- Home

- »

- Automotive & Transportation

- »

-

Electronic Toll Collection Market Size, Industry Report, 2033GVR Report cover

![Electronic Toll Collection Market Size, Share & Trends Report]()

Electronic Toll Collection Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Automatic Vehicle Identification System, Violation Enforcement System), By Technology, By Application (Highways, Urban Areas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-655-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Toll Collection Market Summary

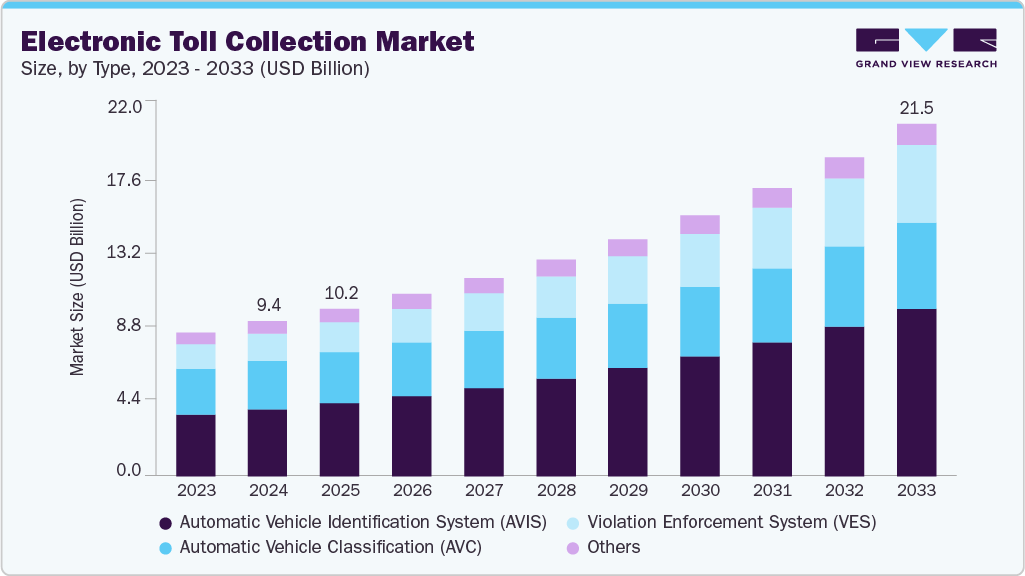

The global electronic toll collection market size was estimated at USD 9.45 billion in 2024 and is projected to reach USD 21.50 billion by 2033, growing at a CAGR of 9.7% from 2025 to 2033. The Electronic Toll Collection (ETC) market has been driven by increasing traffic congestion, the need for efficient tolling solutions, and growing investments in transportation infrastructure.

Key Market Trends & Insights

- Asia Pacific dominated the electronic toll collection market and accounted for a share of 36.7% in 2024.

- The electronic toll collection industry in India is expected to grow significantly over the forecast period.

- By type, the Automatic Vehicle Identification System (AVIS) segment dominated the market in 2024, accounting for the largest share of 43.1%.

- By technology, the Radio Frequency Identification (RFID) segment dominated the market in 2024.

