- Home

- »

- Sensors & Controls

- »

-

Electric Vehicle Charging Cables Market Size Report, 2020-2027GVR Report cover

![Electric Vehicle Charging Cables Market Size, Share & Trends Report]()

Electric Vehicle Charging Cables Market (2020 - 2027) Size, Share & Trends Analysis Report By Power Supply, By Cable Length, By Charging Level, By Shape, By Application, And Segment Forecasts

- Report ID: GVR-4-68038-664-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Charging Cables Market Summary

The global electric vehicle charging cables market size was valued at USD 208.0 million in 2019 and is expected to reach USD 1.25 billion by 2027, growing at a compound annual growth rate (CAGR) of 25.4% from 2020 to 2027. Growing adoption of electric vehicles (EV), rising demand for electric vehicle fast-charging cables, and rapid development of electric vehicle supply equipment are anticipated to upkeep the market growth over the forecast period. For instance, in 2018, electric car fleet size exceeded over 5.1 million across the globe, up by 2 million from the previous year.

Key Market Trends & Insights

- Asia Pacific dominated the market in 2019 and held a 58.9% share of the overall revenue.

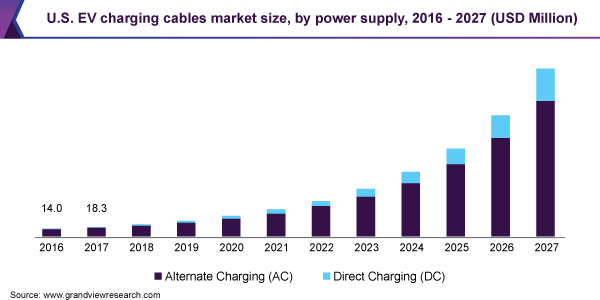

- By power supply, the AC segment dominated the market in 2019 with a share of 73.3%.

- By cable length, the below 5 meters segment dominated the market in 2019 with over 53.0% share.

- By charging level, the level 2 segment dominated the market in 2019 with 47.8% share.

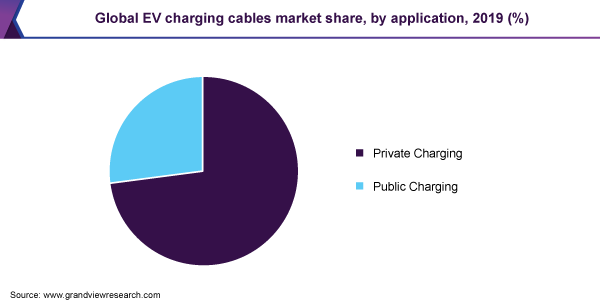

- By application, the private charging segment dominated the market in 2019 with over 71.0% share.

Market Size & Forecast

- 2019 Market Size: USD 208.0 Million

- 2027 Projected Market Size: USD 1.25 Billion

- CAGR (2020-2027): 25.4%

- Asia Pacific: Largest market in 2019

- North America: Fastest growing market

EVs are installed with rechargeable battery packs to supply energy to drive them and these batteries can be charged through public or private station outlets. Battery electric vehicles (BEVs) are exclusively powered through electricity while plummeting vehicular noise, air pollution, and greenhouse gas emissions. Increasing the stringency of carbon dioxide emission norms in emerging markets is driving the demand for EVs. Therefore, need for electric vehicle charging infrastructure is increasing at an exponential rate. For instance, according to the International Energy Agency (IEA), the number of EV charging points across the world grew by around 44% between 2017 and 2018. Such factors are projected to fuel the demand for EV charging cables in the emerging economies over the next decade.

EVs are installed with rechargeable battery packs to supply energy to drive them and these batteries can be charged through public or private station outlets. Battery electric vehicles (BEVs) are exclusively powered through electricity while plummeting vehicular noise, air pollution, and greenhouse gas emissions. Increasing the stringency of carbon dioxide emission norms in emerging markets is driving the demand for EVs. Therefore, need for electric vehicle charging infrastructure is increasing at an exponential rate. For instance, according to the International Energy Agency (IEA), the number of EV charging points across the world grew by around 44% between 2017 and 2018. Such factors are projected to fuel the demand for EV charging cables in the emerging economies over the next decade.

Additionally, rising number of government initiatives and emphasis on encouraging the adoption of EVs are contributing towards market growth. Countries such as China, Netherlands, U.S., France, Norway, and Japan have invested considerably in the development of charging infrastructure, which is further expected to impact the market size for EV charging cables. For instance, in the U.K., USD 650 is offered for the installation of a dedicated home charger for an electric car.

