- Home

- »

- Beauty & Personal Care

- »

-

Facial Cleansing Balm Market Size And Share Report, 2030GVR Report cover

![Facial Cleansing Balm Market Size, Share & Trends Report]()

Facial Cleansing Balm Market (2024 - 2030) Size, Share & Trends Analysis Report By Gender (Men, Women), By Age Group (Young Adults, Adults), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-396-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Facial Cleansing Balm Market Size & Trends

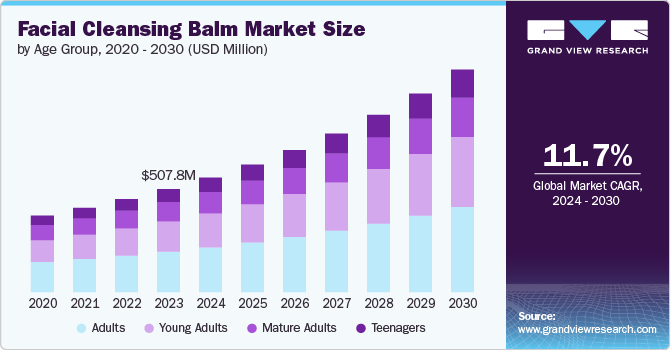

The global facial cleansing balm market size was estimated at USD 507.84 million in 2023 and is expected to grow at a CAGR of 11.7% from 2024 to 2030.Facial cleansing balms are popular due to their effectiveness in removing makeup and impurities, including waterproof products, while being gentle on the skin. Their oil-based formula cleanses without stripping natural oils, making them ideal for dry, sensitive, or acne-prone skin. Enriched with nourishing ingredients like shea butter and avocado oil, they hydrate and protect the skin from environmental factors. Additionally, their ease of use makes them a convenient choice for those seeking a quick and efficient skincare solution.

The rise of Korean beauty, with its meticulous and comprehensive skincare routines, has significantly popularized the double cleansing method, propelling the demand for cleansing balms and oils. This approach, fundamental to Korean skincare, involves using an oil-based cleanser followed by a water-based one to thoroughly remove makeup, sunscreen, and impurities, ensuring a deep cleanse. As showcased at Cosmobeauty Seoul 2024, the market has responded with innovative launches of functional beauty products, particularly in the face cleansing segment. Brands like Frankly, Jumiso, and Tenzero are introducing cleansing balms and oils infused with moisturizing plant oils, exfoliating acids, and beneficial extracts, catering to the growing consumer preference for effective and gentle skin care solutions. This trend underscores the global influence of K-beauty, driving heightened demand for high-quality cleansing products that support the double cleansing ritual.

Hero Cosmetics, known for its best-selling Mighty Patch, launched its first-ever cleansing balm, the Dissolve Away Cleansing Balm, in February 2024. This non-comedogenic balm is formulated specifically for acne-prone skin, effectively lifting away makeup, dirt, sunscreen, and excess oil without leaving a filmy residue. Priced affordably at USD 17.99, it's suitable for sensitive skin and leaves it moisturized. It is ideal for acne-prone skin, offering a gentle yet effective solution for clearer skin by embracing oil cleansing.

Cleansing balms have emerged as a top product for removing makeup, thanks to their gentle yet effective formulation. These balms dissolve makeup, dirt, and excess oil, leaving the skin clean without harsh scrubbing or irritation. This functionality has significantly boosted their demand, particularly among those with sensitive or acne-prone skin. As consumers become more aware of the environmental and skin benefits of avoiding traditional makeup wipes, the popularity of cleansing balms is expected to rise, driving further innovation and growth in the skincare market.

Gender Insights

Women users accounted for a share of about 67% in 2023. CivicScience's 2023 data reveals that women are more likely than men to use 3-4 skincare products, indicating a broader adoption of comprehensive skincare routines. In these routines, facial cleansing balms fit seamlessly, favored for their ability to gently and effectively remove makeup and impurities without irritating. Women with sensitive or acne-prone skin particularly appreciate the soothing properties of cleansing balms.

