- Home

- »

- Processed & Frozen Foods

- »

-

Europe Plant-based Meat Market Size, Industry Report, 2030GVR Report cover

![Europe Plant-based Meat Market Size, Share & Trends Report]()

Europe Plant-based Meat Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Soy, Pea, Wheat), By Product (Burgers, Sausages, Patties), By Type, By End-user, By Storage, By Region (Country Based), And Segment Forecasts

- Report ID: GVR-4-68040-202-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Plant-based Meat Market Trends

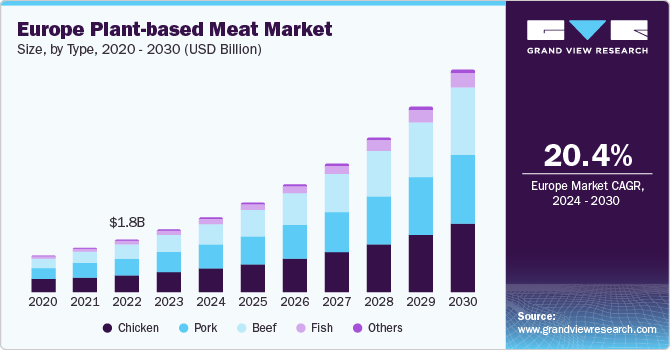

The Europe plant-based meat market size was estimated at USD 2,142.5 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 20.4% from 2024 to 2030. With rising health concerns associated with animal products consumption, increasing prevalence of animal to human transmitted diseases, growing awareness about animal welfare and quality of experience provided by plant-based meat substitutes, huge number of consumers are shifting to meat substitutes while skipping their usual intake of animal products. Young and fitness enthusiast peer groups are identified as primary consumers of plant-based meat alternatives and therefore considered as key market drivers for this segment.

The popularity of meat substitutes sourced from plant-based materials, plant-based patties, and other replacements such as tofu, hummus has reached its highest level, and these alternatives are now preferred by a greater number of customers as suitable replacements to fulfil their daily need of protein and nutrition. However, these products that are developed from plant protein that retains the texture, flavor, and nutritional properties of meat, they are made by the use of non-animal sources. To increase their functionality, desired plant proteins isolated from plants are put through hydrolysis in this process. Further, to create the texture that matches the texture of meat sourced from animals, these plant proteins are combined diligently with other elements such as different types of flour, food adhesives, and plant-based oil. Therefore, the volume leads to greater amounts when it comes to plant-based protein sources and this is identified as one of the key factors assisting the market in its growth.

The consumers, who are opting for plant-based meats in place of real meats sourced from animals, have an extensive range of products available for them. These products are known for their inventive flavors and for providing suitable alternatives for consumer’s dietary requirements. In addition, those who already consume meat in their diets are also opting for frequent inclusion of plant-based meat replacements as they provide various advantages in terms of weight management, concern for animal welfare, long-term environmental sustainability, and more. Furthermore, aspects such as the unending introduction of new flavors backed by constant inventions, formulation of new products, and addition of functional ingredients are assisting the meat substitutes market growth. Several key industry leaders and innovators are initiating strategic partnerships through mergers and acquisitions intending to enhance their product portfolio, expand their market presence, and attain advantageous positions over competitors.

Like every other consumable food product, regulatory authorities have enforced a set of regulations that includes detailed labelling standards. This step ensures much required aspect of transparency and disclosure of correct information regarding the product offering for consumers of meat substitutes.

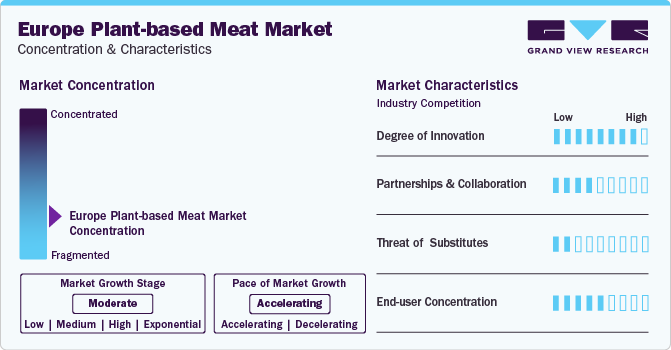

Market Concentration & Characteristics

The market growth in identified as moderate, however, the market is projected to grow at accelerating pace in upcoming years. The industry is characterized by a high degree of innovation due to unending customer specific needs, adoption of product differentiations techniques by key players, increasing number of investments in R&D and more. Every key company operating in the industry is willing to design closer to meat experience for their consumers while not using any ingredients sourced from animals. This develops a challenge which leads to constant research and innovation.

The industry is moderate in terms of merger and acquisitions. The taste secrets, ingredients and technologies used by brands and companies operating in the Europe plant-based meat market are of greater significance and this leads to less amount of mergers in the industry. Threat of substitutes is almost at lowest level as meat substitutes are primarily extracted from plant-based ingredients.

