- Home

- »

- IT Services & Applications

- »

-

Extended Warranty Market Size, Share, Industry Report 2033GVR Report cover

![Extended Warranty Market Size, Share & Trends Report]()

Extended Warranty Market (2026 - 2033) Size, Share & Trends Analysis Report By Coverage (Standard Protection Plan, Accidental Protection Plan), By Distribution Channel, By Application (Automobiles, Consumer Electronics), By Sales Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-476-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extended Warranty Market Summary

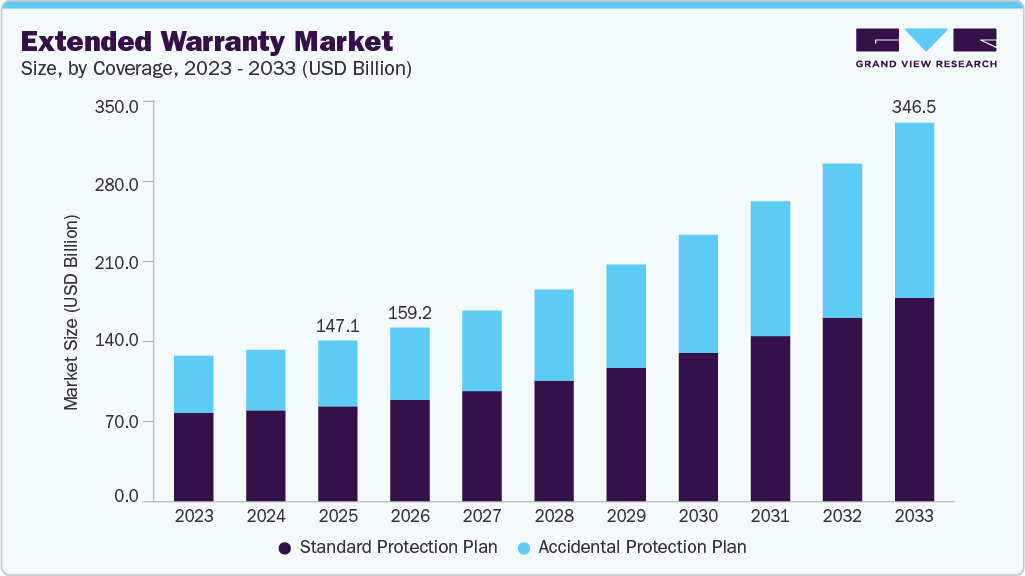

The global extended warranty market size was estimated at USD 147.13 billion in 2025 and is projected to reach USD 346.51 billion by 2033, growing at a CAGR of 11.8% from 2026 to 2033. Rising consumer awareness of high repair and replacement costs is driving demand for extended warranties, particularly for premium electronics and vehicles.

Key Market Trends & Insights

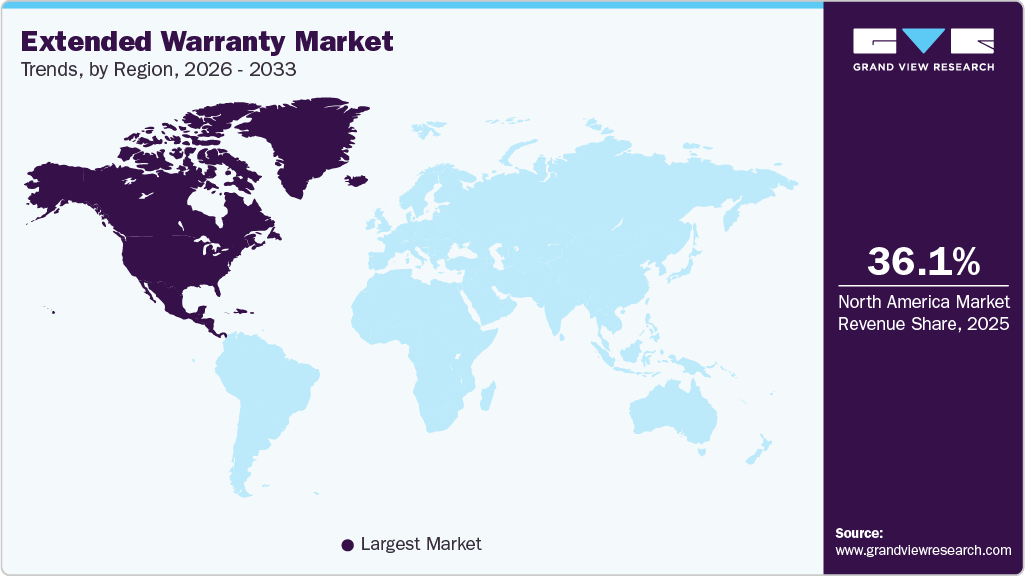

- North America extended warranty dominated the global market with the largest revenue share of 36.1% in 2025.

