- Home

- »

- Automotive & Transportation

- »

-

Electric Ship Market Size, Share And Trends Report, 2030GVR Report cover

![Electric Ship Market Size, Share & Trends Report]()

Electric Ship Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Semi Autonomous, Fully Autonomous), By Power Source (Fully Electric, Hybrid), By Power Output (<75 kW, 75 - 745 kW), By Vessel Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-545-8

- Number of Report Pages: 74

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Ship Market Summary

The global electric ship market size was estimated at USD 7.98 billion in 2022 and is anticipated to reach USD 17.91 billion by 2030, growing at a CAGR of 10.9% from 2023 to 2030. The market is in its introduction stage and has enormous scope for growth in the forecast period.

Key Market Trends & Insights

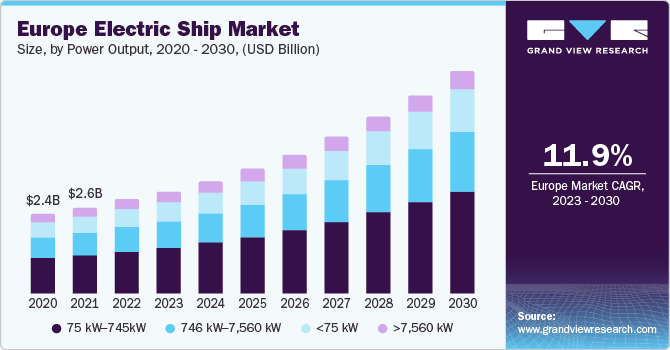

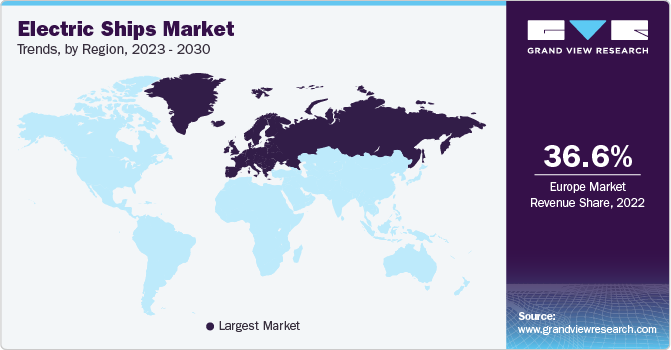

- Europe accounted for the largest revenue share of 35.8% in 2022 and is expected to grow at the fastest CAGR of 11.9% during the forecast period.

- Asia Pacific is expected to grow at a significant CAGR of 11.5% over the forecast period.

- Based on the type, semi-autonomous vessels held the largest share of 97.2% in 2022.

- By power source, the hybrid segment dominated the market for electric ship with a share of 81.5% in 2022.

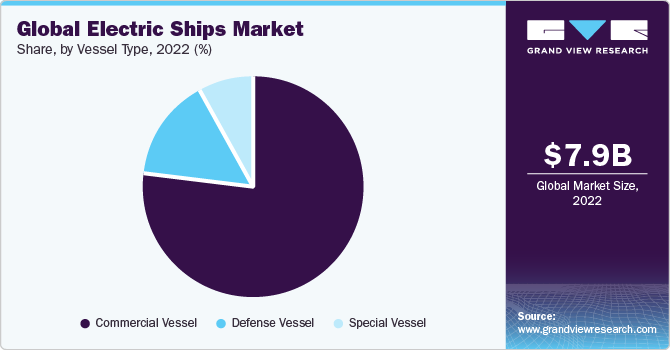

- By vessel type, the commercial vessel segment accounted for the largest market share of 77.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7.98 Billion

- 2030 Projected Market Size: USD 17.91 Billion

- CAGR (2023-2030): 10.9%

- Europe: Largest market in 2022

The rising need for reduction of carbon footprints as well as lower fuel wastage has led to the need for an electric-operated marine ship. Furthermore, the increasing focus of shipbuilders on reducing the noise generated by marine vessel propulsion systems is supporting the growth of the market. The transportation sector is one of the prominent sources of increasing greenhouse emissions across the globe. These emissions from transportation primarily come from burning fossil fuel in aircraft, trains, ships, and vehicles. Approximately 90% of the fuel used for transportation is petroleum-based, which primarily includes diesel and gasoline. Besides, several initiatives taken by the government for the reduction of carbon emissions, such as subsidies on the purchase of electric-operated transportation ships, are expected to boost the growth of the market over the forecast period.

Moreover, the installation of an engine generator (Genset, electric generator) with diesel engines optimizes the overall ship efficiency even at a high load factor. This arrangement also consumes less fuel as compared to the conventional internal combustion engine (diesel engine) used in a marine ship.

