- Home

- »

- Renewable Energy

- »

-

Ethanol Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Ethanol Market Size, Share & Trends Report]()

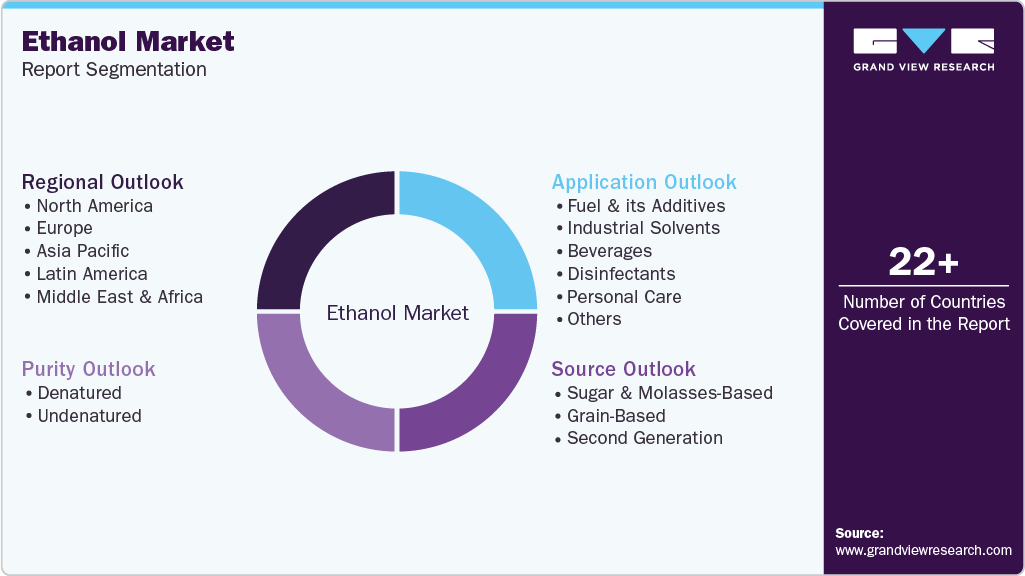

Ethanol Market (2026 - 2033) Size, Share & Trends Analysis Report By Source (Sugar & Molasses-Based, Grain-Based, Second Generation), By Purity (Denatured, Undenatured), By Application (Industrial Solvents), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-626-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethanol Market Summary

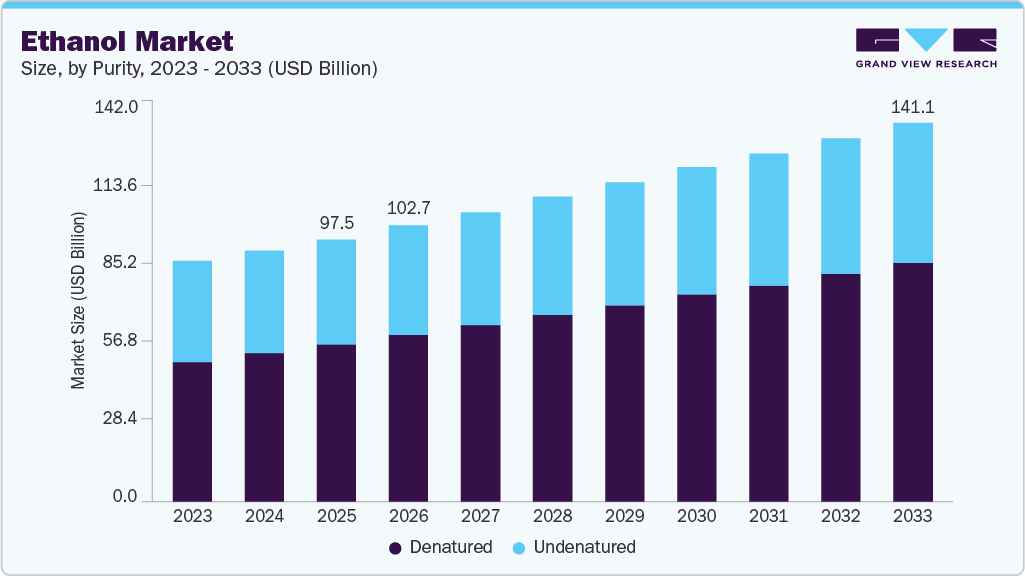

The global ethanol market size was estimated at USD 97.52 billion in 2025 and is projected to reach USD 141.05 billion by 2033, growing at a CAGR of 4.6% from 2026 to 2033. The market is experiencing strong growth driven by rising government mandates for biofuel blending in gasoline.

