- Home

- »

- Automotive & Transportation

- »

-

Electric Motorcycle Market Size, Share, Growth Report, 2030GVR Report cover

![Electric Motorcycle Market Size, Share & Trends Report]()

Electric Motorcycle Market (2023 - 2030) Size, Share & Trends Analysis Report By Drive Type (Belt Drive, Chain Drive, Hub Motor), By End-use (Personal, Commercial), By Battery Type (Lithium-ion, lead acid), By Region And Segment Forecasts

- Report ID: GVR-4-68040-075-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Motorcycle Market Summary

The global electric motorcycle market size was estimated at USD 30.11 billion in 2022 and is projected to reach USD 121.07 billion by 2030, growing at a CAGR of 19.9% from 2023 to 2030. The market is expected to grow due to increasing demand for energy-efficient commuting options, rising concern for carbon emission by ICE-based two-wheelers, and increasing fossil fuel prices worldwide coupled with depleting reserves contributing to market growth.

Key Market Trends & Insights

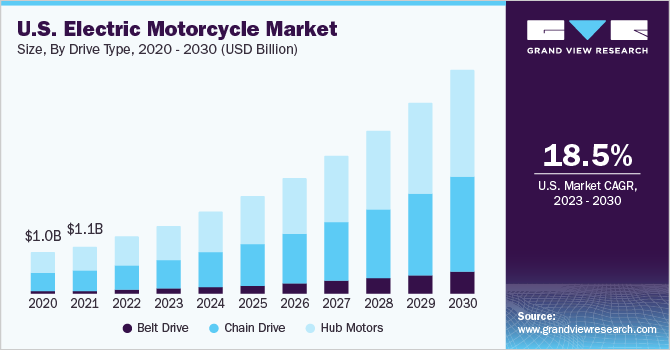

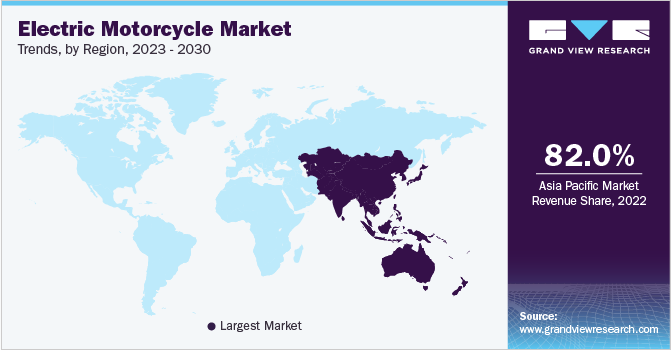

- Asia Pacific region accumulated revenue of over 82% in 2022 and the fastest CAGR throughout the projection period.

- Based on drive type, hub motor segment has accumulated the highest market share of over 48% in 2022.

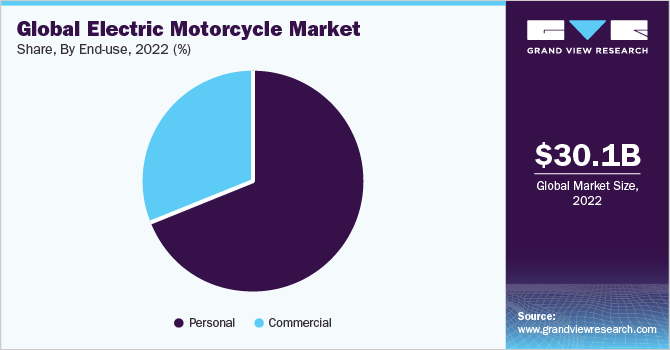

- Based on end-use type, personal segment has the largest market share of over 70 % in 2022.

- Based on the battery type, lithium-ion based battery segment is anticipated to continue growing at the largest market share rate of more than 90% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 30.11 Billion

- 2030 Projected Market Size: USD 121.07 Billion

- CAGR (2023-2030): 19.9%

- Asia Pacific: Largest market in 2022

Furthermore, an increasing interest of established two-wheeler market players entering electric motorcycle space and an advent of electric motorcycle startups providing technologically advanced vehicles also supports the market growth. Introduction of charging station ecosystems, declining battery costs, and development of battery management technologies by major market players is contributing to the electric motorcycle industry growth. Additionally, inclusion of telematics, cellular connectivity, and improvement in aerodynamic characteristics of vehicles, are creating new opportunity avenues for electric motorcycle industry development within the forecast period.

