- Home

- »

- Plastics, Polymers & Resins

- »

-

Fiber-reinforced Plastic (FRP) Recycling Market Size ReportGVR Report cover

![Fiber-reinforced Plastic (FRP) Recycling Market Size, Share & Trends Report]()

Fiber-reinforced Plastic (FRP) Recycling Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Glass-Fiber Reinforced Plastic, Carbon-Fiber Reinforced Plastic), By Recycling Technique, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-078-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiber-reinforced Plastic Recycling Market Summary

The global fiber-reinforced plastic (FRP) recycling market size was estimated at USD 442.24 million in 2022 and is projected to reach USD 795.06 million by 2030, growing at a CAGR of 8.0% from 2023 to 2030.Increasing demand from various end-user industries, including building & construction, industrial, transportation, and others is expected to be a driving factor for the global fiber-reinforced plastics (FRP) recycling market.

Key Market Trends & Insights

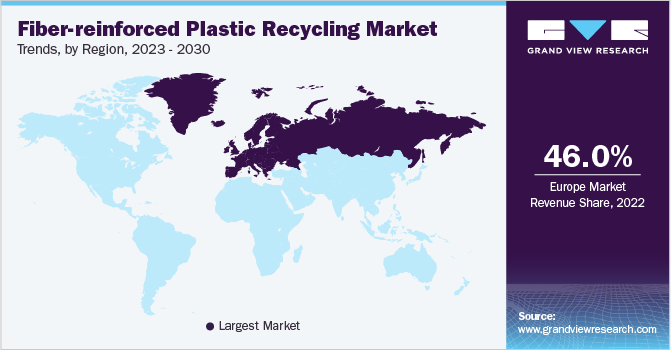

- Europe dominated the market and accounted for around 46.0% share of the global revenue in 2022.

- By product, the glass-fiber reinforced plastics (GFRPs) product segment accounted for more than 61.0% of the global volume share in 2022.

- By recycling technique, the incineration & co-incineration recycling technique segment dominated the fiber-reinforced plastic recycling market.

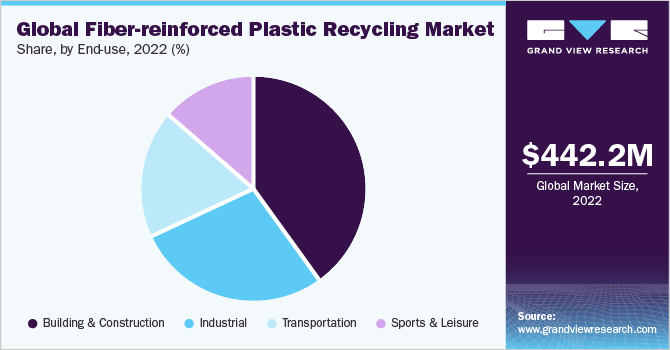

- By end-use, the building & construction end-use segment led the market, accounting for more than 40.0% of the global revenue share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 442.24 Million

- 2030 Projected Market Size: USD 795.06 Million

- CAGR (2023-2030): 8.0%

- Europe: Largest market in 2022

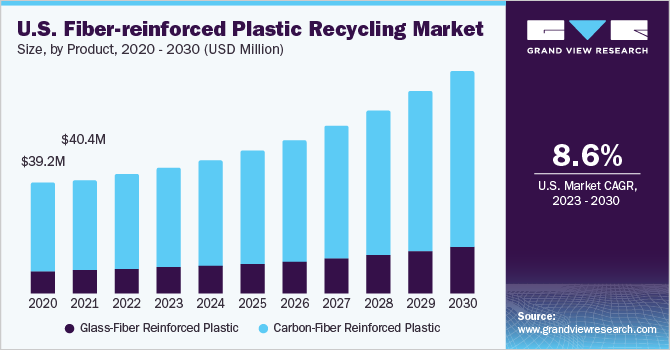

The U.S. FRP recycling market is projected to expand at a CAGR of 8.6% over the forecast period. Substantial infrastructure development, coupled with steady economic growth, has factored in regional revenue generation. In addition, the patterns associated with consumption, import & export, and domestic production have helped manufacturers to capitalize on potential opportunities in the market.

