- Home

- »

- Automotive & Transportation

- »

-

Electric Mobility Market Size, Share & Trends Report, 2030GVR Report cover

![Electric Mobility Market Size, Share & Trends Report]()

Electric Mobility Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Electric Bikes, Electric Scooter, Electric Motorized Scooters, Electric Motorcycle), By Drive, By Battery, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-591-5

- Number of Report Pages: 164

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Mobility Market Summary

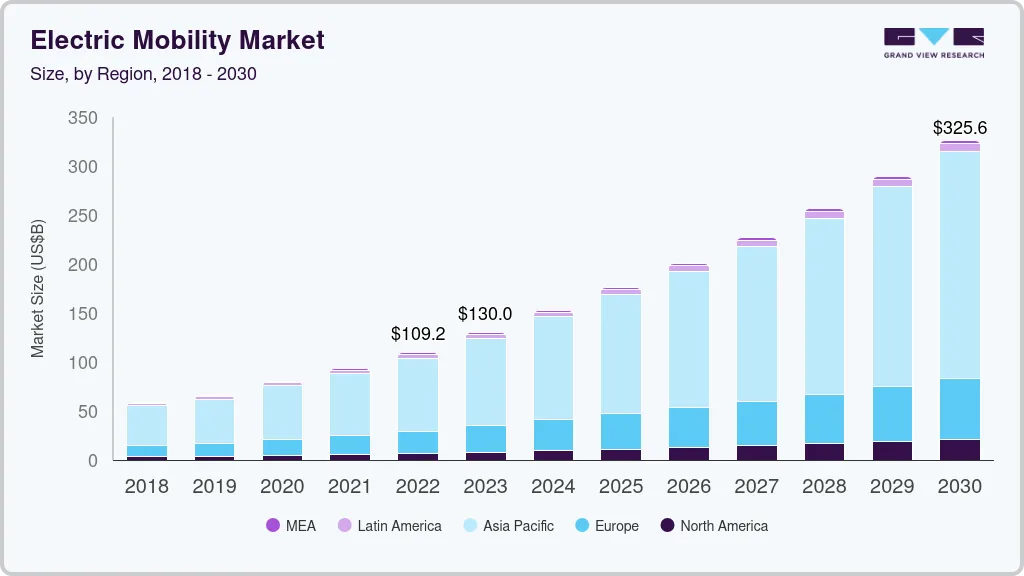

The global electric mobility market size was estimated at USD 109.23 billion in 2022 and is projected to reach USD 325.64 billion by 2030, growing at a CAGR of 14.6% from 2023 to 2030. The increasing concentration of greenhouse gases harming the environment and the extensive rise in carbon footprint is anticipated to drive the adoption of electric mobility over the forecast period.

Key Market Trends & Insights

- Asia Pacific held the largest share of over 68% of the global electric mobility market in the year 2022.

- Based on product, the electric bikes segment held a dominant revenue share of more than 38% in 2022.

- Based on battery, the lithium-ion battery segment accounted for the largest revenue share of 82% in 2022.

- Based on end use, the personal segment accounted for the largest revenue share of 76% in 2022.

- Based on drive, the chain drive segment held the dominant revenue share of 46% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 109.23 Billion

- 2030 Projected Market Size: USD 325.64 Billion

- CAGR (2023-2030): 14.6%

- Asia Pacific: Largest market in 2022

Stringent emission norms by the government agencies such as emission standards for greenhouse gas (GHG) emissions by the U.S. Environmental Protection Agency (EPA), BS-VI in India, and China VI are driving the market growth for electric mobility.

Besides, the escalating need for the construction of charging infrastructure, autonomous transportation, and sustainability are contributing to the growth of the market. While smart charging strategies such as electrified roadways and quick direct current (DC) chargers decrease range anxiety, large-scale electrification speeds up the production of charging infrastructure and new batteries, which is propelling the demand for the electric mobility industry.

Moreover, governments across the globe have formulated several policies to increase the penetration of electric mobility in the market. For instance, according to Invest India, a national facilitation and investment agency, the government of India has aimed to target 30% of vehicle electrification by 2030. Moreover, the Delhi-Chandigarh highway is the first roadway in the country to be made EV-friendly with the successful commissioning of solar-based electric vehicle chargers.