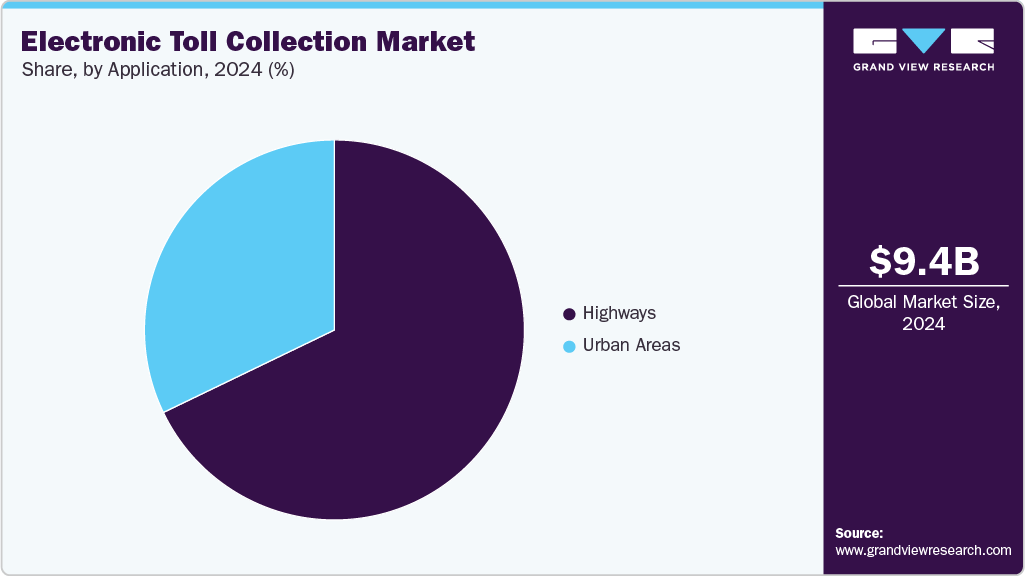

- By application, the highways segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.45 Billion

- 2033 Projected Market Size: USD 21.50 Billion

- CAGR (2025-2033): 9.7%

- Asia Pacific: Largest market in 2024

Governments and transport authorities have prioritized the modernization of toll systems to reduce vehicular delays, minimize fuel consumption, and improve revenue collection efficiency. The widespread adoption of cashless transactions and real-time vehicle tracking has also accelerated the growth of the electronic toll collection industry. As urbanization intensifies and vehicle ownership rises, ETC systems have been positioned as key enablers of smart mobility and intelligent transportation networks globally. In addition, electronic tolling systems are increasingly being integrated into broader smart city frameworks and environmental pricing strategies. Cities use ETC to implement congestion pricing, low-emission zones, and dynamic tolling to reduce traffic volume and air pollution.

The market's growth is further attributed to the increasing integration of advanced technologies such as Radio Frequency Identification (RFID), Dedicated Short-Range Communication (DSRC), and Global Navigation Satellite Systems (GNSS). These technologies have enabled vehicle identification, classification, and toll deduction automation with minimal human intervention. Mobile-based tolling, including cell phone tolling and app-integrated systems, has also gained traction in urban corridors. Moreover, AI-powered analytics and cloud-based platforms are integrated into ETC solutions to support dynamic pricing and predictive maintenance.

The regulatory landscape surrounding ETC systems has become more structured and supportive, with mandates and compliance standards being enforced to ensure uniformity and accountability. Initiatives such as the European Electronic Toll Service (EETS) and India’s FASTag mandate have been rolled out to streamline tolling across regions. Standardization of protocols and interoperability guidelines has been emphasized to facilitate seamless toll collection across multiple jurisdictions. In several countries, national transport authorities have introduced incentives or deadlines to accelerate ETC adoption among vehicle owners and operators.

Despite its rapid adoption, the electronic toll collection market has faced challenges such as high initial deployment costs, legacy system compatibility issues, and data privacy concerns. Limited digital infrastructure and low consumer awareness have hampered large-scale rollouts in developing economies. Moreover, resistance to technological change and concerns over surveillance and personal data usage have slowed adoption in certain regions. Operational disruptions, cyber threats, and maintenance complexities have also posed challenges for ETC system integrators and stakeholders.

Type Insights

The Automatic Vehicle Identification System (AVIS) segment dominated the market in 2024 and accounted for the largest share of 43.1%. The increasing demand for real-time, contactless tolling solutions is driving the growth of AVIS. AVIS enables the identification of vehicles using RFID tags, DSRC transponders, or license plate recognition, ensuring accurate and efficient toll collection without manual intervention. Governments and toll operators aim to streamline traffic flow and reduce revenue leakage, leading to widespread deployment of AVIS systems across urban and intercity routes. Their integration with centralized tolling databases and enforcement systems further supports scalability and interoperability, especially in regions with high vehicle density and multi-lane free-flow tolling environments.

The Violation Enforcement System (VES) segment is expected to witness the fastest CAGR over the forecast period. The demand for VES is expanding due to the need to curb toll evasion and enforce traffic compliance in electronic tolling environments. VES typically includes license plate recognition, vehicle tracking, and automated fine issuance for vehicles that bypass toll gates or lack valid payment methods. With the increasing adoption of open-road tolling and the removal of physical toll booths, enforcement has become a critical component of ETC operations. Growth in this segment is being supported by smart city initiatives and digital infrastructure investments emphasizing safety, surveillance, and revenue protection.