In terms of end user concentration, the market is poised to grow in both sub-segments of end-user category. Retail and HORECA sales for plant-based meat in Europe are expected to share very less difference.

Source Insights

The soy-based meat sub-segment lead the market and held market share of 48.63% in 2023. Soy is identified as rich source of branch amino acids (BCAAs). Its ability to provide variety of advantages to its consumers such as enhanced performance in exercises and sports, quicker recoveries from tiring workout sessions, assistance in strengthening muscle and mass is expected to help the sub-segment in maintaining its course for growth. Soy products are known for having lower carbon footprint as compared to traditional animal products and dairy-based items. Soy-based meats also bring in various other advantages with it such as convenience. It is microwaveable and can be sliced according to requirements of consumers.

Furthermore, chicken, beef, or pork-based products are widely been replaced by pea-based meat substitutes. Its high resemblance in texture, equivalent nutritional values, easy availability, and least preparation time are some of the key driving factors that are most likely to assist the pea-based sub-segment to grow at the fastest pace and CAGR of 21.7% from 2024 to 2030.

Product Insights

On the basis of product, the Europe plant-based meat market has been segmented into burgers, sausages, patties, nuggets, tenders & cutlets, grounds, and others. In this, Plant-based burgers dominated the market with share of 33.53% in 2023. Ingredients incorporated in this are known to match texture, aroma and flavor of original meat burgers. Variety of plant-based burgers are offered by key companies to attract more and more consumers, even from pool of omnivores. Some of the key companies that offer these plant based products include Kellogg NA Co., Quorn, VBites Foods Limited, Beyond Meats, Impossible Foods, Maple Leaf Foods (Field Roast & Maple Leaf), Vegetarian Butcher, Taifun -Tofu GmbH, Gold&Green Foods Ltd., and Plant & Bean Ltd.

In the product segment, sausages as sub-segment is growing at highest CAGR of 21.6%. These sausages are designed in such a way that they can imitate look and texture of the traditional sausages. Companies like Beyond Meat are developing such sausages by including ingredients such as water, pea protein, cocoa butter, rice protein, coconut oil, fruit and vegetable concentrates (beetroot, carrot, pomegranate), apple extract, and onion powder.

Type Insights

The plant-based chicken segment led the market and accounted for a 32.23% share of the europe revenue in 2022. Some of the most popular foods in traditional meat industry, such as nuggets, patties, and cutlets, are made out of chicken, as it is filled with elements like animal fats, cholesterol, and protein as well. While in comparison, the plant-based chicken products can provide the similar amounts of proteins.

The market also offers plant-based pork products to its consumers. These products, which are often developed from soy and pea protein, are considered to be very high in fiber and protein contents, and known to have no cholesterol and low amounts of fat. Vegetarian Butcher is one of the key manufacturers of such products.

Like every other industry, Europe plant-based meat market experiences entry of new product every now and then. In order to cater to niche, specific requirements of the customers, and to attain competitive advantage. For instance, in September 2023, MorningStar Farms, a division of the Kellogg Company, which produces vegan and vegetarian food products for the market, announced addition of steakhouse style premium plant-based burger that designed to mimic taste and juicy texture of beef burgers. These are available in frozen and ready to use forms.

End User Insights

The hotel/Restaurant/Café (HORECA) segment led the market and accounted for 54.86% share of the europe revenue in 2023. With growing adoption of vegan and flexitarian diets, several restaurants, QSR chains, and casual dining venues are devoting an entire section of their list of menus purely to “meat-free” alternatives, which is most likely to drive the market growth in upcoming years. Key players in the industry are pouncing on the opportunities in the period of transition, where shifting consumer preferences and the rising demand for a more personable, tailored service are becoming a trend.

Furthermore, products such as burgers, nuggets, and strips are attaining lot of attentions from fast-food restaurant chains as they serve prime customers of plant-based meat made dishes. However, retail section of the segment is growing at fastest CAGR of 20.8% and is expected to maintain the momentum with the help of increased shelf space for plant-based products in modern groceries.

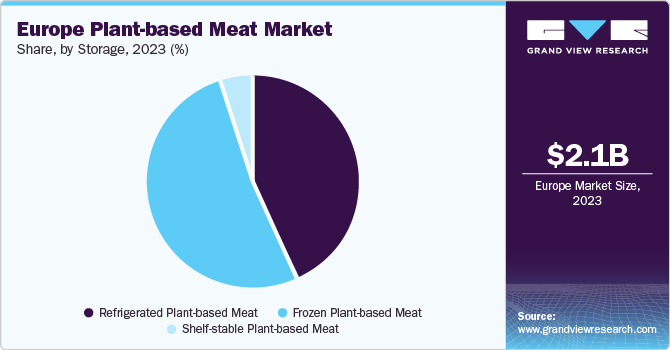

Storage Insights

The frozen plant-based meat product segment dominated the market and held the share of 53.30% of region’s total revenue in 2023. The rising demand for inventive vegan and plant-based meat products has resulted in a substantial rise in new product development across this sub-segment. This leads to wide range of products occupying the shelves of supermarkets and grocery stores, which in turn provides the enhanced visibility of brands operating in plant-based meat market.

