- Home

- »

- Advanced Interior Materials

- »

-

Failure Analysis Test Equipment For Semiconductors Market 2030GVR Report cover

![Failure Report]()

Failure Analysis Test Equipment For Semiconductors Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Scanning Electron Microscope, Transmission Electron Microscope, Focused Ion Beam System), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-548-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

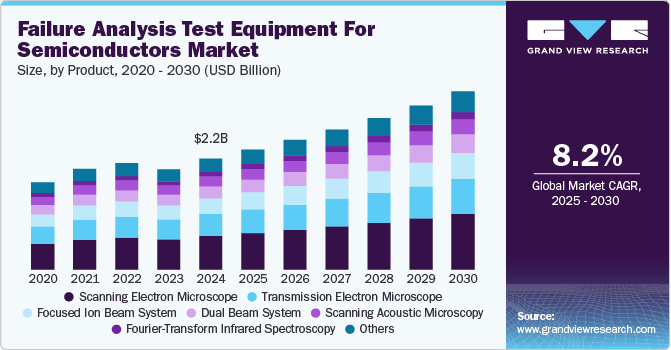

The global failure analysis test equipment for semiconductors market size was estimated at USD 2.19 billion in 2024 and is expected to grow at a CAGR of 8.2% from 2025 to 2030. This growth of the failure analysis test equipment for semiconductors industry is driven by the increasing investments in semiconductor fabrication and rising R&D expenditures aimed at enhancing chip performance and reliability.

Additionally, governments worldwide are implementing strategic initiatives to strengthen domestic semiconductor production, further fueling demand for advanced failure analysis test equipment. Additionally, governments worldwide are implementing strategic initiatives to strengthen domestic semiconductor production, further fueling demand for advanced failure analysis test equipment.

Market Concentration & Characteristics

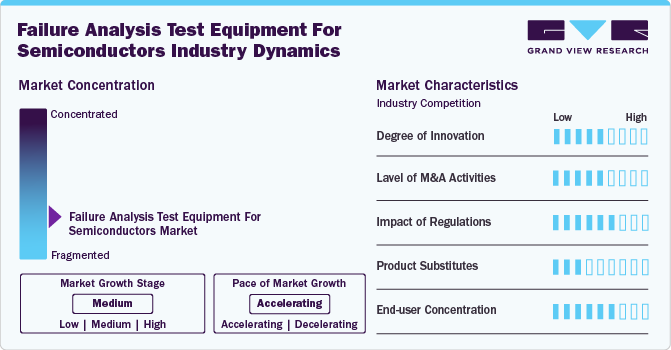

The global failure analysis test equipment for semiconductors industry is considerably fragmented characterized by a mix of large multinational companies and specialized regional players competing for market share. Key manufacturers focus on developing advanced failure analysis tools for semiconductor applications, aiming to enhance the performance and reliability of semiconductors. As the demand for high-quality and high-performance semiconductors rises, especially in industries such as consumer electronics, automotive, telecommunications, and healthcare, manufacturers are increasingly investing in sophisticated testing technologies to meet the needs for precise failure diagnostics and troubleshooting.

Innovation in the market is primarily driven by the need for enhanced efficiency, precision, and speed in failure analysis processes. With the increasing complexity of semiconductor devices, especially with the advent of 5G, AI, and Internet of Things (IoT) technologies, the demand for more advanced failure analysis test equipment, such as scanning electron microscopes (SEM), focused ion beam (FIB) systems, and X-ray inspection systems, is growing. Manufacturers are focusing on providing tools that can handle more intricate and smaller-scale components, as well as those that support rapid testing and data analysis.

Regulatory standards and industry requirements play a significant role in shaping the failure analysis test equipment for semiconductors market, as semiconductor devices are subjected to stringent quality control and safety standards, particularly in industries such as automotive and healthcare. Compliance with these standards is crucial for manufacturers to maintain their competitiveness. Furthermore, the increasing focus on reducing product defects and enhancing yield in semiconductor manufacturing processes is driving the demand for failure analysis equipment capable of identifying even the minutest defects.

