- Home

- »

- Medical Devices

- »

-

Electric Wheelchair Market Size, Share, Growth Report, 2030GVR Report cover

![Electric Wheelchair Market Size, Share & Trends Report]()

Electric Wheelchair Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Rear-wheel, Mid-wheel, Front-wheel), By Age Group (Geriatric, Adult), By Portability, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-121-8

- Number of Report Pages: 212

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Wheelchair Market Summary

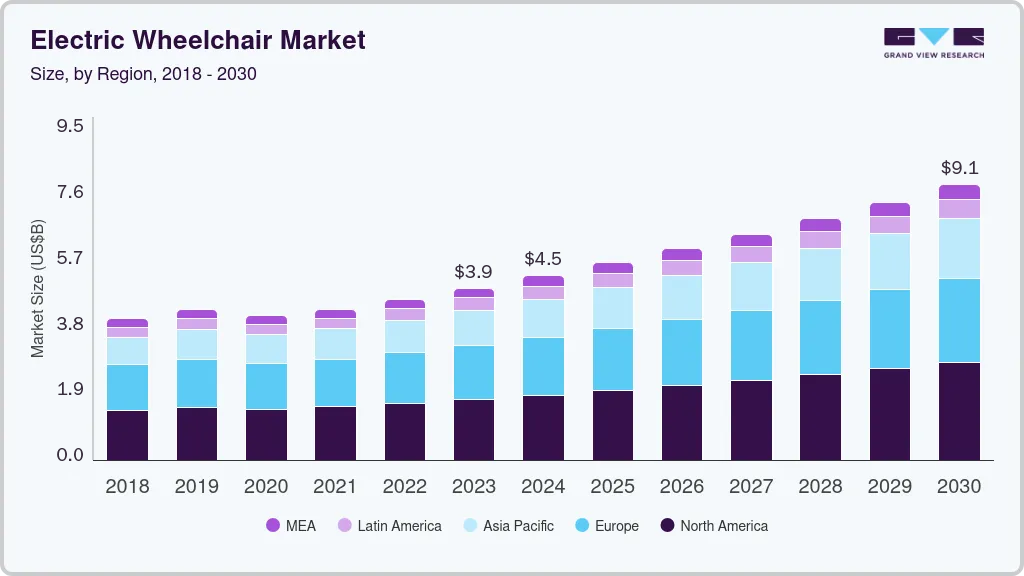

The global electric wheelchair market size was estimated at USD 4.49 billion in 2024 and is projected to reach USD 9.05 billion by 2030, growing at a CAGR of 12.3% from 2025 to 2030. An electric wheelchair, also known as a motorized wheelchair, is a mobility device designed for individuals who find walking challenging due to health conditions, accidents, or other medical barriers.

Key Market Trends & Insights

- North America electric wheelchair market dominated the global industry and accounted for a share of 37.7% in 2024.

- The U.S. electric wheelchair market held a share of 93.2% in 2024.

- By product, the rear-wheel drive segment held a revenue share of 38.2% in 2024.

- By age group, the geriatric segment held a significant revenue share of 55.7% in 2024.

- By portability, the standalone wheelchair segment led the market with a share of 72.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.49 Billion

- 2030 Projected Market Size: USD 9.05 Billion

- CAGR (2025-2030): 12.3%

- North America: Largest market in 2023

Unlike manual wheelchairs, which require physical strength for direction and movement, electric wheelchairs utilize electric motors. This enables users to manage their motion through a joystick or a similar control system. The growing elderly population and rising cases of injuries requiring mobility support are key contributors to the market expansion.