This eco-friendly network of stations was developed by Bharat Heavy Electricals Limited (BHEL) by requirements set forth by the Ministry of Heavy Industries in India. The government's robust initiatives, pursued through several implementing agencies, have led to a rapid expansion in the installation of public EV charging infrastructure. During October 2021 and January 2022, 678 new public EV charging stations were installed in 9 Indian cities. Such initiatives by the government are contributing to market growth.

The emergence of electric mobility is supplementing the growth of EV startups that have gathered a substantial amount of funding, which is expected to help in furthering the market growth. Startups such as Ather Energy raised USD 50,000 in a new funding round. As demand for electric vehicles has increased in 2022, the company will employ the current capital to ramp up its manufacturing capacity. Similarly, significant investments from automakers are expected to cater to the increasing demand for electric vehicles and play a vital role in the evolution of the market.

For instance, in February 2022, Ford Motor Company made an investment of up to USD 20 billion in the production of its electrified vehicles. Over the next five to ten years, the USD 10 billion to 20 billion investment will be rolled out for adapting the company's current factories around the world to produce electric vehicles. In an attempt to bring in more funding, the automaker is also considering spinning off a portion of its electric vehicle (EV) operations as a special acquisition company (SPAC).

The comprehensive adoption of EVs owing to concerns about sustainability has led to the rapid development of Electric Vehicle Supply Equipment (EVSE), which includes entire hardware, software, and charging stations. Owners of charging stations and grid operators use cloud-based platforms to exchange data connections to combat this.

Through smart chargers, they enable operators to properly distribute the available electricity among diverse consumers and remotely manage electric vehicle charging. Additionally, solar-powered EVs with photovoltaic cells & wireless charging features enhance the feasibility of purchasing an EV. In this manner, charging infrastructure development is driving the growth of the market.

Battery swapping can increase the acceptability of electric mobility by resolving the early market purchase cost difference with conventionally powered vehicles and, more crucially, the issues associated with the lengthy recharging times for electric vehicles.

For instance, in August 2022, Hindustan Petroleum Corporation Limited, an oil and gas company, partnered with Honda Motor Co., Ltd. and introduced their first "e: swap" station at HPCL's gas station in Bengaluru on August 6. The partnership aimed to establish battery-switching facilities for electric vehicles at the oil company's petrol pumps. With the rapid uptake of environmentally friendly EVs, infrastructure is built countrywide to provide facilities for charging such vehicles or replacing drained batteries with fully charged ones.

Product Insights

The electric bikes segment held a dominant revenue share of more than 38% in 2022. The favorable government initiatives, advances in technology, growing awareness about performance-based adventure, and rising preference for leisure activities are some of the factors that are expected to drive the growth of the segment.

For instance, in January 2023, VAAN Electric Moto Pvt Ltd, an Indian e-mobility startup, launched the Urbansport electric bicycle in the country. There are two models of the e-bike: Urbansport and Urbansport Pro. According to VAAN, the vehicles have a pedal-assist range of 60 km and a maximum assistance (peak speed) of 25 km/h. According to VAAN, a total charge would only require half a unit of electricity, costing about Rs. 4-5. With a net weight of 2.5 kg and a charging time of 4 hours, the detachable battery pack would provide convenience.

The electric motorcycles segment is expected to witness a high CAGR of 19% over the forecast period. The growth can be attributed to the growing concerns over the rising levels of vehicular emissions, coupled with advances in technology to deliver better acceleration, higher speed, compact size, and reduced motor weight in modern electric motorcycles. The introduction of fast-charging stations is also expected to play a vital role in driving the growth of the segment over the forecast period.

For instance, in September 2022, Zero Motorcycles, Inc. announced a partnership with Hero MotoCorp of India to develop high-end e-motorcycles. The partnership envisaged Hero MotoCorp investing USD 60 million in Zero Motorcycles, Inc. by purchasing shares of the company. The two companies would develop affordable, performance-oriented electric motorcycles as part of the partnership.

In July 2022, Dayco, a manufacturer of engine products and drive systems, announced a partnership with BMW Motorrad, a leading motorcycle brand, to supply drive belt technology for the CE 04 e-scooter to provide high system performance with a better range and allow the scooter to run silently and smoothly. Such developments are anticipated to supplement the growth of the segment over the forecast period.

