- Home

- »

- Medical Devices

- »

-

EMEA Dental Service Organization Market Size Report, 2030GVR Report cover

![EMEA Dental Service Organization Market Size, Share & Trends Report]()

EMEA Dental Service Organization Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Human Resources, Accounting), By End-use (Dental Surgeons, Endodontists), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-109-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The EMEA dental service organization market size was estimated at USD 90.55 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030. The market is experiencing growth due to significant investments in dental care and enhanced operational effectiveness in nonclinical business management facilitated by dental service organizations (DSOs). Furthermore, oral healthcare practices are rapidly aligning their business structure with DSOs to reduce administrative responsibilities and gain access to advanced technology, contributing to market expansion. In addition, the industry is undergoing rapid strategic activities, which propels growth. For instance, in August 2022, Riverdale Healthcare announced the acquisition of Hanji Dental Care into the group. The acquisition is likely to strengthen the company’s position as a leading provider of oral care.

The COVID-19 pandemic negatively impacted the growth of the EMEA DSO market. Most EU countries only provided emergency dental care during the pandemic. To prevent nosocomial coronavirus infection, efficient infection control measures were advised. As a result, the dentistry industry was compelled to comply with new rules & norms. Except for emergency care, dental treatment was discontinued or delayed because of the pandemic and lockdowns. For instance, the COVID-19 pandemic decreased the number of patients and business turnover rate in Danish dentistry offices.

The growing dental technology and technique advancements have propelled the EMEA DSO market. Procedures such as teeth whitening, veneers, and implants have become more efficient and comfortable, attracting more individuals to seek cosmetic dental treatments. In addition, appearance consciousness & aesthetic influence are increasing among the millennials, propelling growth. According to 2019 Hubspot data, 71% of people are more likely to purchase a product or service online when others recommend it. Furthermore, the International Journal of Dentistry and Oral Health has stated that social media has proven to be a powerful tool in Saudi Arabia and the Arabian Gulf region, as more people are using it to communicate with dental professionals, search for information, and provide feedback about their experiences.

Moreover, the EMEA dental service organization (DSO) market has undergone various strategic alliances, which aids growth. For instance, in June 2022, Riverdale Healthcare announced the acquisition of Prettygate Dental. The acquisition is likely to strengthen the industrial position of the company. Similarly, in April 2021, Gilde Healthcare announced its investment in the dental chain Tandarts. The acquisition is likely to help Gilde Healthcare in entering the Dutch dental care market.

However, the EMEA DSO market faces significant challenges. For instance, dentists who partner with DSOs may have to relinquish some degree of autonomy in making business & clinical decisions. DSOs have standardized protocols and procedures that dentists are expected to follow, limiting their independence in treatment planning and practice management. DSOs centralize certain administrative functions, leading to changes in staffing arrangements within practices. This can result in the reassignment or restructuring of support staff, potentially disrupting established working relationships & workflows.

Service Insights

Based on service, the market is segmented into human resources, marketing and branding, accounting, medical supplies procurement, and others. Medical supplies procurement dominated the market in 2022 with a revenue share of 23.2% and is estimated to grow at the fastest CAGR of 12.0% over the forecast period. DSOs can significantly improve the efficiency of their medical supplies procurement services through various strategies, such as establishing a centralized purchasing system, maintaining strong vendor relationships, and implementing inventory optimization techniques.

In addition, various players are leveraging artificial intelligence (AI) to streamline medical supplies procurement, which significantly reduces the cost pressures and drives the DSO industry. For instance, in May 2023, Wellplaece announced the beta launch of an AI platform, allowing dental offices to source, order, and pay for products from multiple vendors at highly competitive prices. Such factors are anticipated to propel the market growth during the forecast period.

End-use Insights

Based on end-use, the market is segmented into dental surgeons, endodontists, general dentists, and others. General dentists dominated the market in 2022 with a revenue share of 33.0% and are estimated to grow at the fastest CAGR of 11.9% over the forecast period. General dentists are the first line of approach for individuals suffering from dental conditions and are efficiently trained to examine & plan overall oral health care needs, thereby holding a significant share in the market.

