- Home

- »

- Communications Infrastructure

- »

-

Fiber Management Systems Market Size & Share Report, 2030GVR Report cover

![Fiber Management Systems Market Size, Share & Trends Report]()

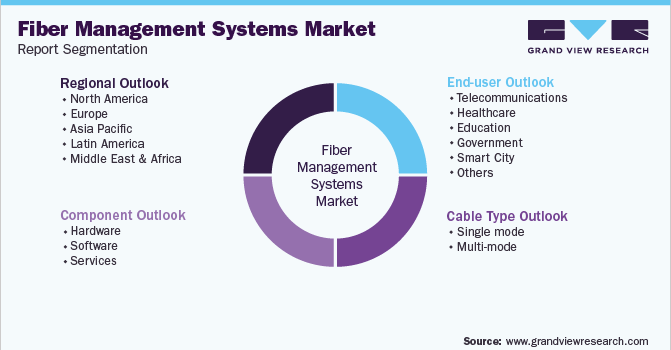

Fiber Management Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Cable Type (Single Mode, Multi-mode), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-047-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global fiber management systems market size was valued at USD 6,911.19 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 13.3% from 2023 to 2030. The Fiber Management Systems (FMS) industry’s growth is driven by the increasing demand for high-speed data transmission and the exponential growth observed in data traffic in recent times. With the rise of cloud computing, big data analytics, and other bandwidth-intensive applications, there is a need for a robust and scalable fiber infrastructure to support these services.

Moreover, the development of new technologies, such as bend-insensitive, multimode, and higher-capacity optical fibers, is driving the demand for these management systems. Fiber management systems are essential for ensuring the reliability and performance of fiber optic networks. They provide protection against environmental factors such as dust, moisture, and temperature fluctuations, which can damage the optic components and degrade network performance.

A fiber management system is a set of tools, equipment, and processes used to organize, protect, and maintain the physical infrastructure of a fiber optic network. A typical management system might include a variety of tools and equipment, such as patch panels, cable trays, splice enclosures, cable ties, cleaning kits, and labeling systems. It may also include specialized software tools for managing network configurations and troubleshooting issues.

These management systems ideally provide a robust and scalable infrastructure for high-speed data transmission, while also minimizing the risk of damage or failure that could impact the network's performance. Along with rendering the aforementioned benefits, these systems allow easy installation and maintenance. They provide a modular, plug-and-play solution that simplifies the process of adding, removing, or reconfiguring network components.

Fiber management systems are essential for efficient network management. They help reduce downtime, optimize network performance, and simplify the management of complex fiber optic networks. As such, businesses and organizations are increasingly investing in efficient management systems to ensure the smooth operation of their networks. Additionally, increasing investments in telecommunications infrastructure, particularly in developing economies, are fueling the demand for the market. Governments and telecom operators are investing heavily in fiber optic networks to support economic growth and improve connectivity.

Another significant advantage of these management systems is that they provide a compact, organized solution for housing and managing fiber optic cables, connectors, and other components, thereby minimizing the footprint required for network infrastructure. They are designed to optimize the use of space in data centers, telecom rooms, and other network infrastructure environments. They are also highly scalable and flexible, making them ideal for networks that need to grow and adapt over time. They allow network operators to easily add or remove components as needed, without disrupting the overall network infrastructure.

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the fiber management systems market, both in the short and long term. The pandemic has caused significant disruptions in global supply chains, leading to shortages of raw materials, components, and finished products. This has impacted the availability of the management systems and other network infrastructure components, leading to delays in network deployments and upgrades.

Furthermore, the pandemic caused significant economic uncertainty and budget constraints for businesses and organizations globally. This has led to a slowdown in network deployments and upgrades, as companies intended to prioritize essential expenses and cut back on non-essential investments.

Despite the short-term challenges posed by the pandemic, the market is expected to continue growing in the long term. The increasing demand for high-speed data transmission, advancements in fiber optic technology, and growing investments in telecommunications infrastructure are all expected to drive growth over the coming years.

The pandemic accelerated the shift towards remote work and online services, leading to a surge in demand for high-speed internet connectivity. This has increased the demand for fiber optic networks and management systems from several end-use industries, such as healthcare, as they are essential for delivering reliable and high-performance internet connectivity.

