- Home

- »

- Beauty & Personal Care

- »

-

Facial Care Market Size And Share, Industry Report, 2030GVR Report cover

![Facial Care Market Size, Share & Trends Report]()

Facial Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type, By Gender (Male, Female), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-926-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Facial Care Market Size & Trends

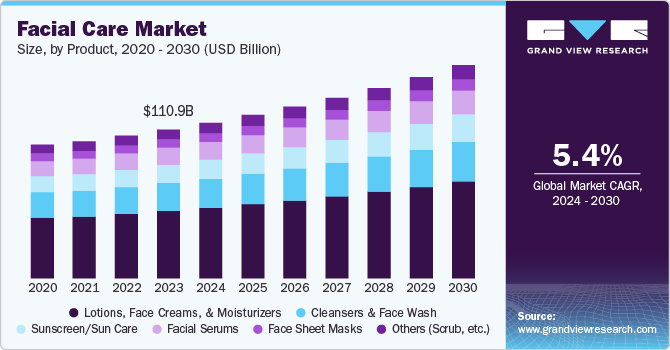

The global facial care market size was valued at USD 110.88 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. Increasing awareness regarding the importance of facial products in maintaining healthy skin and enhancing skin appearance, influenced by celebrities, and beauty influencers, is driving the industry of these products. Additionally, the growing spending power of the working-class population in emerging economies, including China, India, and Brazil, is leading to a rise in demand for these beauty products.

There is a growing trend towards natural and organic facial care products as consumers become more conscious of the ingredients used in their skincare products. Concerns about synthetic chemicals, parabens, sulfates, and other potentially harmful substances have led many consumers to use products made from natural and organic ingredients. The desire for safer, eco-friendly, and sustainable skincare options drives this trend. As a result, many brands have introduced lines of natural and organic products. This shift towards clean beauty is catering to the current demand and shaping the future of the facial care market. For instance, in October 2023, Agrimer launched a mix & mix-and-match concept for a 100% natural skincare range called Marine Sunset. This collection offers a mix & match concept that allows customers to customize their skincare products with different textures, colors, and fragrances. The collection includes cleansers, moisturizers, face masks, and body care products. Customers are able to choose from seven different 100% natural textures, five colors inspired by the shades of the sky at sunset, and five different fragrances.

Manufacturers in the facial care market are leveraging social media platforms to increase engagement, build brand awareness, and influence purchasing decisions. Using platforms such as Instagram, TikTok, and YouTube, they are able to reach a broad audience, including tutorials, product demos, and user-generated content. Social media allows manufacturers to interact directly with consumers, gather real-time feedback, and create a community around their brands. Influencer partnerships and targeted advertising further increase their reach and credibility, allowing them to convert followers into loyal customers.

Technological advancements and research in dermatology have led to the development of more effective and diverse facial care products. Innovations such as serums with high concentrations of active ingredients, lightweight moisturizers, and multi-functional products that combine several benefits are growing. Moreover, introducing products with new ingredients such as hyaluronic acid, retinoids, peptides, and various plant extracts raises the demand for consumers looking for advanced skincare solutions. For instance, in July 2023, Lancôme introduced the Rénegie HPN 300-Peptide Cream. The cream contains hyaluronic acid, over 300 different types of peptides, niacinamide, and others. The cream is designed to renew the skin faster than it ages and has undergone extensive development, including over 250 formulation experiments, more than 500 quality controls, and tests on over 770 women.

Product Insights

The lotions, face creams, & moisturizers segment accounted for the largest market revenue share of 45.2% in 2023. Concerns about synthetic chemicals and safer, eco-friendly options have led many consumers to pursue products made from natural and organic ingredients. Brands have formulated products without harmful substances, using plant-based extracts and essential oils. The growing consumer preference for natural and organic skincare products has also driven the lotions, face creams, and moisturizers segment.

The sunscreen/sun care segment is expected to register the fastest CAGR during the forecast period. Dermatologists and beauty influencers endorse regular sunscreen use as a preventative measure against long-term skin damage. This shift towards daily sun protection has increased the demand for sunscreens suitable for everyday wear, including those with lighter textures and formulations that can be layered under makeup. Developing sunscreens with added ingredients such as hyaluronic acid, vitamin C, and niacinamide, which address multiple skin concerns simultaneously, is driving the market growth. For instance, in June 2024, MONPURE and Cowdray Estate partnered and launched SPF 50 sunscreen for the scalp and face. The sunscreen incorporates ingredients such as Multi-Molecular Weight Hyaluronic acid for hydration, niacinamide for improving skin tone and offering anti-aging advantages, and Blue Light Stem Cell technology.