Key Market Trends & Insights

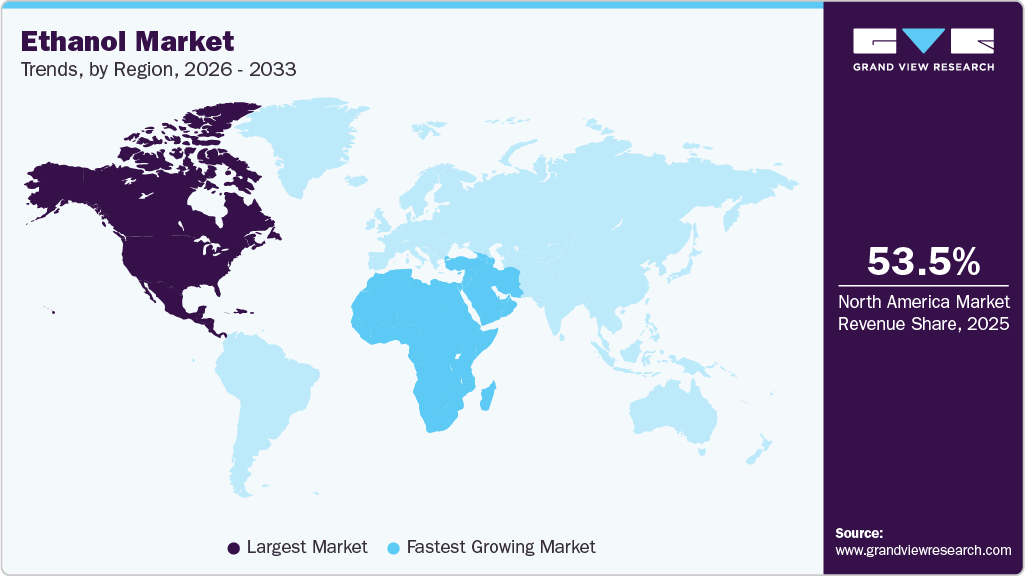

- North America ethanol industry held the largest share of over 53% of the global market in 2025.

- Based on source, the sugar & molasses-based segment held the largest market share in 2025.

- Based on purity, the denatured segment held the largest market share in 2025.

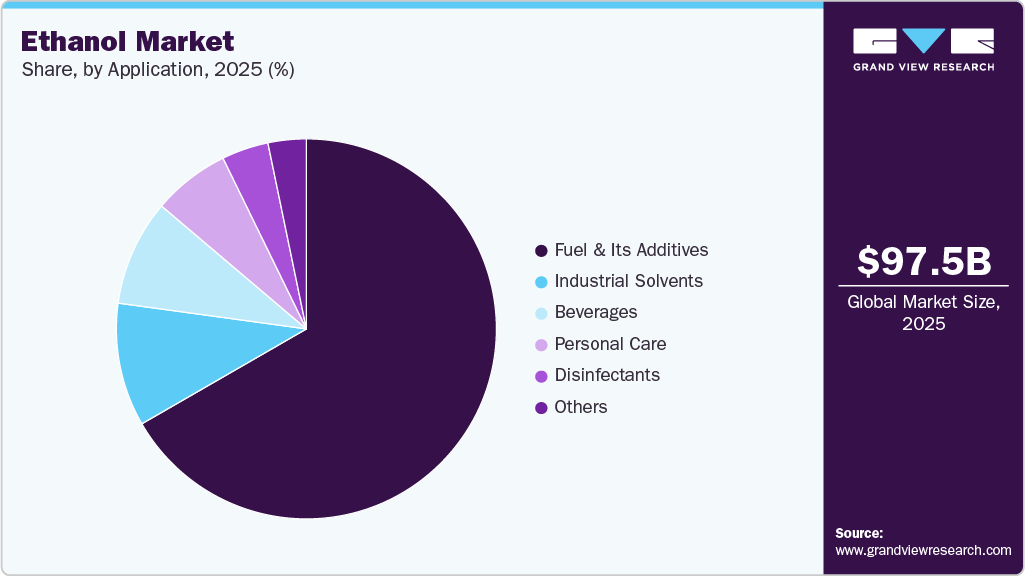

- Based on application, the fuel & its additives segment held the largest market share of over 66% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 97.52 Billion

- 2033 Projected Market Size: USD 141.05 Billion

- CAGR (2026-2033): 4.6%

- North America: Largest market in 2025

- Middle East & Africa: Fastest growing market

Many countries are increasing ethanol blending targets to reduce dependence on fossil fuels and cut greenhouse gas emissions. Policies such as higher ethanol blend ratios in transportation fuels directly stimulate demand from oil marketing companies and refiners. Regulatory support in the form of tax incentives, subsidies, and renewable fuel standards continues to provide long term visibility for ethanol producers, encouraging capacity expansion and new project investments.

