- Home

- »

- Plastics, Polymers & Resins

- »

-

Extruded Plastics Market Size, Share & Growth Report, 2030GVR Report cover

![Extruded Plastics Market Size, Share & Trends Report]()

Extruded Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PE, PVC, PS, PC), By End-use (Construction, Automotive), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-224-4

- Number of Report Pages: 154

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extruded Plastics Market Summary

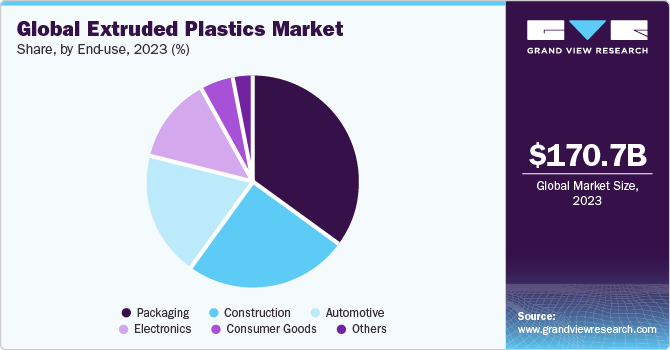

The global extruded plastics market size was estimated at USD 170.74 billion in 2023 and is projected to reach USD 221.18 billion by 2030, growing at a CAGR of 3.9% from 2024 to 2030. The demand for extruded plastics is driven by the increasing adoption in various application industries, including packaging, building & construction, electrical & electronics, automotive & transportation, healthcare, aerospace, and others.

Key Market Trends & Insights

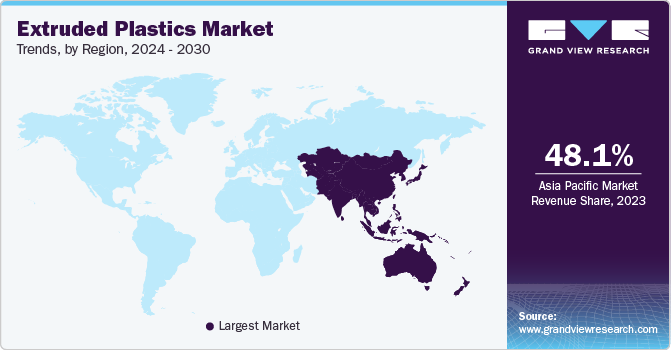

- Asia Pacific dominated the global market with a revenue share of 48.1% in 2023.

- The China extruded plastics market emerged as the leading product manufacturer in 2023 globally.

- Based on application, the profiles segment emerged as the leading segment and accounted for a revenue share of more than 42.7% in 2023.

- Based on end use, the packaging end-use segment dominated the market and accounted for the largest revenue share of over 33.14% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 170.74 Billion

- 2030 Projected Market Size: USD 221.18 Billion

- CAGR (2024-2030): 3.9%

- Asia Pacific: Largest market in 2023

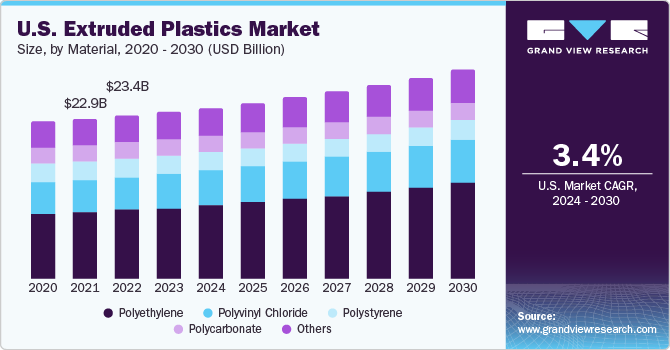

The growing market for e-commerce and online retail drives the growth of the U.S. market. The rise in online shopping activities has increased the requirement for effective and secure packaging to protect goods during transit. With its flexibility and durability, polyethylene is essential for packaging applications in the e-commerce sector.