- The extended warranty market in the U.S. is expected to grow significantly at a CAGR of 10.0% from 2026 to 2033.

- By coverage, the standard protection planled the market and held the largest revenue share of 59.3% in 2025.

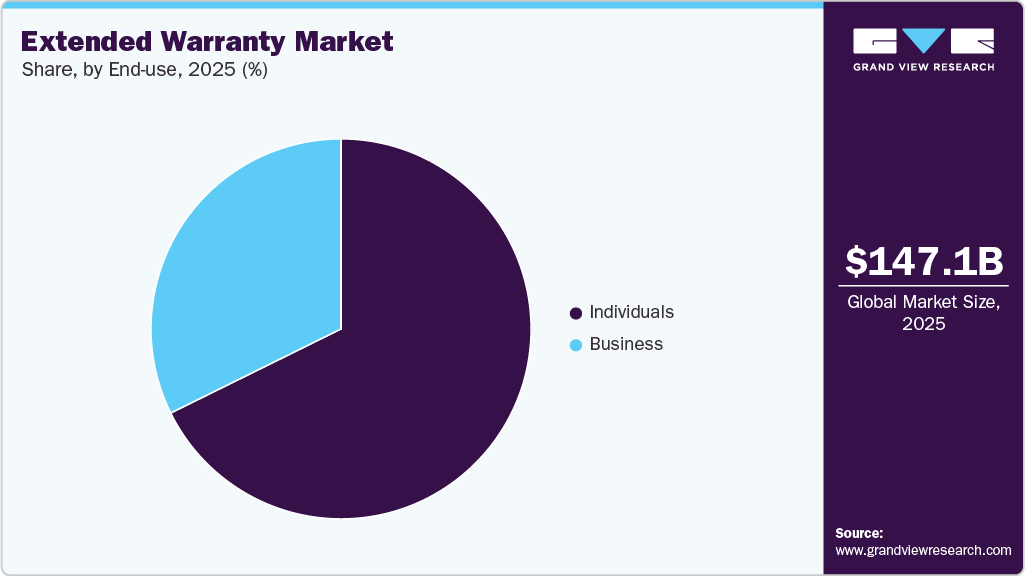

- By end-use, the individuals segment dominated the market and accounted for the largest revenue share in 2025.

- By application, the automobiles segment dominated the market and accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 147.13 Billion

- 2033 Projected Market Size: USD 346.51 Billion

- CAGR (2026-2033): 11.8%

- North America: Largest market in 2025

As product prices increase and components become more complex, consumers seek protection against unexpected expenses. Greater access to information through digital channels, transparent pricing, and point-of-sale education further encourage buyers to view extended protection plans as a cost-effective way to safeguard long-term investments.There has been a significant rise in consumer awareness regarding the benefits of extended warranties. Manufacturers, retailers, and third-party providers have enhanced their marketing strategies to inform consumers about the financial protection provided by these plans. The proliferation of e-commerce platforms has also facilitated the easy bundling of extended warranty packages with products, which has further driven their adoption. As more consumers recognize the value in protecting their investments, extended warranty uptake has seen a steady increase.

Rising repair costs are a key driver of extended warranty adoption as modern products become more technologically complex and expensive to service. Advanced electronics, smart appliances, electric vehicles, and connected devices rely on sophisticated components, proprietary parts, and specialized labor, significantly increasing repair expenses. Even minor failures can result in high out-of-pocket costs once the standard warranty expires. As consumers become more aware of these potential financial risks, they increasingly view extended warranties as a form of cost control and budget protection. This trend is particularly strong for premium electronics and vehicles, where replacement parts and authorized service fees can be substantial, making extended coverage a financially prudent decision.

E-commerce integration has significantly accelerated the adoption of extended warranties by embedding protection plans directly into the online purchasing journey. Digital marketplaces and retailer websites often present extended warranty options at checkout, typically using clear pricing, concise coverage summaries, and one-click add-ons. This seamless integration reduces friction and encourages impulse purchases, especially for high-value electronics and appliances. Data-driven recommendations and bundled offers further improve attach rates by highlighting potential repair costs and long-term savings. Additionally, digital platforms enable instant policy activation, facilitate easy documentation, and facilitate online claims management, thereby improving customer convenience and trust. As online retail penetration continues to grow globally, embedded warranty offerings are gaining traction.

