- Home

- »

- Next Generation Technologies

- »

-

Farm Equipment Rental Market Size & Share Report, 2030GVR Report cover

![Farm Equipment Rental Market Size, Share & Trends Report]()

Farm Equipment Rental Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment (Tractors, Harvesters, Balers, Sprayers, Others), By Power Output, By Drive Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-363-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Farm Equipment Rental Market Summary

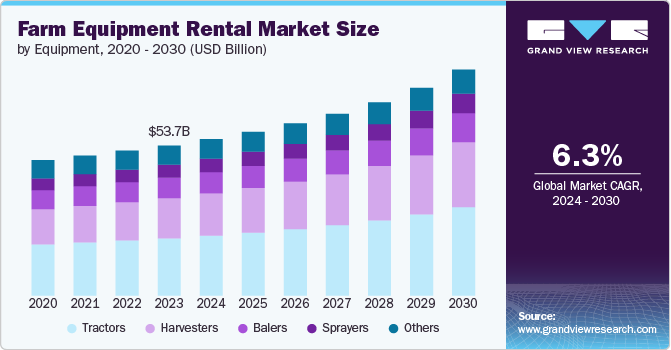

The global farm equipment rental market size was estimated at USD 53.75 billion in 2023 and is projected to reach USD 80.94 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. The market is being propelled by several influential factors that are reshaping the agricultural landscape.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, tractors accounted for a revenue of USD 53,745.9 million in 2023.

- Based on the equipment, the tractors segment led the market with the largest revenue share of 38.1% in 2023.

- Based on power output, the 41 HP to 100 HP segment led the market with the largest revenue share of 46.52% in 2023.

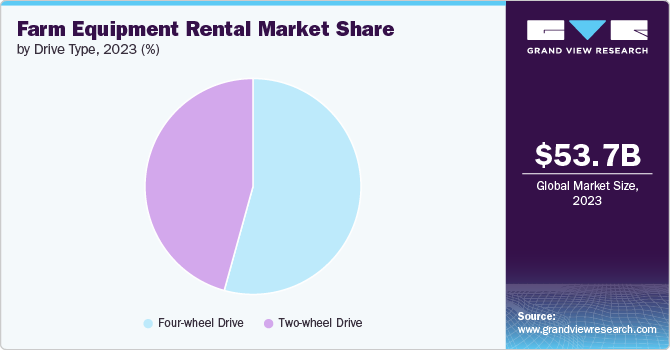

- Based on drive type, the four-wheel drive segment led the market with the largest revenue share of 54.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 53.75 Billion

- 2030 Projected Market Size: USD 80.94 Billion

- CAGR (2024-2030): 6.3%

- Asia Pacific: Largest market in 2023

One of the primary drivers is the high initial cost associated with purchasing modern farm machinery. For many farmers, particularly those with smaller operations, the significant capital investment required for equipment ownership is prohibitive.

Renting equipment offers a financially viable alternative, allowing farmers to access necessary machinery without incurring substantial debt. This economic advantage is particularly critical in regions where agricultural profit margins are thin and fluctuating market conditions can impact income stability.

The rise of agri-tech startups and digital platforms has revolutionized the way farmer’s access rental equipment. Online marketplaces and mobile applications have simplified the rental process, making it easier for farmers to find, compare, and rent machinery. These digital solutions enhance transparency, convenience, and efficiency in the rental market, attracting a broader base of users. The integration of advanced data analytics and IoT technologies in rental equipment also offers added value through real-time monitoring and improved operational management.

Technological advancements are playing a pivotal role in transforming the global market, bringing significant benefits to farmers and rental service providers alike. These innovations are not only enhancing the efficiency and productivity of farming operations but are also making the rental process more seamless and user-friendly. One of the key technological advancements is the integration of sophisticated features in modern farm machinery. Equipment available for rent now often includes advanced GPS systems, automated steering, precision planting, and harvesting technologies. These features allow for more precise and efficient farming practices, reducing waste and optimizing resource use. Farmers renting this advanced equipment can achieve higher yields and better-quality produce, thus maximizing their profitability without the need for large capital investments.