Battery Insights

The lithium-ion battery segment accounted for the largest revenue share of 82% in 2022. The growing awareness about eco-friendly batteries and the rising investments in lithium-ion battery packs are expected to drive the segment’s growth. For instance, in December 2022, Neuron Energy Private Limited, a manufacturer of lithium-ion battery packs for electric two- and three-wheelers, stated its intent to invest INR 50 crore (USD 6 million) in this market.

The company will be able to balance the demand-supply ratio for cells with the help of this investment. The company plans to concentrate on the battery pack sector as part of its expansion strategy. Additionally, an important announcement was made in the Indian budget 2023, stating that customs taxes on lithium batteries have been reduced from 21% to 13%. Importing tangible goods and equipment necessary for lithium and ion cells for packs used in electric vehicles is now exempt from customs duties. As a result, this action by the Indian government will lower the price of EVs.

The lead-acid segment is estimated to witness considerable growth throughout the forecast period. Lead acid batteries are predicted to witness an increase in demand owing to their expanding use across key industries, such as gas turbines, oil and gas, electricity generation, nuclear power, hospitality, transportation infrastructure, construction, manufacturing, mining, and off-grid renewable energy. Additionally, benefits related to these batteries, such as their robustness, high voltage capability, affordability, and simpler manufacturing procedures, are anticipated to boost demand.

End-use Insights

The personal segment accounted for the largest revenue share of 76% in 2022. Sales of electric two-wheelers are expanding in several important markets as more consumers prefer electric mobility for both commuting and leisure. Original Equipment Manufacturers (OEMs) are concentrating on integrating advanced technologies to improve efficiency and range, such as connected two-wheelers and modern motors. Such lucrative features and benefits are expected to drive the demand for electric two-wheelers for personal mobility over the forecast period.

The commercial segment is expected to witness a CAGR of 18.9% during the forecast period. The demand for commercial electric vehicles is growing as several governments have started pursuing green initiatives by allowing e-scooters, e-bikes, and e-bicycles to encourage zero-emission commuting. For instance, in January 2023, the Indian budget for 2023 paved the way for a more rapid shift to green mobility. As per the expected Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme with incentives to promote the use of hybrid and electric automobiles, the subsidy for fiscal 2024 is USD 626.3 million, up from USD 350.8 million in the present year 2023.

Drive Insights

The chain drive segment held the dominant revenue share of 46% in 2022. E-bikes with chain drives tend to be more efficient and offer a longer range. Chains are compatible with most bikes, regardless of the motor or frame type. In September 2021, Schaeffler, an automotive parts manufacturer based in Germany, announced a collaboration with Heizmann, an electric two-wheeler company, to unveil Free Drive. This device eliminates the need for pedals to be chain-driven to a bicycle's rear wheel. The device converts pedaling energy into electrical power while maintaining the standard distance of 5 inches (138mm) between the two pedals, allowing the pedals to be placed anywhere on the bicycle.

The belt drive segment is expected to witness a CAGR of 15.2% during the forecast period. Several government and regulatory bodies are boosting the adoption of electric two-wheelers by proposing tax concession, which is projected to contribute to the growth prospects of the electric mobility industry. Numerous companies have also emphasized investing in the e-motorcycle business, which is expected to further support the growth of the electric motorcycles segment and the overall market.

Regional Insights

Asia Pacific held the largest share of over 68% of the global electric mobility market in the year 2022. In India, the demand for e-scooters is poised to increase as several companies are introducing shared mobility services, while e-commerce companies are opting for e-scooters to ensure last-mile delivery services. In September 2022, Hero Electric, an e-scooter company based in India, announced a partnership with Readily Mobility, a provider of after-sales services for electric vehicles, to provide its B2B partners with various aftermarket services, including insurance (renewals & claims and sales), roadside assistance, and doorstep/hub-based preventive & periodic maintenance.

The company hopes to provide fleet owners with efficient servicing, having realized that fleet owners would have to get their e-bikes serviced regularly due to constant use. Furthermore, in September 2022, phase II of the FAME-India Scheme (FAME II) has been modified to provide 50% more assistance than initially intended. The rate has increased from USD 121 (Rs. 10,000) per kWh to USD 181 (Rs. 15,000) per kWh, with the maximum subsidy set at 40% of the vehicle's cost. Compared to buying a fuel variant, the price difference between electric mobility and bikes has shrunk even further due to the increase in subsidies.

