- Home

- »

- Clinical Diagnostics

- »

-

Europe Laboratory Developed Tests Market, Report, 2030GVR Report cover

![Europe Laboratory Developed Tests Market Size, Share & Trends Report]()

Europe Laboratory Developed Tests Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Immunoassay, Molecular Diagnostics), By Application (Oncology, Immunology, Cardiology), And Segment Forecasts

- Report ID: GVR-4-68040-198-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

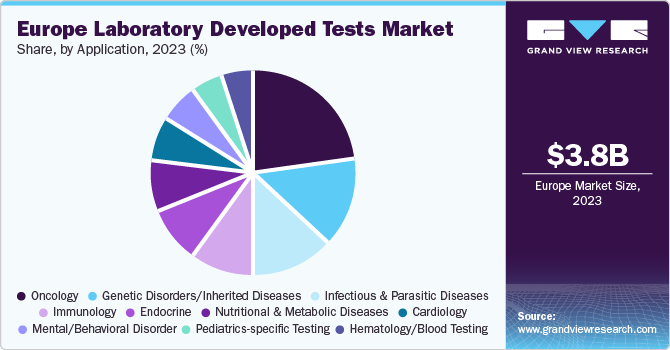

The Europe laboratory developed tests market size was estimated at USD 3.83 billion in 2023 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% from 2024 to 2030. The market growth can be attributed to the factors such as increasing the demand for personalized medicine rising prevalence of cancer, and the unavailability of commercial in vitro diagnostic tests for certain types of diseases in the market.

In addition, regulatory approvals are not required for some of these tests. Since, no regulatory approval is required for LDTs some countries use these tests as a part of their testing strategy, as observed during the COVID-19 pandemic. In 2020, the WHO launched the Emergency Use Listing (EUL) procedure for testing COVID-19 infection, including the rapid antigen test is the best example. The laboratory developed tests are available at a low cost compared to the registered and licensed in vitro diagnostic tests and aid in developing a wide range of diagnostic tools for various health conditions. The COVID-19 pandemic escalated the idea of designing, developing, and using LDTs for emergency use.

The LDTs, also referred to as 'In-house devices' are exempted from IVD regulations, provided the health institution meets the number of conditions mentioned in Article 5 (5) of the Regulation. In 2023, the University of Bath, England developed a prototype device, LoCKAmp, for rapid and low-cost detection of COVID-19 from nasal swabs. Furthermore, in January 2024, Amadix, a Spanish biotech company, received Breakthrough Device Designation (BDD) from the U.S. Food and Drug Administration (FDA) for PreveCol, its colorectal cancer screening blood test.

Endometriosis is often a largely ignored public health priority. Endometriosis affects roughly 10% (190 million) women and girls globally. The French Government announced a National Strategy for Endometriosis in January 2022. For instance, in June 2022, Ziwig, a Lyon based French startup launched Ziwig Endotest, a non-invasive diagnostic test for endometriosis based on the analysis of salivary miRNAs by next generation sequencing method and artificial intelligence.

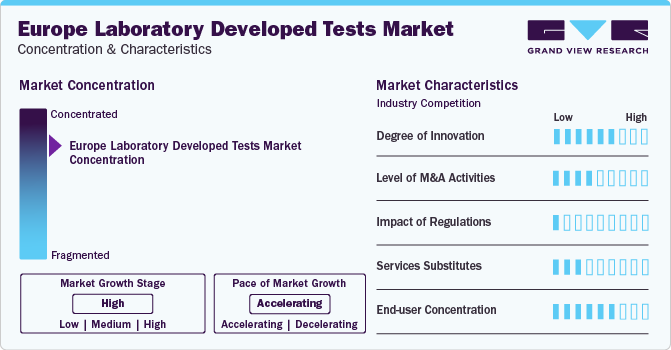

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The laboratory developed tests market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in testing, and point-of-care diagnostics. Moreover, the increasing ability to ship patient specimens across the country quickly, many laboratories accept specimens from across the country, aiding in disease diagnosis of a more extensive and diverse population.

Adoption of artificial intelligence (AI) and high-tech instrumentation, and software in LDTs has helped guide critical health decisions. For instance, to encourage the use of artificial intelligence in oncology, the European Union (EU) has funded PANCAIM project to improve pancreatic cancer treatment which uses AI algorithm to detect small cancers in CT scans that even experienced radiologists might easily overlook.

The mergers, acquisitions, and alliances between pharma companies is likely to drive the market growth. For example, the eight companies’ Alliance for Genomic Discovery, along with Nashville Biosciences, is funding whole-genome sequencing (WGS) of 250,000 samples, and the resulting data is likely reinforce the developments in drug discovery and therapeutics. In December 2023, F. Hoffmann-La Roche Ltd announced its plans to acquire LumiraDx’s cutting-edge point-of-care technology platform, complementing product portfolio of F. Hoffmann-La Roche Ltd in various stages of developments, covering infectious disease, cardiovascular disease, diabetes, and coagulation disorders. Furthermore, In January 2024, Illumina expanded its collaboration with Janssen to advance molecular residual disease cancer tests.