The advanced data analytics and machine learning algorithms are being utilized to enhance the effectiveness of rental services. By analyzing historical data and usage patterns, rental companies can predict demand more accurately, optimize inventory management, and offer personalized rental packages. Machine learning can also assist in predictive maintenance, identifying potential issues before they become critical, thereby reducing downtime and repair costs. These technologies enable rental companies to provide more reliable and tailored services, enhancing customer satisfaction and loyalty.

However, one of the primary restraints is the limited awareness and adoption of rental services, particularly in less developed and rural areas. Many farmers are accustomed to traditional ownership models and may not be aware of the benefits of renting equipment. In addition, there can be a reluctance to shift from established practices due to a lack of understanding of rental agreements and the perceived complexity involved. This resistance to change can slow the adoption of rental services, restricting market growth. Moreover, the logistics of delivering and maintaining rental equipment can be complex and costly, especially in regions with poor infrastructure. Transportation issues, inadequate storage facilities, and a lack of repair and maintenance services can deter both rental companies and potential customers.

Equipment Insights

Based on the equipment, the market is segmented into tractors, harvesters, balers, sprayers, and others. The tractors segment led the market with the largest revenue share of 38.1% in 2023.The tractor segment dominates the market primarily because tractors are indispensable for a variety of fundamental agricultural tasks. Tractors provide the power and versatility needed for plowing, planting, harvesting, and transporting goods, making them a cornerstone of farming operations. Their multi-functionality allows them to be used with various attachments and implements, enhancing their utility across different farming activities. Furthermore, the high initial cost of purchasing tractors and the significant maintenance expenses associated with ownership make renting an attractive option for many farmers. By renting tractors, farmers can access modern, well-maintained machinery without the financial burden of purchase and upkeep.

The harvesters segment is anticipated to grow at the fastest CAGR of 7.4% over the forecast period. There is an increasing trend towards mechanization in agriculture to improve productivity and address labor shortages. Harvesters are central to this shift, as they perform critical tasks more efficiently than manual labor. Renting harvesters provides a practical solution for farmers to mechanize operations during peak seasons when labor is scarce. In addition, harvesters use is largely confined to specific harvesting periods, making ownership less cost-effective. Renting harvesters helps farmers manage expenses by utilizing the equipment only when necessary, avoiding large upfront costs and year-round maintenance.

Power Output Insights

Based on power output, the 41 HP to 100 HP segment led the market with the largest revenue share of 46.52% in 2023. Tractors and other equipment within the 40 hp to 100 hp range are highly versatile, capable of handling a variety of tasks such as plowing, tilling, planting, and hauling. This horsepower range is suitable for a wide range of farming activities, making these machines highly desirable for diverse agricultural operations. In addition, the 40 HP to 100 HP equipment is widely available in the rental market, ensuring that farmers have ready access to these machines when needed. Rental companies often maintain a significant inventory of equipment in this range due to its high demand and broad applicability, enhancing availability and convenience for farmers.

The more than 100 HP segment is expected to register at the fastest CAGR of 7.3% over the forecast period, owing to several factors reflecting the evolving needs and dynamics of modern agriculture. Larger farming operations and commercial farms are increasingly seeking high-power machinery to handle extensive agricultural activities efficiently. Equipment with more than 100 HP is essential for tasks that require substantial power, such as deep plowing, large-scale harvesting, and heavy-duty hauling. The growing scale of agricultural operations has driven the demand for these high-capacity machines.

Drive Type Insights

Based on drive type, the market is segmented into two-wheel drive and four-wheel drive. The four-wheel drive segment led the market with the largest revenue share of 54.3% in 2023. Four-wheel drive equipment offers superior traction and stability, especially in challenging terrain and adverse weather conditions. This capability is crucial for various agricultural tasks such as field preparation, planting, and harvesting, where traction and maneuverability are essential for optimal performance. As farms expand and diversify, there is a growing need for equipment that can operate efficiently across different land types and conditions, driving the demand for 4WD machinery.