Technology Insights

The Radio Frequency Identification (RFID) segment dominated the market in 2024. The growth of RFID-based tolling systems is being propelled by their cost-efficiency, simplicity, and reliability in large-scale deployments. RFID uses passive or active tags to identify vehicles passing toll collection points, enabling quick and contactless payment processing. The technology has become a preferred choice for many developing economies and high-density traffic corridors due to its low infrastructure requirements and ease of adoption.

The Global Navigation Satellite System (GNSS) and GPS segment is expected to witness the fastest CAGR over the forecast period. The implementation of Global Navigation Satellite System (GNSS) and GPS-based tolling has introduced distance-based models that revolutionize how tolls are calculated and collected. These systems are particularly effective across large national road networks and for freight and commercial vehicle operations. GNSS tolling requires minimal roadside infrastructure, thereby lowering deployment costs and simplifying scalability. Governments are adopting this model to ensure fairer road usage charges, especially in response to reduced fuel tax revenues driven by electric vehicle (EV) adoption.

Application Insights

The highways segment dominated the market in 2024. The expansion of ETC systems on highways is being driven by increased vehicle movement across long-distance corridors and the modernization of national transportation infrastructure. Governments and private operators prioritize highway toll automation to reduce congestion, improve fuel efficiency, and increase toll revenue accuracy. Emerging economies invest heavily in national highway development, integrating ETC systems from the outset to support smart mobility objectives. In addition, freight and commercial logistics sectors have reinforced demand for efficient, uninterrupted tolling solutions on major trucking routes.

The urban areas segment is expected to witness the fastest CAGR over the forecast period.Rising concerns over traffic congestion, air pollution, and the need for dynamic traffic management are fueling the rapid implementation of ETC in urban areas. Urban tolling is evolving beyond traditional toll booths to include congestion pricing, low-emission zones, and smart parking integrations. Cities leverage ETC to influence driver behavior, reduce peak-hour traffic, and promote public transportation alternatives. This application segment is experiencing robust growth, particularly in metropolitan areas aiming to achieve sustainability and climate goals.

Regional Insights

The North America electronic toll collection market is expected to grow at a CAGR of 7.9% during the forecast period. The region’s growth is driven by large-scale deployments and a shift toward interoperability and mobile-based tolling. Public-private partnerships and state-level agencies have driven infrastructure investment, particularly in highway and express lane automation, thereby driving the growth of the market.

U.S. Electronic Toll Collection Market Trends

The U.S. electronic toll collection market held a dominant position in the region in 2024, driven byrobust infrastructure and decades-long implementation of tolling networks such as E-ZPass, SunPass, and TxTag. The country is also exploring mileage-based user fees (MBUF) as a potential replacement for declining fuel tax revenues, signaling new use cases and growth opportunities for ETC technologies.

Asia Pacific Electronic Toll Collection Market Trends

Asia Pacific dominated the electronic toll collection industry and accounted for a share of 36.7% in 2024.Asia Pacific represents the largest and fastest-growing market for electronic toll collection, driven by rapid infrastructure development, high vehicle density, and government-led digitalization programs. Countries across the region are actively investing in smart mobility solutions, with ETC being a key component in reducing traffic congestion and improving toll revenue efficiency. The demand is especially strong in emerging economies, where the transition from manual to automated toll systems is being prioritized under national transportation modernization agendas.

The India electronic toll collection market is expected to grow at the fastest rate during the forecast period. India has emerged as one of the most dynamic markets for ETC, primarily due to the successful rollout of the FASTag system under the National Electronic Toll Collection (NETC) program. The mandate for RFID-based tolling across national highways has led to near-universal adoption, drastically improving toll collection efficiency and reducing congestion at plazas.

The China electronic toll collection marketheld a substantial market share in 2024, driven by state policies aimed at modernizing highway networks and improving tolling efficiency nationwide. The full elimination of manual toll booths on major expressways and the mandatory installation of ETC devices in vehicles have resulted in widespread deployment. The integration of ETC with smart city platforms, AI-based traffic management, and digital payment ecosystems has further enhanced user experience and system performance.

Europe Electronic Toll Collection Market Trends

The Europe electronic toll collection market is expected to register a moderate CAGR from 2025 to 2033.The region’s market growth is driven by advanced technology adoption, policy harmonization, and cross-border interoperability efforts under frameworks such as the European Electronic Toll Service (EETS). Europe's high regulatory standards and digital integration are driving demand for sophisticated tolling solutions that offer flexibility, scalability, and compliance.