The in-house medical devices are exempted from regulatory stringency of Regulation (EU) 2017/746 until May 26, 2024 as per the amendment Regulation (EU) 2022/112 made in 2022. This has relaxed the conditions to be met by health institutions making in-house devices placing on the market and putting into service.

Application Insights

Based on application, the oncology segment led the market with the largest revenue share of 21.8% in 2023. The LDTs market is segmented into oncology, genetic disorders/inherited diseases, infectious and parasitic diseases, immunology, endocrine, nutritional and metabolic diseases, cardiology, mental/behavioral disorders, pediatrics-specific tests, hematology/general blood tests, body fluid analysis, toxicology, and other diseases. According to the data published by the EU Science Hub, the number of new cancer cases rose by 2.3% compared to 2020, to reach 2.74 million in 2022. Western and Northern EU countries observe higher incidence rates whereas Eastern EU countries observe higher mortality rates due to cancer.

Late diagnosis and treatment of pancreatic cancer, one of the top four deadliest cancers, is a great healthcare challenge faced. According to a report published in The Lancet, Western Europe is at a high risk of getting infected by pancreatic cancer. The European PANCAID project (pancreatic cancer initial detection via liquid biopsy) is trying to find biomarkers to screen at-risk groups for earlier diagnosis via a blood test.

The nutritional and metabolic disease segment is expected to grow at a fastest CAGR of 10.5% during the forecast period. Neonatal screening is carried out in Germany comprising of 19 congenital diseases, 13 of which are metabolic disorders. According to a data published by German Federal Statistical Office, a total number of live births in Germany in the year 2022 was 7,38,819, and the deaths of children under one year were observed to be 2,345.

Approximately one in 1,300 newborns suffers from one of these target diseases. ZenTech LaCAR company offers a variety of screening tests for rare diseases in neonates. Furthermore, AAV5 DetectCDx, a blood test developed by the pharma services group of ARUP Laboratories helps in identification of patients with Hemophilia A. In December 2023, ARUP Laboratories have partnered with Medicover, a Europe based diagnostics and healthcare service provider company for companion diagnostics for Hemophilia A gene therapy.

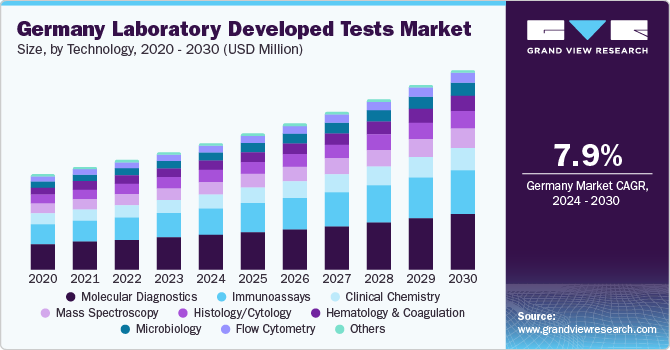

Technology Insights

Based on technology, the molecular diagnostics segment led the market in 2023 with the largest revenue share of 26.1%. The LDT market is segmented into immunoassays, hematology and coagulation, molecular diagnostics, microbiology, clinical chemistry, histology/cytology, flow cytometry, mass spectrometry, and others. Molecular diagnosis has proven to be useful in the detection of various genetic and inherited diseases, along with the detection of viral and bacterial diseases.

The increase in lifestyle-associated diseases has led to a rise in demand for their early detection. In 2020, cancer, an example of genetic disorder, was the second leading cause of death in Europe, with a death toll of 1.2 million. In November 2023, F. Hoffmann-La Roche Ltd launched its next generation qPCR system LightCycler PRO. This system is expected to help testing patients for cancer, infectious diseases, and other public health challenges.

Rising prevalence of autoimmune disorders has led to an increasing demand for rapid detection of these diseases, aiding the development of laboratory developed tests comprising the immunoassay kits. The use of multi-parametric flow cytometry in the diagnosis of leukemia and lymphoma remains a laboratory-developed test because of its lack of FDA approval. In October 2023, Synlab GmbH launched myEDIT-B, being the world’s first blood based diagnostic test for the diagnosis of bipolar disorder. IBDSENSE is a non-invasive fluorescence-based technology developed by University of Edinburgh for the diagnosis of inflammatory bowel disease.