The two-wheel drive segment is anticipated to register at a significant CAGR of 5.7% over the forecast period.Two-wheel drive equipment is typically more affordable to rent compared to four-wheel drive (4WD) counterparts. This affordability makes it an attractive option for farmers, particularly those with smaller operations or limited budgets. Renting 2WD equipment allows farmers to access necessary machinery without the higher upfront costs associated with purchasing or renting more expensive 4WD machinery. In addition, two-wheel drive equipment is well-suited for lighter agricultural tasks such as mowing, spraying, and light tillage work. Many farming operations, especially in less challenging terrain, do not require the heavy-duty capabilities of 4WD machinery.

Regional Insights

The farm equipment rental market in North America is projected to grow at the fastest CAGR of 5.9% over the forecast period. The adoption of advanced technologies in agriculture, such as precision farming tools and automated machinery, is driving the demand for rental equipment in North America. Renting enables farmers to utilize the latest technological innovations without the long-term commitment of ownership. Equipment with GPS guidance, variable rate technology, and data analytics capabilities helps improve efficiency, reduce input costs, and enhance overall farm management practices.

U.S. Farm Equipment Rental Market Trends

The farm equipment market in U.S. held the largest market share of 68.5% in North America in 2023. The U.S. agricultural industry is at the forefront of adopting advanced technologies and precision farming practices. Rental equipment providers in the U.S. offer access to cutting-edge technologies such as GPS guidance systems, variable rate application tools, and automated machinery. This availability of technologically advanced equipment enhances productivity and efficiency on farms, further driving demand for rental services. In addition, The U.S. has one of the most diverse agricultural sectors, encompassing a wide range of crops, livestock, and farming practices. This diversity creates substantial demand for farm equipment across different regions and farming operations, contributing to a robust rental market.

Asia Pacific Farm Equipment Rental Market Trends

Asia Pacific dominated the farm equipment market with the revenue share of 34.22% in 2023 and is expected to continue its dominance over the forecast period. Asia Pacific is home to diverse agricultural landscapes ranging from large-scale commercial farms to smallholder operations. The region's agricultural sector encompasses a wide variety of crops and farming practices, including rice, wheat, sugarcane, fruits, and vegetables. This diversity creates a robust demand for a wide range of farm equipment, driving the rental market's growth. In addition, many countries in the Asia Pacific, particularly emerging economies such as India, Japan, and South Korea, have significant agricultural sectors that contribute significantly to their GDPs. However, access to capital for purchasing expensive farm equipment can be limited. Renting provides a cost-effective alternative for farmers to access modern machinery without the upfront investment and ongoing maintenance costs associated with ownership.

Europe Farm Equipment Rental Market Trends

The farm equipment market in Europe is anticipated to grow at the fastest CAGR over the forecast period. European Union agricultural policies and subsidies support the adoption of efficient and sustainable farming practices. Programs such as the Common Agricultural Policy (CAP) provide financial incentives for farmers to invest in modern equipment and technology. Rental services align with these policies by offering farmers access to subsidized machinery, fostering market demand for rental solutions in compliance with EU standards. In addition, Europe has stringent environmental regulations aimed at reducing emissions, conserving resources, and promoting sustainable farming practices. Rental equipment providers offer machinery that meets these regulatory standards, such as low-emission engines and precision farming technologies. Renting allows farmers to comply with regulations without investing in costly equipment upgrades, thereby supporting sustainable agriculture initiatives.

Key Farm Equipment Rental Company Insights

Some of the key companies operating in the global market include Deere & Company, CNH Industrial, among others.

-

Deere & Company is one of the leading U.S.-based companies that specializes in manufacturing agricultural machinery, drivetrains, heavy equipment, diesel engines, forestry machinery, and lawn care equipment. The company operates through four business segments, namely, production & precision farming, small agriculture & turf, construction & forestry, and financial services. The production & precision farming segment focuses on developing and manufacturing advanced agricultural machinery, including tractors, combines, harvesters, tillage equipment, soil preparation, seeding, crop care, and more with precision technologies. This segment integrates GPS, telematics, and data analytics to optimize farming operations such as planting, seeding, spraying, and harvesting. The company serves its customers in over 100 countries with administrative and sales offices in Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Mexico, Poland, Singapore, Sweden, South Africa, Spain, Ukraine, the U.K., and the U.S.

