- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Molded Pulp Packaging Market, Industry Report 2030GVR Report cover

![Europe Molded Pulp Packaging Market Size, Share & Trends Report]()

Europe Molded Pulp Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Wood Pulp, Non-wood Pulp), By Molded Type (Thick Wall, Transfer), By Product Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-911-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Europe molded pulp packaging market was estimated at USD 1.28 billion in 2024 and is projected to grow at a CAGR of 8.1% from 2025 to 2030. The increasing demand for sustainable and biodegradable packaging materials is a key factor driving the growth of the Europe molded pulp packaging industry. As consumers and businesses focus more on reducing plastic waste, molded pulp packaging offers a viable alternative to recycled paper and other eco-friendly materials. A growing awareness of environmental issues supports this shift toward greener packaging solutions. The Europe molded pulp packaging industry continues to benefit from this trend toward eco-friendly solutions.

The rise of e-commerce and online shopping has significantly increased the need for protective packaging solutions. Molded pulp packaging is highly valued for its ability to provide cushioning and protection for fragile items during shipping. This makes it an ideal choice for e-commerce businesses that must ensure their products reach customers safely. Molded pulp's lightweight and customizable nature further contributes to its popularity in the online retail sector. As e-commerce grows, the demand for safe and sustainable packaging solutions such as molded pulp is expected to rise. This trend is driving the expansion of the Europe molded pulp packaging industry.

In addition, European consumers are becoming more aware of the environmental impact of their purchasing decisions. This has led businesses to seek packaging solutions that reduce waste and environmental damage. Molded pulp packaging is gaining popularity as a sustainable option that aligns with consumer preferences for eco-friendly products. Moreover, advancements in molded pulp production technologies have enhanced the packaging's quality, cost-effectiveness, and versatility. New designs, coatings, and finishes make molded pulp packaging more functional and suitable for various applications. These factors are contributing to the growth of the Europe molded pulp packaging industry.

Source Insights

The wood pulp segment dominated the market and accounted for the largest revenue share of 84.5% in 2024, driven by the increasing consumer demand for sustainable packaging solutions that utilize renewable resources. Wood pulp is widely recognized for its recyclability and biodegradability, aligning with the growing environmental consciousness among consumers and businesses. In addition, the availability of wood pulp from sustainably managed forests enhances its appeal as a preferred material for molded pulp products.

The non-wood pulp segment is projected to grow at the highest CAGR of 10.2% over the forecast period, fueled by a shift toward alternative fiber sources and innovative materials. As companies seek to diversify their raw material inputs, non-wood fibers such as agricultural residues are gaining traction due to their sustainability benefits. This trend is further fueled by consumer preferences for eco-friendly packaging options that reduce reliance on traditional wood pulp, thus promoting a circular economy and minimizing environmental impact.

Molded Type Insights

The transfer segment dominated the market with the largest revenue share in 2024, fueled by its ability to produce complex shapes and designs for various applications. Transfer molding is highly efficient for high-volume production, ensuring consistent quality and precision. This makes it especially suitable for packaging solutions that require durability and accuracy. The versatility of transfer-molded products allows them to be used in diverse industries, including food and electronics. As a result, this segment strengthens its position in the market. These factors contribute to the growth of the Europe molded pulp packaging industry.

The thermoformed segment is projected to grow at the highest CAGR over the forecast period due to technological advancements that enhance its capabilities. Thermoforming offers flexibility in design and material use, allowing manufacturers to create lightweight yet sturdy packaging solutions. This process is increasingly favored for its ability to produce custom shapes that meet specific consumer needs while maintaining cost-effectiveness and sustainability.

Product Type Insights

The trays segment dominated the market with the largest revenue share in 2024, driven by their widespread application in food packaging, particularly for eggs and fresh produce. Trays made from molded pulp provide excellent protection during transportation while being environmentally friendly. Their ability to be customized for different products further enhances their appeal in various sectors.

The clamshells segment is projected to grow at the highest CAGR over the forecast period due to rising demand for convenient and secure packaging solutions. Clamshells are particularly popular in food service applications as they offer content visibility while ensuring product safety. Their design facilitates easy handling and storage, making them an attractive option for consumers and retailers looking for efficient packaging alternatives.