The market also faces competition from alternative testing methods and technologies, which may offer cost-effective solutions or quicker turnaround times. Manufacturers must continually innovate to integrate features like automation, artificial intelligence (AI), and real-time data analytics into their failure analysis systems to stay ahead in the market. Emphasizing reliability, precision, and the ability to analyze increasingly complex semiconductor devices will be key to capturing the growing demand for advanced failure analysis test equipment

Drivers, Opportunities & Restraints

Failure analysis test equipment is key in ensuring the integrity of semiconductor devices, as it allows manufacturers to detect minute imperfections that may compromise the functionality of these chips. As the complexity of semiconductor devices increases, with advanced packaging techniques and more intricate circuitry, the role of failure analysis test equipment becomes even more vital. The rising demand shows a growing emphasis on quality control and defect detection, which has led to greater investments in advanced testing equipment and techniques.

The high costs associated with failure analysis test equipment for semiconductor manufacturing significantly restrain the growth of the market. While the initial purchase price of these advanced instruments is a major consideration, companies often overlook several hidden costs that contribute to the total cost of ownership.

As the global automotive sector shifts towards EVs, there is a marked increase in the reliance on semiconductors for various critical functions, including battery management, powertrain control, charging systems, and vehicle connectivity. As a result, manufacturers are ramping up production of semiconductor devices tailored specifically for automotive applications in response to the growing demand for EVs.

Product Insights

The Scanning Electron Microscope (SEM) segment dominated the market in 2024, accounting for 30.4% of the market share in 2024 due to governments pushing the expansion of the semiconductor industry. SEM is crucial in semiconductor failure analysis for identifying surface defects, particle contamination, and structural anomalies at the nanoscale

The Focused Ion Beam (FIB) system is a versatile tool used in semiconductor failure analysis for imaging, milling, and modifying materials at the nanoscale. FIB systems direct a focused ion beam to etch, mill, or deposit material on a sample, allowing for precise manipulation and analysis of semiconductor structures. FIB is especially useful for sample preparation, defect analysis, and conducting cross-sectional imaging of complex semiconductor devices. The FIB segment is expected to experience robust growth due to its high versatility in failure analysis and its ability to work in tandem with other technologies such as SEM and TEM.

Technology Insights

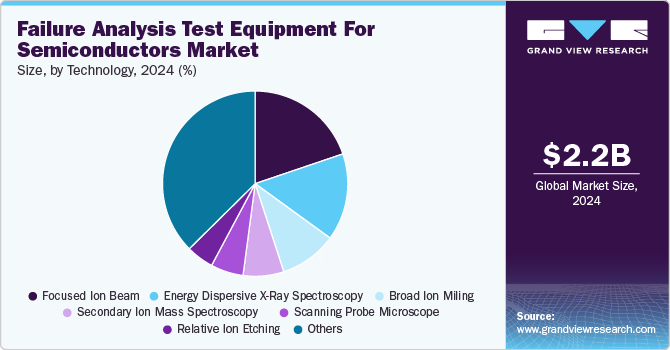

The Focused Ion Beam (FIB) segment dominated the market in 2024, accounting for a 19.8% market share, driven by its high versatility and ability to execute both imaging and sample preparation tasks. With the increasing complexity of semiconductor devices, FIB’s ability to inspect and repair structures at the nanoscale will be in high demand.

The EDX segment is expected to maintain a significant share of the failure analysis test equipment for semiconductors market due to its high resolution and effectiveness in analyzing semiconductor materials. EDX’s ability to provide rapid and accurate elemental analysis is crucial as semiconductors become more complex, with smaller nodes and advanced materials. The segment is anticipated to grow steadily over the forecast period, driven by increasing demand for precision in analyzing defects in semiconductor components and expanding use in next-generation semiconductor devices.

Regional Insights

The growth of the failure analysis test equipment market in North America is primarily driven by advancements in semiconductor technology, increased investment in R&D, and the rising demand for high-performance electronics across industries like automotive, healthcare, and telecommunications. The presence of key semiconductor manufacturers and a strong focus on innovation in regions like Silicon Valley further support market expansion.

U.S. Failure Analysis Test Equipment For Semiconductors Market Trends

The industry in the U.S. is projected to expand at a CAGR of 8.6% over the forecast period,driven by the country's leadership in semiconductor innovation, with significant investments in R&D and manufacturing facilities. The presence of major semiconductor companies and the rapid advancement of technologies such as AI, 5G, and electric vehicles increase the demand for high-quality testing solutions.