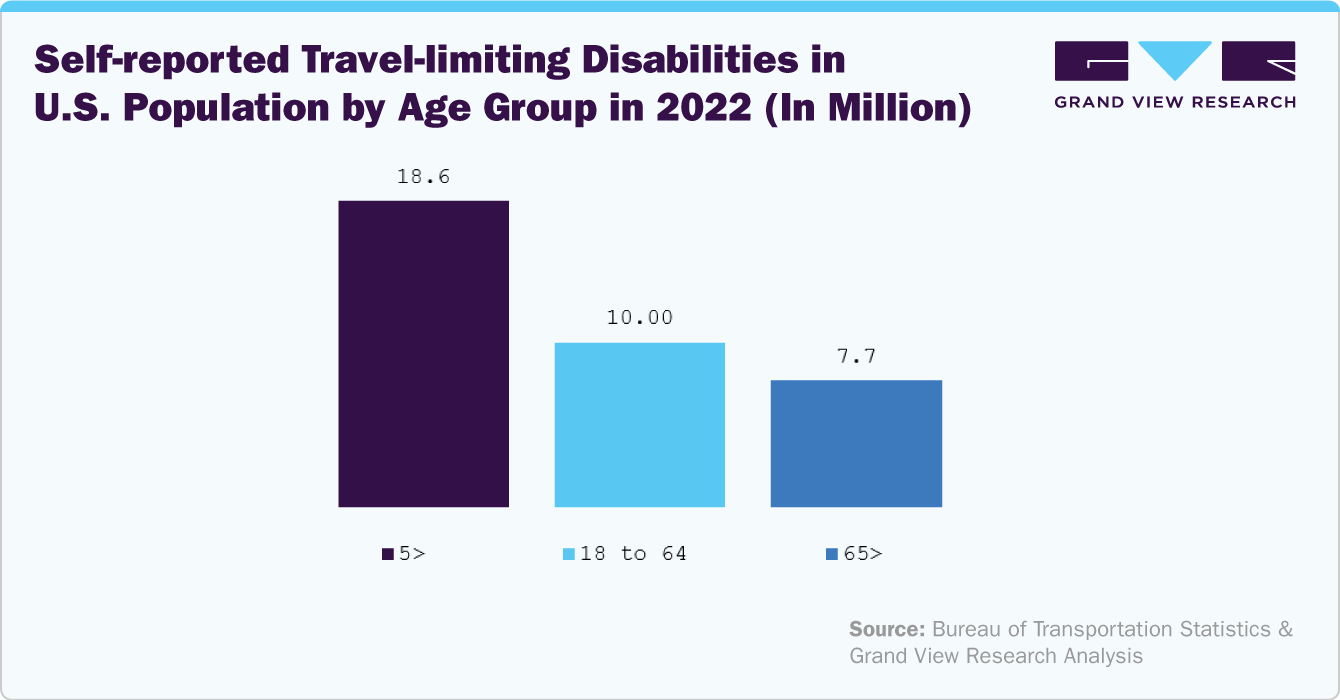

Rising road accident rates drive demand for electric wheelchairs. According to the WHO article published in December 2023, every year, road traffic accidents result in the loss of 1.19 million lives and leave an additional 20 to 50 million people with varying degrees of non-fatal injuries. Among those injured, a significant number suffer from long-term or permanent disabilities, often requiring mobility assistance for the rest of their lives. This frightening increase in accident-related disabilities is contributing to increased demand for electric wheelchairs, which offer essential support for individuals who face daily mobility challenges.

The anticipated demand increase in the future is attributed to the high prevalence of chronic illnesses, the growing population, and the increasing risk of developing lifestyle diseases, such as obesity, among a significant portion of the population. Moreover, easy product access in several countries is a significant factor in market expansion. For example, in Asia, Singapore is known for its commitment to accessibility.

According to a study by the World Economic Forum (WEF), Singapore has the best infrastructure for wheelchair users, with specially designed buses and lifts across all public transport systems. The United Arab Emirates is another country making substantial strides in accessible travel. The UAE has invested heavily to ensure that individuals with disabilities can move freely throughout the country, offering complimentary passes on public transport and reserved parking spots for disabled drivers. The country also supports various events and initiatives to increase awareness about accessibility and inclusivity issues.