However, COVID-19 is expected to have a significant impact on the supply chain and product demand in the automotive sector. The immediate impact was visible as production disruptions at Fiat Chrysler Automobiles (FCA) and Hyundai factories across the world. Given the size and importance of the Chinese market for the overall automotive industry, especially for the EV segment, global electric vehicle sales are expected to be adversely impacted in the short term. Therefore, the present situation is affecting the growth of the EV charging cables market. The recovery from this pandemic is expected to have a positive impact on the demand. Increase in EV production thereafter would demand more charging infrastructure, which is projected to positively impact the demand for EV charging cables in the forthcoming years.

Moreover, rising demand for fast charging cables and swift growth in the development of EV charger’s equipment is anticipated to drive the market. Electric vehicle charging cables support different charging modes in various regions. To support increasing battery electric vehicles and plug-in electric vehicle sales, the EV charging industry is expected to mature rapidly and become progressively competitive.

Power Supply Insights

By power supply, the market is segmented into Alternate Charging (AC) and Direct Charging (DC). The AC segment dominated the market in 2019 with a share of 73.3%. Alternate charging supplies a 120 V with charging speed of 22 kW depending on vehicle and charging infrastructure standards. AC power supply is mostly used in semi-commercial and residential stations across the world. This type of power supply charging station has a low installation costs and offers a low power output. Moreover, wall-mounted electric vehicle chargers are preferred over floor-mounted chargers as they help to save the cost of underground electrification. Additionally, wall-mounted chargers are best suited for residential stations.

The DC segment is anticipated to exhibit the highest CAGR of 28.0% from 2020 to 2027 owing to several advancements in public stations. DC fast chargers transfer the energy speedily and thus allow wide flexibility in using electric vehicles. Moreover, increasing demand for faster in less time is anticipated to fuel the segment growth over the forecast period.

Cable Length Insights

By cable length, the market is segmented into below 5 meters, 6 meters to 10 meters, and above 10 meters cable. The below 5 meters cable length segment dominated the market in 2019 with over 53.0% share and is projected to maintain its lead over the forecast period. This is majorly due to growing adoption of private electric vehicle charging stations across the world. In addition, below 5 meters cables are more efficient for use in residential applications and offer ease of storage and ease of use.

Moreover, choosing the right electric vehicle charging cable length according to consumer demand and convenience to charge vehicles is crucial to service providers. The 6 meters to 10 meters cable length segment is poised to expand at the highest CAGR of 27.7% from 2020 to 2027. This is because the cable length of at least 18 to 20 feet is perfect for charging stations to cater to increasing consumer demand and augmented penetration of electric vehicles.

Charging Level Insights

Based on charging level, the market has been segmented into level 1, level 2, and level 3. The level 2 segment dominated the market in 2019 with 47.8% share as they are being used progressively in the residential and semi-commercial applications, such as individual homes, apartments, condominiums, hotels, parking lots, and retail facilities.

The level 3 segment category is anticipated to exhibit the highest CAGR of 27.5% from 2020 to 2027. A Level 3 system is equipped with CHAdeMO technology, which charges through a 480V. A level 3 charger can charge a fully drained electric vehicle battery up to 80% in less than 15 minutes. High-power charging capability that to in less than 30 minutes is the major factor amplifying the segment growth. In addition, increasing demand for fast charging systems in countries, such as Japan, South Korea, and China, is anticipated to aid in swift advancements of high-power electric vehicle charging infrastructure, which, in turn, is anticipated to drive the segment over the forecast period.

Shape Insights

Based on cable shape, the market has been segmented into straight and coiled cable. The straight cable dominated the market in 2019 with over 62.0% share and is projected to maintain its lead over the forecast period. Most of the public charging stations have adopted these cables due to their low maintenance requirement, reduced costs, and ease of installations.

The coiled cable segment is poised to expand at the highest CAGR of 27.3% from 2020 to 2027. They are also called spiral cables and are easy to maintain as they do not spread over the surface, hence helping to prevent a tripping hazard. Therefore, these cables need lesser storage space and are more long-lasting than straight cables. Additionally, developments are estimated to reduce the price of coiled cables, thereby boosting the segment growth over the forecast period.

Application Insights

By application, the market is segmented into private charging and public charging applications. The private charging segment dominated the market in 2019 with over 71.0% share of the overall revenue and is projected to maintain its lead over the forecast period. This growth is attributed to the wide usage of these electric vehicles charging stations for private charging.

