- Home

- »

- Advanced Interior Materials

- »

-

Failure Analysis Test Equipment Market Size Report, 2033GVR Report cover

![Failure Report]()

Failure Analysis Test Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Scanning Electron Microscope (SEM), Transmission Electron Microscope (TEM), Focused Ion Beam System), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-440-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Failure Analysis Test Equipment Market Summary

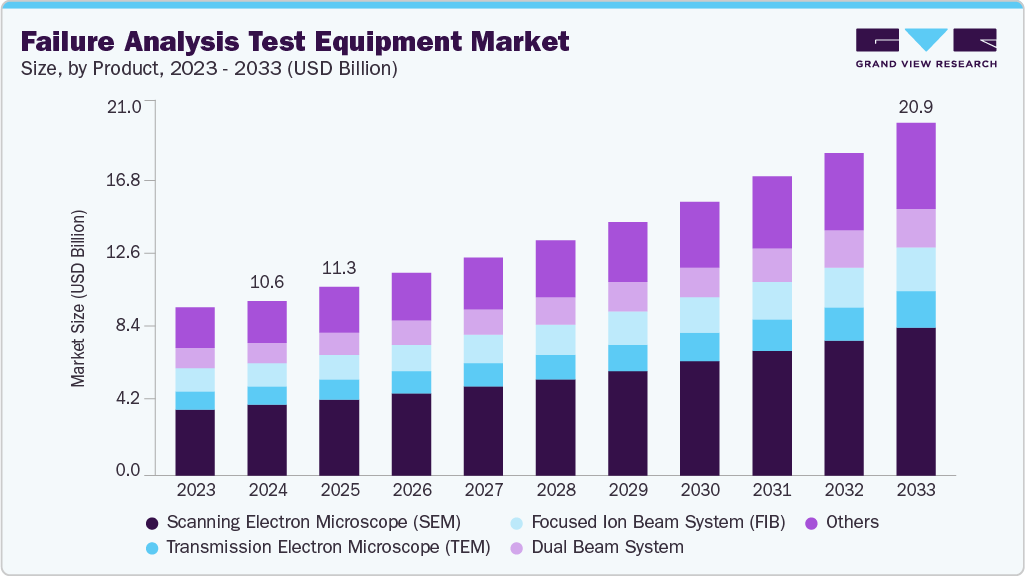

The global failure analysis test equipment market size was estimated at USD 10.6 billion in 2024 and is projected to reach USD 20.9 billion by 2033, growing at a CAGR of 8.0% from 2025 to 2033. A major factor driving market growth is the increasing complexity of electronic devices and systems.

Key Market Trends & Insights

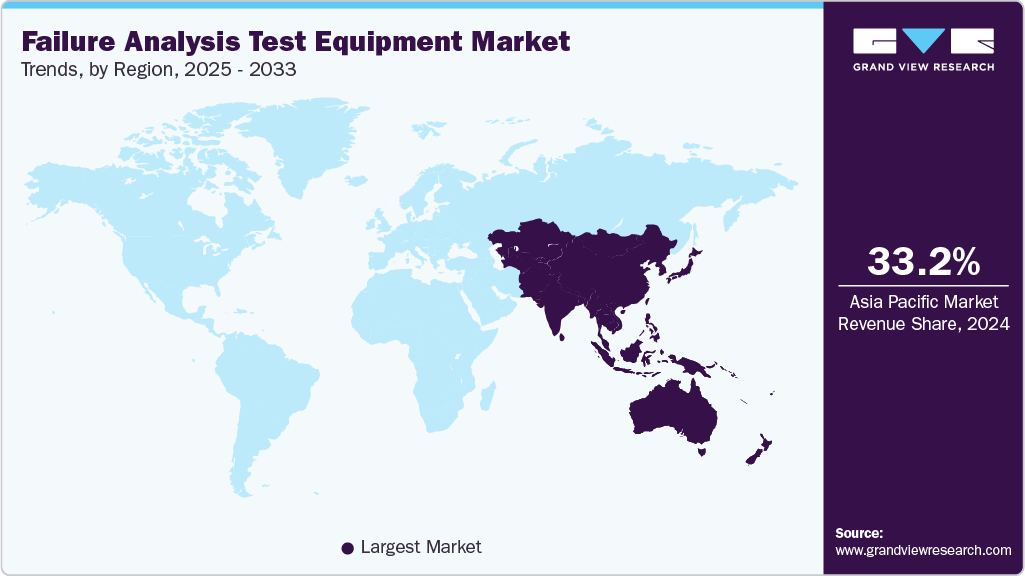

- Asia Pacific dominated the failure analysis test equipment market with the largest revenue share of 33.2% in 2024.