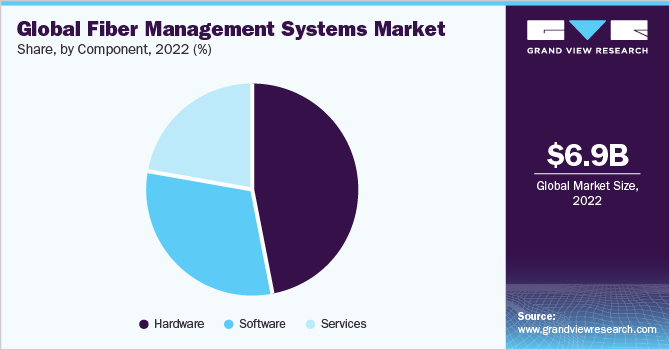

Component Insights

The hardware segment held the largest revenue share of 47.4% in 2022 and is expected to witness a CAGR of over 12.0% during the forecast period. The hardware segment is further categorized into fiber optic cassettes, cable assemblies, enclosures, fiber optic patch panels, and others (splice tray, adapter, connectors, slack spool manager, and cable accessories). Hardware components help to simplify cable management by providing a centralized location for housing and organizing cables and connectors.

This reduces the risk of cable congestion, which can cause signal loss and other performance issues. Hardware components are highly scalable and flexible, making them ideal for networks that need to grow and adapt over time. They allow network operators to easily add or remove components as needed, without disrupting the overall network infrastructure.

The software segment is anticipated to witness the fastest CAGR of 14.9% throughout the forecast period. Software plays a critical role in this market by automating tasks associated with fiber management, such as monitoring, testing, and maintenance. It also provides real-time information about the status and performance of the network, including information about individual fibers, connections, and equipment.

The software enables operators to configure, modify, and optimize the fiber network to meet changing requirements and provides a centralized platform for managing networks, allowing operators to collaborate and share information more effectively.

Cable Type Insights

The multi-mode cable type segment dominated in 2022, gaining a revenue share of 54.3%. Multimode fiber cable is a type of optic cable that has a larger core diameter than single-mode cable, typically between 50 - 62.5 microns. This larger core allows multiple modes of light to propagate through the cable, which can result in a lower maximum transmission distance and lower speeds than single-mode cable.

This cable type is generally inexpensive, offers environmental flexibility, and is easy to install. Multi-mode cables support high data rates, making them well-suited for applications that require high bandwidth, such as data centers, local area networks (LANs), and video surveillance systems. Additionally, multi-mode cables can be upgraded to support higher data rates and longer distances by using advanced transceiver technology, which can extend the lifespan of the fiber network.

The single-mode cable-type segment is expected to witness the highest growth rate of 14.1% during the forecast period. Single-mode cable is a type of fiber optic cable that has a small core diameter, typically 9 microns. This type of cable is designed to transmit a single mode of light, which enables it to carry data over longer distances and at higher speeds than multimode fiber cable.

Single-mode cables have lower attenuation (signal loss) than multi-mode cables, which enables them to transmit data over long distances without the need for signal amplification or regeneration. Moreover, single-mode cables offer a more stable and reliable transmission quality, which can improve the quality of service (QoS) for voice, video, and data applications. Lastly, single-mode cables are less susceptible to interference from external sources, such as electromagnetic interference (EMI) and radio frequency interference (RFI), which improves their reliability.

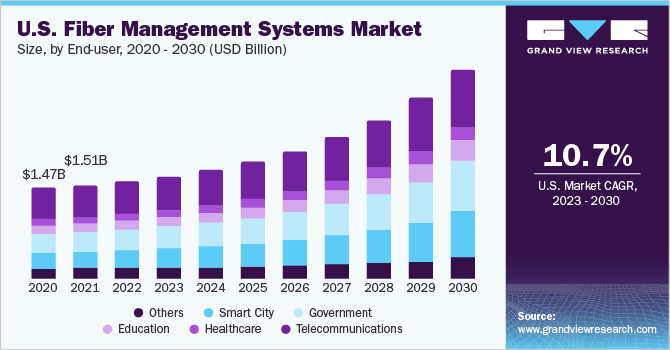

End-user Insights

The telecommunications segment held the largest revenue share of 31.3% in 2022 and grow at a CAGR of over 10.0% throughout the forecast period. Fiber management systems help to manage the physical connections of fiber-optic cables, which results in better network performance. By managing the cables properly, telecommunication companies can reduce signal loss and improve the overall reliability of their network.

These systems are highly scalable, which means that they can easily adapt to changing network requirements. As telecommunication companies expand their networks or upgrade their equipment, the management systems can be easily modified or expanded to meet their needs. Additionally, proper fiber management also helps to reduce safety hazards in the work environment, as it prevents accidental damage to cables and reduces the risk of cable-related accidents.

The smart city end-user segment is expected to witness the highest CAGR of 16.5% during the forecast period. Fiber management systems play a crucial role in the development of smart cities, as they are responsible for ensuring the efficient and effective operation of the optic infrastructure that underpins many smart city applications and services. Smart cities rely on fiber optic networks to connect the various components of their infrastructure, including sensors, cameras, and other devices that collect and transmit data.