The market has gained significant traction over the years owing to active advocacy from government authorities worldwide. In emerging economies such as India and Indonesia, governments are introducing incentives and schemes for purchasing and manufacturing electric motorcycles. For instance, in January 2023, Indonesian government announced by 2024, Indonesia would provide public funds amounting to USD 455.88 million (7 trillion rupiah) to subsidize a purchase of electric motorcycles. The government anticipates increasing vehicle count by 2024. The shift towards electric vehicles will contribute to a decrease in the usage of fossil fuels and development of EV production facilities to use nation's abundant nickel sources, which are crucial for a production of batteries. Similarly, on June 2021, Indian government increased subsidy for electric two-wheelers under second phase of the FAME India scheme by 50%, making them more affordable-a decision that will significantly benefit customers of electric motorcycles. According to the Ministry of Heavy Industries and Public Enterprises, under FAME India phase II, the subsidy for electric two-wheelers will now be USD 17.96 (Rs 15,000) per kWh.

Development of battery technology to address concerns surrounding range and performance anxiety further contributes to market growth. The expansion of battery capacity and its safety is a crucial parameter governing traction of market growth. However, electric motorcycle batteries encounter issues such as catching fires, temperature vulnerability, battery weight, size, and running cost which hinder market growth The OEMs have developed their batteries with improved power output to address these problems. For instance, in November 2021, Zero Motorcycles, Inc. introduced its new battery pack made of polycarbonate and die-cast aluminum. Lithium ion-based battery contains 56 cells, increasing battery capacity and improving cell chemistry.

Lithium-ion batteries by Zero Motorcycles Inc. have undergone significant advancements. Zero Motorcycles Inc. has increased energy density of its batteries by up to 20%. These upgraded power packs are available in two standard capacities of 15.6 and 14.4 kWh owing to major battery design and construction advancements. The pack size plus symbol denotes options for further capacity increases of up to 17.3 kWh. SR/S and SR/F, premium street vehicles, are equipped with a larger 15.6+ kWh battery arrangement, while an ordinary SR/S and SR/F will have a 14.4+ kWh battery configuration. Increase in battery capacity owing to the upgrades coupled with use of a power tank enables a battery to produce and store over 21 kWh of energy. The maximization of battery capacity prompts rider to leverage an increased vehicle range of 227 miles (365 km) and an accelerated range of 113 miles (182 km) at 70 mph. and performance. Moreover, this development also created avenues for accelerating the adoption of electric motorcycles, thus supporting market growth.

Absence of charging infrastructure is one of the main obstacles to electric motorcycle industry expansion. Unlike developed nations, most emerging nations lack requisite charging infrastructure. Solutions for infrastructure of charging are provided by manufacturers everywhere. For instance, ChargePoint (U.S.) develops and manufactures hardware for the charging stations and power management software for a mobile application for charging network. Moreover, ChargePoint offers demand-based charging stations for every type of electric vehicle. A similar selection of charging options is provided by ONEX Commercial (Taiwan), including standard, quick, and battery swapping. For the market to flourish, customers need an extensive charging infrastructure network that allows them to go long distances without worrying about where the nearest charging station is.

Market Dynamics

The market for electric motorcycles is expected to benefit significantly from a number of promotional measures adopted by governments globally to encourage the adoption of electric vehicles and subsequently phase out vehicles powered by fossil fuels. For instance, Indonesia has to unconditionally reduce greenhouse gas emissions by 29% against the Business-As-Usual (BAU) scenario by 2030. As part of this goal, the country has implemented the Presidential Regulation No. 55/2019 and has built and deployed battery-powered electric vehicles for road transportation. Such aggressive government support is expected to drive the growth of the electric motorcycle market over the forecast period.

