- Home

- »

- Pharmaceuticals

- »

-

Europe Nutrition And Supplements Market, Industry Report, 2030GVR Report cover

![Europe Nutrition And Supplements Market Size, Share & Trends Report]()

Europe Nutrition And Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report, By Product (Sports Nutrition, Fat Burners), By Formulation, By Consumer Group, By Application, By Sales Channel, And Segment Forecasts

- Report ID: GVR-2-68038-373-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

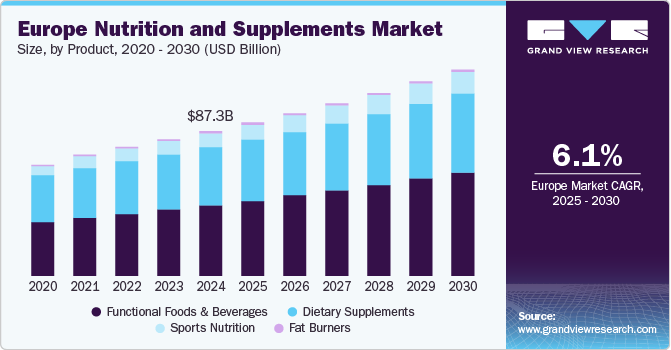

The Europe nutrition and supplements market size was estimated at USD 87.33 billion in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2030. This growth is driven by increasing consumer health and wellness awareness, rising disposable incomes, and a growing preference for preventive healthcare measures. Factors such as the aging population, increased prevalence of chronic diseases, and demand for natural, organic, and personalized supplements also contribute to market expansion. In addition, e-commerce and digital marketing advancements have made supplements more accessible, further boosting regional sales.

The COVID-19 pandemic initially had a negative impact on the market, but it later experienced significant growth. During the pandemic, demand for nutritional and dietary supplements surged across Europe, allowing the market to thrive despite transport restrictions and supply chain disruptions. An increase in health consciousness among consumers led to a rise in online health clubs and a boost in supplement sales through e-commerce platforms. Retail stores also saw higher foot traffic, with many consumers purchasing vitamins and immune-boosting supplements as a precautionary measure against COVID-19. This surge in demand is expected to continue driving market growth in the coming years.

Nutritional supplements have become a popular way to boost immunity across all age groups, with growing demand for essential vitamins and micronutrients to support health goals. This trend gained significant momentum during the COVID-19 pandemic, driving an increase in supplement consumption. The rising prevalence of obesity, which contributes to higher rates of non-communicable diseases such as diabetes, hypertension, and cardiovascular issues, has further fueled the demand for supplements focused on overall wellness. These factors have played a key role in driving market growth.

Moreover, European countries have witnessed a surge in demand for multivitamins and immune-boosting supplements. The shift towards a more health-conscious mindset, coupled with a holistic approach to fitness through functional foods and nutritional supplements, gained significant momentum during the pandemic. Regulatory authorities across Europe have streamlined the approval process for nutritional supplements and functional foods, positively impacting market growth. Recent amendments and regulatory changes have simplified the approval process, making it easier for new products to enter the market and meet consumer demand.

Product Insights

The functional foods and beverages segment held the largest revenue share of 48.90% in 2024. This segment, including probiotics, omega-3, and similar products, has seen significant growth due to a shift in consumer focus toward health and wellness. More people are incorporating these products into their diets to reduce the risk of chronic conditions such as cardiovascular diseases, diabetes, and other health issues. This growing awareness and adoption are driving market expansion.

The sports nutrition segment is expected to grow at the fastest CAGR of 7.3% during the forecast years. This growth can be attributed to the rising number of teenagers prioritizing health and fitness as part of a healthy lifestyle. People are increasingly incorporating physical activity and sports into their routines to achieve fitness goals and prevent diseases related to a sedentary lifestyle. Furthermore, introducing new products in the sports nutrition segment has played a significant role in driving market expansion.

Formulation Insights

The powder segment held the largest revenue share of over 38.12% in 2024. The availability of a wide range of powder-based products for all age groups has been a key driver for this segment's growth. Powder formulations are easily absorbed by the body, making them popular among sports enthusiasts and professional athletes. These products come in various flavors and can be used in different preparations, offering versatility. Factors such as ease of consumption and widespread availability have significantly contributed to the segment’s growth.

