- Home

- »

- Biotechnology

- »

-

Epigenetics Market Size, Share And Trends Report, 2030GVR Report cover

![Epigenetics Market Size, Share & Trends Report]()

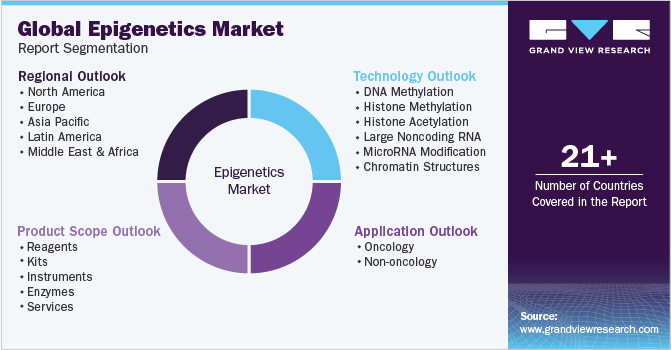

Epigenetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Reagents, Kits, Instruments), By Technology (DNA Methylation), By Application (Oncology), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-583-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Epigenetics Market Summary

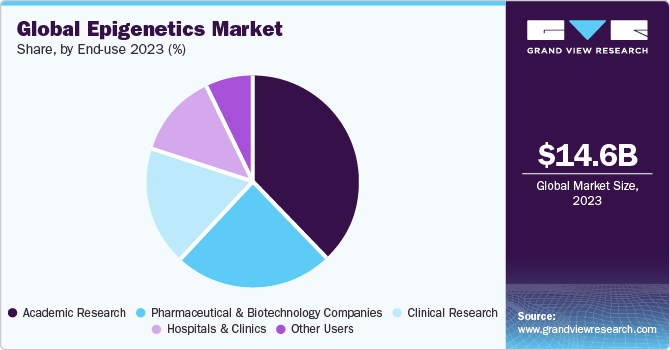

The global epigenetics market size was estimated at USD 14.62 billion in 2023 and is projected to reach USD 39.15 billion by 2030, growing at a CAGR of 15.3% from 2024 to 2030. This growth can be attributed to the pivotal role of epigenetics in understanding gene regulation beyond DNA sequencing, aiding disease research, and advancing personalized medicine.

Key Market Trends & Insights

- North America dominated the market and accounted for a 38.19% share in 2023.

- By application, the oncology segment dominated the market with a revenue share of 69.06% in 2023.

- By technology, the DNA methylation segment dominated the market with a revenue share of 45.36% in 2023.

- By end-use, the academic research segment dominated the market in 2023 with a revenue share of 37.98%.

- By product, the reagents segment dominated the industry, accounting for 33.45% of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.62 Billion

- 2030 Projected Market Size: USD 39.15 Billion

- CAGR (2024-2030): 15.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The established companies and startups operating in the industry are investing significantly to develop the epigenetics domain. For instance, in January 2024, Moonwalk Biosciences, a biotechnology startup, was launched after the completion of its seed and series A financing rounds with the funding of USD 57 million to advance its epigenetic profiling and engineering technology platform. Thus, the rising investments and funding in this field are anticipated to boost industry growth over the forecast period.

The global rise in the prevalence of cancer is one of the major factors facilitating market growth in the recent past. For instance, according to PAHO, an estimated 20 million new cancer cases and 10 million cancer deaths were estimated in 2023, and the annual reported cases of cancer are expected to reach about 30 million by 2040. The need to develop diagnostic options that can detect cancer at an early stage, which can help improve disease management & reduce mortality, is anticipated to propel the overall market growth.

Several studies focusing on epigenetics drugs and therapeutics for treating various disorders like cancers and brain disorders are being published. For instance, the study published by the MDPI in April 2023 concluded that epigenetic drugs may help treat many disorders by inhibiting DNA methylation. Epigenetic drugs are used to inhibit various enzymes such as HDMs, HMTs, DNMTs, HATs, and HDACs in epigenetic disorders. They can effectively act with other therapies, such as immunotherapy or chemotherapy. In the future, epigenetic therapy can be considered the most efficacious method for treating cancer and brain disorders. Thus, with the rising prevalence of cancer coupled with the increasing focus of industry participants on epigenetics for treating cancer and other diseases, the market is anticipated to witness significant growth over the forecast period.

The COVID-19 pandemic has significantly impacted the epigenetics market, reflecting both opportunities and challenges. The increasing awareness of the complex interplay between SARS-CoV-2 and epigenetic regulation has underscored the potential of epigenetic therapies in combating the virus. Moreover, the absence of clinically accepted antiviral drugs has created an opportunity for market players to explore innovative approaches, such as combining antiviral drugs with DNMT/HDAC inhibitors and other epigenetic remedies. If successful in clinical trials, such novel strategies may alleviate drug resistance and enhance efficacy, presenting a positive outlook for market growth.

