- Home

- »

- Medical Devices

- »

-

Electrochemical Sensors Market Size & Share Report, 2030GVR Report cover

![Electrochemical Sensors Market Size, Share & Trends Report]()

Electrochemical Sensors Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Healthcare, Agriculture, Food & Beverage, Veterinary), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-263-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrochemical Sensors Market Summary

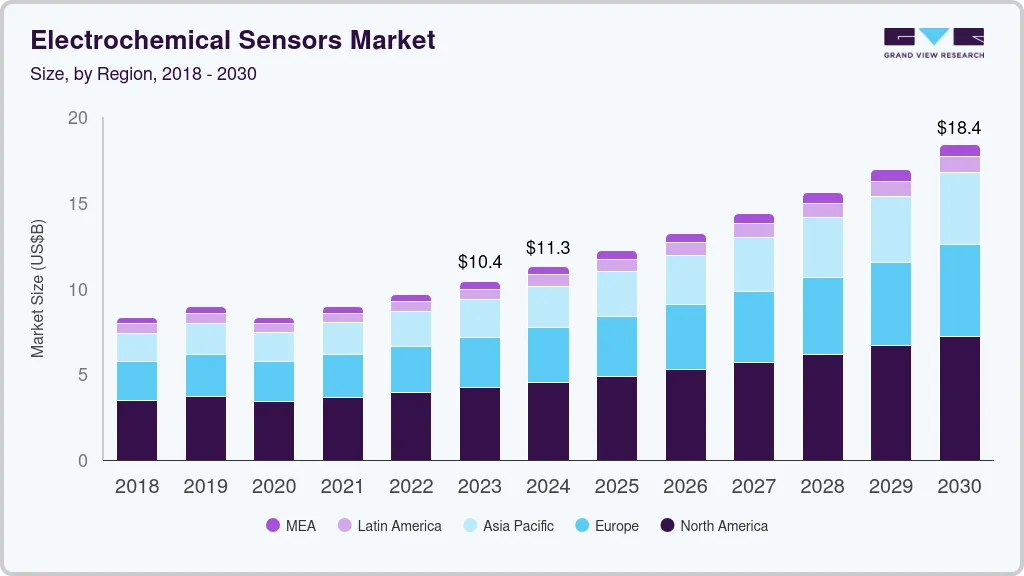

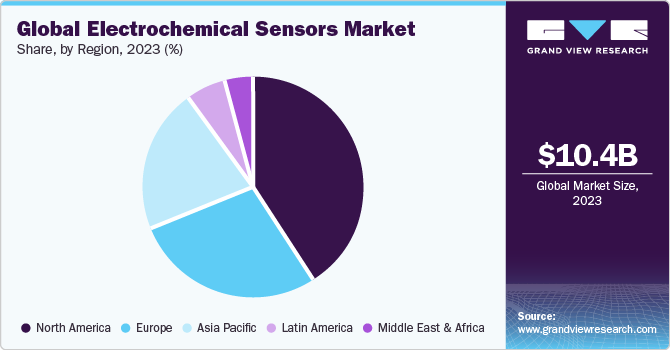

The global electrochemical sensors market size was estimated at USD 10.4 billion in 2023 and is projected to reach USD 18.4 billion by 2030, growing at a CAGR of 8.5% from 2024 to 2030. Electrochemical sensors are most commonly used in glucose testing and have been effectively marketed.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the significant CAGR from 2024 to 2030.

- By application, the healthcare electrochemical sensors segment dominated the market with a share of 97.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.4 Billion

- 2030 Projected Market Size: USD 18.4 Billion

- CAGR (2024-2030): 8.5%

- North America: Largest market in 2023

These sensors include enzymatic sensors and nonenzymatic sensors. Carbon materials such as diamond, fullerenes, graphene, carbon nanofibers, and carbon nanotubes have been broadly used as electrode materials for nonenzymatic glucose sensors owing to their tremendous electrochemical inertness & electrical conductivity. Among them, graphene is the most widely used material. In addition, flexible and implanted glucose electrochemical sensors are trending technology for continuous blood glucose monitoring of diabetes patients.

The rise in the prevalence of diabetes due to unhealthy lifestyle, obesity, and aging is one of the factors aiding growth of electrochemical sensors market. Obesity is a major factor leading to diabetes. According to the World Health Organization (WHO), in 2022, the number of obese individuals worldwide exceeded 1 billion, including 650 million adults, 340 million adolescents, and 39 million children. In addition, the WHO predicted that by 2025, around 167 million people, both adults and children, will experience worsening health problems due to their weight issues. Moreover, diabetes is progressively becoming more prevalent across the globe. The International Diabetes Federation (IDF) estimates that there were 537 million adults (aged 20-79) living with diabetes in 2021, and this number is expected to increase to 783 million by 2045. The IDF also stated that the highest increase in prevalence of diabetes is witnessed in low- and middle-income countries.