The capsule segment is expected to grow at the fastest CAGR of 8.4% during the forecast years. Capsule formulations are preferred by individuals who dislike the taste of powder or soft chew supplements. They offer flexibility in dosage to suit individual needs and are gentler on the gastrointestinal tract. However, the main challenges include the shorter shelf life of active ingredients and the higher manufacturing costs, which have hindered the growth of this segment.

Application Insights

Weight management held the largest share of 23.94% in the European nutrition and supplements industry in 2024. This is attributed to the growing concern over obesity and lifestyle-related diseases, leading to an increased focus on weight control and healthier body composition. Consumers increasingly turn to dietary supplements, such as fat burners, appetite suppressants, and meal replacement products, to support their weight management goals. In addition, rising health awareness and the availability of personalized weight management solutions have driven strong demand in this segment.

Sports & athletics is expected to grow at the highest CAGR of 11.2% over the forecast period. This growth is driven by increased participation in sports and physical activities and a growing focus on performance enhancement and recovery. Athletes and fitness enthusiasts increasingly turn to nutritional supplements, such as protein powders, amino acids, and energy boosters, to optimize performance, improve endurance, and accelerate recovery. Furthermore, the rise of fitness culture and awareness of the benefits of sports nutrition are contributing to the growing demand in this segment.

Consumer Group Insights

Adults held the largest revenue share in the European nutrition and supplements industry in 2024. This is primarily due to the increasing awareness among adult consumers about the importance of maintaining good health through dietary supplements. Adults are increasingly investing in products that support immunity, energy, and overall wellness, driven by factors such as busy lifestyles, aging, and the desire to prevent chronic health conditions. Moreover, the availability of tailored supplements to address specific health concerns further contributed to the dominant revenue share from this demographic.

The geriatric segment is expected to grow significantly over the coming years. This growth is driven by the aging population across Europe, with older adults increasingly seeking supplements to address age-related health issues such as joint pain, bone health, cognitive function, and immunity. As the demand for products that promote healthy aging and manage chronic conditions rises, the geriatric segment is becoming a key focus for market expansion. In addition, greater awareness of the role of nutrition in maintaining overall well-being in later years is further fueling this growth.

Sales Channel Insights

The brick-and-mortar sales channel segment dominated the industry for nutrition and supplements and held a revenue share in 2024. This is attributed to the widespread consumer preference for in-store shopping, where they can physically assess products, receive expert advice, and make immediate purchases. In addition, the convenience of purchasing from retail stores, combined with the trust established by established brands, continues to drive consumer traffic and sales in this segment.

The e-commerce segment is expected to grow at the fastest CAGR during the forecast years. This growth is attributed to the increasing shift toward online shopping, driven by the convenience of purchasing from home, a wider range of product options, and competitive pricing. The growing use of mobile devices, digital platforms, and enhanced delivery services has further boosted consumer confidence in online transactions. Moreover, targeted marketing, easy product comparison, and direct-to-consumer sales models contribute to the e-commerce segment's rapid expansion.

Country Insights

UK Nutrition and Supplements Industry Trends

In 2024, the nutrition and supplements market in the UK held the largest revenue share in Europe. This is attributed to the country's strong consumer demand for health and wellness products, driven by an increasing focus on preventive healthcare and a growing awareness of the benefits of dietary supplements. The UK market is also characterized by a high level of e-commerce adoption, with more consumers opting for the convenience of online shopping for supplements. Furthermore, the rise in fitness culture, along with the popularity of immune-boosting and weight-management products, has significantly contributed to the UK’s dominant market position.

Germany Nutrition and Supplements Industry Trends

The nutrition and supplements market in Germany is growing rapidly, driven by increasing consumer focus on health and wellness. There is a strong demand for natural and organic supplements, with consumers preferring plant-based, non-GMO, and gluten-free options. Probiotics, vitamins, and immune-boosting supplements are particularly popular, partly due to the impact of the COVID-19 pandemic. Online sales are also booming, as more people turn to e-commerce for convenience and a wider product selection. Moreover, sports nutrition products are seeing rising demand as fitness culture continues to grow.