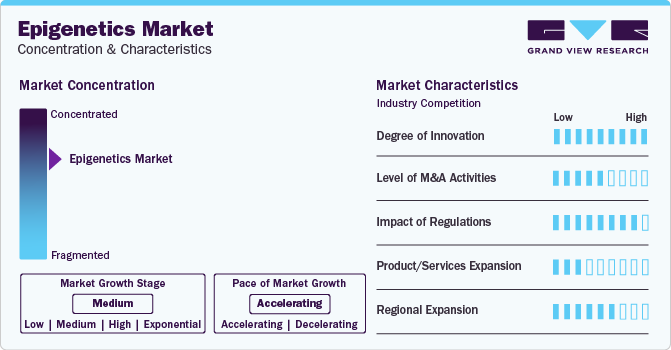

Market Concentration & Characteristics

Numerous industry players are launching novel and innovative bioinformatics and computational services, which can also help revolutionize the field of epigenetics. For instance, in July 2023, FOXO Technologies Inc., a major player operating in the domain of epigenetic biomarker technology, introduced its cutting-edge Bioinformatics Services to leverage the full potential of epigenetic data by helping overcome the challenges associated with data analysis, processing, and interpretation. Such advancements are leading to a high degree of innovation in the industry.

The market is also characterized by a moderate level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. Some of the players undergoing mergers and acquisitions in this industry include PPD, Inc.; Arc Bio LLC; Singular Genomics Sys; and BioVision.

Regulations in the market provide a framework for the safety and quality of products but they also present challenges for industry players. The market is characterized by a high impact of regulations although the impact varies depending on the nature and stringency of regulations across geographical conditions. Furthermore, ethical and legal constraints may lead to further complexities in formulation and adherence to regulations leading to significant market challenges.

Numerous industry players are focusing on expanding their product and service portfolio. They are launching novel epigenetics services and products. For instance, in November 2023, Active Motif, the U.S.-based firm, introduced End-to-End Epigenetics Services and CUT&RUN assay kit for (cleavage under targets and release using nuclease) CUT&RUN analysis. Such product and service launches are anticipated to support the expansion of the industry’s products & services.

The industry is currently witnessing a moderate level of regional expansion, with growth prospects driven by an expanding customer base for epigenetics products & services. As scientific awareness of the technique grows globally and access to biotechnology improves in emerging markets a rise in regional expansion initiatives is expected from key players in the market.

Product Insights

The reagents segment dominated the industry, accounting for 33.45% of the global revenue in 2023. The large share of this segment can be attributed to the high usage of reagents in epigenetic research studies. The two main categories of reagents used in epigenetics are histone and DNA modifiers. The reagents play a crucial role in the study and manipulation of epigenetic mechanisms, which involve changes in gene expression that do not alter the underlying DNA sequence. These reagents are essential for understanding epigenetic regulation and are used in research & potential therapeutic applications. Moreover, various industry players offer reagents for epigenetics research and studies. For instance, Promega Corporation provides kits and reagents to analyze DNA methylation, histone modification, and RNA transcription to support epigenetic study. Thus, the availability of several reagents from major players is also expected to be the major factor propelling the segment's growth.

The services segment is expected to witness the highest CAGR of 17.68% over the forecast period. Epigenetic services encompass a range of offerings, including sequencing, analysis, and consultation services. Epigenetic analysis involves sophisticated techniques, such as ChIP-seq, bisulfite sequencing, and DNA methylation profiling. Many researchers and institutions rely on specialized services to perform these complex analyses accurately and efficiently. The continuous development of high-throughput sequencing technologies and other advanced epigenetic analysis tools creates a demand for services that can leverage these technologies to generate comprehensive and reliable epigenomic data.

Technology Insights

The DNA methylation segment dominated the market with a revenue share of 45.36% in 2023. DNA methylation's demand in epigenetics stems from its pivotal role in gene expression regulation. This epigenetic modification influences various biological processes, including development, aging, and disease. Understanding DNA methylation patterns aids in deciphering complex diseases, such as cancer, and holds promise for precision medicine, driving the demand for its study in epigenetics research & therapeutic development.

The histone acetylation segment is projected to witness the fastest CAGR of 18.17% from 2024 to 2030, owing to the improved efficacy of the technology due to the development of innovative methods. In addition, several studies have demonstrated that histone acetylation may have healing benefits in disorders such as solid tumors, inflammation, leukemia, and viral infection.

Application Insights

The oncology segment dominated the market with a revenue share of 69.06% in 2023. Oncology's demand for epigenetics arises from the intricate relationship between epigenetic alterations and cancer development. Epigenetic changes are crucial in assessing tumor initiation, progression, and metastasis. Targeting these modifications offers potential avenues for innovative cancer treatments, including precision therapies. Understanding epigenetic mechanisms in oncology holds promise for developing novel diagnostics and more effective, personalized cancer interventions, driving the demand within the field.