The prevalence of diseases such as cancer, neurological, gynecological, ophthalmic, and cardiac disorders is increasing. The treatment of these disorders may require surgical procedures, boosting the demand for surgical intervention, thus resulting in the requirement for long-term care. Timely diagnosis of such diseases through electrochemical sensors is expected to drive the market. For instance, the prevalence of cancer is rising. As per statistics published by WHO in 2020, approximately 10.0 million people die annually due to cancer, accounting for 13.0% to 15.0% of deaths worldwide. Moreover, a 60.0% increase in new cancer cases is expected over the coming decades.

The rise of precision agriculture is a key driver for the electrochemical sensor market. These sensors offer real-time data on attributes of crop health and soil conditions, enabling farmers to optimize resource use. Electrochemical sensors can measure factors like nutrient levels (e.g., nitrates, phosphates), pH, and moisture content in soil, allowing for targeted application of fertilizers and irrigation. With the growing need for sustainable and efficient agricultural practices, electrochemical sensors are poised to play a vital role, propelling their market growth in the agricultural sector.

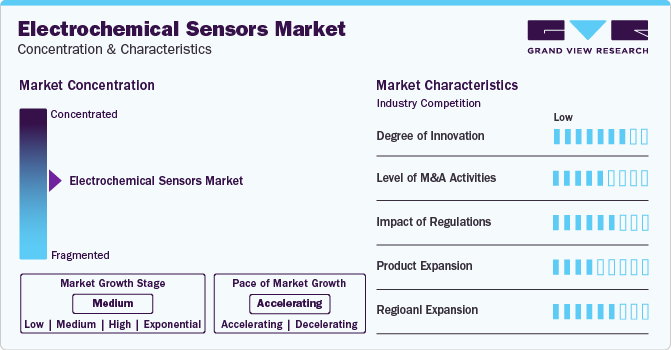

Market Characteristics & Concentration

Some of the latest innovations in electrochemical sensor technology include improved sensor accuracy, smaller & more discreet devices, and real-time data sharing with healthcare providers & caregivers. For instance, in February 2023, DexCom, Inc. launched the Dexcom G7 CGM System in the U.S. The company has introduced the CGM system through a Super Bowl commercial starring Nick Jonas, who is suffering from diabetes. The commercial was expected to be watched by over 4.8 million diabetic U.S. individuals, of which 3.3 million were not using CGM and 2.3 million had CGM coverage.

The electrochemical sensor market is characterized by a high level of M&A activities undertaken by leading players in the last three years. For instance, in October 2023, AMETEK, Inc. announced the acquisition of Amplifier Research Corp., a major manufacturer of RF and microwave amplifiers, as well as Electromagnetic Compatibility (EMC) testing equipment.

Manufacturers of biosensor devices must comply with the FDA’s Quality System Regulation (QSR), which outlines good manufacturing practices for medical devices in U.S. They are also required to submit a premarket notification (510(k)) or Premarket Approval (PMA) application to the FDA, depending on the device’s classification.

Some of the key players in the market are focusing on introducing novel products that can cater to specific needs of patients. For instance, in March 2023, Abbott received U.S. FDA approval for the integration of its FreeStyle Libre 3 and FreeStyle Libre 2 Integrated Continuous Glucose Monitoring (iCGM) system sensors with Automated Insulin Delivery (AID) systems. Both the FreeStyle Libre 3 and FreeStyle Libre 2 sensors are currently accessible in the U.S., with approval for use in individuals aged 4 years and above.

Key companies in the market for electrochemical sensors are also focusing on market expansion. For instance, in October 2023, Dexcom, Inc. expanded its presence in Canada by launching Dexcom G7.

Application Insights

The healthcare electrochemical sensors segment dominated the market with a revenue share of 97.1% in 2023. The widespread use of biosensors in this field supports segment growth. Significant developments in nanomaterial and biomolecule techniques for increased sensitivity have resulted in the development of electrochemical biosensors. Electrochemical sensors are being employed in several analytical, medical diagnostic, and screening applications due to their great performance, portability, simplicity, and low cost. In addition, electrochemical sensors are used in various healthcare applications, including cholesterol testing, blood glucose testing, blood gas analyzers, and others.

The increasing prevalence of diabetes is a key factor driving the growth of blood glucose monitoring testing biosensors. Blood glucose monitoring is an essential tool for diabetes management. Several advanced glucose biosensors have been developed to help diabetic patients maintain normal blood glucose levels. Blood Glucose Monitoring (BGM) is the most successful application of electrochemical biosensor technology, and it has led to significant advancements in biosensor biology, chemistry, measurement, and production. The combination of optimized enzymes, mediators, and electrochemical measuring methods is leading to significant improvements in BGM.