- The failure analysis test equipment market in the U.S. is expected to grow significantly.

- By product, Scanning Electron Microscope (SEM) segment is expected to grow at a considerable CAGR of 8.6% from 2025 to 2033 in terms of revenue.

- By technology, Scanning Probe Microscope (SPM) segment is expected to grow at a considerable CAGR of 9.1% from 2025 to 2033 in terms of revenue.

- By application, the manufacturing segment is expected to grow at a considerable CAGR of 8.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 10.6 Billion

- 2033 Projected Market Size: USD 20.9 Billion

- CAGR (2025-2033): 8.0%

- Asia Pacific: Largest market in 2024

As technology advances, electronics become more intricate, necessitating sophisticated failure analysis tools to diagnose and troubleshoot issues. This complexity drives demand for advanced test equipment capable of identifying and analyzing subtle defects in highly integrated circuits and components.

The rising emphasis on quality control and reliability in manufacturing. Industries such as manufacturing, aerospace, and consumer electronics are focusing on improving product reliability and performance to meet stringent quality standards and consumer expectations. Failure analysis test equipment plays a crucial role in ensuring that products meet these high standards by detecting and addressing potential issues early in the production process.

Market Concentration & Characteristics

The failure analysis test equipment market is moderately fragmented, with a mix of global and regional players competing across various segments such as semiconductors, electronics, aerospace, and automotive. While a few large companies hold significant market share due to their technological capabilities and strong distribution networks, many smaller firms also operate successfully by offering specialized or cost-effective solutions. This competitive landscape promotes innovation and price competitiveness but also leads to varied product quality and service levels.

The failure analysis test equipment market illustrates a high degree of innovation, driven by rapid technological advancements in electronics, semiconductors, and materials science. Companies invest heavily in R&D to enhance precision, automation, and integration with AI and machine learning for predictive analysis. Innovations like non-destructive testing, advanced microscopy, and real-time monitoring tools are improving reliability, enabling faster failure detection, and supporting complex applications across high-tech industries.

Merger and acquisition activities in the failure analysis test equipment market are gaining momentum as companies seek to expand their technological capabilities and global reach. Leading players acquire specialized firms to integrate new testing technologies, strengthen portfolios, and access niche markets. These strategic moves also help consolidate market positions, reduce competition, and streamline supply chains. M&A is particularly active among semiconductor testing and materials analysis firms looking to scale innovation.

Regulations significantly influence the failure analysis test equipment market, especially in sectors like defense, manufacturing, and electronics, where safety and quality standards are stringent. Compliance with ISO, ASTM, and industry-specific protocols drives demand for advanced testing equipment capable of precise and traceable analysis. Environmental and sustainability regulations also push manufacturers to adopt eco-friendly testing processes. Regulatory oversight ensures consistent product reliability, encouraging continuous improvement and the adoption of more sophisticated failure analysis technologies.

Drivers, Opportunities & Restraints

The growing adoption of advanced technologies such as 5G, the Internet of Things (IoT), and artificial intelligence (AI) also fuels market growth. These technologies require highly reliable components and systems, leading to an increased need for failure analysis to maintain performance and reliability. As these technologies become more prevalent, the demand for sophisticated failure analysis equipment to support their development and deployment continues to rise.

A significant restraint is the high cost of advanced failure analysis equipment. The sophisticated technology and precision required for these tools often result in substantial investment, which can be prohibitive for smaller companies or startups. This financial barrier may limit the adoption of advanced failure analysis solutions among businesses with constrained budgets.