Demand among men is expected to rise at a CAGR of about 12.5% from 2024 to 2030. According to a January 2020 article by Tiege Hanley, 83% of men aged 65 and older showed interest in skincare. As men increasingly focus on skincare, facial cleansing balms have gained popularity for their ability to offer gentle yet effective cleansing and hydration, which is especially beneficial for aging skin. With higher disposable incomes and increased accessibility through various distribution channels, the demand for facial cleansing balms among men is set to grow, addressing their specific skincare needs and preferences.

Age Group Insights

Adults aged 31 to 50 accounted for a share of about 39% of the market in 2023. A March 2021 survey by Future Plc found that half of the UK women aged 40 and over view skincare and haircare as the best way to relax at home. Additionally, 78% said that caring for their body and mind brings them happiness, and 46% reported increasing their investment in these areas. Cleansing balms, which gently cleanse without stripping natural oils and prevent dryness and irritation, are particularly popular among those aged 31-50, boosting demand in this age group.

Demand for facial cleansing balm among young adults aged 20 to 30 is set to grow at a CAGR of about 12.8% from 2024 to 2030. The growing popularity of anti-aging products among young adults signifies a trend toward prevention rather than correction. As concerns about aging arise earlier, many individuals are now incorporating products designed to keep their skin supple and hydrated without removing natural oils. For instance, CeraVe Cleansing Balm effectively dissolves makeup, gently removes dirt, oil, and impurities, and moisturizes the skin while leaving it feeling comforted and hydrated. It is formulated with three essential ceramides to help maintain the skin’s natural barrier.

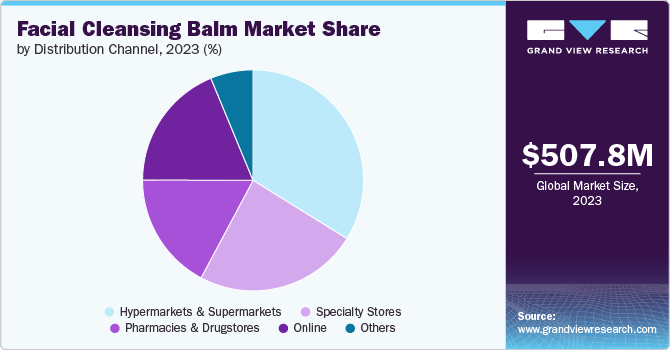

Distribution Channel Insights

The hypermarkets and supermarket segment constituted 33% of the revenue share of face cleansing balm sales. Supermarkets and hypermarkets, with their extensive selection of skincare and cosmetics, are becoming reliable sources of beauty products. These boutiques offer a fascinating beauty buying experience by placing a strong emphasis on visual merchandising and categorization. Sainsbury's, Garnier, and L'Oréal Paris partnered in 2022 to launch AI and AR-powered skincare consultations at more than 100 UK locations. This technology, which evaluates consumers' faces to provide tailored skincare advice, emphasizes the growing importance of skin health and the surge in demand for goods like facial cleansing balms.

Online sales of facial cleansing balm are expected to grow at a CAGR of 13.5% from 2024 to 2030. The growth of e-commerce in the cosmetics market is driven by the convenience of online shopping, which allows consumers to easily access a wide range of beauty products from home. For instance, Sephora has optimized its website by creating dedicated sections for new product launches in seven categories: Makeup, Skin Care, Bath and Body, Fragrance, Hair, and Tools and Brushes. This structured approach appeals to customers looking for innovative products, such as facial cleansing balms, and boosts sales through online channels.

Regional Insights

The facial cleansing balm market in North America accounted for a revenue share of around 26% in 2023 in the global market. The region's skincare product sales are driven by a rising number of consumers who are increasingly conscious of their appearance and the growing use of cosmetics among middle-class and upper-class individuals. The market is expected to expand further due to the increasing number of retail stores and the presence of renowned manufacturers such as Unilever and Procter & Gamble.

