systems. The long shelf life, ease of storage, and strong regulatory acceptance across industrial, commercial, and residential settings supported sustained, high-volume adoption.

b. Some of the key players operating in the fire fighting chemicals market include Johnson Controls International plc, Perimeter Solutions, Solvay S.A, 3M, Foamtech Antifire Company, DIC Corporation, Linde plc, Angus Fire, Fire Safety Devices Pvt. Ltd., and Safequip Pty Ltd

b. The fire fighting chemicals market is driven by stringent fire safety regulations, mandatory installation of fire protection systems, and rising investments in industrial, commercial, and critical infrastructure. Growing awareness of asset protection, coupled with replacement and maintenance demand for portable extinguishers and automatic suppression systems, further supports market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.