In addition, the ongoing technological advancements in product design are anticipated to fuel future sales in the market. The introduction of battery-electric wheelchairs is expected to offer enhanced assistance to users. Moreover, design improvements now enable wheelchairs to store and link the device with the patient’s medical records and monitor the user’s health. For instance, in March 2024, the Indian Institute of Technology Madras developed NeoStand, a customizable power-standing wheelchair in India. The device is designed to benefit patients by offering versatile usage options.

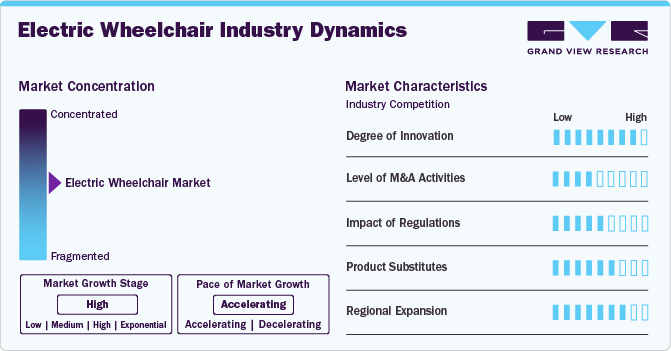

Market Concentration & Characteristics

The shift toward providing care at home or bedside is fueling the creation of wheelchairs with advanced therapeutic, diagnostic, display, and monitoring tools while being more adaptable, accurate, and compact. These systems represent a consumer-centric approach to healthcare, which encourages the adoption of innovations, such as personalized wearable devices, digital patient records, and systems connected to the internet wirelessly. All these technologies are expected to provide smart, user-friendly, and convenient healthcare services at home. Several market players are focused on this progress.

Numerous merger and acquisition activities are observed among top product manufacturers aimed at broadening their footprint in the country. For example, in October 2023, Sunrise Medical acquired Ride Designs, specializing in high-quality custom seating products for wheelchair users. This acquisition represents a notable extension of Sunrise Medical’s custom seating offerings and service capabilities, enhancing its current manual and electric mobility product lineup.

Efforts by the government to enhance financial support for patients in need of long-term care are anticipated to bolster the growth of this market. For example, in the U.S., several initiatives have been introduced to aid people with disabilities, which is predicted to stimulate market expansion. The U.S. government, for instance, has started several programs to help people who have disabilities, and this is likely to drive the market’s growth.

The market is poised for expansion, driven by product advancements and a surge in demand for electric wheelchairs, which will subsequently enhance sales. Dominant entities such as Numotion, Permobil, and Sunrise Medical hold most of the revenue share. Furthermore, Sunrise Medical has been making significant strides and increasing its market share.

Regional expansion significantly drives the market's growth. Though strict safety and accessibility standards can challenge market penetration and expansion in certain areas, varying cultural perceptions of disability and accessibility increase market acceptance. Policies that govern insurance coverage and compensation for motorized wheelchairs can affect market accessibility and adoption. In different countries, wheelchair-friendly infrastructure, such as ramps and lifts, is vital for the broad acceptance of motorized wheelchairs. This can fuel the market growth for companies to expand to different regions.

Product Insights

The rear-wheel drive segment held a revenue share of 38.2% in 2024. The rear-wheel drive segment of the electric wheelchair market is known for its speed and stability, particularly in outdoor settings. With the power concentrated in the rear wheels, these wheelchairs provide strong propulsion and perform well at higher speeds. Strategic initiatives by the key players drive the market. For instance, in June 2022, Sunrise Medical introduced a new compact, rear-wheel-drive power wheelchair to its range. The product was named QUICKIE Q200 R. This design emphasizes ease of maneuverability and transport, making it highly practical for navigating tight spaces and portability.

Moreover, Sunrise Medical’s Director of Power Product Management stated, “With the Q200 R, our vision was to create a true indoor/outdoor power chair-one with super-tight indoor maneuverability and zero compromise on outdoor stability and performance. A large drive base means difficulty when maneuvering in tight environments. Too small, and it becomes tippy with a loss of traction. In development, we tested hundreds of configurations to find the perfect combination of maneuverability and performance.”