Asia Pacific Failure Analysis Test Equipment For Semiconductors Market Trends

The market in Asia Pacific dominated in terms of global revenue share, accounting for 55.8% of the market share in 2024 primarily due to the dominance of semiconductor manufacturing in countries like China, South Korea, Taiwan, and Japan. The growing electronics industry, especially in consumer electronics and mobile devices, coupled with significant investments in semiconductor production, accelerates the need for advanced testing solutions.

The failure analysis test equipment for semiconductors market in China is expected to grow at a CAGR of 9.2% over the forecast period due to the country’s strong position as the world’s largest semiconductor producer. The government's heavy investment in semiconductor manufacturing and technology development, along with the rapid expansion of industries such as consumer electronics, automotive, and telecommunications, is fueling demand for advanced failure analysis.

The failure analysis test equipment for semiconductors market in India is expected to grow at a CAGR of 9.9% over the forecast period as the country becomes a key player in semiconductor design and manufacturing. The increasing demand for consumer electronics, mobile devices, and automotive technologies, coupled with government initiatives to boost semiconductor production under the "Make in India" program, is pushing the need for more efficient testing and failure analysis solutions. The growing focus on R&D in semiconductor technology also contributes to the market's expansion.

Europe Failure Analysis Test Equipment For Semiconductors Market Trends

In Europe, failure analysis test equipment for semiconductors industry growth is fueled by the increasing adoption of IoT devices, automotive electronics, and the rise of electric vehicles, all of which require high-quality semiconductor testing. The region's emphasis on sustainable and energy-efficient technologies also drives demand for failure analysis equipment, as manufacturers need to ensure product reliability and performance.

The failure analysis test equipment for semiconductors market in Germany is projected to expand at a CAGR of 7.1% over the forecast period as it benefits from the country's strong industrial base, particularly in automotive, industrial automation, and precision engineering. As Germany pushes forward with Industry 4.0 and the integration of more advanced electronics in manufacturing, there is an increasing need for high-quality semiconductors, driving demand for failure analysis testing..

The Spain failure analysis test equipment for semiconductors market is projected to expand at a CAGR of 6.3% over the forecast period as the country strengthens its position in the European semiconductor ecosystem. While Spain's semiconductor manufacturing base is smaller compared to other European countries, there is a rising demand for testing solutions driven by sectors such as automotive, telecommunications, and renewable energy.

Latin America Failure Analysis Test Equipment for Semiconductors Market Trends

In Latin America, the growth of the failure analysis test equipment industry is driven by the increasing penetration of electronics and the rising demand for quality control in semiconductor manufacturing. While the market is still developing, growing industrialization and the expansion of tech infrastructure are likely to boost demand for failure analysis solutions in the region.

The failure analysis test equipment for semiconductors market in Brazil is projected to expand at a CAGR of 6.6% over the forecast period as the country’s electronics and telecommunications sectors expand. While Brazil’s semiconductor manufacturing capabilities are still emerging, the increasing demand for consumer electronics, automotive applications, and industrial equipment is driving the need for high-quality failure analysis tools.

Middle East & Africa Failure Analysis Test Equipment for Semiconductors Market Trends

In the Middle East and Africa, the semiconductor market is expanding, supported by rising technological infrastructure investments and growing sectors like automotive and telecommunications. Though the market is in the early stages of development, increased government support for tech innovation and partnerships with global semiconductor players are likely to drive the adoption of failure analysis test equipment.

The Saudi Arabia failure analysis test equipment for semiconductors marketis projected to expand at a CAGR of 6.9% over the forecast period due to the country's diversification efforts under its Vision 2030 plan, which includes a focus on high-tech industries like electronics, automotive, and renewable energy. As Saudi Arabia looks to develop its semiconductor capabilities and reduce dependence on imports, the demand for failure analysis equipment is rising to ensure the quality and reliability of locally produced semiconductors.

Key Failure Analysis Test Equipment for Semiconductors Company Insights

Some of the key players operating in the market include HORIBA, Ltdand Emerson Electric Co.

-

Hitachi High-Technologies Corporation is a global company in high-tech solutions, offering advanced products and services across various sectors, including semiconductor manufacturing, healthcare, industrial equipment, and analytical instruments.

-

Thermo Fisher Scientific Inc. is the global leader in serving science, providing innovative solutions to customers across various sectors, including pharmaceutical and biotech companies, hospitals and clinical diagnostic labs, universities, research institutions, government agencies, and industries involved in environmental, industrial, research and development, and quality control.

