- Home

- »

- Consumer F&B

- »

-

Europe Nutraceuticals Market Size, Industry Report, 2030GVR Report cover

![Europe Nutraceuticals Market Size, Share & Trends Report]()

Europe Nutraceuticals Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel (Offline, Online), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-503-4

- Number of Report Pages: 165

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Nutraceuticals Market Size & Trends

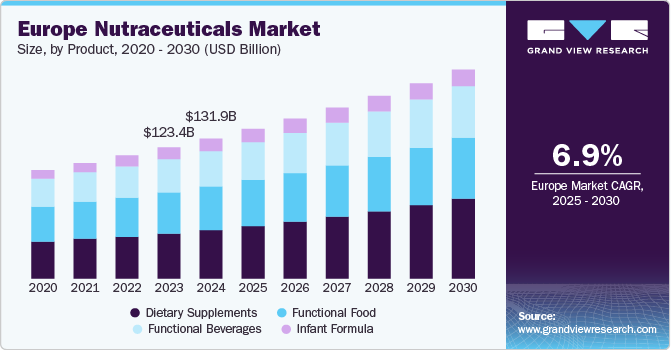

The Europe nutraceuticals market size was estimated at USD 131.9 billion in 2024 and is anticipated to grow at a CAGR of 6.9% from 2025 to 2030. The market growth is attributed to the growing focus on preventative health and overall well-being. Consumers are increasingly proactive about their health, seeking natural solutions to manage stress, boost energy, and support immune function. This trend is fueled by an aging population, rising healthcare costs, and greater access to health information through online sources. Specifically, demand is high for supplements like vitamins, minerals, and omega-3 fatty acids, often marketed for daily wellness and long-term health benefits. Beyond traditional formats, consumers are also drawn to functional foods and beverages fortified with nutrients that seamlessly integrate into their lifestyles, reflecting a desire for convenient and effective health solutions.

The escalating rates of obesity and digestive issues are major factors fueling the demand for nutraceuticals focused on weight management and digestive health. Consumers are looking for products that support healthy metabolism, manage appetite, and improve gut microbiome balance. This includes weight-loss supplements, appetite suppressants, probiotic and prebiotic formulations, and dietary fibers. The preference for natural ingredients and less restrictive approaches to weight management, compared to conventional diets, is also a notable trend, driving innovation toward products that support overall digestive wellness rather than solely focusing on weight loss. Consumers are also becoming more aware of how the gut microbiome impacts their health, resulting in a more nuanced approach to digestive health.

The demand for sports nutrition nutraceuticals is experiencing robust growth, driven by the expanding fitness culture and a heightened focus on athletic performance at both amateur and professional levels. The demand for protein powders, energy bars, and specialized supplements aimed at muscle building, recovery, and endurance is continuously rising. Moreover, there’s a growing interest in plant-based protein sources and personalized nutrition plans tailored to individual fitness goals. Social media influencers and fitness communities play a crucial role in promoting these products, shaping consumer preferences, and fostering a community-driven consumption pattern within this segment. The trend toward clean labels and natural ingredients further reinforces consumer confidence and drives product innovation.

The growing awareness of the link between diet and cognitive function is fueling demand for nutraceuticals targeting brain health and mental performance. Products containing nutrients like omega-3 fatty acids, B vitamins, and antioxidants are gaining popularity for their purported ability to enhance focus, memory, and overall cognitive function. Moreover, the "beauty from within" concept is driving the consumption of collagen peptides, antioxidants, and vitamins that are claimed to support healthy skin, hair, and nails. Furthermore, consumers are increasingly seeing supplements as part of a holistic beauty routine, and this is creating a strong demand for products that address specific beauty concerns from the inside out.

Technological advancements are significantly influencing the Europe nutraceuticals industry, especially in terms of improved product delivery and efficacy. Innovations in areas like nanoencapsulation and liposomal technology are gaining traction, allowing for better absorption and bioavailability of active ingredients. This means that smaller doses of nutrients can have a greater impact, addressing consumer concerns about product effectiveness. Moreover, the growth in research and development surrounding probiotics and prebiotics, with an advanced understanding of gut health, is leading to more targeted and effective formulations for digestive health and overall immunity. These technologies are not only improving existing products but also opening doors for new, innovative applications in areas like cognitive health and beauty from within.

Product Insights

The dietary supplements market segment accounted for a revenue share of 34.6% in 2024, fueled by a rising awareness of preventive healthcare and the desire for self-management of well-being. A significant trend is the increasing consumer preference for natural, organic, and plant-based supplements, driven by concerns over synthetic ingredients and a focus on clean-label products. Demand is further boosted by an aging population seeking to maintain vitality and address age-related health concerns, alongside a younger generation proactively seeking to optimize their health and performance through targeted supplementation. Personalized nutrition, delivered through customized supplement formulations and convenient delivery formats like gummies and powders, is also gaining significant traction. Furthermore, the pandemic has heightened awareness of immune system support, leading to a surge in demand for vitamins, minerals, and herbal supplements with immune-boosting properties.