Despite these challenges, the market presents numerous opportunities for growth. The increasing focus on miniaturization and higher performance in electronic devices opens up opportunities for advanced failure analysis tools. As devices become smaller and more complex, the need for precise and reliable analysis to ensure functionality and reliability grows, driving demand for innovative testing solutions.

Product Insights

Scanning Electron Microscope (SEM) dominated the market in 2024, accounting for the highest revenue share at 40.1% due to its extensive applications in material science, biology, and semiconductor industries. SEM's ability to provide high-resolution imaging and detailed surface characterization makes it indispensable for researchers and manufacturers seeking to understand material properties and detect defects. The increasing demand for high-quality imaging and analysis across various scientific and industrial fields propels the adoption of SEM technology.

The Transmission Electron Microscope (TEM) segment is expected to grow at a considerable CAGR of 7.8% from 2025 to 2033 in terms of revenue, due to increasing demand for high-resolution imaging in semiconductor and electronics industries. TEMs are essential for detecting nanoscale defects and material inconsistencies, making them critical for ensuring quality and reliability in advanced components. As semiconductor devices become smaller and more complex, the need for precise failure analysis tools such as TEMs is rising, particularly in research, manufacturing, and quality control applications across global markets

Technology Insights

Energy Dispersive X-Ray Spectroscopy (EDX) segment dominated the market in 2024, accounting for the highest revenue share at 29.5% due to its complementary role in elemental analysis. EDX is often used in conjunction with other microscopy techniques to provide quantitative analysis of the elemental composition of materials. As industries such as electronics and materials science continue to prioritize detailed elemental analysis for quality control and research, the demand for EDX technology remains strong.

The Scanning Probe Microscope (SPM) segment is expected to grow at a considerable CAGR of 9.1% from 2025 to 2033 in terms of revenue, due to its ability to provide high-resolution surface imaging at the atomic level. SPM techniques, such as Atomic Force Microscopy (AFM), are increasingly used in materials science, biology, and nanotechnology to explore surface topography and mechanical properties. The demand for advanced surface characterization in research and industrial applications fuels the growth of the SPM market.

Application Insights

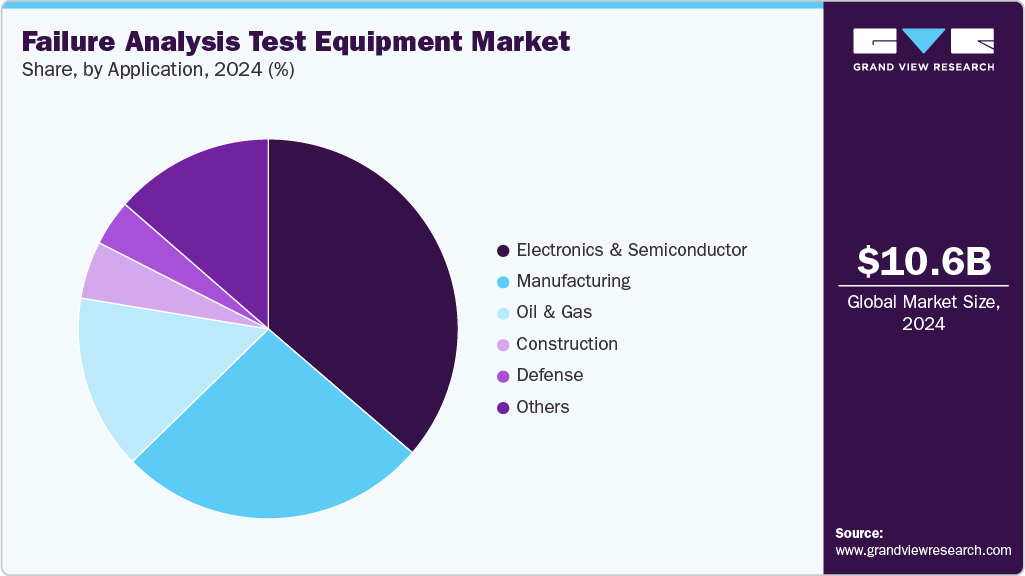

The electronics & semiconductor segment dominated the failure analysis test equipment market in 2024, holding the largest revenue share at 36.3% due to its constant innovation and the demand for high-performance components, the electronics & semiconductor industry is a significant driver for the market. As electronic devices become more complex, the need for advanced failure analysis to ensure device reliability and performance intensifies. The ongoing advancements in semiconductor technology and the push for miniaturization and higher functionality in electronic devices fuel the growth of testing and analysis solutions tailored to this sector.