The growing popularity of online retail platforms and growing requirements for sustainable packaging solutions offer opportunities for polyethylene manufacturers to meet specific demands of the e-commerce sector. According to the U.S. Department of Commerce, e-commerce sales reached USD 1.04 trillion in 2022, representing an 8.5% annual increase. Despite the growth rate being less than half that of the previous year and the slowest in a decade, the surge fueled total sales beyond the USD 1 trillion milestone. Global e-commerce sales projections indicate a staggering USD 6.3 trillion worldwide in 2024. This persistent upward trend underscores the sustained appeal & profitability of the e-commerce business model, making it an increasingly attractive option for the packaging industry.

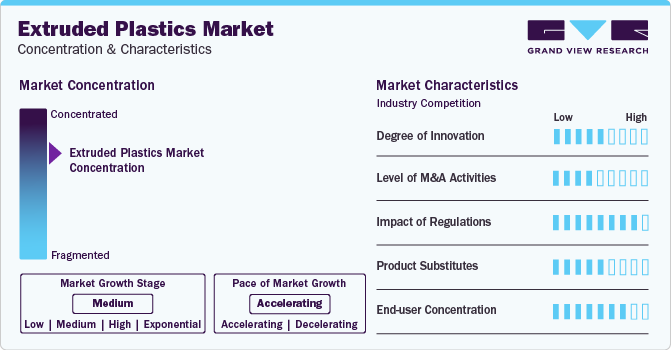

Market Concentration & Characteristics

The market is slightly concentrated with key players operating in the industry, such as BASF SE, Borealis AG, Dow, Exxon Mobil Corporation, Mitsubishi Chemical Corporation, SABIC, and China Petrochemical Corp. (Sinopec). They have adopted strategies of joint ventures to expand their business footprint. In October 2023, Borealis AG and TotalEnergies SE announced plans to construct a USD 1.4 billion Borstar polyethylene (PE) unit within the Baystar joint venture. The establishment of this unit, with a capacity of producing 625,000 metric tons of PE annually, doubles the current manufacturing capability of the Baystar site, including the manufacturing output of its two existing PE production units.

Growing emphasis on circular plastic economy has led many market leaders to focus on expanding plastic production from bio-based sources. For instance, in February 2023, Avient Corporation announced an expansion of its Maxxam bio-based plastics range. This move underscores strong dedication to offering sustainable solutions. New additions to the Maxxam lineup incorporate natural fillers sourced from cellulose fiber, presenting an eco-friendly alternative to traditional filled plastics.

Material Insights

The Polyethylene (PE) segment held the largest share of 42.7% in 2023. Polyethylene is one of the most consumed plastics globally owing to its crystalline structure and a wide array of applications across several industries. High-density polyethylene (HDPE) is comparatively more crystalline and possesses higher density than low-density polyethylene (LDPE). LDPE is used in the packaging sector, such as in grocery bags or plastic wraps, whereas HDPE has major applications in the construction industry.

Polycarbonates (PCs) are commonly used in the electrical and electronics industries in the production of a variety of comparable equipment. Due to their low weight and high strength, PCs are used in the manufacturing of several products, including reflectors, lighting profiles, diffusers, refractors, luminaries, and lenses.

Application Insights

Profiles application emerged as the leading segment and accounted for a revenue share of more than 42.7% in 2023. A major factor influencing the profile extrusion of plastics includes rapid expansion in terms of volume at crystalline melting point. Several plastics can be extruded as monolayer and multilayer film, including Linear low-density polyethylene (LLDPE), LDPE, HDPE, and other plastic-based films can be coextruded with the help of other polymers, such as ethylene vinyl alcohol (EVOH), polyester barrier resins, and more.

Extruded plastics are long-lasting and adaptable materials commonly used in the film and sheet industries. As they are chemical resistant, odorless, and nonporous, plastics are frequently utilized in the consumer goods and food packaging industries. Shrink wraps and sheets are often used to wrap food items, gift boxes, and a variety of other items.