The mid-wheel drive segment is expected to grow at the fastest CAGR from 2025 to 2030. The mid-wheel drive segment of the electric wheelchair market is known for offering superior maneuverability, especially in tight spaces, due to its central wheel placement. These wheelchairs provide a tight turning radius, making them ideal for indoor use while offering stability on various outdoor terrains. Advancements by the manufacturers fuel market growth. For instance, in September 2022, the newly launched Karma Medical Morgan M is a mid-wheel-driven power wheelchair designed for adaptable use in both indoor and outdoor settings. Its compact design allows for exceptional maneuverability, especially in tight spaces. The wheelchair features a mid-wheel drive configuration with a small turning radius, making it ideal for navigating narrow hallways and doorways. Its six-wheel design enhances stability and traction across various surfaces, ensuring a comfortable ride.

Age Group Insights

The geriatric segment held a significant revenue share of 55.7% in 2024. Increasing gait disease disorders among the geriatric population drive market growth. According to an article published by PM&R Knowledge Now in July 2023, the prevalence of gait disorders significantly increases with age, affecting only 10% of individuals aged 60-69 but rising to over 60% in those above 80 and 82% in adults over 85. These disorders not only impair mobility but are also linked to higher risks of cognitive decline, cardiovascular disease, disability, and a 2.2 times higher likelihood of institutionalization and death compared to older adults without gait issues. Falls, often resulting from gait problems, are the leading cause of injury among seniors in the U.S., causing 3 million emergency room visits, 800,000 hospitalizations, and nearly $50 billion in healthcare costs yearly.

The adult segment is expected to grow at the fastest CAGR over the forecast period. Rising road accident injuries among adults boost demand in the electric wheelchair market. According to the HT Digital Streams Ltd. article published in October 2023, 461,312 road accidents resulted in 168,491 fatalities and 443,366 injuries in 2022. Young adults aged 18 to 45 accounted for 66.5% of the victims, while those in the broader working age group of 18 to 60 made up 83.4% of all fatalities. These figures emphasize the significant impact road accidents have on adults, many of whom face long-term mobility challenges due to severe injuries. As a result, the demand for electric wheelchairs is rising, particularly within the adult segment.

Portability Insights

The standalone wheelchair segment led the market with a share of 72.2% in 2024. Standalone electric wheelchairs are designed to cater to individuals with significant mobility limitations. Unlike conventional wheelchairs, these are generally more robust and have many features, making them an ideal choice for those who heavily rely on such aids for their daily mobility. Moreover, these wheelchairs are feature-rich, often including elements like adjustable seats, customizable controls, and even health monitoring systems. These features enhance the user’s comfort and contribute to their overall well-being.

The portable wheelchair segment is expected to grow at the fastest CAGR during the forecast period. Portable electric wheelchairs are designed to be compact and lightweight, making them easy to transport. They are typically used by individuals who have some mobility but need a wheelchair for longer distances or when venturing outside their homes. These wheelchairs have several advantages, including travel-friendly features, lightweight construction, and compact storage. Therefore, portable electric wheelchairs serve as a comprehensive mobility solution, significantly improving the quality of life for those with severe mobility restrictions.