The manufacturing segment is expected to grow at a considerable CAGR of 8.7% from 2025 to 2033 in terms of revenue. In the manufacturing sector, the increasing complexity of products and the need for rigorous quality control drive the adoption of failure analysis tools. Manufacturing processes are becoming more sophisticated, requiring precise analysis to ensure product reliability and performance. The need for advanced testing and diagnostic tools to address manufacturing challenges contributes to the growth of failure analysis equipment in this sector.

Regional Insights

North America failure analysis test equipment market is expected to grow at 7.5% CAGR during the forecast period fueled by advancements in semiconductors, aerospace, and defense technologies. High R&D spending, the presence of major tech companies, and increased demand for high-performance electronics are driving adoption of advanced testing tools. The region's focus on innovation, product reliability, and quality control continues to boost demand for failure analysis systems across manufacturing and research institutions.

U.S. Failure Analysis Test Equipment Market Trends

The failure analysis test equipment market in the U.S. is expected to grow significantly due to its dominance in semiconductor design, electronics manufacturing, and technological R&D. With increased demand for precise diagnostics in fields like AI, defense, and automotive, U.S. companies are investing in sophisticated testing systems. Supportive government initiatives and private sector innovation are driving widespread adoption of failure analysis tools to ensure product quality, reliability, and competitiveness.

Mexico’s failure analysis test equipment market is driven by its expanding electronics manufacturing base and integration into global supply chains. As more companies establish production facilities in Mexico, the need for quality assurance and failure diagnostics is rising. Supportive trade policies, skilled labor, and growing demand for export-quality products are encouraging greater adoption of advanced testing equipment, particularly in automotive, aerospace, and consumer electronics sectors.

Asia Pacific Failure Analysis Test Equipment Market Trends

Asia Pacific dominated the failure analysis test equipment market over the forecast period, accounting for 33.2% of the market in 2024. Rapid industrialization and technological advancement are key drivers of market growth. The region is home to some of the world’s largest electronics and semiconductor manufacturing hubs, such as China, Japan, and South Korea. The increasing complexity and miniaturization of electronic components in these countries drive demand for advanced failure analysis tools to ensure product reliability and performance.

China leads the Asia Pacific failure analysis test equipment marketdriven by rapid advancements in its semiconductor, electronics, and high-tech manufacturing sectors. As the country pushes for self-reliance in chip production and industrial innovation, demand for advanced diagnostic tools such as electron microscopes and other failure analysis systems is increasing. Supportive government policies, rising R&D investments, and expanding production facilities further boost market growth across both domestic and global supply chains.

India is growing rapidly in the failure analysis test equipment market is fueled by the expansion of its electronics manufacturing and semiconductor sectors. As the country strengthens its domestic chip design and production capabilities, the need for advanced testing and diagnostic tools is rising. Government initiatives promoting local manufacturing, along with increased focus on quality control and R&D, are driving adoption of failure analysis technologies across industries such as defense, and consumer electronics.

Europe Failure Analysis Test Equipment Market Trends

Europe is witnessing strong growth in the failure analysis test equipment market driven by high standards in automotive, aerospace, and semiconductor industries. The region is seeing increased adoption of advanced diagnostic tools to meet growing demands for reliability and safety, especially in electric vehicles and industrial electronics. Strong investment in R&D, along with sustainability goals and regulatory compliance, is supporting market growth across major economies including Germany, France, and the UK.

Germany’s failure analysis test equipment market is growing rapidly due to its strong presence in automotive, engineering, and high-tech manufacturing. As the country advances Industry 4.0 initiatives and smart production systems, the need for precision failure detection tools is rising. Strong collaboration between industrial firms and research institutions, along with demand for quality control in export-driven sectors, is driving adoption of advanced microscopes and analytical instruments across the country.

