- Home

- »

- Consumer F&B

- »

-

Enhanced Water Market Size & Share, Industry Report, 2030GVR Report cover

![Enhanced Water Market Size, Share & Trends Report]()

Enhanced Water Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flavored, Plain), By Distribution Channel (Online, Offline), By Region (North America, Europe, Middle East & Africa, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68038-904-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enhanced Water Market Summary

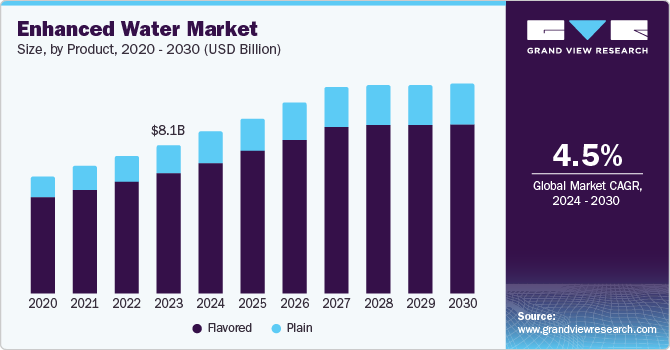

The global enhanced water market size was valued at USD 8.79 billion in 2024 and is projected to reach USD 14.87 billion by 2030, growing at a CAGR of 9.2% from 2025 to 2030. The rising concern about the health issues caused by dehydration drives the increasing demand for hydrating drinks with added minerals, leading to the growing demand for enhanced water worldwide.

Key Market Trends & Insights

- North America held the largest market revenue share of 48.5% in 2024.

- The demand for enhanced water in the U.S. is rising significantly due to increasing health consciousness among consumers seeking functional beverages that offer more than just hydration.

- Based on product, the flavored segment held the largest market revenue share of 68.8% in 2024.

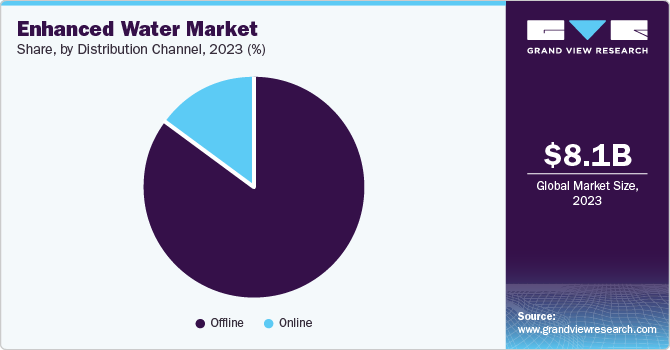

- Based on distribution channel, the offline segment held the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.79 Billion

- 2030 Projected Market Size: USD 14.87 Billion

- CAGR (2025-2030): 9.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The introduction of flavored alternatives by key players in this industry significantly fuels the market demand for enhanced water as an alternative to unhealthy carbonated water. As consumers become more informed and aware of their unique dietary needs and health goals, they seek beverages tailored to support specific health outcomes. Enhanced water products often feature a variety of additives, such as antioxidants, amino acids, and probiotics, which are marketed as providing targeted health benefits such as improved digestion, enhanced immune function, or better skin health. This trend towards personalization in health and wellness is encouraging consumers to choose enhanced water over standard hydration options.

Increasing lifestyle-related health issues, such as obesity, diabetes, and cardiovascular diseases, are also pushing consumers toward healthier beverage choices. Enhanced water, often marketed as a low-calorie, sugar-free alternative, benefits individuals looking to manage or prevent these conditions. The growing emphasis on preventive healthcare and the role of diet in managing long-term health drives the adoption of enhanced water as a part of daily hydration routines. According to the 2023 Food Health Survey published by The International Food Information Council (IFIC), approximately 74% of Americans think that their diet and health depend on the food and beverages they intake. This is expected to fuel the demand for enhanced water in upcoming years.

Lastly, the global rise of e-commerce and direct-to-consumer sales channels has made enhanced water more accessible to a broader audience. The convenience of online shopping, combined with the ability to discover a wide range of products and brands, has contributed to the increased visibility and availability of enhanced water. Many consumers are also drawn to subscription services that deliver enhanced water directly to their doorsteps, making it easier to maintain their health routines. This shift in how consumers purchase beverages is helping to sustain the growth of the enhanced water industry globally.