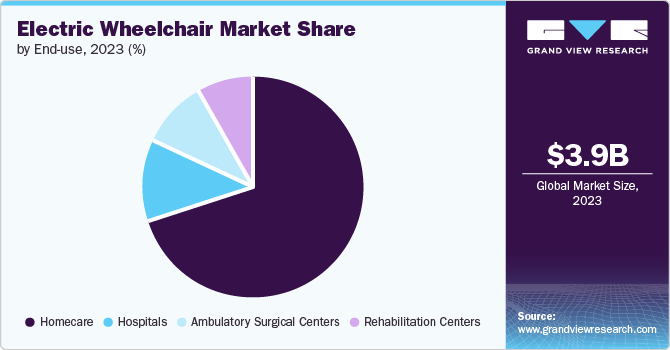

End-use Insights

The homecare segment had the highest revenue share of over 49.5% in 2024. The adoption of electric wheelchairs in homecare settings is growing globally, mainly due to the rising geriatric population. Furthermore, they are designed to provide stability and reduce the risk of falls. Individuals with chronic health conditions that affect mobility, such as multiple sclerosis, muscular dystrophy, and spinal cord injuries, often use wheelchairs to facilitate daily activities at home. According to the article published in Axiscare, in August 2023, about 12 million Americans utilize home health care services, reflecting a significant preference for aging in their residences rather than relocating to long-term care facilities. This inclination is reinforced by research indicating that 88% of Americans would prefer to receive any essential long-term care services in the comfort of their own homes as they grow older.

The ambulatory surgical centers (ASCs) segment is expected to grow at a significant CAGR over the forecast period due to the increasing volume of outpatient surgeries, which offer benefits such as shorter hospital stays and cost-effectiveness. ASCs are medical facilities that perform minor surgical operations. These centers are rising in developed and developing nations as they help alleviate the load on hospitals and doctors’ clinics. These centers primarily aim to cater to surgical procedures or emergencies exclusively. In the U.S., there are approximately 9,280 operational ASCs, with California hosting the most centers (1,213) nationwide. Among the operational ACSs, about 60% are certified by Medicare.

Number of Ambulatory Surgical Centers in April 2024

U.S. State

Number of ASCs

California

1,218

Texas

760

Florida

736

Georgia

536

Maryland

439

Pennsylvania

374

New York

362

Ohio

310

Washington

272

Michigan

221

Regional Insights

North America electric wheelchair market dominated the global industry and accounted for a share of 37.7% in 2024. The growth was driven by the rising incidence of disability, increasing demand for electric wheelchairs, supportive government initiatives, and technological advancements. According to an article published by The Trustees of the University of Pennsylvania in January 2023, arthritis impacts over 50 million adults in the U.S., making it the leading cause of disability in the nation. Moreover, as per a CDC article published in May 2023, almost 61 million adults in the U.S. are living with a disability.

U.S. Electric Wheelchair Market Trends

The U.S. electric wheelchair market held a share of 93.2% in 2024. This can be attributed to the growing need for mobility solutions, increasing demand for electric wheelchairs, and technological advancements fueling the market's growth. According to the CDC article published in July 2024, in the U.S., more than 1 in 4 adults (28.7%) are living with some form of disability, highlighting the significant demand for assistive technologies. Among these individuals, 12.2% face serious mobility challenges, including difficulties with walking or climbing stairs. The rising incidence of mobility-related issues emphasizes the critical role of electric wheelchairs in improving quality of life.

Europe Electric Wheelchair Market Trends

The Europe electric wheelchair market held the second-largest revenue share in 2024.Factors such as a growing geriatric population and a rise in conditions, such as spinal cord injuries, necessitating mobility aids drive the market growth. While the market is still in its early stages, its availability and acceptance are anticipated to grow due to increasing consumer knowledge and favorable government policies. As the population ages, more individuals will likely face mobility issues, increasing the demand for wheelchairs. In addition, advancements in wheelchair technology and heightened awareness of sophisticated products are expected to propel market growth.

Germany electric wheelchair market held the dominant revenue share of 25.7% in 2024. Germany is recognized as one of the world’s most aged societies, with individuals aged 65 years and above projected to constitute approximately one-third of the total population by 2050. The country is at the forefront of utilizing digital technology to promote a healthier and more active lifestyle among older adults, and the government has implemented programs to help seniors acquire basic tech skills. In 2021, Germany had approximately 7.8 million individuals classified as severely disabled, according to the Federal Statistical Office (Destatis). This group constituted 9.4% of the total population of Germany.

The electric wheelchair market in the UK held the second-largest share in 2024 due to the high geriatric population and a rise in the number of individuals with physical disabilities. The UK is home to over 11 million disabled individuals, who make up 45% of the country’s disabled population, compared to 16% of working adults and 6% of children. An estimated 1.2 million people in the UK use wheelchairs, with most users aged over 60 years, representing over two-thirds of all wheelchair users in the country. The UK’s public health system includes reimbursement policies for disabled and elderly citizens. Furthermore, the government has implemented measures like the Disabled Facilities Grant (DFG) to construct ramps, acquire heating systems, and provide financial aid for equipment and assistive devices for people with disabilities.