Public charging stations are poised to expand at the highest CAGR of 27.0% from 2020 to 2027. These stations are installed at shopping malls, airports, hotels, parking lots of commercial properties, government offices, taxi stands, and highways. These charging stations have the capability to charge an electric vehicle in less time with high voltage. Proliferation in the adoption of EVs and growing demand among EV owners to reduce the charging time of EV would proliferate the demand for public charging stations over the forecast period.

Regional Insights

Asia Pacific dominated the market in 2019 and held a 58.9% share of the overall revenue. The growth in this region is mainly driven by China, South Korea, and Japan. China is the largest electric vehicle charging cable market. The Japanese and Chinese governments have expected the growth potential of the global EV supply equipment market and thus have adopted various policies and initiatives to encourage major market players to manufacture EV charging infrastructure in domestic markets. High number of EV charging stations in the region is projected to uplift the regional market growth over the forecast period.

However, South Korea and China are severely impacted by the COVID-19 epidemic, which further adds an unusual dimension for carmakers. As EV batteries are primarily sourced from Chinese and South Korean suppliers, including LG Chem, CATL, and Samsung HDI, their supply could be constrained, and obtaining them from alternative sources is highly challenging. This is certainly an acute concern for manufacturers in Europe as they thrive to attain their respective emissions targets. In a protracted scenario, lower government subsidies, falling oil prices, and economic impact of the pandemic may reduce EV demand, which would further impact the demand for EV charging cables.

North America is anticipated to exhibit the highest CAGR of 29.6% from 2020 to 2027, followed by Europe and Asia Pacific. This is attributed to increased focus of most of the manufacturers on developing high-performance, cleaner, and faster electric vehicles. Growing installation of advanced charging infrastructure and presence of major EV supply equipment manufacturers in the region are likely to drive the regional market.

Key Companies & Market Share Insights

Companies are continuously undertaking strategic initiatives, such as contracts and agreements, partnerships, joint ventures, and new product launches, to sustain their market position. Furthermore, they are aiming at expanding their presence regionally as well as globally and offering improved product portfolio to their customer base. These companies have strong distribution networks across the world. Some of the prominent players in the electric vehicle charging cables market include:

-

Leoni AG

-

Coroplast

-

Chengdu Khons Technology Co., Ltd.

-

Phoenix Contact

-

Aptiv

-

BESEN-Group

-

General Cable Technologies Corporation

-

Dyden Corporation

-

TE Connectivity

Electric Vehicle Charging Cables Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 256.6 million

Revenue forecast in 2027

USD 1.25 billion

Growth Rate

CAGR of 25.4% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power supply, cable length, charging level, shape, application, region

Regional scope

North America; Europe; Asia Pacific

Country scope

U.S.; Canada; U.K.; Germany; France; Netherlands; Norway; China; Japan; South Korea

Key companies profiled

Leoni AG; Coroplast; Chengdu Khons Technology Co., Ltd.; Phoenix Contact; Aptiv; BESEN-Group; General Cable Technologies Corporation; Dyden Corporation; TE Connectivity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the global electric vehicle charging cables market report based on power supply, cable length, charging level, shape, application, and region:

-

Power Supply Outlook (Revenue, USD Million, 2016 - 2027)

-

Alternate Charging (AC)

-

Direct Charging (DC)

-

-

Cable Length Outlook (Revenue, USD Million, 2016 - 2027)

-

Below 5 meters

-

6 meters to 10 meters

-

Above 10 meters

-

-

Charging Level Outlook (Revenue, USD Million, 2016 - 2027)

-

Level 1

-

Level 2

-

Level 3

-

-

Shape Outlook (Revenue, USD Million, 2016 - 2027)

-

Straight Cable

-

Coiled Cable

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Private Charging

-

Public Charging

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Netherlands

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The global EV charging cables market size was estimated at USD 208.0 million in 2019 and is expected to reach USD 256.6 million in 2020.

b. The global EV charging cables market is expected to grow at a compound annual growth rate of 25.4% from 2020 to 2027 to reach USD 1,254.5 million by 2027.

b. Asia Pacific dominated the EV charging cables market with a share of 58.8% in 2019. The growth in this region is also mainly driven by China, South Korea, and Japan, and the high number of EV charging stations in the region.

b. Some key players operating in the EV charging cables market include Leoni AG; Coroplast; Chengdu Khons Technology Co., Ltd.; Phoenix Contact; Aptiv; BESEN-Group; General Cable Technologies Corporation; Dyden Corporation; and TE Connectivity,

b. Key factors that are driving the market growth include the growing adoption of electric vehicles, rising demand for electric vehicle (EV) fast charging cables, and prompt development of EV supply equipment across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.