Many buyers are skeptical due to unclear policy terms, complex exclusions, and concerns about claim denials or lengthy repair processes. In some cases, coverage limitations are not well explained at the point of sale, leading to mismatched expectations and dissatisfaction when claims are filed. This lack of transparency causes consumers to question whether the cost of the warranty justifies the benefits. Negative past experiences, word-of-mouth feedback, and limited understanding of coverage details further reinforce the perception that extended warranties offer low value, restraining wider adoption across price-sensitive customer segments.

Coverage Insights

The standard protection plan segment accounted for the largest market share of 59.3% in 2025. The rapid growth of consumer electronics and home appliances is expanding the addressable market for standard protection plans. The rising adoption of smartphones, smart TVs, wearables, and large appliances increases the number of high-value devices in use, particularly in emerging markets such as India and Southeast Asia. As households invest in more durable and technologically advanced products, the risk of post-warranty failures grows. This encourages consumers to purchase standard protection plans to ensure reliable performance and avoid unexpected repair expenses over the product’s lifecycle.

The accidental protection plan segment is anticipated to grow at a significant CAGR over the forecast period. The rapid expansion of mobile and wearable devices is a significant contributor to the growth of the accidental protection plan segment. Smartphones, smartwatches, fitness trackers, and wireless earbuds have become essential to everyday life, yet their portability and frequent use make them highly susceptible to damage. These devices are commonly exposed to risks such as drops, liquid spills, and general wear from constant handling. As a result, consumers are increasingly opting for accidental protection plans to protect their high-value devices. The rising adoption of wearable technology has created new and attractive opportunities for providers of accidental damage coverage.

Distribution Channel Insights

The manufacturers segment dominated the market, accounting for the largest revenue share in 2025. Manufacturers are increasingly strengthening the adoption of extended warranties through proprietary, branded programs, such as AppleCare and Samsung Care+. By offering coverage under their own brand, OEMs leverage existing customer trust, product familiarity, and perceived service quality. Consumers often view manufacturer-backed warranties as more reliable than third-party alternatives, particularly for complex or premium devices. This direct ownership of the warranty relationship allows manufacturers to control service standards, pricing, and customer experience, while also reinforcing brand loyalty and increasing attachment rates at the point of sale and during product registration.

The retailers segment is anticipated to grow at a significant CAGR over the forecast period. E-commerce platform integration plays a crucial role in driving extended warranty adoption by seamlessly embedding protection plans directly into the online checkout process. Marketplaces and retailer websites prominently display warranty options alongside products, with transparent pricing and concise explanations of coverage benefits. Seamless add-on functionality allows consumers to include protection with a single click, reducing decision friction. This convenience, combined with impulse buying behavior in online retail, significantly increases attachment rates and supports the growth of retailer-led extended warranty sales.

Application Insights

The automobiles segment dominated the market and accounted for the largest revenue share in 2025. Automotive repair and maintenance costs have increased significantly due to the growing complexity of modern vehicles. Advanced electronics, onboard software, sensors, and integrated safety systems require specialized diagnostics and skilled labor, making repairs expensive once the standard warranty expires. Replacement parts for modern vehicles are also costlier, especially for premium and technologically advanced models. Extended warranties help vehicle owners manage these unpredictable expenses by offering financial protection and cost certainty, making them an appealing option for reducing long-term ownership risks.

The consumer electronics segment is anticipated to grow at a significant CAGR over the forecast period. The growing presence of high-value consumer electronics, including smartphones, tablets, laptops, smart TVs, gaming consoles, and premium audio devices, is driving demand for extended warranties. As average selling prices continue to rise, the cost of repairing or replacing these products becomes a significant concern for consumers. Extended protection plans offer a cost-effective way to safeguard these investments, making them increasingly attractive for households seeking financial security and peace of mind.

Sales Channel Insights

The offline segment dominated the market and accounted for the largest revenue share in 2025.Point-of-sale influence drives growth in the offline extended warranty market by leveraging the moment of purchase to encourage additional coverage. Retailers and dealerships can actively promote warranties at checkout, present bundled offers with products, and provide hands-on demonstrations to showcase benefits. Trained sales staff guide customers through options, answer questions, and highlight value, increasing the likelihood of purchase. This direct engagement builds confidence, simplifies decision-making, and effectively upsells warranty plans, making the offline channel a crucial driver of sales and revenue.

The online segment is anticipated to grow at a significant CAGR over the forecast period. Online platforms in the extended warranty market provide 24/7 accessibility, enabling customers to explore, compare, and purchase coverage without needing to visit physical stores. Buyers can review different plans, read user feedback, and make informed choices at their convenience. Tools such as calculators, comparison widgets, and instant quote systems simplify evaluation by clearly presenting costs and benefits, enhancing decision-making. This transparency and ease of use reduce purchase friction, build trust, and encourage more consumers to opt for online warranty solutions.