FRP is difficult to recycle despite its exceptional durability and great commercial value. Different recycling procedures are utilized to create various components, paving the way for different recycling methods. Furthermore, these goods can be produced by utilizing the recyclable material produced by pre-impregnated wastes from component offcuts and crushing composites.

The components’ surface quality is degraded due to the recycling process. This is because recycled fibers lack sizing and have resin residues or char left on them after the process. These residues cause poor fiber-matrix adhesion. Currently, there are only a handful of recycling techniques available that are ideal for processing carbon-fiber-reinforced plastic. The absence of ideal methods to recover the best waste material poses a difficulty, which is expected to be a restraining factor for market growth over the forecast period.

The COVID-19 pandemic adversely affected the market growth in 2020 owing to various operational and trade restrictions. However, after the removal of restrictions in the latter half of 2021, the market advanced positively, owing to the increased utilization of recycled fiber plastic composites in different end-use industries, including building and construction, transportation, and others.

Product Insights

The glass-fiber reinforced plastics (GFRPs) product segment accounted for more than 61.0% of the global volume share in 2022. GFRPs are the most popular FRPs, with benefits including design flexibility and simple forming. Transportation, building & construction, and industrial are some of the end-use sectors that utilize GFRPs, owing to which GFRP waste is increasing rapidly. Furthermore, GFRP recycling is also increasing due to strict government laws regarding waste disposal, and expansion of the end-uses of recycled GFRP.

Carbon-fiber reinforced plastics (CFRPs) showcase properties such as stiffness, chemical resistance, high tensile strength, and low thermal expansion, which has led to them being utilized in different industries including building & construction, transportation, sports & leisure, and others. CFRPs are being utilized in multiple sectors, and the instances of the end of their useful lives have been increasing, which is further increasing the demand for their recycling. Environmental responsibilities and governmental regulations are responsible for affecting the supply chain of recycling CFRPs.

Recycling Technique Insights

The incineration & co-incineration recycling technique segment dominated the fiber-reinforced plastic recycling market and accounted for more than 55.0% of the global revenue share in 2022. The co-incineration recycling technique is ideal for utilization in GFRP recycling. Incineration is a thermal technique that allows energy reclaimed from waste combustion heat to be converted into electricity or directly utilized. The co-incineration recycling technique utilizes cement kilns for recycling purposes and offers both energy and material recovery.

It is a cost-effective and better option for GFRP waste. One of the key global recyclers, neocomp GmbH, utilizes this technique to recycle GFRP waste. The mechanical recycling method is utilized for breaking down scrap composites into small recyclable materials. It is an ideal recycling method for thermoset FRP composite materials. This method includes size reduction using milling, shredding procedures, or crushing to create a powdered material.

End-use Insights

The building & construction end-use segment led the market, accounting for more than 40.0% of the global revenue share in 2022. Recycled fiber-reinforced plastic waste is utilized by this industry for various applications. Recycled FRPs possess thermal stability and electrical insulation, and are lightweight, easy to install, and durable in corrosive environments, making them suitable for utilization in the building and construction sector. Recycled FRPs in the construction industry are utilized as an alternative to traditional building materials such as concrete and steel.

Recycled fiber-reinforced plastics (FRP) composites offer a better strength-to-weight ratio. This is an important factor for the automotive industry, as high-strength and low-weight materials reduce fuel consumption in vehicles, thus offering enhanced mileage and reducing air pollution. In addition, governments across the world are adopting stringent policies for maintaining the average fuel consumption per vehicle. These factors are expected to drive the demand for FRPs in the transportation industry, which in turn is expected to promote the FRP recycling industry.

Regional Insights

Europe dominated the market and accounted for around 46.0% share of the global revenue in 2022, owing to increasing product demand from major countries, including UK, Italy, and Germany. Landfilling is prohibited in major European countries such as Germany, which is boosting the adoption of recycled plastics/composites. Recycled FRPs are utilized in windmill blades, with wind power being one of the major drivers behind Germany's switch to renewable energy. In addition, several decommissioned blades are expected from Spain and Germany.

By 2025, WindEurope recommended a waste ban on wind turbine blades throughout Germany. The wind business in the country is committed to recycling, reusing, or recovering 100% of the decommissioned blades. Furthermore, the landfill ban is expected to accelerate the development of environment-friendly recycling technologies in the region.