The refrigerated plant-based meat products segment is projected to attain the quickest growth and is most likely to grow at a CAGR of 20.9% from 2024 to 2030. Various aspects backing such a trend are meat scarcities across various parts and concerns over the pandemic outbreak reportedly from meat processing facilities.

Regional Insights

Germany plant-based meat market held a share of 32.62 % of the Europe plant-based meat market revenue in 2023 and projected to grow at a CAGR of 21.3%. The second largest market share was held by the UK; however, France market showed faster growth rate than UK in 2023. Peas, faba beans, and rapeseed are examples of crops that are being developed with an intent to enhance the yield and downstream incorporation in plant-based meats. Key companies and institutes in Europe are primarily concentrating on nutrition and health research and new product formulation as well.

Key Europe Plant-based Meat Market Company Insights

Contrary to earlier scenario, increasing number of players competing for greater market share and increased revenue figures characterizes the Europe plant-based meat market. This has developed a competitive scenario where almost every company is investing in aspects such as innovation, research & development, diversified portfolios and more. In addition, the regional market is gaining attention from Europe players as well due to unceasing number of consumers shifting their diets to vegan trends. For instance, in October 2022, JBS SA-owned plant-based meat company, Planterra discontinues its operations in the U.S. with an intent to focus on budding alternative protein markets of European countries.

Key Europe Plant-based Meat Companies:

The following are the leading companies in the Europe plant-based meat market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Europe plant-based meat companies are analyzed to map the supply network.

- Impossible Foods Inc.

- Beyond Meats

- Kellogg NA Co.

- Quorn

- VBites Foods Limited

- Maple Leaf Foods (Field Roast & Maple Leaf)

- Vegetarian Butcher

- Gold&Green Foods Ltd.

- Plant & Bean Ltd.

- Taifun-Tofu GmbH

Recent Developments

-

In September 2023, MorningStar Farms, a division of the Kellogg Company, which produces vegan and vegetarian food products for the market, announced addition of steakhouse style premium plant-based burger that designed to mimic taste and juicy texture of beef burgers. These are available in frozen and ready to use forms.

-

In August 2023, Beyond Meat commenced with an expansion initiative for its burger portfolio, by launch of its latest product innovation, the Beyond Stack Burger™. The patty in this burger is designed to reach beef like taste and texture, which can be used for stacked burgers. This was newest addition to market leader’s portfolio of products, which have gained lot of popularity in recent past.

Europe Healthy Snacks Market Scope

Report Attribute

Details

Revenue forecast in 2030

USD 7,834.4 million

Growth Rate

CAGR of 20.4% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, products, types, storage, end users and region

Key companies profiled

Impossible Foods Inc.; Beyond Meats; Kellogg NA Co.; Quorn; VBites Foods Limited; Maple Leaf Foods (Field Roast & Maple Leaf); Vegetarian Butcher; Gold&Green Foods Ltd.; Plant & Bean Ltd.; Taifun-Tofu GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Europe Plant-based Meat Market Report Segmentation

This report forecasts revenue growth at the Europe, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the Europe plant-based meat market report based on source, product, type, end-user, storage, and region:

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Soy

-

Pea

-

Wheat

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Burgers

-

Sausages

-

Patties

-

Nuggets, Tenders & Cutlets

-

Grounds

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

HORECA (Hotel/Restaurant/Café)

-

-

Storage Outlook (Revenue, USD Million, 2017 - 2030)

-

Refrigerated Plant-based Meat

-

Frozen Plant-based Meat

-

Shelf-stable Plant-based Meat

-

-

Region Outlook (Revenue, USD Million, 2017 - 2030)

-

Germany

-

UK

-

France

-

The Netherlands

-

Italy

-

Rest of Europe

-

Frequently Asked Questions About This Report

b. The Europe plant-based meat market size was estimated at USD 2,142.5 million in 2023 and is expected to reach USD 2.57 million in 2024.

b. The Europe plant-based meat market is expected to grow at a compound annual growth rate of 20.4% from 2024 to 2030 to reach USD 7,834.4 million by 2030.

b. Germany dominated the Europe plant-based meat market with a share of more than 32.6% in 2023. The plant-based meat is gaining significant popularity in Germany mainly due to the continuous growth plant-based food trend.

b. Some key players operating in the Europe plant-based meat market include Impossible Foods Inc.; Beyond Meats; Kellogg NA Co.; Quorn; VBites Foods Limited; Maple Leaf Foods (Field Roast & Maple Leaf); Vegetarian Butcher; Gold&Green Foods Ltd.; Plant & Bean Ltd.; Taifun-Tofu GmbH.

b. Key factors that are driving the Europe plant-based meat market growth include rising health concerns associated with animal products consumption, increasing prevalence of animal to human transmitted diseases, growing awareness about animal welfare and quality of experience provided by plant-based meat substitutes, huge number of consumers are shifting to meat substitutes while skipping their usual intake of animal products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.