End-use Insights

The individuals segment dominated the market and accounted for the largest revenue share in 2025. Extended warranty providers are increasingly offering flexible payment plans, allowing individual consumers to spread out the cost of the warranty over time. For example, warranties are often bundled with installment-based purchasing, making it easier for consumers to include warranty protection without incurring a large upfront expense.

The business segment is anticipated to grow at a significant CAGR over the forecast period, driven by the rising complexity of equipment and advanced technologies that require extended warranty coverage to reduce financial risk. These growth patterns reflect a shift toward more customized offerings. While individual consumers are focusing on warranties for personal devices and household appliances, businesses are prioritizing comprehensive plans that protect complex machinery, enterprise equipment, and IT infrastructure.

Regional Insights

The extended warranty market in North America dominated the global market with the largest revenue share of 36.1% in 2025.In North America, consumer awareness and understanding of extended warranties are high due to a mature market and widespread information availability. Buyers recognize the financial protection these warranties provide against repair or replacement costs for electronics, appliances, and vehicles. This informed mindset encourages proactive purchasing, as consumers seek to safeguard their investments and avoid unexpected expenses. Consequently, high awareness directly drives strong demand for extended warranty products across multiple sectors in the region.

U.S. Extended Warranty Market Trends

The extended warranty market in the U.S. is expected to grow significantly at a CAGR of 10.0% from 2026 to 2033.Businesses, particularly SMEs, are major consumers of extended warranties in the U.S. The rising adoption of technology, machinery, and IT infrastructure by small businesses has driven demand for extended warranties to protect these valuable assets. SMEs rely on extended warranties to manage maintenance costs and minimize operational downtime, particularly for essential equipment such as computers, office appliances, and business vehicles.

Europe Extended Warranty Market Trends

The extended warranty market in Europe is anticipated to register a considerable growth from 2026 to 2033. Europe’s extensive vehicle ownership, including a growing number of electric and technologically advanced cars, drives demand for extended warranties. As repair and maintenance costs for these complex vehicles rise, consumers seek financial protection through service contracts. This trend is reinforced by the desire to avoid unexpected expenses and ensure long-term vehicle reliability, making automotive warranties a key growth driver.

The UK extended warranty market is expected to grow rapidly in the coming years. The increasing use of online platforms in the UK allows customers to easily research, compare, and purchase extended warranties at their convenience. This digital accessibility simplifies the buying process, reduces friction, and encourages more consumers to opt for coverage, significantly boosting adoption rates across electronics, appliances, and automotive products.

Extended warranty market in Germany held a substantial market share in 2025. Germany’s advanced automotive sector, including premium and electric vehicles, generates high repair and maintenance costs, encouraging consumers to purchase extended warranties. These warranties provide financial protection and peace of mind, making them essential for vehicle owners. Consequently, strong automotive demand is a key driver of Germany’s extended warranty market growth.

Asia Pacific Extended Warranty Market Trends

Asia Pacific held a significant share in the global market in 2025. The extended warranty market in Asia-Pacific is becoming increasingly competitive, with numerous players entering the space, including traditional insurers, third-party warranty providers, and technology companies. This competition is driving innovation, leading to the development of more flexible and customized warranty products that cater to specific consumer needs. Providers are offering diverse plans that cover various scenarios, including accidental damage, technical support, and on-site repairs.

The Japan extended warranty market is expected to grow rapidly in the coming years. In Japan, consumers prioritize quality, reliability, and long-lasting products, making them more inclined to purchase extended warranties. This preference for long-term protection ensures that high-value electronics, appliances, and vehicles remain covered beyond the manufacturer’s warranty. By investing in extended coverage, buyers gain peace of mind, reduce potential repair costs, and maximize the lifespan and value of their products.

The China extended warranty market held a substantial market share in 2025. The rapid increase in smartphones, laptops, smart home devices, and household appliances in China drives demand for extended warranties. As these high-value products become essential in daily life, consumers seek protection against repair or replacement costs, making extended warranty plans a crucial solution for safeguarding their technology investments.

Southeast Asia extended warranty market is experiencing robust growth as rising consumer electronics ownership and expanding automotive sales drive demand for post-purchase protection services. Although Asia Pacific broadly is the fastest-growing region for extended warranties, including SEA as part of that broader APAC growth trajectory, the increased penetration of smartphones, connected devices, and automobiles in countries such as Indonesia, Thailand, Malaysia, and Singapore is boosting extended warranty adoption, particularly for consumer electronics and vehicle service contracts. Digital channels and e-commerce platforms are becoming key distribution avenues, enabling seamless purchase and claims experiences, while growing consumer awareness of the total cost of ownership and repair risk mitigation strengthens willingness to buy extended warranty plans.