Electric motorcycle manufacturers are also putting a strong emphasis on integrating smartphone connectivity into their motorcycles. Pairing smartphones with electric motorcycles can allow riders to access GPS information, telematics services, charging indicators, and low-battery alerts, among other notifications related to their motorcycles, on their smartphones, thereby ensuring a personalized riding experience.

Electric motorcycles incorporate technologically advanced features such as geofencing, remote lock/unlock, vehicle health monitoring, live location tracking, and detailed ride statistics. Manufacturers are introducing new electric motorcycles with various technological advancements to stay competitive in the market. For instance, in June 2023, Matter Motor Works Pvt. Ltd., an EV startup, partnered with Airtel India, a telecommunications service provider, to implement Airtel India’s IoT solution, Airtel IoT Hub, in Matter AERA, a geared electric motorbike. This would enable real-time vehicle tracking, vehicle monitoring with advanced analytics, and improved security with telco-grade reliability. The emergence of such smart motorcycles is enabling users to design, and curate connected experiences.

Drive Type Insights

Based on drive type the market is divided based on belt, chain, and hub drive. Hub motor has accumulated the highest market share of over 48% in 2022. Electric motorcycle hub motors have different advantages, such as easier installation, superior performance, and lower cost. Consequently, hub motors is anticipated to become a favorable option for electric motorcycle manufacturers. Moreover, parameters including high torque, improving vehicle handling, increased power, and increased range have increased segmental growth. Hub motors are becoming more and more popular as a result of its benefits, including, high power efficiency, flexibility, lightweight, elasticity, and small sizes. It also helps to reduce maintenance costs while providing enhanced driving experience. Additionally, electric motorcycle hub motors require fewer components. As a result, it contributes to lowering mechanical component losses, which results in a vehicle that runs quietly.

End-Use Insights

Based on end-use type the market is bifurcated into personal and commercial segments. Among all the segments, personal segment has the largest market share of over 70 % in 2022 owing to its environmental friendliness, low cost, lightweight, low maintenance requirements, and ease of maneuverability. Electric motorcycles are revolutionizing personal vehicle market. They are generally favored above their electric competitors. Electric motorcycles are popular among millennials as well as middle and low-income demographics. To create a proactive driving experience, many manufacturers are incorporating linked car technology in these scooters. Electric motorcycle usage will also increase due to manufacturers placing more emphasis on creating private charging stations or specific locations for charging cars.

Commercial segment is anticipated to have the fastest growth with a CAGR of 22.1% during the forecast period. Electric motorcycles are a practical and affordable last-mile delivery option for business applications. Electric motorcycle may be a viable solution for quick and effective mobility in factories, universities, warehouses, and industrial sites with enormous land areas. Many car rental companies are implementing electric motorcycles that may be used in combination or time-length packages for lengthy trips as the trend of shared mobility is taking off, causing the market to grow.

Battery Type Insights

Based on the battery type segment, the market is divided into lead acid battery lithium-ion battery, and others. Among all the segments, lithium-ion based battery sub-segment is anticipated to continue growing at the largest market share rate of more than 90% in 2022. The demand for battery-operated electric motorcycles is driven by more ecologically friendly batteries and a growing need for high-performance batteries such as lithium ion based batteries. These batteries have many advantages, including high charge density, low weight, and good charging-discharging efficiency, which is supporting the demand for lithium-ion battery based electric motorcycle market growth. In 2022, lead acid battery market contributed a consistent portion of total sales. The use of lead-acid batteries is declining due to considerations like their lower abuse tolerance, bulkier size, and quick discharge, even when not carrying a significant load.

Regional Insights

Asia Pacific region accumulated revenue of over 82% in 2022 and the fastest CAGR throughout the projection period, showcasing dominance in the market in the region. Improved economic conditions in nations such as India, Thailand, Indonesia, and China are supporting market growth. Rapid urbanization, rising affordability of electric motorcycles, and rising consumer awareness of clean energy mobility to reduce vehicle emissions are further factors driving regional market growth. Also, over the following years, research and development activities will continue to significantly improve the market.

Major Japanese players such as Kawasaki Heavy Industries, Ltd., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., and Suzuki Motor Corporation, are investing aggressively to develop electric motorcycles, battery pack technology, and charging infrastructure while announcing plans to introduce electric motorcycles. Other major companies such as Energica have also entered Asia Pacific market space by shipping orders to countries such as Australia and Pakistan Thus, supporting electric motorcycle industry growth.