Furthermore, growing competition among various end users, such as trade, transportation, and logistics industry, has compelled the service providers to reduce their operational costs, such as fuel consumption and large crew, in order to increase their profit margin and reach the breakeven. This move by the logistics and transportation service providers to decrease operational costs is expected to support the growth of the market.

Earlier, in conventional propulsion engines, the prime movers of the ship were directly coupled with the shaft, which creates vibration and friction, thereby reducing the efficiency of the electric ship. However, in the electric propulsion engine, the prime movers are not directly connected, which reduces the vibration and increases the effectiveness of the system. Additionally, the space required for the installation of electric propulsion machinery is much less and compact as compared to conventional propulsion systems. The space that is occupied by these machines can be used for other purposes to earn more income.

Various government bodies as well as the regulatory authorities across the globe, such as the International Maritime Organization (IMO), United Nations Conference on Trade and Development (UNCTAD), and China Maritime Safety Administration, among others, are taking several strategic steps and outlining various regulations to protect the environment from the harmful emissions from ships. The growing maritime traffic across the globe has led to an increase in greenhouse gas emissions, which is concerning the maritime and environmental regulatory authorities worldwide. As per the European Commission for Energy, Climate Change, and Environment, 800 million tons of CO2 is emitted annually from maritime transport, which constitutes approximately 2.5% of the global CO2 emissions and an estimated 97% of all greenhouse gas emissions from international shipping.

Maritime tourism has been witnessing growth over the years owing to the increase in the disposable income of individuals as well as their increased inclination towards spending on maritime leisure activities. This has increased the usage of passenger cruise ships and luxury yachts. The Cruise Lines International Association (CLIA), which is one of the largest cruise industry trade associations, stated in its report that the global cruise industry is witnessing steady growth over the years. Additionally, the report outlines the fact that cruising played an important role in international tourism with a 7% increase in the number of passengers.

Large marine vessels, such as cruise ships, travel on longer routes. Herein, the limited capacity of the batteries would only suffice some of the energy requirements of the ship. Therefore, the vessels that cover long voyages that last for several days do not prefer to install electric propulsion engines. Moreover, these ships consume large amounts of energy/electricity that is not sufficiently provided by the batteries in the market. This, in turn, is hindering the widespread adoption of electric ships in the market, especially with respect to vessels that consume large amounts of energy in a single voyage.

Type Insights

Based on the type, the electric ship market has been segmented into semi-autonomous and fully autonomous. Semi-autonomous vessels held the largest share of 97.2% in 2022. Semi-autonomous ships are equipped with advanced navigation systems and sensors, enabling them to navigate autonomously in certain conditions. This capability reduces the likelihood of human error and enhances the safety and reliability of maritime transport.

By incorporating cutting-edge technology, these ships can operate more efficiently and securely, essential for safely transporting goods and passengers across the seas. Furthermore, companies investing in semi-autonomous ships can gain a competitive edge. They attract environmentally conscious customers and stakeholders by showcasing their commitment to sustainability and innovation. This strategic positioning can increase market share and better brand reputation, aligning with the growing demand for greener transportation solutions.

The fully autonomous segment is anticipated to witness the fastest CAGR of 24.7% from 2023 to 2030 due to several advantages that these vessels offer as compared to semi-autonomous marine ships. These benefits include efficient utilization of ship space, reduction in human errors, and risk mitigation of the transport. Navigation systems and other advanced maneuvering systems that use sensors and GPS will enable efficient maritime transportation without human involvement. Furthermore, faster operations with the reduced operational cost of fully autonomous electric ships are expected to propel the segment growth over the forecast period.

Power Source Insights

The hybrid segment dominated the market for electric ship with a share of 81.5% in 2022. Various advantages, such as reliability offered by hybrid electric ships are supporting its demand owing to the use of supplementary propulsion systems and higher speed, which can reduce the risk of failure and can cover greater distances in less time.

Furthermore, ship owners or shipping and logistic companies across the globe prefer hybrid electric ships as they enable lower fuel consumption and help to reduce operational costs. The use of diesel-electric propulsion at low power and direct diesel-driven propulsion in need of high power, i.e. inland water sailing with different speed conditions, enables a reduction in operational cost in the electric ship. This is a smarter way to use available energy and save on fuel costs by using hybrid electric ship propulsion.

A fully electric segment is expected to grow at a significant CAGR of 10.7% over the forecast period. One of the primary growth drivers was the tightening of environmental regulations and ambitious sustainability targets set by governments and international bodies. These regulations aimed to reduce greenhouse gas emissions and curb pollution from the shipping sector. As a result, shipowners and operators were increasingly compelled to explore cleaner and more sustainable alternatives, such as fully electric vessels.

