- Home

- »

- Medical Devices

- »

-

Europe Hyperspectral Imaging Systems Market, Report 2030GVR Report cover

![Europe Hyperspectral Imaging Systems Market Size, Share & Trends Report]()

Europe Hyperspectral Imaging Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Camera, Accessories), By Technology (Snapshot, Push Broom), By Application (Military Surveillance, Remote Sensing), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-960-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

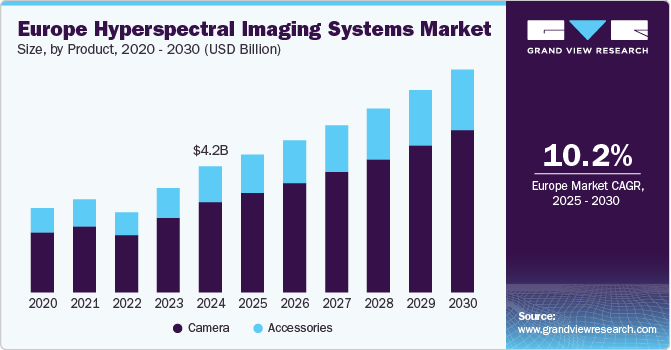

The Europe hyperspectral imaging systems market size was estimated at USD 4.22 billion in 2024 and is expected to grow at a CAGR of 10.2% from 2025 to 2030. The increasing adoption of technology in medical diagnostics and healthcare applications, significant advancements in imaging technologies, and rising investments in research and development across multiple sectors are major drivers of the market’s growth. Additionally, the expanding use of hyperspectral imaging in agriculture and food safety, coupled with its growing application in defense, surveillance, and environmental monitoring, is further propelling the market. Supportive government initiatives and funding for innovative imaging solutions are also playing a crucial role in boosting market expansion.

Hyperspectral imaging is an efficient technology since it is a non-invasive, non-contact, non-destructive tool and provides detailed images that disclose the most spectrum information possible for each pixel of the image, unlike other technologies. HSI has been widely employed in a variety of fields and applications, including the detection of rock minerals, the diagnosis of plant diseases in crops, diagnostic imaging, and the detection of foreign contaminants in food processing. Furthermore, HSI is a developing imaging technique for use in medicine, particularly in the diagnosis of disease and image-guided surgery. Due to its ability to identify biochemical alterations brought on by the onset of diseases, such as changes in cancer cell metabolism, HSI holds great potential for disease screening, detection, and diagnosis.

An increase in awareness and initiative events & conferences supporting advanced HSI is expected to drive the market growth. For instance, the Photonex organization conducts exhibitions on photonics and optical technologies annually in the U.K. In December 2022, it is hosting a conference on HSI technology. These conferences are increasing the reach of advancements in hyperspectral technology, thereby contributing to the industry's growth. Furthermore, the launch of the Hyperspectral Remote-Sensing Center in the region to support the implementation and utilization of HSI technology is expected to boost the market growth

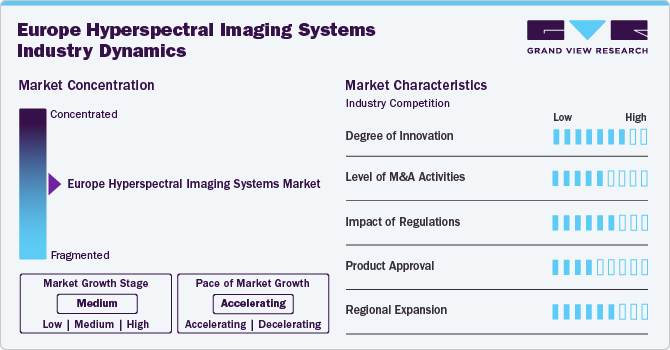

Market Concentration & Characteristics

The industry growth stage is high. This is primarily owing to the rapid advancements in imaging technologies, which are enhancing the capabilities and precision of hyperspectral systems, and the increasing adoption of the technology across various sectors such as healthcare, agriculture, food safety, defense, and environmental monitoring. Additionally, rising investments in research and development by both public and private entities are accelerating innovation and expanding the range of applications.

The growing number of partnerships and collaborative efforts among companies is expected to significantly boost industry growth. This trend can be seen in various industries, where players are realizing the benefits of working together to improve their competitiveness. By partnering, companies can combine resources, share knowledge, and utilize each other's strengths, which helps in innovation and the creation of new products or services. For instance, in April 2023, Photonis, a producer of highly differentiated technology for defense and industrial markets, announced a definitive agreement to acquire Telops.

The industry is experiencing a high degree of innovation, driven by advancements in technology. These technological improvements have enhanced the resolution, speed, and accuracy of hyperspectral imaging systems, allowing for more detailed analysis and broader application across industries.