In addition, partnering with general dentists allows DSOs to offer comprehensive oral care services to patients, catering to their diverse oral healthcare needs. This increases patient satisfaction and retention, thereby propelling market growth during the forecast period. Furthermore, favorable oral healthcare insurance policies & reimbursement scenario adds a significant portion of the population under care. For instance, since 2019, Austria’s nine regional funds have been merged into one combined Social Health Insurance (SHI). Moreover, the cost of basic dental treatments is fully covered by the SHI funds.

Regional Insights

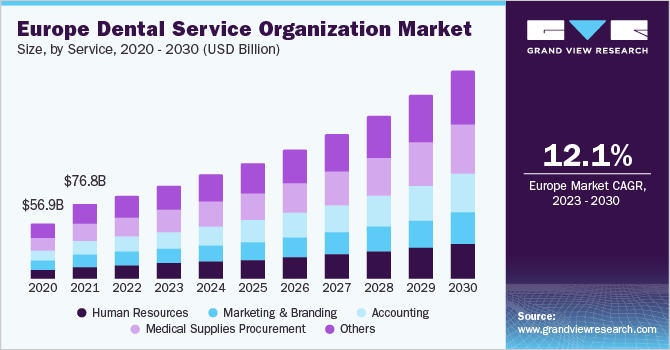

In terms of region, Europe dominated the EMEA dental service organization market in 2022 with a revenue share of 94.15%. The European DSO market has continually consolidated with independent dental practices merging or being acquired by DSOs. Owing to the streamlining of such operations, the region’s share is dominant. In addition, DSOs are continually expanding via geographical collaboration or international partnerships, thereby allowing them to enter newer markets & consolidate their regional share.

For instance, in April 2023, Portman Dental Care & Dentex entered into a strategic partnership to serve as a combined entity with more than 1.5 million patients per year. The companies aim to expand across regions in the forecast period. Similarly, in February 2021, Dental Beauty Partners announced the expansion of its business in the UK to enhance its product portfolio and provide high-standard dental care services in the region.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of service providers, the players are focusing on various strategic initiatives such as new service launches, geographical expansion, mergers and acquisitions, collaboration, and partnerships. For instance, in June 2022, mydentist launched three new orthodontic practices and invested approximately £400,000 or USD 432,000 across different locations. Some prominent service providers in the EMEA dental service organization market include:

-

Riverdale Healthcare.

-

Colosseum Dental Group

-

Dentex Healthcare Group

-

Paloma Capital Partners

-

Clyde Munro Dental Group.

-

Dental Beauty Group Ltd.

-

Bupa

-

Portman Dental Care

-

mydentist

EMEA Dental Service Organization Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 100.49 billion

Revenue Forecast in 2030

USD 218.40 billion

Growth rate

CAGR of 11.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service, end-use, region

Regional scope

Europe; MEA

Country scope

UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Poland; Hungary; Czech Republic; Austria; Croatia; Israel; Bulgaria; Finland; Iceland; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Riverdale Healthcare; Colosseum Dental Group; Dentex Healthcare Group; Paloma Capital Partners; Clyde Munro Dental Group; Dental Beauty Group Ltd.; Bupa; Portman Dental Care; mydentist

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

EMEA Dental Service Organization Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the EMEA dental service organization market report based on service, end-use, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Human Resources

-

Marketing & Branding

-

Accounting

-

Medical Supplies Procurement

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dental Surgeons

-

Endodontists

-

General Dentists

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Poland

-

Hungary

-

Czech Republic

-

Austria

-

Croatia

-

Israel

-

Bulgaria

-

Finland

-

Iceland

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The EMEA dental service organization market size was estimated at USD 90.55 billion in 2022 and is expected to reach USD 100.49 billion in 2023

b. The EMEA dental service organization market is expected to grow at a compound annual growth rate of 11.7% from 2023 to 2030 to reach USD 218.40 billion by 2030.

b. Europe dominated the dental service organization market with a share of 94.1% in 2022. This is attributable to rising healthcare awareness, increasing presence of DSOs in the country, high Private Equity inflow in the market and large pool of dental professionals in the region

b. Some key players operating in the EMEA dental service organization market include Riverdale Healthcare., Colosseum Dental Group, Dentex Healthcare Group, Paloma Capital Partners, Clyde Munro Dental Group., Dental Beauty Group Ltd., Bupa, Portman Dental Care, mydentist.

b. Key factors that are driving the market growth include administrative benefits offered by the DSO, dental practice autonomy, easy procurement of dental supplies at lower costs and quality treatment services

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.