The UK electronic toll collection market is expected to grow significantly from 2025 to 2033. The government’s push toward sustainable transportation and emission reduction creates new opportunities for ETC solution providers, particularly those offering cloud-based and mobile-integrated platforms. Investments in connected vehicle infrastructure are also expected to complement ETC advancements in the coming years.

The Germany electronic toll collection market held a substantial market share in 2024.Germany has pioneered GNSS-based tolling for commercial vehicles through its Toll Collect system, one of the most advanced in Europe. Germany is also exploring ETC expansion for passenger vehicles and regional roadways to enhance equity in road usage and meet climate policy objectives, thereby driving the market’s growth.

Key Electronic Toll Collection Company Insights

Some of the key companies in the electronic toll collection industry include Kapsch TrafficCom AG, Conduent Incorporated, and TransCore, among others. These players leverage proprietary technologies, strategic partnerships, and government contracts to strengthen their market position.Competition is driven by advancements in RFID, GNSS, and cloud-based platforms, as well as the ability to offer interoperable, scalable, and data-integrated solutions.

-

Kapsch TrafficCom AG is a global provider of intelligent transportation systems, specializing in electronic toll collection, traffic management, and connected mobility solutions. The company operates in over 30 countries and has been pivotal in deploying nationwide ETC systems across Europe, the Americas, and Asia.

-

Conduent Incorporated is a prominent business process services provider with a strong presence in the tolling and transportation sector. The company manages complex electronic toll collection systems, customer service centers, and transaction processing platforms through its transportation solutions division for public agencies and private operators.

Key Electronic Toll Collection Companies:

The following are the leading companies in the electronic toll collection market. These companies collectively hold the largest market share and dictate industry trends.

- Kapsch TrafficCom AG

- Conduent Incorporated

- EFKON GmbH

- TransCore

- Thales

- Mitsubishi Heavy Industries, Ltd.

- Neology, Inc.

- Toshiba Infrastructure Systems & Solutions Corporation

- STAR Systems International

- VaaaN

Recent Developments

- In January 2025, TransCore introduced its next-generation tolling technology on the West Virginia Turnpike, enhancing both driver convenience and operational efficiency. The deployment includes a toll-by-plate payment option, upgraded E-ZPass infrastructure, and advanced in-lane digital signage. As part of the West Virginia Parkways Authority’s mission to improve the overall traveler experience, TransCore implemented its Infinity Digital Lane System, which features fully integrated toll-by-plate transaction processing at all four toll plazas along the Turnpike. This comprehensive upgrade will streamline toll collection while supporting the state’s long-term smart transportation goals.

Electronic Toll Collection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.22 billion

Revenue forecast in 2033

USD 21.50 billion

Growth rate

CAGR of 9.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Kapsch TrafficCom AG; Conduent Incorporated; EFKON GmbH; TransCore; Thales; Mitsubishi Heavy Industries, Ltd.; Neology, Inc.; Toshiba Infrastructure Systems & Solutions Corporation; STAR Systems International; VaaaN

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Toll Collection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electronic toll collection market report based on type, technology, application, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic Vehicle Identification System (AVIS)

-

Automatic Vehicle Classification (AVC)

-

Violation Enforcement System (VES)

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Radio Frequency Identification (RFID)

-

Dedicated Short Range Communication (DSRC)

-

Global Navigation Satellite System (GNSS) and GPS

-

Cell Phone Tolling

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Highways

-

Urban Areas

-

- Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

- South Africa

-

Frequently Asked Questions About This Report

b. The electronic toll collection market size was estimated at USD 9.45 billion in 2024 and is expected to reach USD 10.22 billion in 2025.

b. The electronic toll collection market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 21.50 billion by 2033.

b. The Automatic Vehicle Identification System (AVIS) segment dominated the market in 2024 and accounted for the largest share of 43.1%. The growth of AVIS is being driven by the increasing demand for real-time, contactless tolling solutions.

b. Some key players operating in the electronic toll collection market include Kapsch TrafficCom AG, Conduent Incorporated, EFKON GmbH, TransCore, Thales, Mitsubishi Heavy Industries, Ltd., Neology, Inc., Toshiba Infrastructure Systems & Solutions Corporation, STAR Systems International, and VaaaN.

b. The Electronic Toll Collection (ETC) market has been driven by increasing traffic congestion, the need for efficient tolling solutions, and growing investments in transportation infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.