UK’s failure analysis test equipment market is supported by increasing demand in sectors like electronics, automotive, aerospace, and telecommunications. Investment in research and innovation, especially in areas like nanotechnology and 5G infrastructure, is driving the use of advanced testing solutions. Government support for science and technology, along with industry focus on quality assurance, is further fueling adoption of modern failure analysis systems.

Middle East & Africa Failure Analysis Test Equipment Market Trends

Middle East & Africa failure analysis test equipment market is fueled by ongoing industrialization and increasing focus on quality control in manufacturing and research. Key sectors like electronics, telecommunications, and materials science are adopting advanced diagnostic tools. As infrastructure and technology investments rise, the demand for high-precision failure analysis systems is expected to grow across both public and private sector industries.

Saudi Arabia is one of the fastest-growing markets in the region for failure analysis test equipment. The country’s focus on diversifying its economy through technology and industrial development is driving demand for advanced diagnostic tools. Growth in sectors such as electronics, automotive, and aerospace, along with government-backed manufacturing initiatives, is encouraging the adoption of high-resolution testing equipment like electron microscopes to ensure product reliability and meet global quality standards.

Latin America Failure Analysis Test Equipment Market Trends

Latin America’s failure analysis test equipment market is gradually expanding, driven by rising demand for quality control in electronics, telecommunications, and industrial manufacturing. As the region strengthens its production and technology infrastructure, companies are increasingly investing in advanced diagnostic tools to ensure product reliability.

Brazil is emerging as Latin America’s fastest-growing market for failure analysis test equipment. With its expanding electronics and semiconductor industries, the country is seeing increased adoption of technologies such as scanning electron microscopes and other precision tools. A growing focus on quality standards, improved manufacturing capabilities, and government support for industrial development are driving demand.

Key Failure Analysis Test Equipment Company Insights

Some of the key players operating in the market include Thermo Fisher Scientific Inc., Stress Engineering Services, Inc., Hitachi High-Technologies Corporation

-

Thermo Fisher Scientific Inc. is a U.S.-based company that develops and manufactures scientific instrumentation, reagents, consumables, and software services. It serves industries including healthcare, life sciences, and materials science. The company offers a wide range of products used in research, diagnostics, and industrial applications. Its portfolio includes electron microscopes, spectrometry systems, and laboratory equipment used for analysis, testing, and failure investigation in both academic and commercial environments.

-

Hitachi High-Technologies Corporation, headquartered in Japan, focuses on manufacturing and supplying advanced scientific instruments and industrial systems. The company provides products such as electron microscopes, analytical instruments, and semiconductor manufacturing equipment. It serves sectors including electronics, automotive, and healthcare.

Key Failure Analysis Test Equipment Companies:

The following are the leading companies in the failure analysis test equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Stress Engineering Services, Inc

- Hitachi High-Technologies Corporation

- CARL Zeiss SMT GmbH

- Leica Microsystems

- HORIBA, Ltd.

- Oxford Instruments

- Bruker

- Tescan Orsay Holding

- A&D Company Ltd.

- Motion X Corp.

- Jeol Ltd.

- Imina Technologies SA.

- Veeco Instruments

- Rigaku Corporation

Recent Developments

-

In July 2025, Thermo Fisher announced the launch of its Scios 3 and Talos 12 electron microscopes. These advanced tools are designed to enhance high-resolution imaging and materials analysis, supporting applications in research, failure analysis, and nanotechnology.

-

In January 2024, HORIBA, Ltd. introduced the AP-380 series of analyzers to address various Focused Ion Beam (FIB) quality monitoring requirements. With globally optimized software and a modular, eco-friendly design, the AP-380 series broadens its scope beyond the regulatory applications of the AP-370 series, catering to a wider range of industries.