Volatility in crude oil prices and geopolitical risks linked to oil supply chains are pushing governments to diversify energy sources. Ethanol produced from domestically available feedstocks such as corn, sugarcane, wheat, and cassava helps reduce fuel import bills and strengthens rural economies. This strategic role of ethanol as a locally produced fuel alternative makes it an attractive component of national energy transition strategies.

Flex fuel vehicles and engines compatible with higher ethanol blends are becoming more common, particularly in emerging economies. Growing vehicle ownership, urbanization, and freight movement increase overall fuel demand, part of which is increasingly met through ethanol-blended fuels. Advancements in engine technology and fuel infrastructure are also reducing compatibility concerns, allowing wider adoption of ethanol blends.

Ethanol is widely used in beverages, pharmaceuticals, personal care products, and industrial solvents. Rising healthcare expenditure, increasing demand for sanitizers and disinfectants, and steady growth in chemical manufacturing are supporting industrial and potable ethanol demand. This multi-sector demand base helps stabilize the market and reduces overreliance on fuel consumption alone.

Improvements in fermentation efficiency, enzyme technologies, and process optimization have reduced production costs and improved yields. At the same time, the development of second-generation ethanol from agricultural residues and non-food biomass addresses sustainability concerns related to food crops. These innovations enhance the environmental profile of ethanol and strengthen its role as a renewable, scalable fuel and industrial chemical for the future.

Drivers, Opportunities & Restraints

The market for ethanol is primarily driven by strong policy support for renewable fuels, rising ethanol blending mandates, and the global push toward decarbonization of the transportation sector. Governments across major economies are promoting ethanol to reduce greenhouse gas emissions, improve energy security, and lower reliance on imported crude oil. Growing demand for cleaner-burning fuels, expanding flex fuel vehicle adoption, and increasing awareness around sustainable energy solutions continue to reinforce ethanol consumption across fuel and industrial applications.

Despite these drivers, the market faces several restraints that limit its growth potential. Price volatility of feedstocks such as corn and sugarcane directly impacts ethanol production costs and profit margins. Competition between food and fuel use of crops raises concerns over food security and land use, especially during periods of supply disruption. In addition, infrastructure limitations related to storage, transportation, and compatibility with higher ethanol blends in conventional engines can slow adoption in certain regions.

The market presents significant opportunities through technological advancements and diversification into next-generation biofuels. Development of second-generation ethanol from agricultural residues, biomass, and waste materials reduces dependence on food-based feedstocks while improving sustainability. Expanding use of ethanol in chemicals, pharmaceuticals, personal care products, and industrial solvents further broadens the demand base.

Source Insights

Sugar & molasses-based segment held the largest revenue share of over 58% in 2025. The sugar and molasses-based segment is experiencing steady growth due to strong government support for biofuel blending and energy security objectives. Many ethanol-producing countries have implemented mandatory blending targets that directly favor sugarcane-rich regions, creating assured demand for ethanol derived from sugar and molasses. Molasses, being a byproduct of sugar production, offers a cost-efficient and readily available feedstock, enabling producers to improve overall mill profitability while reducing dependence on volatile sugar prices. This integration of sugar and ethanol value chains strengthens supply stability and supports long term capacity expansion.

The second generation segment under the source category is gaining momentum due to rising emphasis on sustainability and carbon intensity reduction. This segment utilizes non food biomass such as agricultural residues, forestry waste, and energy crops, which helps address concerns around food security and land use. Governments and regulators increasingly favor advanced biofuels in policy frameworks because of their higher greenhouse gas reduction potential, creating preferential incentives, credits, and long term demand visibility for second-generation ethanol. This regulatory backing encourages technology development and commercialization of cellulosic ethanol pathways.