Key Extended Warranty Company Insights:

Key players operating in the extended warranty market includeAssurant, Inc,Asurion,American International Group, Inc., Endurance Warranty Services, LLC andAXA. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In November 2025, Samsung expanded its Samsung Care+ extended warranty program to include home appliances such as refrigerators, washing machines, air conditioners, microwave ovens, and smart TVs in India. The new plans, available from 1 to 4 years at affordable daily rates, offer broader protection, including industry‑first coverage for software updates and screen malfunctions in addition to hardware issues. This gives consumers comprehensive, long‑term peace of mind and easy access to service through certified engineers and support channels.

-

In April 2025, Assurant introduced a vehicle protection plan called Assurant Vehicle Care Technology Plus that goes well beyond traditional extended warranties by combining comprehensive vehicle coverage with smartphone repair benefits. The plan protects advanced vehicle technology such as safety sensors, adaptive cruise control, and infotainment systems as well as wear‑and‑tear parts not typically covered by factory warranties. It also includes Assurant Device Care, offering discounted smartphone repairs, along with emergency roadside assistance and digital tools for managing the service contract.

-

In August 2024, Asurion partnered with Reach, a U.S.-based platform provider specializing in digital connectivity and mobile virtual network enabler (MVNE) solutions. This collaboration aims to offer seamless device protection and trade-in services to small and mid-sized regional operators. By integrating Asurion's services into Reach’s platform marketplace, the partnership provides operators with a valuable revenue stream. It enhances customer retention, streamlines the go-to-market process, and delivers a superior user experience.

Key Extended Warranty Companies:

The following are the leading companies in the extended warranty market. These companies collectively hold the largest Market share and dictate industry trends.

- American International Group, Inc.

- ASSURANT, INC

- Asurion

- AXA,

- CARCHEX, LLC

- Edel Assurance

- Endurance Warranty Services, LLC

- Liberty Mutual Insurance

- Likewize

- SquareTrade, Inc.

Extended Warranty Market Report Scope

Report Attribute

Details

Market size in 2026

USD 159.16 billion

Revenue forecast in 2033

USD 346.51 billion

Growth Rate

CAGR of 11.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Coverage, distribution channel, application, sales channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; SEA; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

American International Group, Inc.; Asurion; AXA; CARCHEX, LLC; Edel Assurance; Endurance Warranty Services, LLC; Liberty Mutual Insurance; Likewize; SquareTrade, Inc.; ASSURANT, INC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extended Warranty Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the extended warranty market report based on coverage, distribution channel, application, sales channel, end-use, and region.

-

Coverage Outlook (Revenue, USD Billion, 2021 - 2033)

-

Standard Protection Plan

-

Accidental Protection Plan

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturers

-

Retailers

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automobiles

-

Passenger vehicles

-

Two-wheelers

-

Others

-

-

Consumer Electronics

-

Personal Devices

-

Smartphones

-

Tablets

-

PCs & Laptops

-

Others

-

-

Home Appliances

-

Refrigerators

-

Washing machine

-

Air conditioners

-

Others

-

-

Others

-

-

Others

-

-

Sales Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Online

-

Offline

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Individuals

-

Business

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South Korea

-

SEA

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global extended warranty market size was estimated at USD 147.13 billion in 2025 and is expected to reach USD 159.16 billion in 2026.

b. The global extended warranty market is expected to grow at a compound annual growth rate of 11.8% from 2026 to 2033 to reach USD 346.51 billion by 2033.

b. Key players operating in the extended warranty market include Assurant, Inc, Asurion, American International Group, Inc., Endurance Warranty Services, LLC and AXA.

b. Rising consumer awareness of high repair and replacement costs is driving demand for extended warranties, particularly for premium electronics and vehicles. As product prices increase and components become more complex, consumers seek protection against unexpected expenses. Greater access to information through digital channels, transparent pricing, and point-of-sale education further encourages buyers to view extended protection plans as a cost-effective way to safeguard long-term investments.

b. The standard protection plan segment accounted for the largest market share of 59.3% in 2025. The rapid growth of consumer electronics and home appliances is expanding the addressable market for standard protection plans. Rising adoption of smartphones, smart TVs, wearables, and large appliances increases the number of high-value devices in use, especially in emerging markets such as India and Southeast Asia.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.