End Use Insights

The women facial care segment accounted for the largest revenue share in 2023. Women's awareness of the benefits of a comprehensive skincare routine has significantly increased, driven by extensive educational campaigns from skincare brands, dermatologists, and health organizations. This awareness emphasizes the importance of maintaining skin health to prevent dryness and acne. This awareness has led to a consistent and growing demand for facial care products as essential to daily personal care routines. Additionally, women are increasingly incorporating anti-aging products into their skincare routines at an earlier age as a preventive measure. The willingness to invest in high-quality, effective solutions that provide results drives the demand for anti-aging facial care products.

The men facial care segment is expected to register the fastest CAGR during the forecast period. Male grooming influencers and skincare enthusiasts regularly share their skincare routines, product reviews, and grooming tips, significantly impacting men's purchasing decisions. Celebrity endorsements and collaborations with skincare brands targeting men also play a crucial role in driving product popularity. The visual and interactive nature of social media allows men to discover new products, learn about their benefits, and see real-life results through testimonials and tutorials. Additionally, brands are developing products that cater to men's specific skincare needs, such as oil control, soothing post-shave irritation, and addressing rougher skin textures. Including masculine scents and packaging designs that men demand has further increased product offerings. For instance, 82E launched a personal care line for men. The product range consists of a cleanser and a moisturizer. The face, beard, and body cleanser has woody oud and fresh citrus fragrances.

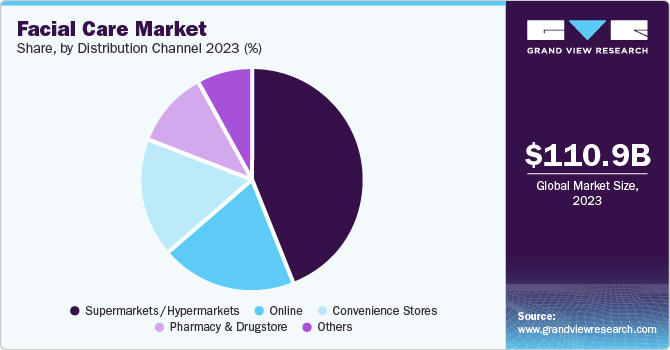

Distribution Channel Insights

The supermarkets & hypermarkets distribution segment accounted for the largest market revenue share in 2023. Supermarkets and hypermarkets offer customers a one-stop shopping experience. This convenience saves the customer time and effort. Supermarkets and hypermarkets allow consumers to see, touch, and even sample products before purchasing. This physical interaction enables building trust and confidence in the products, especially for new or unfamiliar brands. These factors combined are driving the segment's growth.

The online distribution segment is expected to register the fastest CAGR during the forecast period. Consumers browse and purchase facial care products anytime without visiting a physical store, which is useful for busy individuals. Additionally, online shopping platforms often provide features such as home delivery, subscription services, and easy return policies, further enhancing the shopping experience. For instance, in May 2024, Ombré Men expanded into Walmart online and on the Walmart app. The expansion includes 16 products, including skincare, deodorants, grooming products, and more.

Regional Insights

The North America facial care market is expected to witness the fastest CAGR over the forecast period. Innovations in dermatological research and cosmetic science led to developing new and improved products that offer enhanced effectiveness and safety. Additionally, increasing consciousness in men regarding appearance and skin health leads to an increase in demand for products specifically formulated for male skin. Brands are responding by developing product lines that cater to men's unique skincare needs, including after-shave lotions, oil-control moisturizers, and anti-aging treatments. These factors coupled together are driving demand in market.

U.S. Facial Care Market Trends

The U.S. market is expected to witness significant growth over the forecast period. Extensive educational campaigns from health organizations and skincare brands have informed consumers about the benefits of maintaining a regular skincare routine. This awareness is spread through various media channels, including blogs, online forums, and beauty magazines. This results in more consumers incorporating facial care products into their daily routines to maintain skin health, prevent acne and dryness, and achieve a youthful appearance. Moreover, consumers are becoming more aware of using sunscreen and products with SPF to protect their skin from sun damage, leading to skin cancer and premature aging. Including sun protection in daily skincare routines drives demand for facial care products. For instance, in May 2024, Eucerin expanded into the U.S. sun protection market with the new Eucerin Sun product line, which includes seven facial and body products. These products are integrated with antioxidants such as Licochalcone A, Glycyrrhetinic Acid, Vitamin E, Vitamin C, and Oxynex ST, offering sun protection for different skin types and tones.

The Canada market is expected to witness significant growth over the forecast period. The U.S. market is expected to witness significant growth over the forecast period. Access to extensive information through beauty blogs, magazines, and expert consultations has increased awareness of the benefits of a proper skincare routine. This has driven demand for high-quality facial care products that treat skin concerns such as dryness, sensitivity, acne, and aging. Additionally, products made with natural ingredients such as botanical extracts, essential oils, and plant-based actives are in high demand. The move towards natural and organic skincare has resulted in many new product lines and the reformulation of existing products to meet the need for safer and more sustainable facial care options.