Furthermore, long-term cost savings were becoming increasingly apparent as another incentive for embracing electric ships. While the upfront costs of electric vessels were higher than conventional ships, the potential for significant reductions in fuel and maintenance expenses over the ship's lifespan made them a compelling investment for forward-thinking ship owners. This economic advantage added to the attractiveness of electric ships as viable alternatives in the long run.

Vessel Type Insights

The commercial vessel segment accounted for the largest market share of 77.3% in 2022. With rising manufacturing and globalization of trade, there has been a rise in the number of marine vessels added to the existing fleet. Additionally, an increase in maritime logistics drives the need for more sailors, which adds up to the operational costs of the logistics service providers. Rising competitiveness among logistics service providers and the adoption of a competitive pricing strategy is expected to fuel the adoption of automated systems in commercial ships. The electrically propelled automated ship reduces the operating cost and provides more space for the cargo, which is expected to spur the segment growth in the upcoming years.

The defense vessel segment is expected to grow at the fastest CAGR of 11.9% during the forecast period. The growth is attributed to advantages including lower noise and emissions, increased range and endurance, reduced maintenance costs, and improved performance. Electric ships have fewer moving parts than traditional ships, which require less maintenance. This can save the military a significant amount of money over the lifetime of a ship.

One crucial advantage of these ships is their stealth and reduced signature. The electric propulsion systems enable quieter operations and decreased acoustic signatures, making them highly suitable for missions where avoiding detection is paramount. These vessels excel in anti-submarine warfare (ASW) and intelligence, surveillance, and reconnaissance (ISR) operations, allowing for more effective and discreet operations. Energy efficiency is another critical factor driving the adoption of these ships. These vessels can be more energy-efficient, especially at lower speeds, which extends their operational range and reduces the need for frequent refueling or replenishment. Enhanced energy efficiency contributes to prolonged missions and increased operational capabilities in various environments.

Power Output Insights

The 75-745 KW power output segment accounted for the largest revenue share of 44.2% in 2022. The growth can be attributed to the upgrades in existing passenger transport and inland transportation vessels. Factors such as low fuel consumption and lower maintenance cost than diesel propulsion also attract more end-users to invest in this technology. Also, the market for recreational boats is large and fast-growing, and the high adoption rate of electric vessels in maritime tourism is expected to fuel the market growth over the forecast period.

During the last decade, 75-745 KW power output ships were the most preferred in the shipping industry. Increasing awareness pertaining to environmental conservation resulting in the development of propulsion systems, which emit minimal emissions, has generated particular importance in the medium-sized marine vessel, thereby boosting the growth of the 75-745 KW power output segment. Advantages such as less vibration and lower engine noise have also boosted the growth of electric vessels in medium-size passenger and luxury ships. Additionally, the electric propulsion system encapsulates less space, thus providing more space for the interior and increasing its preferability in luxury ships.

The <75 KW power output segment is expected to expand at the fastest CAGR of 12.0% over the forecast period. The 75kW electric ship serves various critical purposes across maritime applications due to its moderate power capacity and eco-friendly characteristics. These vessels are particularly suitable for shorter trips and activities that demand lower power requirements. Electric ships with a power capacity of 75kW are well-suited for short-haul coastal transport and ferry services.

These vessels can efficiently transport passengers and cargo between nearby ports and islands, reducing emissions and noise pollution in environmentally sensitive coastal regions. They offer a sustainable alternative to conventional fossil fuel-powered ferries, contributing to cleaner coastal transportation networks. Electric ships with a power source of 75kW are ideal for recreational and leisure activities on the water. This includes electric yachts, sailboats, and small pleasure crafts. Electric propulsion systems' quiet and emission-free operation enhances the overall experience for boaters and passengers, promoting an eco-friendly and more peaceful environment for recreational activities on lakes and other water bodies.

Regional Insights

Europe accounted for the largest revenue share of 35.8% in 2022 and is expected to grow at the fastest CAGR of 11.9% during the forecast period. One of the most significant drivers is the stringent environmental regulations set forth by the European Union (EU). As part of their commitment to combat climate change and reduce greenhouse gas emissions, the EU has been pushing for cleaner and more sustainable transportation solutions, including maritime transport. This has pressured the shipping industry to explore alternative technologies, such as electric ships, to comply with these regulations and stay competitive.

Germany emerged as a significant contributor to the market growth in Europe owing to the rising environmental awareness of the general population, along with government initiatives to promote electrically operated transportation modes. Moreover, the growing popularity of electric recreational and leisure vessels in marine tourism, water adventures, and fishing activities in the region is expected to propel the regional market growth. However, the COVID-19 pandemic, which recently spread across European countries, especially Italy, the U.K., Spain, and Germany, is expected to negatively impact the regional market growth.