End-use Insights

The packaging end-use segment dominated the market and accounted for the largest revenue share of over 33.14% in 2023. The growing key application industries, such as personal & household care, medicines, and food & drinks, and the global penetration of e-commerce are driving the demand for extruded plastic packaging. Extruded plastics are used in a variety of packaging materials, including food, beverage, and oil. They are widely used due to their high performance, low cost, and durability.

Building and construction plastics have a wide range of applications in the construction industry, including piping, roofing, flooring, insulation, and others. The segment is expected to maintain its second-highest market share on account of high product demand due to its characteristics, such as durability, corrosion resistance, and cost efficiency. Extruded plastics are used for fluid and material transport through pipes. In architecture and construction applications, plastics are preferred over other materials by the majority of architects, builders, and designers due to their low upkeep.

Regional Insights

North America is expected to witness significant growth during the forecast period as the region is one of the largest consumers of plastics owing to high demand from the automotive, electrical & electronics, packaging, and construction sectors. The regional market growth is also driven by rising demand for epoxy polymers in the medical devices segment for manufacturing disposables and devices, such as catheters and surgical instruments.

U.S. Extruded Plastics Market Trends

The U.S. extruded plastics market is distinguished by technological advancements in extruded plastic formulation technologies and strong consumer awareness about the health and environmental implications of plastics. Regulatory policies set by the U.S. Environmental Protection Agency (EPA), U.S. Food and Drug Administration (FDA), and other agencies are anticipated to act as a restraint for market growth. However, the impact of these policies is predicted to be minimized in the coming years with the adoption of alternative manufacturing techniques for developing sustainable products.

Asia Pacific Extruded Plastics Market Trends

The extruded plastics market in Asia Pacific held a revenue share of over 48.1% in 2023. Countries, such as Vietnam, Indonesia, Thailand, China, Japan, and India, are expected to emerge as the primary growth markets for extruded plastics in Asia Pacific over the forecast period. The growing manufacturing sector is expected to propel product demand in the automotive, industrial machinery, construction, packaging, and electrical & electronics industries.

The China extruded plastics market emerged as the leading product manufacturer in 2023 globally. The country is self-sufficient in terms of extruded plastic production, with the presence of an adequate number of plants and production capacities required to fulfill the local demand. Moreover, China supplies PE, PVC, and other types of extruded plastics to neighboring countries due to its large production base. The country also recycles a significant amount of waste plastic into various products, such as fibers, sheets, and films.

Europe Extruded Plastics Market Trends

The extruded plastic market in Europe is likely to witness sluggish growth owing to various factors, such as supply chain disruptions, delayed industrial output caused by economic uncertainties in the developed economies, and regulatory initiatives to limit the usage of plastic, which have collectively impacted market dynamics and expansion. In addition, the regional market is shaped by stringent environmental regulations enforced by entities, such as the European Chemicals Agency (ECHA) and the European Commission, along with other federal-level agencies, further influencing industry dynamics.

The Germany extruded plastics market plays a significant role in providing newly developed and innovative products to key industries, such as automotive, packaging, construction, and industrial manufacturing. Germany is establishing itself as a key location for the plastic industry in Europe, with the country’s leading-edge network of industrial infrastructure, unique cluster concept, and chemical parks offering the companies smooth access to all parts of the industry value chain.

Central & South America Extruded Plastics Market Trends

The extruded market plastics market in Central & South America is driven by the growing manufacturing industry in Brazil, Argentina, Venezuela, and Peru. Several initiatives are being undertaken to improve the manufacturing sector in the region, which is expected to fuel product demand. The rapidly growing automotive industry, due to high demand for EVs, especially in Mexico on account of high adoption of compact family cars, is expected to positively impact the demand for plastics in the automotive industry.

The Brazil extruded market plastics market will have considerable growth from 2024 to 2030, mainly due to heavy investments from local and foreign multinational businesses that have helped improve the economic stability of the country. Furthermore, the presence of major automobile makers in the country has assisted in significantly reducing inflation and unemployment.