Regional Insights

North America electrochemical sensors market dominated and accounted for 40.4% of the total revenue share in 2023. Growth can be attributed to the rising prevalence of chronic diseases, especially diabetes, and rapid technological advancements. Rapid technological advancements such as the introduction of miniaturized diagnostic equipment providing rapid & accurate results, and the growing penetration of Electronic Medical Records (EMR) are expected to drive the market growth over the forecast period. Furthermore, the presence of the Clean Air Act, Clean Water Act, and the National Environmental Policy Act in the U.S., which continuously monitor environmental pollution, are expected to create lucrative growth opportunities over the forecast period.

U.S. Electrochemical Sensors Market Trends

The U.S. electrochemical sensors market dominated the market with a revenue share of 85.3% in 2023. Nearly half of all Americans, or 133 million people, are currently thought to have at least one chronic ailment, such as arthritis, heart disease, or hypertension. One of the key factors fueling the U.S. market growth is the rising incidence of diabetes in the country.

Europe Electrochemical Sensors Market Trends

Electrochemical sensors market in Europe held the second largest revenue share in 2023.The rising demand for healthcare sensors and supportive central data management systems for providing accurate information & medical services to patients are likely to fuel market growth. The aging population in Europe and increasing focus on personalized medicine necessitate rapid & user-friendly diagnostic tools outside traditional laboratory settings.

Germany electrochemical sensors market dominated the market with the highest revenue share of 27.3% in 2023. Germany enforces strict regulations regarding air and water quality. This necessitates the adoption of reliable & cost-effective methods for monitoring pollutants and contaminants. Electrochemical sensors offer real-time monitoring capabilities, making them suitable for air & water quality monitoring.

Electrochemical sensors market in the UK showed the second largest market share in 2023. The increasing prevalence of diabetes and the rising number of government initiatives promoting the introduction of technologically advanced product lines are among the key factors contributing to the UK market growth.

France electrochemical sensors market is anticipated to witness significant CAGR 9.2% during the forecast period. The government in France is continuously increasing its investment in medical devices and digital health to provide patients with high-quality & reliable devices for treatment. In addition, initiatives such as France’s 2020 eHealth Strategy and eHealth France are supporting the evolution of digital healthcare in France. These initiatives aim to increase eHealth adoption in France, which is likely to drive the healthcare sensors market.

Asia Pacific Electrochemical Sensors Market Trends

Asia Pacific electrochemical sensors market is projected to register the fastest CAGR of 9.8% during the forecast period. The presence of a significant target population, an increasing number of government initiatives, the rising incidence of food allergies, and significant R&D investments are some of the factors driving market growth.

Electrochemical sensors market in China held the largest revenue market share of 32.4% in 2023. As per the International Diabetes Federation, the prevalence of diabetes in adults in China is 13%, accounting for around 140 million cases. Diseases such as diabetes require daily monitoring, where electrochemical sensors are efficient. Hence, the increasing prevalence of diabetes & other diseases, such as heart diseases and hypertension, and rapid technological advancements are some factors expected to drive the market growth.

Japan electrochemical sensors market held the second largest market share in the Asia Pacific region. Japan has a relatively high healthcare expenditure per capita. According to the OECD, in 2023, Japan spent USD 5,251 per capita on health. As the government & private sector continue to invest in healthcare infrastructure and technology, there is greater accessibility to advanced medical treatments.

Electrochemical sensors market in India is expected to grow at the fastest CAGR of 11.1% during the forecast period. Factors such as urbanization, unhealthy dietary habits, and the rising prevalence of diabetes contribute to the growing burden of cardiovascular diseases. According to the International Diabetes Federation & Lancet, in 2023, the prevalence of diabetes in adults is around 11.4%, accounting for 101 million cases. In addition, cardiovascular diseases are the leading cause of mortality in India. Hence, the increasing prevalence of diabetes and cardiovascular diseases is expected to drive the demand for electrochemical biosensors in India.

Latin America Electrochemical Sensors Market Trends

Latin America electrochemical sensors market is expected to witness a lucrative growth during the forecast period. Reforms in the healthcare system, the growing number of countries seeking to implement universal healthcare coverage, and improvements in healthcare infrastructure are some of the factors expected to drive market growth in this region. In addition, the surging prevalence of heart diseases is leading to an increase in the number of patients with diabetes in the region.

The electrochemical sensors market in Mexico is expected to grow due to various factors, such as Mexico spends nearly 5.5% of its GDP on healthcare, with the private sector playing a vital role. This increases the focus on improving the quality of healthcare services offered in the country. The geriatric population is more susceptible to various diseases, such as diabetes, arthritis, cancer, and Alzheimer’s disease. This is anticipated to increase the number of hospitalized patients and boost the demand for sensors over the forecast period.