Product Insight

The flavored segment held the largest market revenue share of 68.8% in 2024. The demand for the flavored segment in the enhanced water industry is rising due to evolving consumer preferences toward healthier and more enjoyable hydration options. As people become more health conscious, there's a shift away from sugary beverages such as sodas and juices toward drinks perceived as healthier, such as enhanced water. Adding natural flavors enhances the taste and makes the product more preferred, offering a satisfying alternative without traditional soft drinks' high calorie and sugar content. Moreover, the growing variety of flavors available caters to diverse consumer tastes, further driving demand in this segment.

The plain segment is projected to grow at the fastest CAGR over the forecast period. Plain-enhanced water offers the benefits of added electrolytes, vitamins, and minerals without compromising water's clean and natural taste, making it a preferred choice for health-conscious individuals. Additionally, the growing awareness of the adverse effects of excessive sugar intake has led consumers to prefer plain versions over flavored alternatives, further boosting the demand for this segment.

Distribution Channel Insights

The offline segment held the largest market revenue share in 2024. Consumers often prefer purchasing enhanced water from physical retail outlets, such as supermarkets, convenience stores, and specialty health stores, where they can see, feel, and compare different products before purchasing. Additionally, offline channels provide instant gratification, allowing consumers to access and consume the products immediately. The increasing awareness of health and wellness, combined with impulse buying behavior, drives customers to these physical stores, where they can discover new flavors and brands.

The online segment is projected to grow at the fastest CAGR over the forecast period. The growing prevalence of E-commerce and Q-commerce platforms has made it easier for consumers to access a wide variety of enhanced water products from the convenience of their homes. Additionally, the shift in consumer behavior towards health-conscious choices has driven the popularity of enhanced water, and online channels provide an effective medium for brands to educate consumers and promote their health benefits. Furthermore, online shopping offers competitive pricing, subscription options, and door-to-door delivery, beneficial to busy, health-oriented consumers. The rise of social media and digital marketing also plays a crucial role in boosting the visibility and demand for enhanced water products in online channels.

Regional Insights

North America held the largest market revenue share of 48.5% in 2024. The increasing demand for enhanced water is primarily driven by a shift in consumer preferences toward health and wellness, especially in the U.S. and Canada. With rising concerns about obesity, diabetes, and other lifestyle-related diseases, consumers are actively seeking out healthier beverage options. According to the World Obesity Atlas 2024 published by Global Obesity Observatory, every year 41 million deaths occur due to high body mass index (BMI) in adults. The report also estimates that by 2035, over 750 million children are expected to suffer from obesity. Enhanced water, often infused with vitamins, minerals, and natural flavors, provides a perceived healthier alternative to traditional sugary sodas and energy drinks. Additionally, the trend towards active, fitness-oriented lifestyles is powerful in North America, where consumers seek beverages that hydrate and support their health and fitness goals.

U.S. Enhanced Water Market Trends

The U.S. market is anticipated to grow in the coming years. The demand for enhanced water in the U.S. is rising significantly due to increasing health consciousness among consumers seeking functional beverages that offer more than just hydration. Additionally, the growing trend towards fitness and active lifestyles drives the demand for products that support hydration and nutrient replenishment.

Europe Enhanced Water Market Trends

Europe accounted for a significant market revenue share in 2024. The demand for enhanced water in Europe is rising due to growing consumer awareness of health and wellness and a shift towards healthier beverage options. The trend towards natural and organic products influences consumer preferences, with many opting for enhanced water that offers added health benefits without artificial additives. The region's robust regulatory framework also supports the growth of high-quality, safe products, further boosting consumer confidence and driving demand. For instance, according to (EU) 2020/2184 of the European Parliament and of the Council, water suppliers are required to monitor and report the quality of drinking water. The key purpose of this directive is to ensure that all EU citizens have access to clean and safe drinking water that meets specific quality standards.

The UK enhanced water industry is projected to witness significant growth over the forecast period. The UK has seen a shift from sugary drinks, driven by public health campaigns and government policies such as the Soft Drinks Industry Levy, pushing consumers towards healthier alternatives. The convenience of enhanced water, often available in on-the-go formats, also aligns with the busy lifestyles of many UK consumers, further fueling its popularity. This demand is further bolstered by the expanding range of flavors and product innovations, making enhanced water a preferred option for a broad demographic.