The non-oncology segment is projected to witness the fastest CAGR of 16.30% from 2024 to 2030. The understanding of epigenetic mechanisms in a wide range of conditions, including neurological disorders, cardiovascular diseases, metabolic disorders, autoimmune diseases, infectious diseases, rare diseases, aging, reproductive health, psychiatric disorders, drug development, precision medicine, regenerative medicine, environmental exposures, chronic inflammatory diseases, and geriatric medicine collectively contributes to the growth & development of the epigenetics market in non-oncological applications.

End-use Insights

The academic research segment dominated the market in 2023 with a revenue share of 37.98%, due to the profound implications of epigenetics across diverse fields like medicine, biology, and genetics. The complexity of epigenetic mechanisms presents intriguing avenues for exploration, fostering curiosity and driving academic interest. Moreover, the potential for epigenetics to unlock answers about diseases, development, and personalized medicine fuels the growth of academic research in this field.

The clinical research segment is projected to witness the fastest CAGR of 16.38% over the forecast period. Contract research organizations (CROs) are increasingly integrating epigenetic analyses due to their pivotal role in identifying and validating therapeutic targets with precision, a crucial step in the pursuit of effective treatments. Epigenetic insights offer a holistic understanding of how environmental factors impact gene expression, aiding in identifying biomarkers and potential therapeutic interventions. CROs harness these insights to enhance drug efficacy assessments, predict patient responses, and streamline preclinical studies. The aforementioned factors are expected to support the segment growth.

Regional Insights

North America dominated the market and accounted for a 38.19% share in 2023. The region experiences growth due to heightened public awareness, robust medical facilities, and substantial R&D investments. In addition, the prevalence of chronic illnesses and substantial investments by market players in epigenetic research amplify regional expansion, fostering a promising environment for further growth. Furthermore, the presence of key players like Thermo Fisher Scientific, Inc.; Element Biosciences, Inc.; Dovetail Genomics LLC.; Illumina, Inc.; and Promega Corporation in the U.S. market is expected to support the regional expansion.

U.S. Epigenetics Market Trends

The epigenetics market in the U.S. is expected to grow over the forecast period due to the prevalence of chronic diseases and increasing investments by market players in epigenetics development further propel regional growth. For instance, Chroma Medicine, Inc. (Chroma), a new genomic medicine company pioneering epigenetic editing, was launched in November 2021 with a USD 125 million investment to treat various medical conditions.

Europe Epigenetics Market Trends

The epigenetics market in Europe was identified as a lucrative space for epigenetics. This is attributed to strong government support, advancements in research infrastructure, and the technological growth in gene editing.

The epigenetics market in the UK is expected to grow over the forecast period due to robust research and innovation in genetic & molecular studies, coupled with supportive government initiatives and a strong healthcare infrastructure that fosters advancements in epigenetic research. According to an article published in November 2023 by the Imperial College Healthcare NHS Trust, the UK's approval of gene editing therapy, specifically the CRISPR-based Casgevy, marks a milestone with potential implications for the UK epigenetics industry.

The France epigenetics market is expected to grow over the forecast period due to collaborative efforts contributed to the dynamic landscape of genetic and molecular advancements. For instance, in November 2023, AstraZeneca entered a collaboration agreement with Cellectis to accelerate next-generation therapeutics in areas of high unmet need.

The epigenetics market in Germany is expected to grow over the forecast period due to various factors such as R&D initiatives, regulatory frameworks, and collaborations between academic institutions & industry. For instance, in January 2023, Asklepios BioPharmaceutical, Inc. and ReCode Therapeutics announced a strategic collaboration to explore a novel gene editing platform using ReCode's proprietary single-vector delivery technology.

Asia Pacific Epigenetics Market Trends

Asia Pacific is anticipated to witness the fastest CAGR of 16.71% from 2024 to 2030. This growth of the regional market is expected to be driven by the rising demand for genome editing technologies and prevalence of genetic disorders and diseases across several countries like India and Australia. Moreover, the domestic companies providing epigenetics products and services are attracting investments and funding. For instance, in August 2023, Epigenic Therapeutics, a China-based firm, raised USD 32 million in a Series A financing round. This company develops next-generation gene modulation therapy using epigenome regulation to treat prevalent disorders. Thus, rising investments among such industry players are expected to boost regional expansion.

The epigenetics market in China is expected to grow over the forecast period due to a well-established regulatory framework for developing and commercializing Genetically Modified Organisms (GMOs), including those generated using epigenetics.