Market players are actively engaging in partnerships and collaborations as a strategic move to enhance their competitive positioning and drive growth. For instance, in January 2024, Specim, Spectral Imaging Ltd,entered into a partnership with GEONA hyperspectral. Specim proudly endorses GEONA as its preferred standalone processing solution for the complete range of SPECIM airborne hyperspectral sensors.

Regulations in Europe play a crucial role in ensuring the safety, efficacy, and quality of hyperspectral imaging devices. These stringent regulatory frameworks help maintain high standards for product development, testing, and industrial approval, thereby fostering trust among consumers and healthcare professionals. Compliance with such regulations also drives innovation, as manufacturers must continuously improve their devices to meet evolving safety and performance criteria.

Manufacturers are actively launching new products to meet the growing demand in the hyperspectral imaging industry. For instance, in January 2024, Specim, Spectral Imaging Ltd. announced the release of the Specim FX120, an advanced long-wave infrared hyperspectral camera featuring a full LWIR spectral range of 7.7 to 12.3 µm. This fast push-broom thermal hyperspectral camera is poised to redefine chemical imaging capabilities in challenging environments, operating seamlessly day and night. The geographical reach of Europe Hyperspectral Imaging Systems has also been expanding at a moderate to high level.

Product Insights

The camera segment dominated the market in 2024 and is also expected to grow at the fastest CAGR of 10.5% over the forecast period. This dominance can be attributed to the widespread adoption of hyperspectral cameras across various industries, including healthcare, agriculture, environmental monitoring, and defense. These cameras offer high-resolution imaging capabilities and the ability to capture detailed spectral information, making them invaluable for applications such as disease detection, crop analysis, and material identification.

The accessories segment is also expected to grow at a significant rate. As industries adopt hyperspectral imaging technologies, there is an increase in the demand for accessories such as specialized lenses, lighting systems, data processing software, and calibration tools. These accessories are essential for improving image quality, ensuring accurate data capture, and facilitating effective analysis. Additionally, the growing interest in integrating hyperspectral imaging with other imaging technologies contributes to the rising demand for these accessories

Technology Insights

The snapshot technology segment held the largest market share of 51.5% in 2024 and is also expected to grow at the fastest rate over the forecast period. This is attributed to its ability to provide fast and efficient imaging capabilities, allowing for real-time data acquisition without the need for scanning, which is particularly beneficial in dynamic environments. The simplicity of using snapshot imaging systems also enhances user experience, making them accessible for a wide range of applications across various industries, including healthcare, agriculture, and environmental monitoring. Additionally, advancements in snapshot technology have led to improvements in image quality and resolution, further driving its adoption and preference over other imaging techniques.

The push broom technology segment is also expected to grow at a significant rate over the forecast period. This growth can be attributed to its unique ability to capture high-resolution images across large areas quickly and efficiently, making it particularly suitable for applications in agriculture, environmental monitoring, and remote sensing. As industries recognize the advantages of push broom technology in collecting extensive spectral data in a single pass, its adoption is expected to rise.

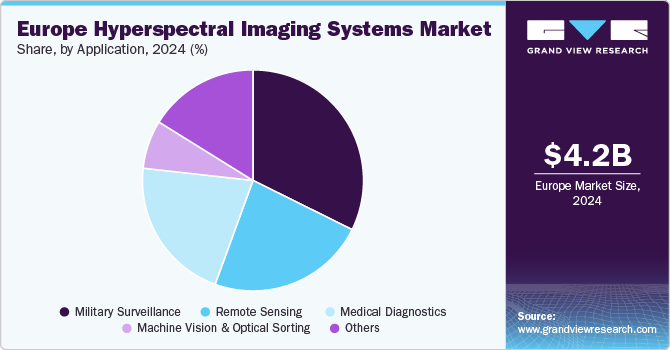

Application Insights

The military surveillance segment held the largest market share of 32% in 2024, owing to the increasing demand for advanced imaging technologies in defense and security applications. The need for high-resolution, real-time data collection for reconnaissance, target identification, and situational awareness is driving the adoption of hyperspectral imaging in military operations. Hyperspectral imaging provides critical information that enhances decision-making capabilities and operational effectiveness in various environments.

The medical diagnostics segment is expected to grow at the fastest rate during the forecast period. This growth is largely attributed to the technology's ability to provide detailed spectral information about tissues and cellular structures, enabling healthcare professionals to detect abnormalities at earlier stages. Hyperspectral imaging can assist in diagnosing various medical conditions, including cancers, skin disorders, and other diseases, by identifying subtle changes that may not be visible through traditional imaging techniques.