Europe’s electric scooter market is expected to witness a considerable CAGR of 7.9% over the forecast period. In Europe, the growing concerns over vehicular pollution and supportive government policies to decarbonize transportation are expected to drive the growth of the regional electric mobility industry over the forecast period. For instance, in October 2022, the European Commission signed an agreement ensuring that by 2035, all newly registered automobiles and vans in Europe will be emission-free. The new CO2 regulations will also require new vans and vehicles to reduce their average emissions by 50% and 55% by 2030 as a transitional step towards zero emissions. These factors are expected to fuel the overall growth of the Europe market.

Key Companies & Market Share Insights

Prominent participants in the electric scooter industry include BMW Motorrad International; Gogoro, Inc.; Honda Motor Co. Ltd.; KTM AG; Mahindra Group; Ninebot Ltd.; Suzuki Motor Corporation; Terra Motors Corporation; Vmoto Limited ABN; and Yamaha Motor Company Limited. Electric Scooter manufacturers such as Lime and Govecs AG are focused on launching last-mile e-scooter rental services in different countries and cities with a joint venture strategy to expand their industry footprint across the world.

Prominent players in the Indian electric mobility industry are focused on research and development activities to launch a range of electric mobility solutions. For instance, in July 2022, Motovolt India, a bicycle store, raised USD 12 million to expand its retail network and ramp up its existing manufacturing capacity in the e-scooter and e-bike segments. The company has marked its presence in the east and south of India and is looking forward to expanding into the country’s west and north. The company also intends to increase its sales representatives from 100 to 250 by the end of fiscal 2023. Some prominent players in the global electric mobility market include:

-

BMW Motorrad International

-

Gogoro, Inc.

-

Honda Motor Co. Ltd.

-

KTM AG

-

Mahindra Group

-

Ninebot Ltd.

-

Suzuki Motor Corporation

-

Terra Motors Corporation

-

Vmoto Limited ABN

-

Yamaha Motor Company Limited

Electric Mobility Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 130.02 billion

Revenue forecast in 2030

USD 325.64 billion

Growth rate

CAGR of 14.6% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, drive, battery, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Mexico; Brazil

Key Company Profiled

BMW Motorrad International; Gogoro, Inc.; Honda Motor Co. Ltd.; KTM AG; Mahindra Group; Ninebot Ltd.; Suzuki Motor Corporation; Terra Motors Corporation; Vmoto Limited ABN; Yamaha Motor Company Limited

Customization scope

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Electric Mobility Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric mobility market report based on product, drive, battery, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Bikes

-

Electric Scooters

-

Electric Motorized Scooters

-

Electric Motorcycles

-

-

Drive Outlook (Revenue, USD Million, 2018 - 2030)

-

Belt Drive

-

Chain Drive

-

Hub Drive

-

-

Battery Outlook (Revenue, USD Million, 2018 - 2030)

-

Lead Acid Battery

-

Li-Ion Battery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global electric mobility market size was estimated at USD 109.23 billion in 2022 and is expected to reach USD 130.02 billion in 2023.

b. The global electric mobility market is expected to grow at a compound annual growth rate of 14.0% from 2023 to 2030 to reach USD 325.64 billion by 2030.

b. Asia Pacific dominated the electric mobility market with a share of over 68% in 2022. The regional market for electric mobility is anticipated to dominate owing to the higher rate of adoption of EVs, specifically electric bicycles and electric scooters, in economies such as China and Japan.

b. Some key players operating in the electric mobility market include Vmoto Limited ABN, Tesla, Terra Motors, Continental AG, ALTA MOTORS, Accell Group, Nissan Motor Corporation, Zero Motorcycles, Inc., and Kinetic Green Energy & Power Solutions Ltd.

b. Key factors that are driving the market growth include the growing adoption of Mobility-as-a-Service (MaaS) and the continuously declining costs of high capacity Li-Ion batteries, which, in turn, brings down the overall vehicle cost, are also driving the increased adoption of electric vehicle (EV).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.