France Nutrition and Supplements Industry Trends

The nutrition and supplements market in France held a significant revenue share in the European market. This is due to the growing awareness among French consumers about the importance of maintaining a healthy lifestyle through proper nutrition and supplementation. The demand for natural, organic, and locally sourced supplements is strong, with consumers seeking products to support immunity, digestive health, and overall wellness. In addition, the increasing popularity of sports nutrition and weight management supplements, combined with the country's well-established retail and e-commerce channels, has contributed to France's strong market position.

Key Europe Nutrition And Supplements Company Insights

The European nutrition and supplements industry has many international companies as well as domestic players. These companies' product offerings aim to provide complete nutritional value and improved therapeutic value products. Multilevel marketing companies, as well as big multinational companies, are present in the regional market. The most recent trend in product offerings across the region has been that of functional foods, which have captured a large proportion of the market owing to their health benefits.

Key Europe Nutrition And Supplements Companies:

- Herbalife International of America, Inc.

- Amway

- Bayer AG

- Sanofi

- Abbott

- Nestle

- Pfizer

- General Nutrition Centers, Inc.

- LivaNova PLC

Recent Developments

-

In November 2024, Hong Kong-based biotechnology start-up Prenetics, in partnership with UK football star David Beckham, launched their new health and wellness brand, IM8. The brand will offer two premium products, Daily Ultimate Essentials, and Daily Ultimate Longevity, available for purchase on its online store, with shipping to the UK and 30 other countries.

-

In November 2024, Nestlé Health Science launched a new range of Garden of Life probiotics in the UK and Ireland. For the first time, these products are available in over 600 Holland & Barrett stores and online, marking a major brand expansion in these markets.

-

In November 2024, Abbott announced the opening of a state-of-the-art global manufacturing facility in Kilkenny, Ireland. The site is part of a €440 million (USD 458.6 million) investment in two locations in Ireland focusing on diabetes technology production.

Europe Nutrition And Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 92.54 billion

Revenue forecast in 2030

USD 124.46 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, formulation, sales channel, application, consumer group, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Herbalife International of America, Inc.; Amway; Bayer AG; Sanofi; Abbott; Nestle; Pfizer; General Nutrition Centers, Inc.; LivaNova PLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Europe Nutrition And Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe nutrition and supplements market based on product, formulation, sales channel, consumer group, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Sports Supplements

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentil Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamin

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acids

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega -3 fatty acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Food

-

Protein Bars

-

Energy Bars

-

Protein Gels

-

-

Meal Replacement Products

-

Weight Loss Products

-

-

Fat Burners

-

Green Tea

-

Fiber

-

Protein

-

Green Coffee

-

Others

-

-

Dietary Supplements

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

-

Minerals

-

Enzymes

-

Amino Acids

-

Conjugated Linoleic Acids

-

Others

-

-

Functional Foods & Beverages

-

Probiotics

-

Omega -3

-

Others

-

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick & Mortar

-

Direct Selling

-

Chemist/Pharmacies

-

Health Food Shops

-

Hyper Markets

-

Super Markets

-

-

E-commerce

-

-

Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Infants

-

Children

-

Adults

-

21-30 years

-

31-40 years

-

41-50 years

-

51-65 years

-

-

Pregnant

-

Geriatric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports & Athletics

-

General Health

-

Bone & Joint Health

-

Brain Health

-

Gastrointestinal Health

-

Immune Health

-

Cardiovascular Health

-

Skin/Hair/Nails

-

Sexual Health

-

Women’s Health

-

Anti-aging

-

Weight Management

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe nutrition and supplements market size was estimated at USD 87.33 billion in 2024 and is expected to reach USD 92.54 billion in 2025.

b. The Europe nutrition and supplements market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 124.46 billion by 2030.

b. The powder segment dominated the Europe nutrition and supplements market with a share of 38.12% in 2024. This is attributable to the easy availability of these products in pure forms and controlled dosage.

b. Some key players operating in the Europe nutrition and supplements market include Amway; Bayer AG; Sanofi; Abbott; Nestle; Pfizer; General Nutrition Centers, Inc.; LivaNova PLC

b. Key factors that are driving the Europe nutrition and supplements market growth include the availability of a large number of commercialized products coupled with the presence of a wide base of target consumers, growing health consciousness among consumers, and increasing willingness to spend on nutrition and dietary supplements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.