- Home

- »

- Medical Devices

- »

-

Europe Pharmaceutical Analytical Testing Services In CRO Market, 2030GVR Report cover

![Europe Pharmaceutical Analytical Testing Services In CRO Market Size, Share & Trends Report]()

Europe Pharmaceutical Analytical Testing Services In CRO Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Bioanalytical Testing, Stability Testing, Method Development & Validation), By End-use (Pharmaceutical Companies), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-530-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

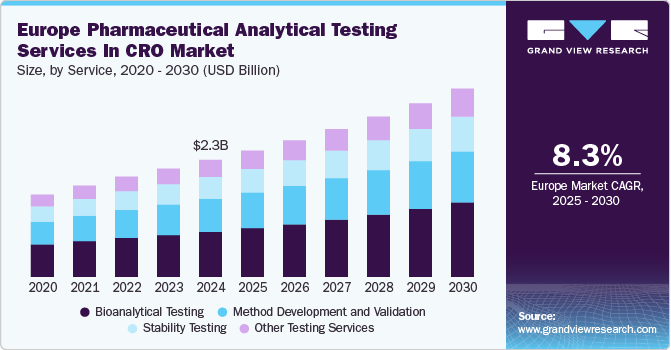

The Europe pharmaceutical analytical testing services in CRO market size was estimated at USD 2.3 billion in 2024 and is projected to grow at a CAGR of 8.34% from 2025 to 2030. The increasing demand for outsourcing analytical testing services among pharmaceutical companies, driven by stringent regulatory requirements and the need for cost-effective solutions, is a key factor contributing to market growth. Advancements in analytical testing are improving accuracy and efficiency, further supporting the market's expansion.

The industry has been advancing at a rapid pace due to an increasing demand for the analytical testing of biologics and biosimilars. The increasing incidence rate of chronic disorders such as inflammatory bowel diseases, cancer, and rheumatoid arthritis has emphasized the need for biologics.

The presence of advanced bioanalytical testing service facilities in Europe has led to noticeable improvements in areas such as drug development & clinical research, driving market expansion. These services comprise a vital aspect of the analysis of pharmaceutical compounds, such as biologics and small molecules, with leading providers offering methods such as immunoassays, chromatography, and biomarker analysis.

Technological advancements are improving the precision, efficiency, and cost-effectiveness of analytical testing services. Enhanced methodologies allow for comprehensive quality assessments, ensuring drug safety and efficacy throughout the development lifecycle. Growing investments in research and development, along with strategic collaborations between pharmaceutical companies and CROs, are expected to further drive market growth. With an increasing focus on regulatory compliance and streamlined drug development processes, the demand for analytical testing services is anticipated to rise steadily.

Service Insights

Bioanalytical testing dominated the market, accounting for a share of 38.5% in 2024, and is expected to grow at a rapid CAGR during the forecast period. Europe is a leading region in terms of drug development, making it a significant opportunity for companies involved in offering bioanalytical testing services to establish their operational base. The increasing focus on understanding drug performance, as well as ensuring its approval and commercialization, is a major driver for this market. Additionally, the rising importance of personalized patient care and medicine has further highlighted the necessity for these solutions in European economies.

Stability testing is expected to witness a significant CAGR over the forecast period. It plays a key role in assessing the impact of environmental factors on pharmaceutical products, ensuring their potency, safety, and shelf life. By analyzing chemical, physical, and microbiological stability, these tests help maintain product efficacy throughout its lifecycle. The growing demand for biologics and complex formulations has increased the need for advanced stability studies to meet regulatory standards. With rising research investments and advancements in analytical methodologies, stability testing is gaining prominence in pharmaceutical development. As outsourcing trends continue to rise, CROs are expanding their capabilities, reinforcing the role of stability testing in the evolving landscape of European pharmaceutical analytical testing services in the CRO industry.

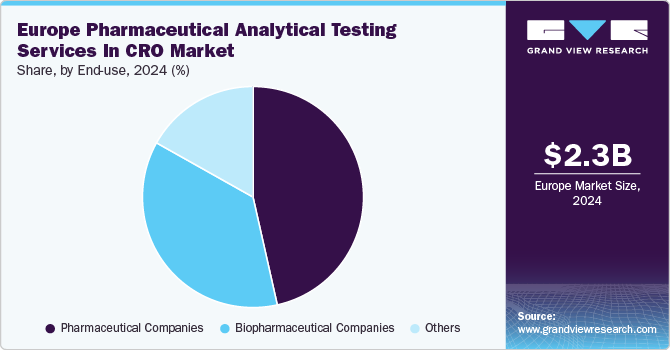

End-use Insights

Pharmaceutical companies dominated the market with a revenue share of 46.5% in 2024. These companies drive the European pharmaceutical analytical testing services in the CRO industry by outsourcing analytical testing to ensure drug safety, efficacy, and regulatory compliance. The increasing complexity of drug formulations and the rising demand for biologics have led pharmaceutical firms to rely on specialized testing services for quality assurance. The growing need for cost-effective solutions and stringent regulatory requirements has further accelerated outsourcing trends.

Biopharmaceutical companies are expected to grow at the fastest CAGR of 9.6% over the forecast period. Stringent regulatory requirements necessitate rigorous quality control assessments, leading biopharmaceutical firms to outsource analytical testing to CROs with expertise in compliance. Advancements in bioassays, stability testing, and impurity profiling enhance the ability to analyze complex biopharmaceutical products, making outsourcing a preferred choice for efficient testing. In addition, growing research and development investments and the introduction of new biopharmaceutical products further support market growth.