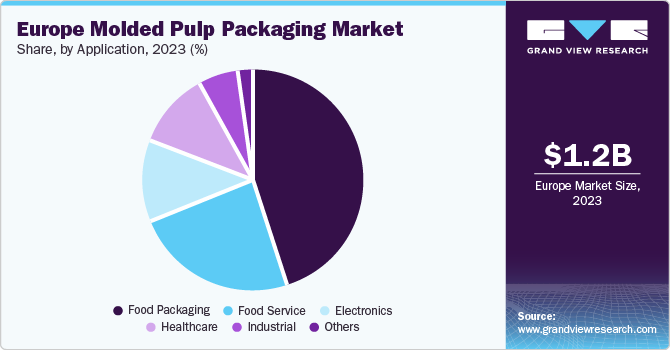

Application Insights

The food packaging segment dominated the market with the largest revenue share in 2024, fueled by increasing consumption of packaged foods and a growing preference for sustainable options. The rise in ready-to-eat meals and on-the-go snacks has led to greater demand for molded pulp packaging that meets hygiene standards while being environmentally responsible. This trend aligns with consumer expectations for convenience without compromising sustainability.

The electronics segment is projected to grow at the highest CAGR over the forecast period as manufacturers seek eco-friendly alternatives to traditional plastic packaging. Molded pulp provides effective cushioning and protection for delicate electronic items during shipping, reducing reliance on non-biodegradable materials. The increasing emphasis on sustainability within the electronics industry further drives this transition toward molded pulp solutions.

Key Europe Molded Pulp Packaging Company Insights

Key companies in the Europe molded pulp packaging industry are Omni-Pac Group; Huhtamaki; Pulp-Tec Limited; PAPACKS Sales GmbH., and KIEFEL GmbH. These players adopt numerous strategies to improve their competitive edge. Strategic partnerships are formed to leverage complementary strengths, improve product offerings, and expand distribution networks. In addition, mergers and acquisitions enable companies to consolidate resources, enter new markets, and diversify their product lines. Furthermore, new product launches focus on innovation and meeting evolving consumer preferences, allowing companies to capture market share.

-

Omni-Pac Group offers trays, clamshells, cups, plates, and bowls from recycled paper and cardboard. Its manufacturing process includes waste recovery, pulp preparation, molding, and drying, ensuring high-quality and sustainable production. The company also offers customization for branding and labeling and works with HP to enhance production efficiency and sustainability.

-

Huhtamaki offers various molded pulp packaging solutions focused on food safety and sustainability, including egg cartons, trays, wine bottle dividers, cup carriers, and fruit packaging made from recycled paper fibers. Its products are designed for functionality and environmental responsibility, with features such as hinged egg carton lids and sturdy wine bottle dividers.

Key Europe Molded Pulp Packaging Companies:

- Omni-Pac Group

- Huhtamaki

- Pulp-Tec Limited

- PAPACKS Sales GmbH.

- KIEFEL GmbH

- James Cropper PLC

- buhl-paperform GmbH

- International Paper

- Graphic Packaging International, LLC

- Great Northern Corporation

Recent Developments

-

In June 2023, Omni-Pac Group announced the opening of a new facility in the United States to enhance its production capacity for molded pulp packaging. This strategic expansion was designed to meet the growing demand for sustainable packaging solutions and to strengthen the company’s position in the market. The facility featured advanced technology and equipment, which allowed for increased efficiency and improved product quality.

-

In June 2022, Huhtamaki announced a significant investment of nearly USD 100 billion to expand its molded fiber production facility in Hammond, Indiana. This expansion aimed to enhance the company’s capacity to produce environmentally sustainable packaging solutions from 100% recycled North American raw materials. The new manufacturing unit, covering approximately 23,000 square meters, was expected to introduce innovative products such as egg cartons and cup carriers while improving production efficiency.

Europe Molded Pulp Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.36 billion

Revenue forecast in 2030

USD 1.89 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, molded type, product type, application, region

Regional scope

Europe

Country scope

Germany, France, UK, Italy.

Key companies profiled

Omni-Pac Group; Huhtamaki; Pulp-Tec Limited; PAPACKS Sales GmbH.; KIEFEL GmbH; James Cropper PLC; buhl-paperform GmbH; International Paper; Graphic Packaging International, LLC; Great Northern Corporation.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Molded Pulp Packaging Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Europe molded pulp packaging market report based on source, molded type, product type, application, and region:

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood Pulp

-

Non-wood Pulp

-

-

Molded Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Thick Wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

France

-

UK

-

Italy

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.