The functional beverages market segment is anticipated to witness a growth rate of 6.5% from 2025 to 2030, propelled by a shift away from sugary drinks and a growing interest in beverages that offer specific health benefits. Consumers are actively seeking alternatives that are low in sugar, naturally sourced, and provide added functionality like energy enhancement, cognitive support, or improved digestion. This has led to increased demand for beverages fortified with vitamins, minerals, probiotics, and adaptogens. The market is seeing a rise in the popularity of categories like kombucha, sparkling waters with added benefits, protein shakes, and plant-based milk alternatives. Convenience and on-the-go consumption are also key demand drivers, fostering innovation in packaging and product formats. Another trend is the focus on transparency and ethical sourcing, with brands emphasizing sustainable ingredients and clear labeling.

Application Insights

The infant health application accounted for a revenue share of 15.8% in the Europe nutraceuticals market in 2024, fueled by increased parental awareness of the importance of early-life nutrition. Demand is driven by a preference for products containing essential fatty acids like DHA and ARA, known to support brain and visual development, as well as probiotics and prebiotics to foster healthy gut microbiota. Furthermore, stringent regulations and rising rates of breastfeeding support are pushing innovation toward formulas and fortified foods that mimic breast milk more closely. Parents are also increasingly seeking organic and clean-label options with minimal artificial additives, reflecting a broader consumer trend toward natural and wholesome product. This combination of scientific understanding, health consciousness, and regulatory influence is creating a strong and sustainable demand in the infant health nutraceuticals sector of the European market.

The Europe immune system nutraceuticals market is estimated to grow at a CAGR of 8.1% from 2025 to 2030, largely due to heightened health awareness and an aging population. Demand is driven by a desire for proactive health management and a growing understanding of the crucial link between diet and immunity. Popular ingredients include vitamin C, vitamin D, zinc, and various herbal extracts, all prized for their purported immune-boosting properties. Furthermore, the COVID-19 pandemic significantly accelerated consumer interest in immune support products, encouraging both preventative and therapeutic approaches. This surge in demand is influencing the development of novel delivery formats like gummies and effervescent tablets, making these products more appealing to consumers who are actively seeking ways to improve their immunity.

Distribution Channel Insights

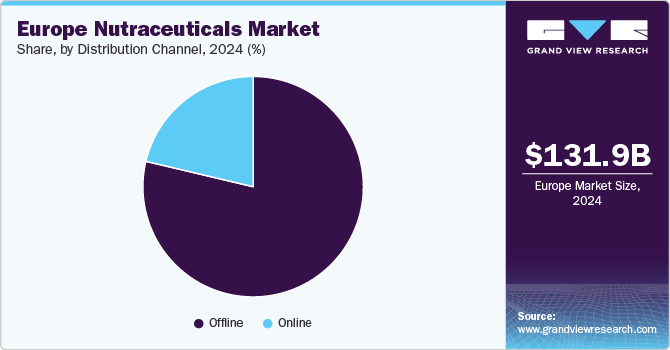

The sales of nutraceutical products through offline channels accounted for a revenue share of 78.7% in 2024. The offline channel, encompassing supermarkets & hypermarkets, pharmacies, specialty stores, practitioners, and grocery stores, continues to be a significant force in the Europe nutraceuticals industry. A major trend is the increasing integration of personalized health and wellness advice within these physical locations, with trained staff guiding product selection. Demand is driven by consumers’ preference for immediate access to products, the ability to physically examine items, and the perceived trustworthiness of established retail outlets. Furthermore, the aging population across Europe, with a greater awareness of preventative healthcare, often seeks guidance from pharmacists and other healthcare professionals, solidifying the role of pharmacies as key distribution points.

The online segment is estimated to grow at a CAGR of 10.0% from 2025 to 2030, fueled by convenience, wider product selection, and often competitive pricing. A key trend is the rise of direct-to-consumer (DTC) brands, which are building a strong online presence and fostering direct relationships with customers. Furthermore, consumers are increasingly researching and purchasing through the internet, drawn to the detailed product information, reviews, and comparison tools available online. This channel is driven by the desire for ease of access, especially for those living in rural areas or who have busy lifestyles, and the convenience of home delivery. Besides, Amazon's private label offerings are gaining traction, offering more affordable alternatives for price-conscious consumers.

Country Insights

Germany Nutraceuticals Market Trends

The nutraceuticals industry in Germany held over 20.0% of the European revenue in 2024, driven by a strong health-conscious population, particularly an aging demographic seeking preventative healthcare solutions. Key trends include a high preference for natural and organic products, with a focus on ingredients backed by scientific evidence. Demand is further fueled by rising awareness of personalized nutrition and the desire to address specific health concerns like joint health, cardiovascular well-being, and immunity. The established presence of pharmacies and drugstores as primary distribution channels, along with a generally conservative approach to health claims, shapes the market landscape.

UK Nutraceuticals Market Trends

The UK nutraceuticals market is expected to grow at a CAGR of 7.3% from 2025 to 2030, characterized by a growing consumer interest in "wellbeing" and proactive health management. Demand is primarily driven by the desire for convenience, leading to the increased popularity of easy-to-consume formats like gummies, powders, and ready-to-drink beverages. A significant trend is the rise of plant-based supplements and a growing awareness of gut health, with probiotics and prebiotics gaining traction. The expansion of online retail and the influence of social media on health trends are also major factors impacting this dynamic market.