Middle East & Africa Extruded Plastics Market Trends

The extruded market plastics market in MEA will witness lucrative growth due to rapidly growing automotive sector, which is driving the product demand in applications, such as under-the-hood components and automobile exteriors & interiors. The demand for lightweight & economical multi-utility vehicle models with high fuel efficiency and an emphasis on aesthetics and comfort is driving the use of resins in the automotive industry. Stringent environmental and safety standards enforced by various governments have compelled car original equipment manufacturers (OEMs) to replace metal components with polymer components. The use of plastics in automobiles reduces the vehicle's overall weight. This improves fuel efficiency and helps reduce greenhouse gas (GHG) emissions.

The Saudi Arabia extruded market plastics market is likely to grow significantly in the coming years. The government of Saudi Arabia has initiated various plans to make the country a regional automotive manufacturing hub and is significantly investing in mega projects, such as The Line, Trojena, and Sindakah. These plans are expected to play a significant role in the growth of the manufacturing and service industry in the country, thereby boosting product demand.

Key Extruded Plastics Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In July 2023, LyondellBasell acquired Mepol Group, one of the leading manufacturers of recycled, high-performing technical compounds located in Italy and Poland

-

In May 2023, Repsol took a significant stride in environmental responsibility by introducing bio-based plastics. This move is specifically aimed at minimizing carbon footprint within the medical sector, showcasing Repsol's dedication to making a positive impact on sustainability within crucial industries like healthcare

Key Extruded Plastics Companies:

The following are the leading companies in the extruded plastics market. These companies collectively hold the largest market share and dictate industry trends.

- LyondellBasell

- Repsol

- Berry Global Inc.

- JM Eagle, Inc.

- Engineered Profiles LLC

- Bemis Company Inc.

- Amcor Limited

- Sealed Air Corporation

- Formosa Plastics Corporation

- Saudi Basic Industries Corp. (SABIC)

- Compagnie de Saint-Gobain S.A.

- Sigma Plastics Group

Extruded Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 175.83 billion

Revenue forecast in 2030

USD 221.18 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Base year

2022

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

LyondellBasell; Repsol; Berry Global Inc.; JM Eagle, Inc.; Engineered Profiles LLC; Bemis Company Inc.; Amcor Ltd.; Sealed Air Corp.; Formosa Plastics Corp.; Saudi Basic Industries Corp. (SABIC); Compagnie de Saint-Gobain S.A.; Sigma Plastics Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

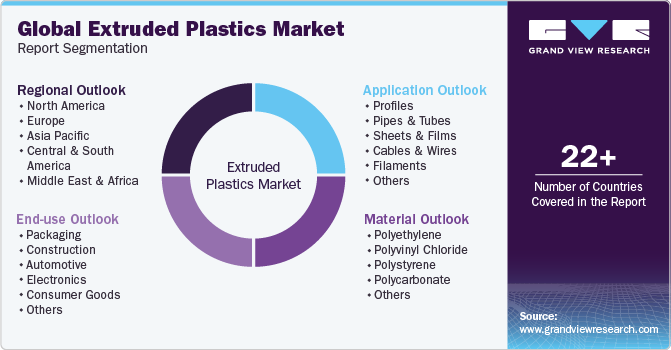

Global Extruded Plastics Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global extruded plastics market report based on material, application, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polyvinyl Chloride

-

Polystyrene

-

Polycarbonate

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Profiles

-

Pipes & Tubes

-

Sheets & Films

-

Cables & Wires

-

Filaments

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Construction

-

Automotive

-

Electronics

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The extruded plastics Market size was estimated at USD 170.74 billion in 2023 and is expected to reach USD 175.83 billion in 2024.

b. The extruded plastics market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 221.18 billion by 2030.

b. Based on region, Asia Pacific was the largest market with a revenue share of over 48% in 2023, owing to the high demand from packaging, construction, and automotive industries in the region.

b. Some of the key players operating in the extruded plastics market include Berry Global Inc., JM Eagle, Inc., Engineered Profiles LLC, Bemis Company Inc., Amcor Limited, Sealed Air Corporation, and Formosa Plastics Corporation.

b. Key factors that are driving the extruded plastics market are growing adoption in various application industries, including packaging, building & construction, electrical & electronics, automotive & transportation, healthcare, aerospace, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.