The construction industry in North America is utilizing recycled GFRP composites owing to their thermal superiority, resistance to harsh chemicals, and enhanced mechanical performance. In addition, GFRP trash can be cut down into large pieces and added to concrete mixtures. Furthermore, the regional government is encouraging the development of wind energy and the costs of wind turbines have been reduced owing to the development of new methods, including using waste FRPs in incineration.

Key Companies & Market Share Insights

Most of the key players operating in the market have integrated their raw material production and distribution operations to maintain product quality and expand their regional presence. This provides companies with a competitive advantage in the form of cost benefits, thus increasing their profit margins. Companies are undertaking research and development activities to develop new industrial plastics to sustain market competition and address changing end-user requirements.

Research activities focused on the development of new materials, which combine several properties, are projected to gain wide acceptance in this industry in the coming years. For instance, in February 2023, Toray Industries, Inc., announced the development of a new high-speed thermal welding technology for CFRPs. This new technology will promote weight savings and high-rate of production of CFRP airframes. This is expected to drive the demand for CFRP in the aircraft industry in the coming years. Some of the major companies operating in the global fiber-reinforced plastic recycling market include:

-

Aeron Composite Pvt. Ltd

-

Carbon Conversions

-

Carbon Fiber Recycle Industry Co. Ltd

-

Carbon Fiber Recycling

-

Conenor Ltd

-

Eco-Wolf Inc.

-

Gen 2 Carbon Limited

-

Global Fiberglass Solutions

-

Karborek Recycling Carbon Fibers

-

MCR (Mixt Composites Recyclables)

-

Mitsubishi Chemical Advanced Materials GmbH

-

neocomp GmbH

-

Procotex

-

Toray Industries Inc.

-

Ucomposites A/S

-

Vartega Inc.

Fiber-reinforced Plastic (FRP) Recycling Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 464.69 million

Revenue forecast in 2030

USD 795.06 million

Growth Rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR (%) from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, recycling technique, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Singapore; Australia; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Aeron Composite Pvt. Ltd; Carbon Conversions; Carbon Fiber Recycle Industry Co. Ltd; Carbon Fiber Recycling; Conenor Ltd; Eco-Wolf Inc.; Gen 2 Carbon Limited; Global Fiberglass Solutions; Karborek Recycling Carbon Fibers; MCR (Mixt Composites Recyclables); Mitsubishi Chemical Advanced Materials GmbH; neocomp GmbH; Procotex; Toray Industries Inc.; Ucomposites A/S; Vartega Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber-reinforced Plastic (FRP) Recycling Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global fiber-reinforced plastic recycling market report based on product, recycling technique, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Glass-Fiber Reinforced Plastic

-

Carbon-Fiber Reinforced Plastic

-

-

Recycling Technique Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thermal/Chemical Recycling

-

Incineration & Co-Incineration

-

Mechanical Recycling

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Transportation

-

Building & Construction

-

Sports & Leisure

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The fiber-reinforced plastic (FRP) recycling market was valued to be USD 442.24 million in 2022 and is anticipated to be USD 464.69 million in 2023, owing to the rising demand for fiber-reinforced plastic (FRP) recycling across various end-use industries including industrial and transportation.

b. The fiber-reinforced plastic (FRP) recycling market is set to grow at a CAGR of 8.0% during the forecast period of 2023-2030.

b. Glass-fiber reinforced plastic segment witnessed a market share of 20.70% in terms of market revenue in 2022, dominating the market space due to its high popularity and properties including design flexibility and simple forming.

b. Key market players present across the fiber-reinforced plastic recycling include Aeron Composite Pvt. Ltd., Carbon Conversions, Carbon Fiber Recycle Industry Co. Ltd., Carbon Fiber Recycling, Conenor Ltd., Eco-Wolf Inc., Gen 2 Carbon Limited, Global Fiberglass Solutions, Karborek Recycling Carbon Fibers, MCR Mixt Composites Recyclables, Mitsubishi Chemical Advanced Materials GmbH, Neocomp GmbH, Procotex, Toray industries Inc., Ucomposites AS, and Vartega Inc.

b. Factors driving the fiber-reinforced plastic (FRP) recycling market include rising demand from the building & construction industry due to its higher thermal stability, electrical insulation, lightweight, and easy installation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.