Italy Nutraceuticals Market Trends

The nutraceuticals market in Italy is expected to grow at a CAGR of 6.5% from 2025 to 2030, largely influenced by its cultural emphasis on food and natural remedies. Key trends include a strong demand for products with traditional ingredients and a focus on digestive health support, driven by the Mediterranean diet's association with health and wellness. Demand for products that address stress and promote cognitive function is also on the rise. The Italy nutraceuticals market growth is supported by strong links with the pharmaceutical industry and distribution channels, including pharmacies and health food stores, and a preference for high-quality ingredients and products with strong brand recognition.

Key Europe Nutraceuticals Market Company Insights

The Europe nutraceuticals industry is characterized by a mix of established multinational players and smaller, regionally focused companies. Key companies including Emmi AG, Amway Corp., Herbalife Nutrition Ltd., Nestlé S.A., Arla Foods Group, Glanbia plc, GlaxoSmithKline plc., Dr. Schär AG/S.p. A, Danone, Haleon group of companies, Unilever Plc and Orkla, ASA hold significant positions due to their extensive R&D capabilities and strong distribution networks to offer a wide range of products, from vitamins and minerals to specialized dietary supplements. These companies often pursue organic growth through continuous innovation, introducing new formulations and delivery methods to capture consumer trends, such as the growing demand for plant-based and personalized nutrition.

Strategic partnerships and collaborations, particularly with research institutions and technology providers, are crucial for staying ahead in the rapidly evolving landscape of nutraceutical science. These collaborations often focus on developing novel delivery systems (e.g., enhanced bioavailability formulas), creating personalized nutrition solutions, and substantiating health claims for new products. Furthermore, companies are investing heavily in direct-to-consumer channels and digital marketing to reach wider audiences and establish a brand presence, especially in the face of growing online sales.

Key Europe Nutraceuticals Companies:

- Amway Corp.

- Emmi AG

- Dr. Schär AG/S.p. A

- Danone

- Nestlé S.A.

- Arla Foods Group

- Glanbia plc

- Herbalife Nutrition Ltd.

- Orkla

- Haleon group of companies

- Unilever Plc

- GlaxoSmithKline plc.

Recent Developments

-

In September 2024, Laboratoire PYC significantly expanded its production capabilities with the launch of a new facility dedicated to food supplements and protein manufacturing in France. This state-of-the-art plant is strategically positioned to provide functional food and high-protein solutions, catering to the growing demands of the food & beverage and nutraceutical sectors. The investment underscores Laboratoire PYC's commitment to innovation and meeting the evolving needs of its clients within these key industries.

-

In April 2024, Valbiotis SA announced the launch of ValbiotisPRO Cholestérol, a 100% natural dietary supplement targeting hypercholesterolemia for the French market. This product, featuring the patented Lipidrive (formerly TOTUM•070) active substance, is designed for managing mild to moderate LDL hypercholesterolemia. Availability is slated for May 2024 through pharmacies and the company website.

-

In November 2023, Fentimans unveiled its foray into the functional beverage market with the launch of Botanical Boost. This new line of still drinks is formulated with added vitamins and minerals, catering to the growing consumer demand for health-conscious options. The strategic move demonstrates Fentimans' commitment to innovation and expansion beyond their core range of carbonated beverages.

Europe Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 140.9 billion

Revenue forecast in 2030

USD 196.6 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel,country

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

Amway Corp.; Emmi AG; Dr. Schär AG/S.p.A; Danone; Nestlé S.A.; Arla Foods Group; Glanbia plc; Herbalife Nutrition Ltd.; Orkla; Haleon group of companies; Unilever Plc; and GlaxoSmithKline plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe nutraceuticals market report based on product, application, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint Health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral Care

-

Personalised Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe nutraceuticals market was estimated at USD 131.9 billion in 2024 and is expected to reach USD 140.9 billion in 2025.

b. The Europe nutraceuticals market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 196.6 billion by 2030.

b. Germany dominated the Europe nutraceuticals market with a share of 20.0% in 2024, driven by a strong health-conscious population, particularly an aging demographic seeking preventative healthcare solutions. Key trends include a high preference for natural and organic products, with a focus on ingredients backed by scientific evidence.

b. Some of the key market players in the Europe nutraceuticals market are Emmi AG, Amway Corp., Herbalife Nutrition Ltd., Nestlé S.A., Arla Foods Group, Glanbia plc, GlaxoSmithKline plc., Dr. Schär AG/S.p. A, Danone, Haleon group of companies, Unilever Plc and Orkla, ASA.

b. The Europe nutraceuticals market growth is driven by the expanding fitness culture and a heightened focus on athletic performance at both amateur and professional levels. Moreover, the growth in research and development surrounding probiotics and prebiotics, with an advanced understanding of gut health, is leading to more targeted and effective formulations for digestive health and overall immunity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.