Key Failure Analysis Test Equipment For Semiconductors Companies:

The following are the leading companies in the failure analysis test equipment for semiconductors market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Hitachi High-Technologies Corporation

- Carl Zeiss AG

- Oxford Instruments

- HORIBA, Ltd.

- Bruker

- Jeol Ltd.

- Tescan Orsay Holding

- Imina Technologies SA.

- Leica Microsystems

- TED PELLA Inc

Recent Developments

-

In October 2024, TESCAN GROUP unveiled three advanced systems: SOLARIS X 2, SOLARIS 2, and AMBER X 2. These innovative systems are specifically developed to address the increasing demands of semiconductor failure analysis, offering enhanced precision, automation, and efficiency for technology nodes at sub-10 nm and beyond.

-

In August 2024, Oxford Instruments plc, a leading provider of high-tech products and services for industry and scientific research, completed the acquisition of FemtoTools AG, Switzerland. The company will now be part of Oxford Instruments' Imaging & Analysis division, where its products will complement the Group’s existing range of materials analysis tools, including electron microscope micro-analyzers and Raman microscopes

Failure Analysis Test Equipment for Semiconductors Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2.36 billion

Revenue forecast in 2030

USD 3.51 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Taiwan; Brazil; Argentina; Israel; Saudi Arabia; UAE

Key companies profiled

Thermo Fisher Scientific Inc.; Hitachi High-Technologies Corporation; Carl Zeiss AG; Oxford Instruments; HORIBA, Ltd.; Bruker; Jeol Ltd.; Tescan Orsay Holding; Imina Technologies SA.; Leica Microsystems; TED PELLA Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Failure Analysis Test Equipment For Semiconductors Market Report Segmentation

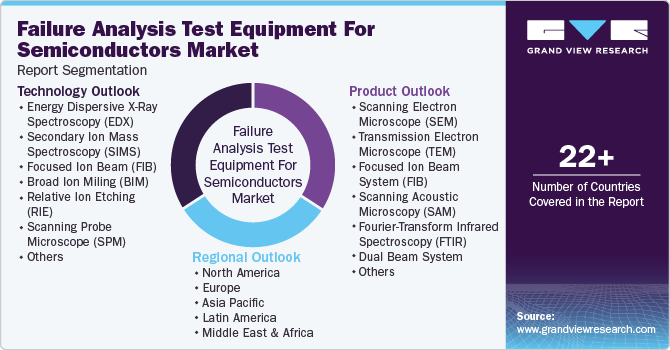

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global failure analysis test equipment for semiconductors market based on product, technology, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Scanning Electron Microscope (SEM)

-

Transmission Electron Microscope (TEM)

-

Focused Ion Beam System (FIB)

-

Scanning Acoustic Microscopy (SAM)

-

Fourier-Transform Infrared Spectroscopy (FTIR)

-

Dual Beam System

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Dispersive X-Ray Spectroscopy (EDX)

-

Secondary Ion Mass Spectroscopy (SIMS)

-

Focused Ion Beam (FIB)

-

Broad Ion Miling (BIM)

-

Relative Ion Etching (RIE)

-

Scanning Probe Microscope (SPM)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Israel

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global failure analysis test equipment for semiconductors market size was estimated at USD 2.19 billion in 2024 and is expected to reach USD 2.36 billion in 2025.

b. The global failure analysis test equipment for semiconductors market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 3.51 billion by 2030.

b. The market in Asia Pacific dominated the market in 2024, accounted for 55.8% of the global revenue share of the region's dominance in semiconductor manufacturing, particularly in countries like China, South Korea, Taiwan, and Japan. The rapid growth of industries such as consumer electronics, mobile devices, and automotive technology is driving a need for advanced testing solutions.

b. Some of the key players operating in the Failure Analysis Test Equipment for Semiconductors Market are Thermo Fisher Scientific Inc., Hitachi High-Technologies Corporation, Carl Zeiss AG, Oxford Instruments, HORIBA, Ltd., Bruker, Jeol Ltd., Tescan Orsay Holding, Imina Technologies SA., Leica Microsystems, TED PELLA Inc.

b. Key factors driving the failure analysis test equipment market for semiconductors include the increasing demand for advanced electronics, high-performance semiconductors, and technological advancements in R&D. Additionally, the push for improved product reliability and quality control across industries like automotive, telecommunications, and consumer electronics is fueling growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.