Failure Analysis Market Size, Share & Trends Analysis Report By Equipment (Optical Microscope, SEM, TEM, FIB, FIB-SEM, Scanning Probe Microscope), By Technology (EDX, SIMS, FIB, RIE, SPM), By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-357-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Failure Analysis Market Size & Trends

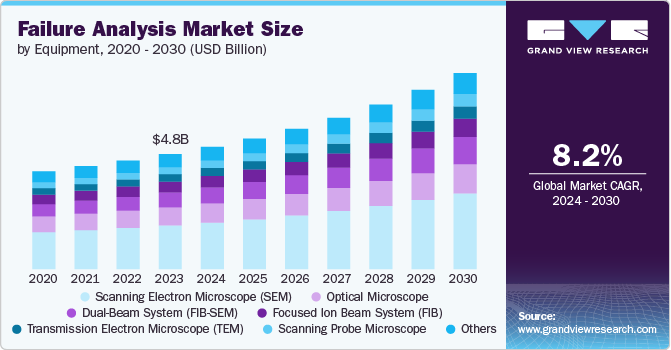

The global failure analysis market size was estimated at USD 4.77 billion in 2023 and is expected to grow at a CAGR of 8.2% from 2024 to 2030. Failure analysis, focuses on identifying the causes of failures in materials, components, and systems, is experiencing significant growth due to increasing demand for high-quality and reliable products across various industries. Market trends indicate a surge in the adoption of advanced analytical techniques and tools, such as scanning electron microscopy (SEM), transmission electron microscopy (TEM), and focused ion beam (FIB) systems, driven by technological advancements and the need for precision in analysis.

The failure analysis market growth is driven by the rising complexity of electronic components and the critical need for failure analysis in sectors such as automotive, aerospace, electronics, and semiconductor manufacturing. The rapid pace of innovation in these industries necessitates stringent quality control measures and thorough investigation of failures to enhance product reliability and longevity. Additionally, the growing emphasis on regulatory compliance and safety standards further propels the demand for comprehensive failure analysis services.

The rise of Industry 4.0 and the digital transformation of manufacturing processes are further fueling the market growth. Smart factories equipped with sensors and automated systems generate vast amounts of data, which can be analyzed to predict and prevent failures before they occur. This predictive maintenance approach not only enhances operational efficiency but also reduces downtime and maintenance costs. The increasing focus on sustainability and environmental impact is also influencing the market. Companies are investing in failure analysis to improve the durability and lifespan of their products, thereby reducing waste and promoting sustainable practices. This trend is particularly evident in the renewable energy sector, where the reliability of wind turbines, solar panels, and energy storage systems is critical to achieving long-term sustainability goals.

Increasing integration of artificial intelligence (AI) and machine learning (ML) in analytical processes are some of the market opportunities which is expected to drive the market growth during the forecast period. These technologies offer enhanced data analysis capabilities, predictive maintenance solutions, and improved diagnostic accuracy, thereby expanding the scope and efficiency of failure analysis. Furthermore, the expanding applications of failure analysis in emerging fields such as renewable energy, medical devices, and nanotechnology present lucrative prospects for market players. As industries continue to prioritize innovation and reliability, the market for failure analysis is poised for sustained growth and development.

Equipment Insights

The scanning electron microscope (SEM) segment dominated the market in 2023 and accounted for a more than 38% share of global revenue. The Scanning Electron Microscope (SEM) dominates the equipment segment due to its unparalleled ability to provide detailed, high-resolution images of sample surfaces. SEMs are extensively used in various industries, including electronics, semiconductor, materials science, and metallurgy, because they can magnify objects up to two million times, revealing minute details critical for failure analysis. Their advanced imaging capabilities help identify defects, contaminants, and microstructural anomalies that could lead to product failures.

The dominance of SEMs is also attributed to their versatility in handling different sample types and sizes, making them indispensable tools in both research and industrial applications. The continuous advancements in SEM technology, such as enhanced imaging modes and automation, further solidify their market position by improving accuracy and efficiency in failure analysis processes. Moreover, the growing demand for miniaturized electronic components and the need for precise quality control in manufacturing processes drive the adoption of SEMs. These microscopes not only help in identifying and characterizing failures but also play a crucial role in the development of more reliable and robust products.