U.S. Facial Cleansing Balm Market Trends

The facial cleansing balm market in the U.S. accounted for a revenue share of around 85% in 2023 in the market. The demand for facial cleansing balms is supported by significant consumer spending on skincare products, essential to three-quarters of Americans. The 2023 LendingTree survey indicates that millennials and Gen Zers are at the forefront of this trend, investing heavily in skincare, with facial cleansing balms being particularly important. Emphasizing skin health and a preference for natural ingredients, these balms cater to the growing interest in effective yet gentle skincare solutions. The spending habits of these demographics highlight the high demand for facial cleansing balms, driven by their effectiveness and appeal across generations.

Asia Pacific Facial Cleansing Balm Market Trends

The Asia Pacific facial cleansing balm market is anticipated to rise at a CAGR of about 12.1% from 2024 to 2030. There has been an increased demand for Korean beauty trends in Southeast Asia, fueled by a preference for glowy and natural skin. This trend is subsequently contributing to the regional market growth. As consumers adopt the celebrated Korean skincare routines, which emphasize gentle yet effective practices like double cleansing, there is a growing preference for cleansing balms due to their nourishing and soothing properties.

Key Facial Cleansing Balm Company Insights

The market is fragmented. Many brands have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new products or making strategic acquisitions to better meet consumer needs and preferences. For example, in September 2022, Shiseido Europe S.A. completed the acquisition of Gallinée Ltd., a London-based beauty brand specializing in comprehensive care for the skin's microbiome. This acquisition reflects Shiseido's commitment to skin beauty and aligns with its mission to harmonize outer skin beauty with inner well-being.

Key Facial Cleansing Balm Companies:

The following are the leading companies in the facial cleansing balm market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever

- Estee Lauder Companies, Inc.

- Amorepacific

- Charlotte Tilbury

- L’Oréal Group

- e.l.f. Cosmetics

- L'Occitane Groupe S.A.

- Procter & Gamble

- Shiseido Company, Limited

- Kao Corporation

Recent Developments

-

In August 2023, Unilever’s brand Tatcha introduced The Indigo Cleansing Balm, a fragrance-free, gentle, moisturizer designed to cleanse and remove makeup. Enriched with Japanese indigo for its protective and restorative properties, this balm-to-oil cleanser is formulated in Tokyo to soothe and hydrate dry, sensitive skin while effectively melting away dirt, oil, and waterproof makeup.

-

In September 2023, L'Occitane Groupe S.A.’s brand Elemis launched its limited-edition Green Fig Pro-Collagen Cleansing Balm. Infused with nourishing ingredients like Padina pavonica, elderberry oil, and starflower oil, the cleanser melts away makeup and impurities while supporting skin health and sustainability.

Facial Cleansing Balm Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 564.3 million

Revenue forecast in 2030

USD 1.01 billion

Growth rate

CAGR of 11.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gender, age group, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Unilever; Estee Lauder Companies, Inc.; Amorepacific; Charlotte Tilbury; L’Oréal Group; e.l.f. Cosmetics; L'Occitane Groupe S.A.; Procter & Gamble; Shiseido Company, Limited; and Kao Corporation

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Facial Cleansing Balm Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global facial cleansing balm market report based on the gender, age group, distribution channel, and region:

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Teenagers (Ages 13-19)

-

Young Adults (Ages 20-30)

-

Adults (Ages 31-50)

-

Mature Adults (Age 51 & Above)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global facial cleansing balm market was estimated at USD 507.84 million in 2023 and is expected to reach USD 564.26 million in 2024.

b. The global facial cleansing balm market is expected to grow at a compound annual growth rate of 11.7% from 2023 to 2030 to reach USD 1,01 billion by 2030.

b. Asia Pacific dominated the facial cleansing balm market with a share of around 39% in 2023. This is due to its strong skincare culture, high consumer demand for effective cleansing solutions, and the presence of leading beauty brands in the region.

b. Key players in the facial cleansing balm market are Unilever; Estee Lauder Companies, Inc.; Amorepacific; Charlotte Tilbury; L’Oréal Group; e.l.f. Cosmetics; L'Occitane Groupe S.A.; Procter & Gamble; Shiseido Company, Limited; Kao Corporation.

b. Key factors that are driving the facial cleansing balm market growth include its effective makeup removal properties, skin-nourishing ingredients, and the increasing trend towards multi-step skincare routines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.