Country Insights

UK Laboratory Developed Tests Market Trends

The UK laboratory developed tests market is expected to grow at the fastest CAGR over the forecast period, due to an increase in long-term physical health conditions across the country's working population. These long-term physical health conditions anticipate economic inactivity. According to NHS, about 90% of the adult population is infected with type 2 diabetes in the UK.

France Laboratory Developed Tests Market Trends

The laboratory developed tests market in France is expected to grow at the fastest CAGR over the forecast period, due to the increasing number of deaths caused by non-communicable diseases (NCDs), thus highlighting the need for early disease detection. According to data published by WHO, Alzheimer's disease and other dementia, and ischemic heart disease accounted for the highest deaths in 2019.

Germany Laboratory Developed Tests Market Trends

The Germany laboratory developed tests market is expected to grow at the fastest CAGR over the forecast period, due to the increasing number of deaths caused by NCDs. According to WHO mortality database, Ischemic heart disease followed by Alzheimer and other dementias were the main causes of death in Germany in 2020. Cancer is also an upcoming threat for Europe and Germany. The German Cancer Research Center is working on more precise diagnosis of cancer and treating cancer patients more successfully

Key Europe Laboratory Developed Tests Company Insights

Some of the key players operating in the market include Illumina, Inc; Abbott, Biomérieux and F.Hoffmann-La Roche.

-

Illumina, Inc provides wide range of biotechnology products that specializes in genetic sequencing and array-based solutions for genetic analysis

-

Abbott offers a wide range of products and services in diagnostics, medical devices, pharmaceuticals and nutrition

Quest Diagnostics, Guardant Health, and SVAR Lifesciences, are some of the other market participants in the Europe laboratory developed tests market.

-

Guardant Health is a delivers precision oncology diagnostic solutions

-

SVAR Lifesciences is a drug discovering and development service provider company researchers, pharmaceutical and biotechnology companies

Key Europe Laboratory Developed Tests Companies:

The following are the leading companies in the Europe laboratory developed tests market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Europe laboratory developed tests companies are analyzed to map the supply network.

- Abbott

- Guardant Health

- Siemens Healthineers AG

- Quest Diagnostics

- Qiagen

- Eurofins Scientific

- Illumina, Inc.

- F.Hoffmann La-Roche Ltd

- SVAR Lifesciences

- Biomérieux

- BD

Recent Developments

-

Innovative Health Initiative (IHI) and UK Research and Innovation (UKRI) funded AD-RIDDLE program provides new solutions in diagnosis and treatment of Alzheimer’s disease

-

Qiagen NV, a Netherlands-based diagnostic test kits producing company, announced in January 2024, that the U.S. FDA gave clearance about NeuMoDx CT/NG Assay 2.0 for detecting sexually transmitted infections (STI) in the U.S.

Europe Laboratory Developed Tests Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.1 billion

Revenue forecast in 2030

USD 6.4 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, country

Regional scope

Europe

Country scope

Germany; UK; France; Italy; Spain; Russia; Denmark; Sweden; Norway

Key companies profiled

Abbott; Guardant Health; Siemens Healthineers AG; Quest Diagnostics; Qiagen; Eurofins Scientific; Illumina, Inc.; F.Hoffmann La-Roche Ltd.; SVAR Lifesciences; Biomeriux; and BD

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Laboratory Developed Test Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe laboratory developed market report based on technology, application, and country.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Hematology and coagulation

-

Molecular diagnostics

-

Microbiology

-

Clinical chemistry

-

Histology/Cytology

-

Flow cytometry

-

Mass spectroscopy

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Companion diagnostics

-

Genomics sequencing and others

-

-

Genetic disorders/inherited diseases

-

Infectious and parasitic diseases

-

Immunology

-

Endocrine

-

Nutritional and metabolic diseases

-

Cardiology

-

Mental/behavioral disorder

-

Pediatrics-specific testing

-

Hematology/general blood testing

-

Body fluid analysis

-

Toxicology

-

Other diseases

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe laboratory developed tests market size was estimated at USD 3.83 billion in 2023 and is expected to reach USD 4.1 billion in 2024.

b. The Europe laboratory developed tests market is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030 to reach USD 6.4 billion by 2030.

b. Germany dominated the Europe laboratory developed tests market with a share of 23.4% in 2023. This is attributable to the presence of a developed healthcare system and the increase in the prevalence of chronic diseases in the region coupled with the presence of favorable government initiatives.

b. Some of the key players operating in the Europe laboratory developed tests market include Abbott, Guardant Health, Siemens Healthineers AG, Quest Diagnostics, Qiagen, Eurofins Scientific, Illumina, Inc., F.Hoffmann La-Roche Ltd, SVAR Lifesciences, Biomeriux, and BD, among others.

b. Key factors driving the market growth include increasing demand for personalized medicine, rising prevalence of cancer, and the unavailability of commercial in-vitro diagnostic tests for certain types of diseases in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.