MEA Electrochemical Sensors Market Trends

MEA electrochemical sensors market is expected to grow at a lucrative growth. The Middle East & Africa (MEA) market is expected to witness a growing adoption of electrochemical sensors driven by several factors. Firstly, environmental concerns necessitate pollution monitoring in the air and water. Electrochemical sensors offer a cost-effective and reliable solution for detecting pollutants like heavy metals and harmful chemicals.

Electrochemical sensors market in South Africa held the largest revenue market share of 29.2% during 2023. South Africa’s market for electrochemical sensors is anticipated to witness the fastest growth over the forecast period. Economic development and the presence of high unmet healthcare needs are among the major drivers expected to boost the electrochemical sensors industry’s growth in South Africa.

Key Electrochemical Sensors Company Insights

Leading companies in market are enhancing their offerings and incorporating new technologies to expand their customer reach, secure a greater market share, and diversify their application range. For example, in December 2022, AMETEK India, announced the opening of a new, cutting-edge facility in Bengaluru that will improve support for its customers in India and around the world.

Key Electrochemical Sensors Companies:

The following are the leading companies in the electrochemical sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Conductive Technologies Inc.

- Comp3

- Abbott

- F. Hoffmann-La Roche AG

- Ascensia Diabetes Care.

- Siemens Healthineers

- Zimmer & Peacock AS

- Metrohm AG

- Shandong Renke Control Technology Co., Ltd

Recent Developments

-

In December 2023, Dexcom, Inc. announced the integration of Dexcom G7 CGM with tslim X2 insulin pump by Tandem Diabetes Care.

-

In March 2023, Abbott received U.S. FDA approval for the integration of its FreeStyle Libre 3 and FreeStyle Libre 2 Integrated Continuous Glucose Monitoring (iCGM) system sensors with Automated Insulin Delivery (AID) systems. Both the FreeStyle Libre 3 and FreeStyle Libre 2 sensors are currently accessible in the U.S., with approval for use in individuals aged 4 years and above.

-

In February 2023, DexCom, Inc. launched the Dexcom G7 Continuous Glucose Monitoring (CGM) System in the U.S. The company has introduced the CGM system through a Super Bowl commercial starring Nick Jonas, who is suffering from diabetes. The commercial was expected to be watched by over 4.8 million diabetic U.S. individuals, of which 3.3 million were not using CGM and 2.3 million had CGM coverage.

Electrochemical Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.3 billion

Revenue forecast in 2030

USD 18.4 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc., Conductive Technologies Inc., Ametek Inc., Abbott, F. Hoffmann-La Roche AG, Ascensia Diabetes Care

Siemens Healthineers, Zimmer & Peacock AS, Metrohm AG, Shandong Renke Control Technology Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

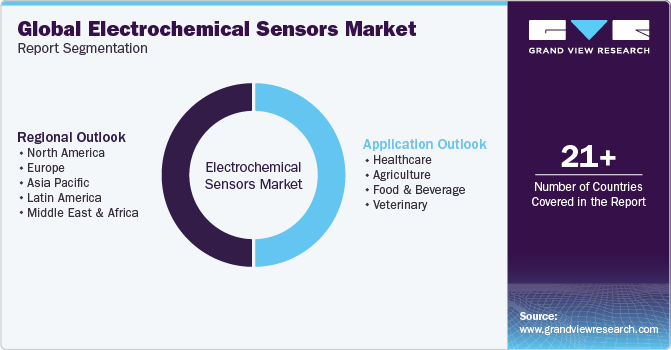

Global Electrochemical Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrochemical sensors market based on application and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Agriculture

-

Food & Beverage

-

Veterinary

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electrochemical sensors market size was estimated at USD 10.4 billion in 2023 and is expected to reach USD 18.4 billion in 2024.

b. The global electrochemical sensors market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 18.4 billion by 2030.

b. North America dominated the electrochemical sensors market with a share of 40.4% in 2023. This is attributable to the strong presence of key market players and research institutions in the region, which is driving innovation in sensor technology. Moreover, stringent regulations regarding environmental monitoring and safety standards in industries are contributing to the high demand for electrochemical sensors.

b. Some of the players operating in this market are Thermo Fisher Scientific, Inc., Conductive Technologies Inc., Ametek Inc., Abbott, F. Hoffmann-La Roche AG, Ascensia Diabetes Care, Siemens Healthineers, Zimmer & Peacock AS, Metrohm AG, Shandong Renke Control Technology Co., Ltd.

b. Key factors that are driving the electrochemical sensors market growth include the increasing applications of electrochemical sensors in various industries such as environmental monitoring, healthcare, and food & beverage. Moreover, the rising demand for portable and wearable devices, along with advancements in sensor technology, is fueling market expansion

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.