These systems provide the necessary tools and processes to manage these networks, including the installation, configuration, monitoring, and maintenance of fiber optic cables, as well as the associated hardware and software. By implementing a management system, cities can ensure that their fiber optic networks are secure, reliable, and scalable, enabling them to support a wide range of smart city applications and services.

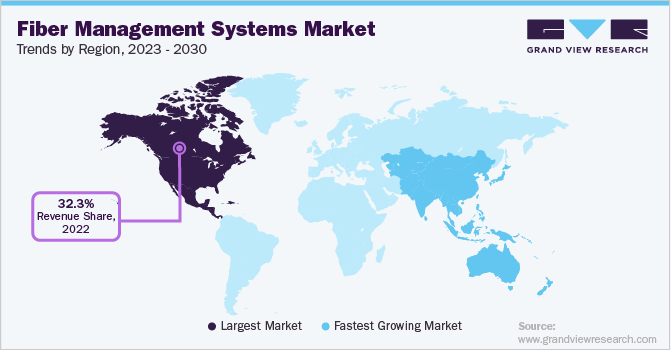

Regional Insights

North America led the overall market in 2022, with a revenue share of 32.3%. The region is equipped with well-developed infrastructure and spends large amounts on extensive research and development base, which makes the region to be the top revenue contributor in this market during the projected period. Moreover, the presence of small and medium players in North America, which offer components and services to the giants such as Corning Incorporated, Panduit, Commscope, and Hubbell has also propelled the market growth.

The U.S. is expected to retain its dominance over the forecast period owing to the large-scale adoption of fiber management systems as they are highly scalable, convenient, cost-effective, and efficient. As the demand for fiber optics and management systems continues to grow, the demand for fiber management systems in the U.S. is expected to increase in the forecasted period.

Asia Pacific is expected to develop considerably during the projection period and grow at a CAGR of 17.0%. Asia Pacific is poised for the fastest growth as several end-use industries in the region are adopting advanced technologies to rake in a variety of benefits, such as increasing the improved network performance offered by FMS, thereby driving the adoption of these management systems across the region.

Market players are acting in response to the present situation by instituting groundbreaking solutions in line with the changing demands of the end-use industries. The growing demand for fiber optics, FTTH, and FTTB, among others in countries, such as China and India, is particularly expected to fuel the demand for fiber management systems over the forecast period.

Key Companies & Market Share Insights

The market is consolidated and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on research and development activities to integrate advanced technologies in fiber management systems used by several industries, such as healthcare, finance, telecommunications, and government, among others has intensified the competition among these players. The major companies are also collaborating with local & regional players to gain a competitive edge over their peers and capture a significant market share. Some prominent companies in the global fiber management systems market include:

-

Corning Incorporated

-

HUBER+SUHNER

-

Panduit

-

Fujikura Ltd.

-

Commscope

-

Hubbell

-

Belden Inc.

-

Patchmanager B.V.

-

Santron Electronics,

-

RackOm System

-

Leviton Manufacturing Co., Inc.

Fiber Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7,430.17 million

Revenue forecast in 2030

USD 17,862.38 million

Growth rate

CAGR of 13.3% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, cable type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Corning Incorporated; HUBER+SUHNER; Panduit; Fujikura Ltd.; Commscope; Hubbell; Belden Inc.; Patchmanager B.V.; Santron Electronics; RackOm System; Leviton Manufacturing Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Management Systems Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fiber management systems market report based on component, cable type, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Fiber optic cassette

-

Fiber optic cable assemblies

-

Fiber optic enclosures

-

Fiber optic patch panels

-

Others

-

-

Software

-

Services

-

-

Cable Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single mode

-

Multi-mode

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecommunications

-

Healthcare

-

Education

-

Government

-

Smart City

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

United Arab Emirates

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiber management systems market size was estimated at USD 6,911.1 million in 2022 and is expected to reach USD 7,430.17 million in 2023.

b. The global fiber management systems market is expected to grow at a compound annual growth rate of 13.3% from 2023 to 2030 to reach USD 17,862.38 million by 2030.

b. North America is expected to dominate the market and grow at a CAGR of 11.6%. The North American region is equipped with well-developed infrastructure and spends a large amount on extensive research and development base, making the region the top revenue contributor in the fiber management system market during the projected period.

b. Some prominent players in the market include Corning Incorporated, HUBER+SUHNER, Panduit, Fujikura Ltd., Commscope, Hubbell, Belden Inc., Patchmanager B.V., Santron Electronics, RackOm System, Leviton Manufacturing Co., Inc., among others

b. Key factors driving the fiber management systems market growth includes the increasing demand for high-speed data transmission and the exponential growth observed in data traffic.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.