The Japan epigenetics market is expected to witness rapid growth over the forecast period. This growth is driven by an increasing demand for advanced synthetic biology solutions for various epigenetics applications in research and development activities in the country.

The epigenetics market in India is anticipated to grow at a rapid rate over the forecast period due to the presence of several key players in the country that are catering to the rising demand for epigenetics research. Furthermore, the high population of the country presents a lucrative target for emerging companies in the region targeting diagnostic applications of epigenetics.

Middle East and Africa Epigenetics Market Trends

The epigenetics market in the Middle East and Africa is projected to grow in the near future due to the increasing awareness and adoption of epigenetic techniques for the development of novel diagnostic and therapeutic tools to combat rising chronic disease prevalence in the region.

The epigenetics market in Saudi Arabia is expected to grow over the forecast period. Saudi Arabia has a high burden of genetic diseases, primarily due to consanguinity. According to the International Journal of Advanced Research article published in June 2023, in Saudi Arabia, the sickle-cell mutation affects 4.45% of the population, with a mortality rate of 0.73%.

The Kuwait epigenetics market is anticipated to witness growth over the forecast period. Kuwaiti institutions are actively collaborating with international researchers and companies in gene editing. This collaboration facilitates knowledge transfer and access to cutting-edge technologies, potentially accelerating the epigenetics market growth.

Key Epigenetics Company Insights

Key players operating in the epigenetics industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Epigenetics Companies:

The following are the leading companies in the epigenetics market. These companies collectively hold the largest market share and dictate industry trends.

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- Eisai Co. Ltd.

- Novartis AG

- Element Biosciences, Inc.

- Dovetail Genomics LLC.

- Illumina, Inc.

- Promega Corporation.

- Abcam plc.

Recent Developments

-

In December 2023, BioLabs and Promega expanded their joint effort to accelerate life sciences innovation globally by supporting early-stage startups. Promega GmbH in Walldorf, which is the German subsidiary of global life sciences manufacturer Promega, provides equipment, services, and training to BioLabs Heidelberg.

-

In November 2023, QIAGEN and Element Biosciences, Inc. have partnered strategically to provide broad NGS workflows for the innovative Element AVITI System.

-

In October 2023, Zenith Epigenetics Ltd. agreed with Cencora to commercialize the ZEN-3694 program, an epigenetic method to synergistically advance the effectiveness of cancer treatment of currently marketed drugs.

-

In September 2023, NanoString Technologies, a leading provider of life science tools for discovery and translational research, launched its latest GeoMx Digital Spatial Profiler (DSP) assay.

-

In July 2023, Chroma Medicine, Inc. formed a license agreement with Sangamo Therapeutics, Inc. to devise epigenetic medicines leveraging zinc finger proteins for sequence-specific DNA recognition.

-

In April 2023, Eisai collaborated with the National Cancer Center to advance investigator-initiated clinical research for the anticancer agent tazemetostat. Tazemetostat is an anticancer agent that operates as an epigenetic therapy targeting enzymes involved in chromatin modification.

-

In February 2023, Tecan and Element Biosciences collaborated to provide a benchtop NGS workflow with MagicPrep NGS. The product is AVITI System, an innovative DNA sequencing platform by Element Biosciences, Inc.

Epigenetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.69 billion

Revenue forecast in 2030

USD 39.15 billion

Growth rate

CAGR of 15.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America;, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Roche Diagnostics; Thermo Fisher Scientific, Inc.; Eisai Co. Ltd.; Novartis AG; Element Biosciences, Inc.; Dovetail Genomics LLC.; Illumina, Inc.; Promega Corporation; Abcam plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Epigenetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global epigenetics market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Kits

-

ChIP sequencing kit

-

Whole Genomic Amplification kit

-

Bisulfite Conversion kit

-

RNA sequencing kit

-

Others

-

-

Instruments

-

Enzymes

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Methylation

-

Histone Methylation

-

Histone Acetylation

-

Large non-coding RNA

-

MicroRNA modification

-

Chromatin structures

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Solid tumors

-

Liquid tumors

-

-

Non-oncology oncology

-

Inflammatory diseases

-

Metabolic diseases

-

Infectious diseases

-

Cardiovascular diseases

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Other Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global epigenetics market size was estimated at USD 14.63 billion in 2023 and is expected to reach USD 16.69 billion in 2024.

b. The global epigenetics market is expected to grow at a compound annual growth rate of 15.27% from 2023 to 2030 to reach USD 39.15 billion by 2030.

b. Reagents dominated the epigenetics market with a share of 33.45% in 2023. This is attributable to the growing R&D activities with increasing demand for rapid and sensitive diagnostic techniques.

b. Some key players operating in the epigenetics market include F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Eisai Co. Ltd.; and Novartis AG.

b. Key factors that are driving the epigenetics market include the increasing prevalence of cancer and other chronic diseases along with the rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.