The France electric wheelchair market is anticipated to witness a CAGR of 13.1% during the forecast period. In France, for every 10,000 individuals, 62 are wheelchair users. These individuals typically face multiple limitations and/or impairments. The average age of these wheelchair users is 70 years, and 64% of them are women. Moreover, wheelchair use is associated with factors such as the severity of impairments and disabilities, confinement, exposure to environmental risks, and life in institutions.As per French disability law, any company in France with more than 20 employees is mandated to employ at least 6% of workers with disabilities. Furthermore, the rising number of road accidents in the country is a significant factor contributing to the growth of the wheelchair market during the forecast period.

Asia Pacific Electric Wheelchair Market Trends

The electric wheelchair market in Asia Pacific is projected to register the fastest CAGR over the forecast period. In this region, wheelchairs are a predominant mobility aid. The rising target population fuels the demand for these devices. In addition, the prevalence of chronic illnesses and the high frequency of road accidents contribute to market growth. According to WHO data from 2023, between 20 and 50 million people sustain non-lethal injuries, with a significant number resulting in disabilities within the region.

China Electric wheelchair market is expected to grow over the forecast period. China has a significant elderly population of over 254 million. The country also has over 85 million disabled individuals, with 20 million of them depending on temporary aids for disability. This substantial and growing number of senior citizens and disabled individuals has led to an increased demand for electric wheelchairs. The market growth in China can be attributed to the rising instances of accidental injuries.

The electric wheelchair market in Japan is expected to grow over the forecast period. Elderly individuals, particularly in countries like Japan, represent a significant demographic. Japan’s health ministry reports that over 7% of the population, or 9.36 million people, have been identified with some form of disability. The Commonwealth Fund indicates that Japan’s statutory health insurance system (SHIS) has plans to include durable medical equipment, such as oxygen therapy devices, prescribed by doctors in their coverage. Government subsidies are available to individuals with disabilities who need other devices like hearing aids or electric wheelchairs, helping to offset the cost. These subsidies are primarily aimed at low-income households and alleviate the cost-sharing burden for individuals with disabilities, mental health conditions, and certain chronic diseases.

India electric wheelchair market is expected to grow rapidly over the forecast period on account of the increasing need for a secure and convenient method of patient mobility in hospitals and homecare environments. The enhancement of healthcare facilities, coupled with a substantial elderly population, are key factors anticipated to propel market growth.

Latin America Electric Wheelchair Market Trends

The electric wheelchair market in Latin America is expected to witness lucrative growth during the forecast period. The market is anticipated to grow due to increased life expectancy, heightened awareness of home healthcare services, a growing incidence of disabilities, and a surge in demand for long-term care medical devices. Furthermore, Brazil has a significant influence on economic activities in this region. The average lifespan in this region is said to exceed 75 years.

Brazil electric wheelchair market is expected to grow over the forecast period due to the country’s increasing healthcare spending and a growing number of disabled individuals nationwide. For instance, more than 16 million people in Brazil are living with disabilities. In addition, the market growth in Brazil can be attributed to the increasing instances of accidental injuries.

Middle East & Africa Electric Wheelchair Market Trends

The electric wheelchair market in MEA is expected to grow lucratively owing to the expanding geriatric population and intensified efforts by governments to enhance healthcare accessibility. These are anticipated to draw the attention of international medical device companies interested in penetrating this market. The market could see growth over the forecast period due to increased healthcare spending, an aging population, and a rise in disability cases.

South Africa electric wheelchair market held the largest revenue share in the MEA regional market. Disabled individuals constitute 10% of Africa’s population, potentially rising to 20% in poorer regions. Disabled children’s school attendance is estimated at 5-10%. The South African Department of Health has been criticized by the National Council for Persons with Disabilities (NCPD) for its ineffective wheelchair provision. Despite the NCPD’s advocacy, the persistent wheelchair shortage remains unresolved.