Flaman Group of Companies and Pacific AG Rentals LLC are some of the emerging market companies in the target market.

- Pacific AG Rentals LLC is an emerging player in the agricultural equipment rental market on the West Coast of the U.S., offering a diverse range of farm machinery, including tractors, harvesters, and sprayers. The company provides flexible rental terms to accommodate the seasonal nature of farming, along with maintenance and support services to ensure equipment reliability. Their focus on integrating advanced technologies supports precision agriculture practices, catering to the diverse needs of both small and large farming operations in states such as California, Oregon, and Washington

Key Farm Equipment Rental Companies:

The following are the leading companies in the farm equipment rental market. These companies collectively hold the largest market share and dictate industry trends.

- Deere & Company

- CNH Industrial

- AGCO Corporation

- Kubota Corporation

- Mahindra & Mahindra

- Flaman Group of Companies

- Pacific AG Rentals LLC

- Messick's

- CLAAS KGaA mbH

- The Papé Group, Inc.

Recent Developments

-

In February 2024, Deere & Company introduced its latest range of four-track tractors with high HP, which includes a top model boasting 830 horsepower. The 2025 lineup features new models, including the 9RX 710, the 9RX 770, and the 9RX 830, equipped with upgraded engines, hydraulic systems, and technology packages, along with updated cabs. To support farmers in preparing their equipment and farms for autonomous operations, the MY25 8 Series and 9 Series tractors will offer an autonomous-ready option. This feature enables farmers to transition to fully autonomous operation seamlessly, aligning with their farm's specific readiness

-

In July 2023, Pacific AG Rentals LLC announced a partnership with Burro, a Philadelphia-based autonomous mobility company. Through this collaboration Pacific AG Rentals LLC would add Burro's autonomous robots to their rental fleet, aiming to enhance productivity and efficiency in the agricultural sector. The partnership is expected to broaden the reach and accessibility of Pacific AG Rentals LLC across the U.S., providing farmers with innovative solutions to labor challenges

Farm Equipment Rental Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 56.02 billion

Revenue forecast in 2030

USD 80.94 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, power output, drive type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Deere & Company; CNH Industrial; AGCO Corporation; Kubota Corporation; Mahindra & Mahindra; Flaman Group of Companies; Pacific AG Rentals LLC; Messick's; CLAAS KGaA mbH; The Papé Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Farm Equipment Rental Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global farm equipment rental market report based on equipment, power output, drive type, and region.

-

Equipment Outlook (Revenue, USD Million, 2017 - 2030)

-

Tractors

-

Harvesters

-

Balers

-

Sprayers

-

Others

-

-

Power Output Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 40 HP

-

41 HP to 100 HP

-

More than 100 HP

-

-

Drive Type Output Outlook (Revenue, USD Million, 2017 - 2030)

-

Two-wheel Drive

-

Four-wheel Drive

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global farm equipment rental market size was estimated at USD 53.75 billion in 2023 and is expected to reach USD 56.02 billion in 2024.

b. The global farm equipment rental market is expected to reach USD 80.94 billion by 2030 at a compound annual growth rate of 6.3% million by 2030.

b. The four-wheel drive segment claimed the largest market share of 54.3% in 2023 in the farm equipment rental market, driven by its high performance, versatility, and ability to handle challenging terrains and heavy-duty tasks efficiently.

b. Prominent players in the farm equipment market are Deere & Company, CNH Industrial, AGCO Corporation, Kubota Corporation, Mahindra & Mahindra, Flaman Group of Companies, Pacific AG Rentals LLC, Messick's, CLAAS KGaA mbH, The Papé Group, Inc.

b. The farm equipment rental market is driven by factors such as the rising cost of purchasing new machinery, increasing demand for mechanized farming, and the need for flexibility and efficiency in agricultural operations. Additionally, government initiatives and subsidies supporting modern farming techniques further boost the farm equipment rental market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.