The Dual-Beam System (FIB-SEM) segment is projected to witness significant growth from 2024 to 2030. The Dual-Beam System, combining Focused Ion Beam (FIB) and Scanning Electron Microscope (SEM), represents the fastest-growing segment. This rapid growth is driven by the system's dual functionality, which allows for both imaging and material modification or removal at a micro and nano-scale. The FIB-SEM systems are particularly valuable in the semiconductor industry, where precise failure analysis and defect characterization are crucial for device reliability and performance. Their ability to prepare ultra-thin samples for Transmission Electron Microscopy (TEM) analysis is a significant advantage, enabling detailed internal examination of complex structures.

Additionally, the integration of FIB and SEM in a single instrument enhances workflow efficiency, reduces analysis time, and increases throughput, making it an attractive option for labs and manufacturing facilities aiming to optimize their failure analysis processes. The growing complexity of modern electronic devices, along with the need for advanced materials research, further fuels the adoption of FIB-SEM systems, positioning them as essential tools in cutting-edge failure analysis applications.

Technology Insights

The Energy Dispersive X-Ray Spectroscopy (EDX) segment dominated the market in 2023. EDX is the dominant technology in the failure analysis market, owing to its capability to provide elemental composition information with high precision. EDX is frequently coupled with SEMs to enhance their analytical power, allowing researchers and engineers to identify the chemical composition of microscopic areas with great accuracy. This combination is particularly beneficial in the semiconductor and electronics industries, where understanding material composition at micro and nano levels is critical for diagnosing failures.

Energy dispersive X-Ray spectroscopyis widely appreciated for its speed, non-destructive nature, and the ability to analyze a wide range of materials, from metals to ceramics to biological samples. The dominance of EDX technology is further reinforced by ongoing improvements in detector sensitivity and resolution, making it an indispensable tool for failure analysis across various verticals. Its application extends to quality control, contamination analysis, and the development of new materials, thereby keeping its dominant position as the leading technology in the market.

The scanning probe microscope (SPM) is the fastest-growing technology segment, due to its versatility and the high-resolution topographical data it provides. SPM encompasses various techniques, including Atomic Force Microscopy (AFM) and Scanning Tunneling Microscopy (STM), which are crucial for analyzing surface properties at the atomic level. The growing demand for advanced materials and nanotechnology research propels the adoption of SPMs, as these tools can measure mechanical, electrical, and thermal properties with exceptional accuracy.

The electronics and semiconductor industries, in particular, benefit from SPM's ability to detect nanoscale defects and variations that can lead to device failures. Moreover, advancements in SPM technology, such as faster scanning speeds, improved accuracy, and the integration of multiple measurement modes, enhance their applicability and efficiency. The trend towards miniaturization and the need for detailed surface characterization in various scientific and industrial applications drive the rapid growth of the SPM market segment.

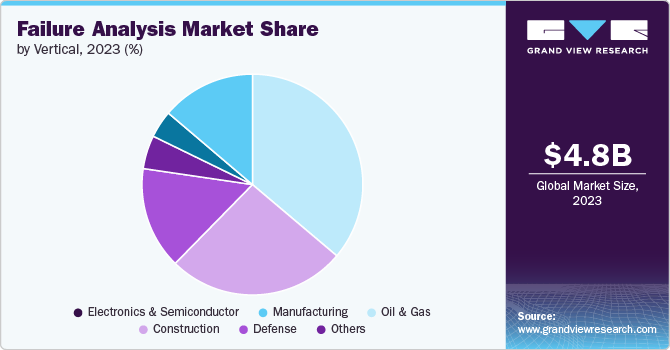

Vertical Insights

The electronics and semiconductor segment dominated the market in 2023. The electronics and semiconductor sector dominates the vertical segment, driven by the critical need for reliability and performance in electronic devices. This sector demands rigorous failure analysis due to the complexity and miniaturization of semiconductor components, where even minor defects can lead to significant performance issues or product failures. Failure analysis in this industry involves identifying and characterizing defects at micro and nano scales, making tools like SEMs, EDX, and FIB-SEM indispensable.