Purity Insights

The denatured segment held the revenue share of over 60.0% in 2025. The denatured ethanol segment under the purity category is witnessing strong growth driven by its widespread applicability across fuel blending and industrial uses. Denatured ethanol is preferred in fuel ethanol programs because additives make it unsuitable for human consumption, allowing governments to exempt it from beverage alcohol regulations and related taxes. This regulatory clarity simplifies compliance for producers and fuel blenders, enabling smoother distribution and faster scaling of ethanol blending programs. As blending mandates rise across major economies, demand for denatured ethanol continues to expand in line with transportation fuel requirements.

The undenatured ethanol segment under the purity category is driven by consistent demand from beverage alcohol and food grade applications where high purity and safety standards are essential. Distilleries supplying potable alcohol rely on undenatured ethanol for spirits, wines, and other alcoholic beverages, particularly in regions with growing disposable incomes and premiumization trends. Rising urbanization and evolving consumer preferences toward branded and craft alcoholic drinks continue to support steady volume growth for undenatured ethanol, especially in emerging markets where legal alcohol consumption is expanding.

Application Insights

Fuel & its additives held the largest revenue share of over 66% in 2025. The fuel and its additives segment under the application category is a major growth driver for the market, supported by rising ethanol blending mandates in gasoline. Governments are steadily increasing blending ratios to reduce dependence on fossil fuels and lower tailpipe emissions, which directly lifts ethanol consumption in transportation fuels. Ethanol improves octane ratings and supports cleaner combustion, making it an attractive additive for refiners seeking cost effective compliance with emission norms. As vehicle fleets continue to rely on internal combustion engines in many regions, fuel grade ethanol remains a critical component of national energy transition strategies.

The industrial solvents segment is anticipated to register the fastest CAGR over the forecast period, due to ethanol’s effectiveness as a versatile and environmentally acceptable solvent. It is widely used in paints, coatings, inks, adhesives, and surface cleaners because of its strong solvency power and rapid evaporation characteristics. As industries face increasing pressure to reduce volatile organic compound emissions, ethanol is being adopted as a preferred alternative to petroleum based solvents. This shift is particularly evident in manufacturing sectors that are aligning their processes with stricter environmental and workplace safety regulations.

Regional Insights

The North American ethanol industry growth is driven by the robust and legislatively supported Renewable Fuel Standard (RFS) program in the U.S. This federal mandate establishes annual volumetric requirements for renewable fuels, including conventional corn-based ethanol and advanced biofuels, creating a stable, policy-driven demand base. Ethanol, particularly when produced with sustainable farming and efficient biorefinery practices, benefits from these carbon credit markets, providing an additional revenue stream and competitive advantage over petroleum.

U.S. Ethanol Market Trends

The ethanol industry in the U.S. is fundamentally anchored by the Renewable Fuel Standard (RFS). This federal program mandates the blending of billions of gallons of renewable fuels into the nation’s gasoline supply each year. This policy creates a guaranteed, base-level demand for corn-based ethanol, ensuring its integration into nearly all gasoline sold as E10 (10% ethanol). The RFS is further reinforced by the year-round authorization of E15 (15% ethanol blend) in many regions, expanding the potential volume ceiling.

Asia Pacific Ethanol Market Trends

The ethanol industry in the Asia Pacific region is primarily driven by ambitious national biofuel blending mandates and energy security policies, though the pace and primary feedstocks vary significantly by country. India is a dominant force, with its government aggressively promoting ethanol derived from sugarcane and surplus grain to reduce crude oil imports, improve air quality, and support agricultural incomes. Its Ethanol Blending Program (EBP) targets 20% blending (E20) by 2025-26, creating massive, structured demand. Similarly, countries like Thailand and the Philippines have long-standing policies supporting sugar- and molasses-based ethanol for their domestic bio-gasoline markets.

Europe Ethanol Market Trends

The Europe ethanol industry growth is overwhelmingly driven by the continent's stringent and comprehensive climate policy framework, most notably the Renewable Energy Directive (RED II and the upcoming RED III). These directives set binding targets for renewable energy in transport, with specific sub-targets for advanced biofuels, creating a stable regulatory demand. Unlike the volumetric approach of the U.S. RFS, the European model strongly emphasizes greenhouse gas (GHG) reduction thresholds and sustainability criteria, favoring producers who can demonstrate significant carbon savings across the entire lifecycle.