Country Insights

Germany's Pharmaceutical Analytical Testing Services In CRO Market Trends

Germany's pharmaceutical analytical testing services in the CRO market dominated the region with a revenue share of 16.4% in 2024. The market's expansion is driven by the country's strong pharmaceutical research infrastructure and the demand for analytical testing services to support drug development and regulatory compliance. The increasing focus on quality control and safety assessments in pharmaceutical manufacturing further contributes to market growth.

In December 2023, the German government introduced a Pharmaceutical Strategy to strengthen the nation's pharmaceutical sector. This initiative accelerates clinical research through a model clinical trial agreement, incentivizes the domestic manufacturing of essential medicines, and advances digital healthcare with a dedicated health data space.

UK Pharmaceutical Analytical Testing Services In CRO Market Trends

The pharmaceutical analytical testing services in the CRO market in the UK is expected to witness the fastest growth, with a projected CAGR of 10.9% over the forecast period. The UK’s strong life science sector and government initiatives to foster pharmaceutical research and innovation support the market expansion. For instance, in October 2024, the UK established the Regulatory Innovation Office (RIO) to enhance efficiency within agencies such as the MHRA. This initiative aims to streamline regulatory processes and support pharmaceutical research and innovation.

Key Europe Pharmaceutical Analytical Testing Services In CRO Company Insights

Some key companies operating in the European pharmaceutical analytical testing services in the CRO industry are SGS Société Générale de Surveillance SA, Eurofins Scientific, Sofpromed, Worldwide Clinical Trials, GalChimia, and Evotec. These organizations compete with each other and other regional companies to generate higher revenues and boost their contribution.

-

Worldwide Clinical Trials is a key player in the European pharmaceutical analytical testing services in the CRO industry. The company offers comprehensive contract research services to support pharmaceutical and biopharmaceutical development.

-

Evotec is a key player in the European pharmaceutical analytical testing services in the CRO industry, providing advanced drug discovery and development solutions. The company specializes in high-throughput screening, biomarker discovery, and bioanalytical testing, supporting pharmaceutical and biopharmaceutical firms in optimizing drug development processes.

Key Europe Pharmaceutical Analytical Testing Services In CRO Companies:

- SGS Société Générale de Surveillance SA

- Worldwide Clinical Trials

- Sofpromed

- ClinChoice

- Evotec

- Eurofins Scientific

- KYMOS Group

- ViviaBiotech S.L.

- GalChimia

- TCI Laboratories

- Cotecna (NEOTRON SpA,)

- Tentamus

- Enzymlogic

- Pharmbiotest

- UNIFARM - Research Centre

- ANAPHARM EUROPE, S.L.U

Recent Developments

-

In December 2024, Eurofins Scientific introduced a new quantitative PCR (qPCR) service to enhance bioanalytical testing for pharmaceutical and clinical research. This service supports drug development by providing precise and regulatory-compliant testing for biomarker analysis, gene expression studies, and quality control.

-

In September 2024, Evotec partnered with X-Chem to enhance drug discovery capabilities. This collaboration grants Evotec access to X-Chem’s DNA-encoded library (DEL) technology, including the DELflex platform and HITMiner, a machine-learning solution.

Europe Pharmaceutical Analytical Testing Services In CRO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.50 billion

Revenue forecast in 2030

USD 3.73 billion

Growth rate

CAGR of 8.34% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Service, end-use, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Poland; Switzerland; Austria; Czech Republic; Croatia; Slovenia; Greece

Key companies profiled

SGS Société Générale de Surveillance SA; Worldwide Clinical Trials; Sofpromed; ClinChoice; Evotec; Eurofins Scientific; KYMOS Group; ViviaBiotech S.L.; GalChimia; TCI Laboratories; Cotecna (NEOTRON SpA,); Tentamus; Enzymlogic; Pharmbiotest; UNIFARM - Research Centre; ANAPHARM EUROPE, S.L.U

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Pharmaceutical Analytical Testing Services In CRO Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pharmaceutical analytical testing services in CRO market report based on service, end use, and country:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioanalytical Testing

-

Clinical

-

Non- Clinical

-

-

Method Development and Validation

-

Extractable and Leachable

-

Impurity Method

-

Technical Consulting

-

Other Method Validation Services

-

-

Stability Testing

-

Drug Substance

-

Stability Indicating Method Validation

-

Accelerated Stability Testing

-

Photostability Testing

-

Other Stability Testing Services

-

-

Other Testing Services

-

-

End Use (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Poland

-

Switzerland

-

Austria

-

Czech Republic

-

Croatia

-

Slovenia

-

Greece

-

-

Frequently Asked Questions About This Report

b. The Europe pharmaceutical analytical testing services in CRO market size was valued at USD 2.3 billion in 2024 and is expected to reach USD 2.5 billion in 2025.

b. The Europe pharmaceutical analytical testing services in CRO market is projected to grow at a CAGR of 8.3% from 2025 to 2030 to reach USD 3.73 billion by 2030.

b. Bioanalytical testing dominated the market, accounting for a share of 38.5% in 2024, and is expected to grow at a rapid CAGR during the forecast period.

b. Some of the key companies operating in the European pharmaceutical analytical testing services in the CRO market are SGS Société Générale de Surveillance SA, Eurofins Scientific, Sofpromed, Worldwide Clinical Trials, GalChimia, and Evotec.

b. The increasing demand for outsourcing analytical testing services among pharmaceutical companies, driven by stringent regulatory requirements and the need for cost-effective solutions, is a key factor contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.