The rapid pace of innovation and the introduction of new materials and processes in semiconductor manufacturing further amplify the need for advanced failure analysis techniques. Additionally, the growing adoption of consumer electronics, automotive electronics, and IoT devices increases the demand for failure analysis to ensure product quality and longevity. As a result, the electronics and semiconductor industry remains the largest consumer of failure analysis services and equipment, driving significant advancements in this market segment.

The manufacturing segment is experiencing significant growth in the forthcoming years, fueled by the increasing complexity and precision requirements of modern manufacturing processes. As industries such as aerospace, automotive, and medical devices advance, the need for thorough failure analysis becomes more critical to maintain high-quality standards and prevent costly recalls or failures. In manufacturing, failure analysis helps identify the root causes of defects, improve product designs, and optimize manufacturing processes.

The rise of Industry 4.0 and the integration of smart manufacturing technologies also contribute to this growth, as these innovations demand more sophisticated analysis tools to monitor and improve production quality. Additionally, the focus on sustainability and reducing waste in manufacturing processes drives the adoption of failure analysis to enhance material efficiency and product reliability. The expanding scope of applications and the necessity for high-performance and reliable products position the manufacturing sector as a rapidly growing segment.

Regional Insights

The failure analysis market in North America is expected to hold a prominent position in the global market due to its strong industrial base, particularly in sectors such as electronics, aerospace, automotive, and healthcare. The region's advanced technological infrastructure and significant investment in research and development drive the adoption of sophisticated failure analysis tools and techniques. The presence of leading semiconductor companies and a robust electronics manufacturing sector further bolster the market in this region. Additionally, North America's focus on innovation and quality control ensures a continuous demand for failure analysis to maintain high standards and competitive advantage. The regulatory environment in the U.S. and Canada also emphasizes safety and reliability, contributing to the extensive use of failure analysis across various industries. As these industries continue to evolve and adopt new technologies, the demand for advanced failure analysis solutions in North America remains strong.

U.S. Failure Analysis Market Trends

The U.S. market is expected to grow at a significant CAGR from 2024 to 2030 and is characterized by its advanced technological capabilities and strong industrial sectors, including electronics, aerospace, automotive, and healthcare. The country's leadership in semiconductor manufacturing and electronics innovation drives significant demand for failure analysis to ensure the quality and reliability of products. The U.S. aerospace and defense industries also heavily rely on failure analysis to maintain safety and performance standards. Additionally, the country's focus on research and development and its regulatory environment that emphasizes safety and quality further support the extensive use of failure analysis across various sectors. As the U.S. continues to lead in technological advancements and high-quality manufacturing, the demand for advanced failure analysis solutions is expected to remain robust.

Asia Pacific Failure Analysis Market Trends

The Asia Pacific market is expected to grow with the fastest CAGR from 2024 to 2030. Asia-Pacific is experiencing rapid growth, driven by the region's booming electronics and semiconductor industries, particularly in countries like China, Japan, South Korea, and Taiwan. The region's dominance in electronics manufacturing and the presence of major semiconductor foundries necessitate advanced failure analysis to ensure product quality and reliability. Additionally, the expanding automotive and aerospace industries in Asia-Pacific contribute to the growing demand for failure analysis services and equipment. The increasing focus on research and development, coupled with significant investments in new technologies and manufacturing capabilities, fuels the adoption of sophisticated failure analysis tools. The region's dynamic industrial landscape and the push towards high-quality production standards position Asia-Pacific as a rapidly growing market for failure analysis solutions.

Europe Failure Analysis Market Trends

Europe represents a significant market for failure analysis, driven by its diverse industrial base and strong emphasis on innovation and quality. The region is home to leading aerospace, automotive, and electronics companies that require advanced failure analysis to maintain high standards of reliability and performance. European industries prioritize safety and regulatory compliance, which further drives the demand for comprehensive failure analysis. The region's focus on sustainable development and the adoption of cutting-edge technologies in manufacturing and materials science also contribute to the market growth. Additionally, Europe's robust research and development ecosystem supports the continuous advancement of failure analysis techniques and tools. As industries in Europe continue to innovate and adopt new materials and processes, the need for sophisticated failure analysis solutions remains critical.