Asia Pacific is expected to grow at a significant CAGR of 11.5% over the forecast period. Strong economic growth and high manufacturing rates are expected to help the Asia Pacific region maintain its position as a global manufacturing hub. Large-scale investments in industries such as chemical manufacturing and mining are projected to augment market growth in global trade, which is expected to fuel the growth. Also, rising environmental concerns and government programs augment the adoption of electric ships in the region.

Key Companies & Market Share Insights

Key market players are entering into collaborations and engaging in mergers & acquisitions of other electric ship companies to capture a greater market share. Furthermore, the market participants are focusing on improving automation technology to attain a competitive edge over other players. For instance, in June 2023, Hurtigruten, a Norwegian cruise line, announced its plan to build the Sea Zero, a zero-emission vessel. The retractable sails on the electric-powered cruise ship set to be outfitted with solar panels to absorb sun and wind energy, which can be stored in powerful batteries.

Key Electric Ship Companies:

- Boesch Motorboote AG

- Bureau Veritas

- Canadian Electric Boat Company

- Corvus Energy.

- Yara

- Duffy Electric Boat Company.

- General Dynamics Electric Boat

- KONGSBERG

- Electrovaya

- TRITON

- VARD AS

- Baltic Workboats AS

Recent Developments

-

In May 2023, PowerX, Inc., a Japan-based energy company launched a detailed design of the first-ever Battery Tanker. The ship ‘X’ is scheduled to be completed in 2025 and will undergo domestic and international field testing in 2026. The Battery Tanker X is designed to be a zero-emission vessel that can transport renewable energy from offshore wind farms to shore.

-

In February 2023, Electric Ship Innovation Alliance (CESIA) was officially founded with the backing of COSCO SHIPPING Development and COSCO SHIPPING. This move cements China's position as a world leader in the electrification of the shipping industry.

-

In January 2023, Hyundai Heavy Industries commissioned South Korea's first big next-generation electric propulsion ship. The ship is dual-powered and runs on battery power, LNG fuel, or a combination of the two. It will be utilized for demonstrations and tourism cruises along the Korean coast.

-

In November 2022, Corvus Energy announced its participation in the Crowley eWolf zero-emission tugboat project This includes an order to provide onshore battery energy storage systems (ESS) using two Corvus Orca BOBs, the containerized variant of the renowned Corvus Orca ESS. These systems collectively offer a substantial energy storage capacity of 2,990 kWh.

-

In May 2022, the Editron division of Danfoss Power Solutions announced a collaboration with Baltic Workboats to provide an electric propulsion system for the Estonian shipyard's bicycle ferry and new hybrid passenger. The hybrid ferry can transport up to 50 persons and 25 bicycles at once. The vessel primarily operates in all-electric mode, assisting the Belgian government in meeting its aim of reducing transportation emissions by 27% by 2030 compared to 2005 levels.

Electric Ship Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.66 billion

Revenue forecast in 2030

USD 17.91 billion

Growth Rate

CAGR of 10.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power output, power source, type, vessel type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Boesch Motorboote AG; Bureau Veritas; Canadian Electric Boat Company; Corvus Energy.; Yara; Duffy Electric Boat Company.; General Dynamics Electric Boat; KONGSBERG; Electrovaya; TRITON; VARD AS; Baltic Workboats AS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Ship Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global electric ship market based on power output, power source, type, vessel type, and region:

-

Power Output Outlook (Revenue, USD Million, 2017 - 2030)

-

<75 kW

-

75 kW-745kW

-

746 kW-7,560 kW

-

>7,560 kW

-

-

Power Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Fully Electric

-

Hybrid

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Semi Autonomous

-

Fully Autonomous

-

-

Vessel Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial vessel

-

Defense vessel

-

Special vessel

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Europe dominated the electric ship market with a share of 35.8% in 2022. This is attributable to the rising environmental awareness among population in the region coupled with government initiatives to promote electrically operated transportation modes.

b. Some key players operating in the electric ship market include Bureau Veritas, Canadian Electric Boat Company, Yara Birkeland, Duffy Electric Boat, General Dynamics( Electric Boat), Kongsberg Gruppen ASA, Triton Submarines, Vard (FINCANTIERI S.p.A.), and Baltic Workboats AS.

b. Key factors that are driving the market growth include imminent need to reduce carbon footprints, lower fuel wastage, and limit noise generated from the marine vessel propulsion systems.

b. The global electric ship market size was estimated at USD 7.98 billion in 2022 and is expected to reach USD 8.66 billion in 2023.

b. The global electric ship market is expected to grow at a compound annual growth rate of 10.9% from 2023 to 2030 to reach USD 17.91 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.