Failure Analysis Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.3 billion

Revenue forecast in 2033

USD 20.9 billion

Growth rate

CAGR of 8.0% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Thermo Fisher Scientific Inc.; Stress Engineering Services, Inc; Hitachi High-Technologies Corporation; CARL Zeiss SMT GmbH; Leica Microsystems; HORIBA, Ltd.; Oxford Instruments; Bruker; Tescan Orsay Holding; A&D Company Ltd.; Motion X Corp.; Jeol Ltd.; Imina Technologies SA; Veeco Instruments; Rigaku Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Failure Analysis Test Equipment Market Report Segmentation

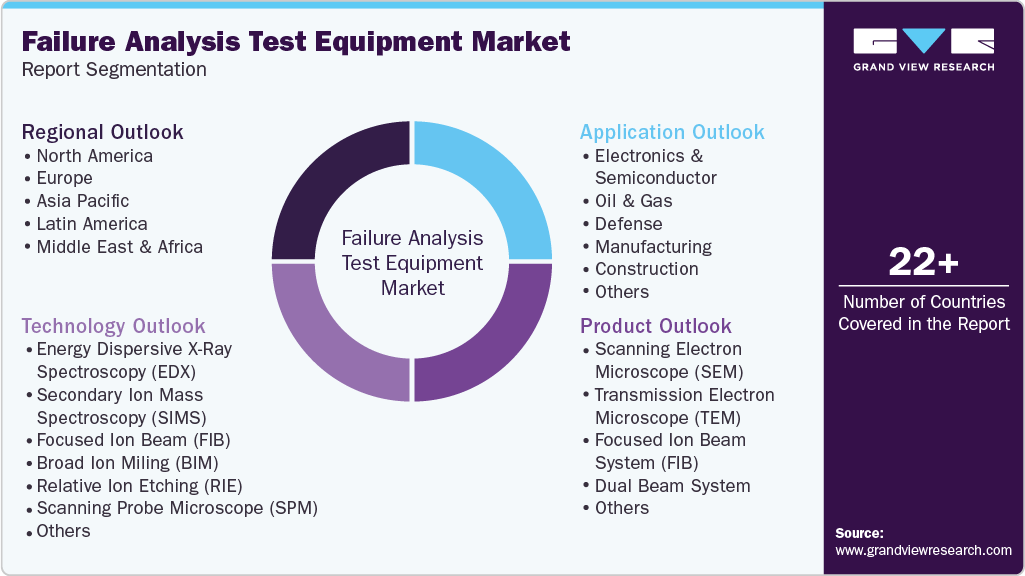

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global failure analysis test equipment market report based on type, automation, application, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Scanning Electron Microscope (SEM)

-

Transmission Electron Microscope (TEM)

-

Focused Ion Beam System (FIB)

-

Dual Beam System

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Energy Dispersive X-Ray Spectroscopy (EDX)

-

Secondary Ion Mass Spectroscopy (SIMS)

-

Focused Ion Beam (FIB)

-

Broad Ion Miling (BIM)

-

Relative Ion Etching (RIE)

-

Scanning Probe Microscope (SPM)

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Electronics & Semiconductor

-

Oil & Gas

-

Defense

-

Manufacturing

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global failure analysis test equipment market size was estimated at USD 10.6 billion in 2024 and is expected to be USD 11.3 billion in 2025.

b. The global failure analysis test equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.0% from 2025 to 2033 to reach USD 20.9 billion by 2033.

b. Scanning Electron Microscope (SEM) dominated the market in 2024, accounting for the highest revenue share at 40.1% due to its extensive applications in material science, biology, and semiconductor industries. SEM's ability to provide high-resolution imaging and detailed surface characterization makes it indispensable for researchers and manufacturers seeking to understand material properties and detect defects. The increasing demand for high-quality imaging and analysis across various scientific and industrial fields propels the adoption of SEM technology.

b. Some of the key players operating in the global failure analysis test equipment market include Thermo Fisher Scientific Inc., Stress Engineering Services, Inc, Hitachi High-Technologies Corporation, CARL Zeiss SMT GmbH, Leica Microsystems, HORIBA, Ltd., Oxford Instruments, Bruker, Tescan Orsay Holding, A&D Company Ltd., Motion X Corp., Jeol Ltd., Imina Technologies SA, Veeco Instruments, Rigaku Corporation.

b. Key factors driving the global failure analysis test equipment market include increasing demand for high-quality electronics, rising semiconductor manufacturing, and the need for advanced materials testing. Growth in industries like manufacturing, defense, and electronics & semiconductor boosts the requirement for precise failure detection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.