Middle East and Africa Enhanced Water Market Trends

The Middle East and Africa market is expected to grow at the fastest CAGR over the forecast period. The demand for enhanced water is increasing in the Middle East and Africa due to various factors, including rising health consciousness among consumers and the growing awareness of the benefits of functional beverages. In these regions, there is a noticeable shift towards healthier lifestyles, particularly in urban areas where the population is more exposed to global health trends. Additionally, the harsh climate and high temperatures in many parts of the Middle East and Africa drive the need for hydration solutions that not only quench thirst but also provide added nutrients and electrolytes, making enhanced water a preferred choice.

Asia Pacific Enhanced Water Market Trends

Asia Pacific is expected to grow at the fastest CAGR during the forecast period 2025 - 2030. The growing urban population in major countries such as China, India, and Japan have increased disposable income, enabling consumers to spend more on premium, health-focused products like enhanced water. Additionally, the expansion of the retail sector and the increasing penetration of e-commerce platforms have made these products more accessible to a broader audience. Moreover, the influence of global health trends, combined with local marketing campaigns emphasizing enhanced water's benefits, has significantly contributed to its growing popularity in the region.

China enhanced water industry is projected to witness significant growth in the forecast period. The increasing prevalence of lifestyle-related health issues, such as obesity and diabetes, has led consumers to seek out functional beverages that offer health benefits without the high sugar content found in traditional soft drinks. This trend is further supported by the expanding middle class, which is more willing to spend on premium, health-focused products, including enhanced water. The influence of social media and marketing campaigns that promote the health benefits of these beverages also contributes to their growing popularity in the region.

Key Enhanced Water Company Insights

Some of the key companies in the enhanced water industry are Hint Inc., Karma Water, Liquid Death Mountain Water, Keurig Dr Pepper Inc. and Others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Liquid Death Mountain Water offers a range of enhanced water products that cater to various tastes and preferences. Their lineup includes naturally sourced Mountain Water, which is rich in minerals and electrolytes, and a variety of flavored sparkling waters such as Severed Lime, Mango Chainsaw, and Convicted Melon.

-

H2rOse offers organic rose and saffron induced water through its enhanced water section. The company's beverages offer numerous benefits that help individuals in their wellness and hydration routine.

-

Karma Water is a provider of energy water that includes a blend of natural caffeine. The company offers its products in three product categories: Karma Energy Water, Karma Probiotic Water, and Karma Stick Packs.

-

PepsiCo Inc. is a food, beverage, and snack company that offers a wide range of products through its numerous brands. Under its beverages portfolio, the company offers products such as energy drinks, enhanced water, etc.

Key Enhanced Water Companies:

The following are the leading companies in the enhanced water market. These companies collectively hold the largest market share and dictate industry trends.

- BiPro USA (Agropur)

- Keurig Dr Pepper Inc.

- H2rOse

- JUST Goods, Inc.

- Essential Water, LLC

- Hint Inc.

- PepsiCo Inc.

- Liquid Death Mountain Water

- Karma Water

- Viking Coca-cola Bottling Co.

Recent Developments

-

In July 2024, Essentia Water, LLC partnered with a Canadian basketball player for its ‘Stop for Nothing’ campaign, which was announced in 2021. The campaign demonstrates how Essentia helps players stay hydrated to keep their performance high and achieve their goals.

Enhanced Water Market Report Scope

Report Attribute

Details

Market Size Value 2025

USD 9.55 billion

Revenue forecast in 2030

USD 14.87 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Base Year for Estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Middle East & Africa; Asia Pacific

Country scope

U.S.; Canada; UK; Germany; France; Italy; Australia

Key companies profiled

Liquid Death Mountain Water; Essentia Water, LLC; H2rOse; Hint Inc; Karma Water Powered by Shopify; Keurig Dr Pepper Inc.; JUST Goods, Inc.; PepsiCo Inc.; BiPro USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enhanced Water Market Report Segmentation

This report forecasts revenue growth at global level, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enhanced water market report based on Product, distribution channel, region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Plain

-

Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

Australia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.