Key Companies & Market Share Insights

Electric motorcycle manufacturers are increasing number of products they offer by adopting strategies such as rentals, partnerships with component suppliers, R&D spending, and product launches. For instance, in September 2023, Maeving, an electric motorcycle provider released the Maeving RM1 in France, Germany, the Netherlands, and Belgium. RM1 have a top speed of 45mph and a range of up to 80 miles (40 miles per battery charge), it can conveniently recharge from any standard socket. Some of the prominent players in global electric motorcycle market include:

-

Honda Motor Co., Ltd.

-

Maeving

-

Energica Motor Company S.p.A.

-

Zero Motorcycles, Inc.

-

CAKE

-

SUR-RON USA

-

Harley-Davidson, Inc.

-

Electric Motion

-

KTM Sportmotorcycle GmbH

-

Fonz Moto Pty Limited

Electric Motorcycle Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 35.72 billion

Revenue forecast in 2030

USD 121.07 billion

Growth rate

CAGR of 19.0 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume thousand units and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drive type, end-use, battery type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Netherlands; Italy; Spain; Denmark; China; India; Japan; South Korea; Taiwan; Vietnam; Indonesia; Brazil; Mexico

Key companies profiled

Honda Motor Co., Ltd.; Maeving; Energica Motor Company S.p.A.; Zero Motorcycles, Inc.; CAKE; SUR-RON USA; Harley-Davidson, Inc.; Electric Motion; KTM Sportmotorcycle GmbH; Fonz Moto Pty Limited

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Motorcycle Market Report Segmentation

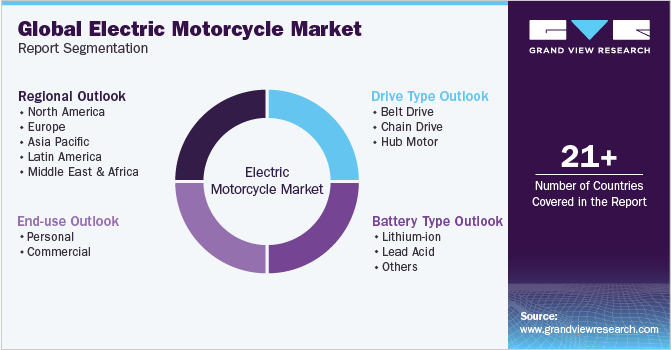

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric motorcycle market report based on, drive type, end-use, battery type, and region:

-

Drive Type Outlook (Revenue, USD Million; Volume Thousand Units, 2018 - 2030)

-

Belt Drive

-

Chain Drive

-

Hub Motor

-

-

End-Use Outlook (Revenue, USD Million; Volume Thousand Units, 2018 - 2030)

-

Personal

-

Commercial

-

-

Battery Type Outlook (Revenue, USD Million, Volume Thousand Units, 2018 - 2030)

-

Lithium-ion

-

Lead Acid

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume Thousand Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Netherlands

-

Italy

-

Spain

-

Denmark

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

Vietnam

-

Indonesia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global electric motorcycle market size was estimated at USD 30.11 billion in 2022 and is expected to reach USD 35.72 billion in 2023,

b. The global electric motorcycle market is expected to grow at a compound annual growth rate of 19.0% from 2023 to 2030 to reach USD 121.07 billion by 2030.

b. Asia Pacific dominated the electric motorcycle market with a share of 82.2% in 2022. This can be attributed to the growing demand for electric motorcycles in the region.

b. Some key players operating in the electric motorcycle market include Harley-Davidson, Inc., LITO Motorcycles, Essence Motorcycles, Tacita, Alta Motors, Yadea Technology Group Co.,Ltd., Arranz Group Ltd, Jiangsu Xinri E-Vehicle Co.,Ltd, and Wuyang-Honda Motorcycle (Guangzhou) Co., Ltd.

b. Key factors driving the electric motorcycle market growth include the growing development in the deployment of charging stations and rising concerns about carbon emissions and fuel depletion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.