Key Failure Analysis Company Insights

Key market players focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Eurofins EAG Laboratories, one of the global leaders in materials testing services, is enhancing its battery materials testing capabilities by opening a new 6,600 square-foot laboratory in Sunnyvale, CA, and expanding its Syracuse, New York facility with an additional 6,500 square feet of laboratory space. Eurofins EAG is the only independent battery testing laboratory in the United States that offers comprehensive 'turnkey' materials and failure analysis-based testing services, addressing the testing needs of batteries throughout their entire life cycle, from coin cell batteries to EV (Electric Vehicle) battery packs.

-

In October 2021, MASER Engineering, is one of the leading failure and reliability testing centers in Europe, and Eurofins Scientific, a renowned international laboratory group, reached an agreement for Eurofins Scientific to acquire MASER Engineering BV, with the current executive management retaining a minority shareholding. Sharing a similar philosophy and complementing each other perfectly, MASER and Eurofins have ambitious plans to expand their presence in the European semiconductor and electronic systems industry. The new ownership will also create additional opportunities for MASER in the international market, particularly within the Eurofins Materials & Engineering Sciences Business line.

Key Failure Analysis Companies:

The following are the leading companies in the failure analysis market. These companies collectively hold the largest market share and dictate industry trends.

- Rood Microtec GmbH

- Eurofins EAG Laboratories

- Presto Engineering Inc.

- TUV SUD

- Eurofins Maser BV

- NanoScope Services Ltd

- Crane Engineering

- Materials Testing

- McDowell Owens Engineering Inc.

- CoreTest Technologies

- Leonard C Quick & Associates Inc.

- Exponent Inc.

Failure Analysis Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.07 billion |

|

Revenue forecast in 2030 |

USD 8.14 billion |

|

Growth rate |

CAGR of 8.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

equipment, technology, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Rood Microtec GmbH; Eurofins EAG Laboratories; Presto Engineering Inc.; TUV SUD; Eurofins Maser BV; NanoScope Services Ltd; Crane Engineering; Materials Testing; McDowell Owens Engineering Inc.; CoreTest Technologies; Leonard C Quick & Associates Inc.; Exponent Inc |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Failure Analysis Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the failure analysis market-report based equipment, technology, vertical, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Microscope

-

Scanning Electron Microscope (SEM)

-

Transmission Electron Microscope (TEM)

-

Scanning Probe Microscope

-

Focused Ion Beam System (FIB)

-

Dual-Beam System (FIB-SEM)

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Dispersive X-Ray Spectroscopy (EDX)

-

Secondary Ion Mass Spectroscopy (SIMS)

-

Focused Ion Beam (FIB)

-

Broad Ion Miling (BIM)

-

Relative Ion Etching (RIE)

-

Scanning Probe Microscope (SPM)

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronics & Semiconductor

-

Oil & Gas

-

Defense

-

Manufacturing

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global failure analysis market size was estimated at USD 4.77 billion in 2023 and is expected to reach USD 5.07 billion in 2024.

b. The global failure analysis market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 8.14 billion by 2030.

b. The Asia Pacific regional market dominated in 2023, accounting for a nearly 37% revenue share of the global market. The region's dominance in electronics manufacturing and the presence of major semiconductor foundries necessitate advanced failure analysis to ensure product quality and reliability.

b. Some key players operating in the failure analysis market include Rood Microtec GmbH, Eurofins EAG Laboratories, Presto Engineering Inc., TUV SUD, Eurofins Maser BV, NanoScope Services Ltd, Crane Engineering, Materials Testing, McDowell Owens Engineering Inc., CoreTest Technologies, Leonard C Quick & Associates Inc., and Exponent Inc

b. Key factors driving market growth include rising complexity of electronic components and the critical need for failure analysis in sectors such as automotive, aerospace, electronics, and semiconductor manufacturing

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."