Asia Pacific Facial Care Market Trends

Asia Pacific facial care market accounted for the largest revenue share in 2023. Consumers increasingly pursue products that match their skin type, concerns, and preferences. Technological advancements have enabled brands to offer personalized skincare regimens through online assessments, AI-powered recommendations, and customized formulations. This trend towards personalization enhances the consumer experience, as individuals find products that precisely address their unique needs. Personalized skincare solutions improve customer satisfaction and drive brand loyalty and repeat purchases.

The China facial care market is expected to witness significant growth over the forecast period. China's e-commerce and digital marketing advancements have grown the facial care market. Platforms such as Tmall, JD.com, and Taobao provide consumers easy access to a wide array of skincare products from both local and international brands. The convenience of online shopping and targeted digital marketing strategies have made it easier for brands to reach and engage with their target audience. This convenience and enhanced shopping experience drive the market growth.

The India facial care market is expected to witness significant growth over the forecast period. Ayurvedic practices and a growing awareness of the potential side effects of synthetic chemicals are driving the demand for natural and herbal skincare products in India. Consumers are increasingly pursuing products made from natural ingredients such as turmeric, neem, aloe vera, and sandalwood. Brands that emphasize the use of natural and organic ingredients, sustainability, and ethical sourcing are gaining popularity. This trend has led to the development of new product lines that cater to the demand for natural and herbal facial care solutions.

Europe Facial Care Market Trends

The Europe facial care market is expected to witness significant growth over the forecast period. Consumers increasingly pursue products that match their skin type and problems. Technology advancements have enabled brands to offer personalized skincare treatments through online assessments and customized formulations. This trend towards personalization enhances the consumer experience, as individuals find products that precisely address their unique requirements. Personalized skincare solutions improve customer satisfaction and increase repeat purchases.

The UK facial care market is expected to witness significant growth over the forecast period. With an aging population and a cultural emphasis on maintaining a youthful appearance, UK consumers are strongly focused on anti-aging products. Consumers are actively seeking solutions to combat signs of aging, such as wrinkles, fine lines, and loss of skin elasticity. Anti-aging products, including serums, creams, and treatments, that incorporate ingredients such as retinoids, peptides, and antioxidants are in high demand. Brands that offer effective anti-aging solutions are able to capture a substantial share of the market as consumers pursue maintaining a youthful complexion and slowing the aging process. For instance, in September 2024, Crown Aesthetics, a Crown Laboratories, Inc. division, launched BIOJUVE, in UK. BIOJUVE is based on clinically proven, living microbe technology to improve the skin biome that can lead to younger-looking & healthier skin.

Key Facial Care Company Insights

This market is highly competitive, involving established manufacturers with a wide range of products. Marketers are focusing on various strategies such as new product introductions, geographic expansion, mergers and acquisitions, collaborations and partnerships. Key manufacturers of this industry include L’Oréal, Procter and Gamble, Oriflamme, Unilever, Estee Lauder Company, Johnson & Johnson, Avon Products, Inc., Coty Inc., Revlon, Shiseido Company Limited.

- L’Oréal, the leader in the beauty industry, has an extensive range of more than 30 brands. These broad categories (extensions) include skincare, hair care, makeup, and fragrance, catering to customer preferences.

Key Facial Care Companies:

The following are the leading companies in the facial care market. These companies collectively hold the largest market share and dictate industry trends.

- Coty Inc.

- ESTEE LAUDER COMPANIES INC.

- Johnson & Johnson Services, Inc.

- L’Oréal

- Oriflame Cosmetics AG

- Procter and Gamble

- Revlon

- Shiseido Company

- The Avon Company

- Unilever

Recent Development

-

In January 2024, VLCC introduced serum facewash range in India. This innovative range consists of eight unique variants integrated with Salicylic Acid Serum, Vitamin C Serum, and Hyaluronic Acid Serum.

-

In April 2024, Rubedo Life Sciences announced a multi-year strategic partnership with Beiersdorf AG to create innovative skincare products to treat cellular aging. The collaboration explores novel compounds developed through Rubedo's extensive research programs, specifically targeting cellular senescence.

Facial CareMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 116.03 billion

Revenue forecast in 2030

USD 158.87 billion

Growth Rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, End Use, Distribution Channel

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Saudi Arabia, and UAE

Key companies profiled

Coty Inc.; ESTEE LAUDER COMPANIES INC.; Johnson & Johnson Services, Inc.; L’Oréal; Oriflame Cosmetics AG; Procter and Gamble; Revlon; Shiseido Company; The Avon Company; Unilever

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Facial Care Market Report Segmentation

This report forecasts revenue growth on a global, regional and country level and analyzes the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global facial care market report by product, distribution channel, end use and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lotion Face, Creams & Moisturizers

-

Cleansers & Face Wash

-

Facial Serums

-

Face sheet masks

-

Sunscreen/ Sun care

-

Others (Scrub, etc.)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/ Hypermarkets

-

Convenience stores

-

Pharmacy & drugstore

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.