Key Electric Wheelchair Company Insights

Leading companies are enhancing their offerings and incorporating new technologies to expand their customer reach, secure a greater market share, and diversify their product range. For example, In November 2023, Magic Mobility, part of the Sunrise Medical brand, introduced the Magic 360 crossover wheelchair in North America. Drawing on more than 25 years of experience in off-road and all-terrain wheelchair design, the Australian company developed the Magic 360 to deliver adaptability and high performance across different settings.

Key Electric Wheelchair Companies:

The following are the leading companies in the electric wheelchair market. These companies collectively hold the largest market share and dictate industry trends.

- Sunrise Medical

- Invacare Corporation

- Permobil

- Pride Mobility Products

- Numotion

- Ottobock

- MEYRA GmbH

- Hoveround Corporation

- Golden Technologies

- Drive DeVilbiss Healthcare Ltd.

Recent Developments

-

In June 2024, Ottobock UK introduced Juvo B7, an advanced power wheelchair designed to provide all-day comfort and control for individuals with complex needs. Available in mid- and front-wheel drive, the Juvo B7 is tailored to those with specific positioning and mobility requirements.

-

In April 2024, Numotion and the United Spinal Association partnered with United Airlines to develop a new tool that helps wheelchair users find flights suited to their mobility devices. Available on the United Airlines app and website, this digital feature allows customers to easily identify flights that can accommodate their wheelchairs' dimensions.

-

In October 2023, Sunrise Medical, a global pioneer in cutting-edge mobility aids, declared its strategic takeover of Ride Designs, a distinguished market leader known for its high-quality custom seating systems for wheelchair users. This takeover signifies a substantial growth in Sunrise Medical’s custom seating portfolio, clinical proficiency, and service competencies, seamlessly enhancing the broad spectrum of manual and electric mobility products already provided by Sunrise Medical

-

In October 2023, Numotion introduced SpinKids, a distinctive platform under SpinLife specifically designed for children. This unique initiative is aimed at addressing the mobility and equipment requirements of pediatric users. It provides a tailored shopping experience exclusively for children and their parents, ensuring they can access mobility aids and equipment. The launch of SpinKids signifies Numotion’s commitment to enhancing the lives of children with mobility challenges by offering products and services that cater specifically to their needs

Electric Wheelchair Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.05 billion

Revenue forecast in 2030

USD 9.05 billion

Growth rate

CAGR of 12.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, age group, portability, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sunrise Medical LLC; Invacare Corp.; Permobil; Pride Mobility Products Corp.; Numotion; Ottobock; MEYRA GmbH; Hoveround Corp.; Golden Technologies; Drive DeVilbiss Healthcare Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Wheelchair Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric wheelchair marketreport based on product, age group, portability, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Front-wheel Drive

-

Mid-wheel Drive

-

Rear-wheel Drive

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

Geriatric

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone

-

Portable

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Homecare

-

Hospitals

-

Ambulatory Surgical Centers

-

Rehabilitation Centers

-

-

Regional Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electric wheelchair market size was estimated at USD 4.49 billion in 2024 and is expected to reach USD 5.05 billion in 2025.

b. The global electric wheelchair market is expected to grow at a compound annual growth rate of 12.3% from 2025 to 2030 to reach USD 9.05 billion by 2030.

b. North America dominated the global market in 2023 and accounted for the largest revenue share of 37.7%. This growth is owing to the high target population and increased adoption of advanced wheelchairs.

b. Some of the key electric wheelchair market players are Drive Medical Design & Manufacturing, Invacare, Sunrise Medical LLC, Karman Healthcare, Quantum Rehab, Numotion, Pride Mobility Products Corp., Ostrich Mobility, MEYRA, and Jinmed.

b. Due to the rise in baby boomer group who have a high need for wheelchairs and rising technological advancements, the demand for the powered wheelchairs is rising.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.