Country Insights

UK hyperspectral imaging systems market held a significant share in 2024. This is due to the country's well-defined regulatory framework and robust infrastructure supporting advanced imaging technologies. The UK government has made substantial investments in research and development, fostering innovation and encouraging the adoption of hyperspectral imaging across various sectors, including healthcare, agriculture, and environmental monitoring. Additionally, the presence of leading research institutions and universities in the UK has contributed to the advancement of hyperspectral imaging technologies, facilitating collaboration between academia and industry.

The hyperspectral imaging systems market in Germany held the largest market share of about 18% in 2024. This is owing to the presence of several key market players and their strategic initiatives in the region which fuels the hyperspectral imaging systems market in the forecast period. For instance, in January 2024, Headwall Photonics acquired inno-spec GmbH of Germany which is a leading manufacturer of industrial hyperspectral imaging systems used for quality testing, industrial sorting, and high-volume recycling. Headwall Photonics is a portfolio company of Arsenal Capital Partners

France hyperspectral imaging systems market is expected to grow owing to the increasing adoption of hyperspectral imaging technologies in various sectors, such as agriculture, healthcare, and environmental monitoring, which is driving demand. Furthermore, advancements in imaging technology and data processing capabilities are making hyperspectral systems more accessible and efficient, further promoting their use across industries, including healthcare.

Key Europe Hyperspectral Imaging Systems Company Insights

The presence of both established and emerging players in the European hyperspectral imaging market, along with various initiatives to remain competitive, is anticipated to significantly propel market growth. These market players are actively pursuing strategic efforts to enhance their product offerings, expand their market presence, and sustain a competitive advantage. Additionally, collaboration and partnerships among these companies are leading to innovation, leading to the development of advanced solutions that meet evolving market needs.

Key Europe Hyperspectral Imaging Systems Companies:

- Imec

- XIMEA GmbH

- Resonon, Inc.

- Headwall Photonics, Inc.

- Telops, Inc.

- Corning, Inc.

- Norsk Elektro Optikk AS

- Cubert GmbH

- EVK DI Kerschhaggl GmbH

- Inno-spec GmbH

- SPECIM Spectral Imaging Ltd.

- Diaspective Vision GmbH

Recent Developments

-

In January 2024, Headwall Photonics acquired inno-spec GmbH, based in Nuremberg, Germany. Inno-spec GmbH is a renowned manufacturer of industrial hyperspectral imaging systems utilized in high-volume recycling, industrial sorting, and quality testing applications.

-

In November 2023, Specim, Spectral Imaging Ltd announced the launch of the upgraded Specim FX50 middle-wave infrared (MWIR) hyperspectral camera. The Specim FX50 stands out as the first and only push-broom hyperspectral camera on the market, covering the full MWIR spectral range of 2.7 - 5.3 μm. This enhanced version marks a significant milestone for Specim and its customers. The initial release of the camera occurred in 2019.

-

In April 2023, Headwall Photonics and K8 announced Aermatica3D srl as an authorized, official reseller of their remote sensing products in Italy. Leveraging Aermatica3D's engineering expertise, the company is capable of developing custom solutions tailored for companies, professional firms, and research institutes.

Europe Hyperspectral Imaging Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.64 billion

Revenue forecast in 2030

USD 7.56 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, country

Country scope

Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Imec; XIMEA GmbH; Resonon, Inc.; Headwall Photonics, Inc.; Telops Inc.; Corning Incorporated; Norsk Elektro Optikk AS; Cubert GmbH; EVK DI Kerschhaggl GmbH; Inno-spec GmbH; SPECIM Spectral Imaging Ltd; Diaspective Vision GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Europe Hyperspectral Imaging Systems Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe hyperspectral imaging systems market report based on product, technology, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Camera

-

Accessories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Snapshot

-

Push Broom

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military Surveillance

-

Remote Sensing

-

Medical Diagnostics

-

Machine Vision & Optical Sorting

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe hyperspectral imaging systems market size was estimated at USD 4.22 billion in 2024 and is expected to reach USD 4.64 billion in 2025.

b. The Europe hyperspectral imaging market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach USD 7.56 billion by 2030.

b. Germany dominated the Europe hyperspectral imaging market with a share of 18% in 2024. This is attributable to the increasing funding and investments in this region.

b. Some key players operating in the Europe hyperspectral imaging systems market include Imec; XIMEA GmbH; Resonon, Inc.; Headwall Photonics, Inc.; Telops Inc.; Corning Incorporated; Norsk Elektro Optikk AS; Cubert GmbH; EVK DI Kerschhaggl GmbH; Inno-spec GmbH; SPECIM Spectral Imaging Ltd; and Diaspective Vision GmbH

b. Key factors that are driving the Europe hyperspectral imaging systems market growth include the growing number of applications in HSI and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.