Latin America Ethanol Market Trends

The Latin America ethanol industry is characterized by robust, long-established national programs driven by a powerful combination of energy security, economic, and agricultural policy. Brazil is the undisputed regional and global leader, operating the world's largest integrated sugarcane-based ethanol industry. Its growth is propelled by the mandatory blending mandate (currently set at 27-28% anhydrous ethanol in gasoline) and the widespread consumer availability of hydrous ethanol (E100) for flex-fuel vehicles (FFVs), which constitute the vast majority of the light vehicle fleet.

Middle East & Africa Ethanol Market Trends

The ethanol industry in the Middle East & Africa (MEA) region is in a nascent but emerging phase, with growth primarily driven by a pressing need to address air pollution, enhance energy security by reducing gasoline imports, and manage agricultural surpluses. Unlike mature markets, the core driver is not broad climate policy but rather targeted national blending mandates aimed at immediate local challenges. Key adopters include South Africa, with its recently reinstated E2 to E10 blending program using sugarcane, and Nigeria, which has launched an E10 mandate to utilize cassava and sugarcane, reduce immense fuel subsidy costs, and curb urban smog.

Key Ethanol Company Insights

Some of the key players operating in the global ethanol industry include ADM, POET LLC, Valero Energy Corporation, Green Plains Inc., Koch Industries, Raizen Energia, Cargill Inc, Alto Ingredients Inc, Tereos Participations, CropEnergies AG, among others. These companies are actively engaged in expanding their market footprint through product innovation, strategic acquisitions, and collaborations aimed at enhancing their global distribution networks and technology capabilities.

Key Ethanol Companies:

The following are the leading companies in the ethanol market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- POET LLC

- Valero Energy Corporation

- Green Plains Inc.

- Koch Industries

- Raizen Energia

- Cargill Inc

- Alto Ingredients Inc

- Tereos Participations

- CropEnergies AG

Recent Developments

-

In January 2026, Bharat Petroleum Corporation Limited (BPCL) flagged off its first tanker lorry carrying domestically produced 1G bio-ethanol from the Bargarh Bio-Refinery in Odisha to the IOTL Raipur Depot. The event marks a key milestone in India's Ethanol Blended Petrol (EBP) Programme, aimed at reducing fossil fuel dependence and promoting sustainable energy under the Atmanirbhar Bharat vision.

Ethanol Market Report Scope

Report Attribute

Details

Market Definition

The ethanol market size represents the global revenue generated from the production, distribution, and consumption of ethanol derived from bio-based and synthetic feedstocks, used across fuel blending, industrial solvents, beverages, pharmaceuticals, and chemical manufacturing applications.

Market size value in 2026

USD 102.69 billion

Revenue forecast in 2033

USD 141.05 billion

Growth rate

CAGR of 4.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in billion litres, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Source, purity, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

ADM; POET LLC; Valero Energy Corporation; Green Plains Inc.; Koch Industries; Raizen Energia; Cargill Inc.; Alto Ingredients Inc.; Tereos Participations; CropEnergies AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ethanol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ethanol market report on the basis of source, purity, application and region:

-

Source Outlook (Volume, Billion Liters; Revenue, USD Million, 2021 - 2033)

-

Sugar & Molasses-Based

-

Grain-Based

-

Second Generation

-

-

Purity Outlook (Volume, Billion Liters; Revenue, USD Million, 2021 - 2033)

-

Denatured

-

Undenatured

-

-

Application Outlook (Volume, Billion Liters; Revenue, USD Million, 2021 - 2033)

-

Fuel & its Additives

-

Industrial Solvents

-

Beverages

-

Disinfectants

-

Personal Care

-

Others

-

-

Regional Outlook (Volume, Billion Liters; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ethanol market size was estimated at USD 97.52 billion in 2025 and is expected to reach USD 102.69 billion in 2026.

b. The global ethanol market is expected to grow at a compound annual growth rate of 4.6% from 2026 to 2033 to reach USD 141.05 billion by 2033.

b. Based on the application segment, fuel & its additives held the largest revenue share of over 67% in the ethanol market in 2025.

b. Some of the key vendors of the global Ethanol market include ADM, POET LLC, Valero Energy Corporation, Green Plains Inc., Koch Industries, Raizen Energia, Cargill Inc, Alto Ingredients Inc, Tereos Participations, CropEnergies AG, among others.

b. The key factors driving the ethanol market include the rapid expansion of biofuel blending mandates, rising demand for cleaner transportation fuels, supportive government policies promoting renewable energy, increasing investments in sustainable fuel technologies, and growing use of ethanol across automotive, industrial, and chemical applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.