- Home

- »

- Consumer F&B

- »

-

Edible Insects Market Size, Share & Growth Report, 2030GVR Report cover

![Edible Insects Market Size, Share & Trends Report]()

Edible Insects Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Beetles, Caterpillar, Cricket), By Application (Powder, Protein Bars), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-285-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Edible Insects Market Summary

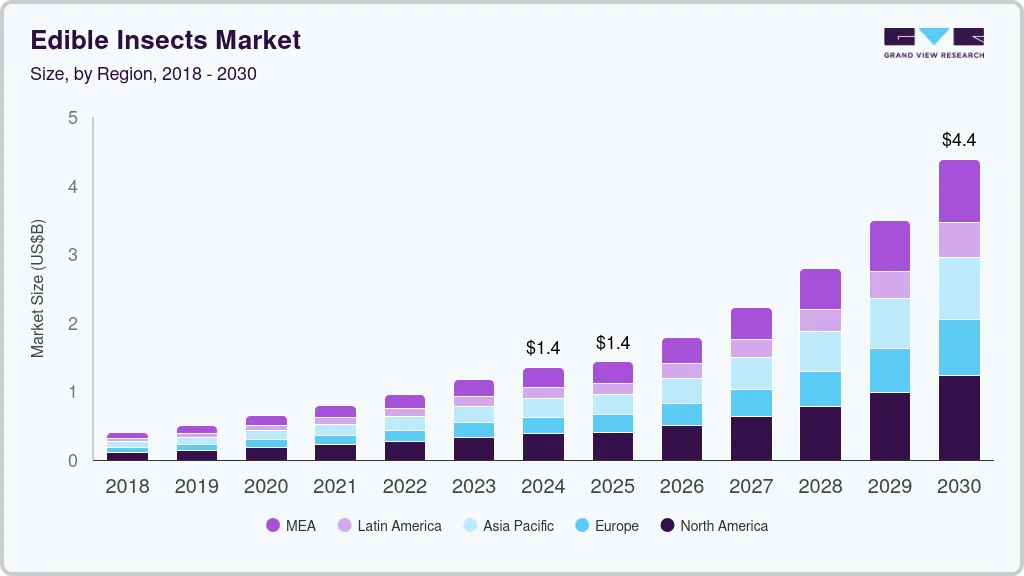

The global edible insects market size was estimated at USD 1.35 billion in 2024 and is projected to reach USD 4.38 billion by 2030, growing at a CAGR of 25.1% from 2025 to 2030. The rising demand for high-protein, low-fat foods is a major driver as consumers increasingly seek healthier alternatives to traditional protein sources.

Key Market Trends & Insights

- North America edible insects market dominated the market with the largest revenue share of 28.2% in 2024.

- The U.S. edible insects market dominated the North American market with the largest revenue share in 2024.

- By product, the beetles segment dominated the market with the largest revenue share of 32.9% in 2024.

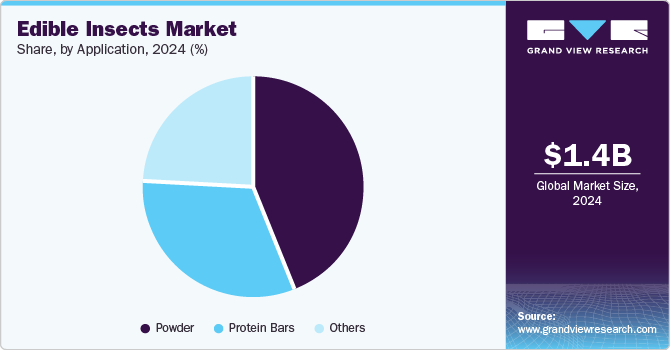

- By application, the powder segment dominated the market with the largest revenue share of 44.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.35 Billion

- 2030 Projected Market Size: USD 4.38 Billion

- CAGR (2025-2030): 25.1%

- North America: Largest market in 2024

Edible insects offer a highly nutritious option, rich in protein, vitamins, and minerals while requiring minimal resources such as land, water, and feed compared to conventional livestock. Additionally, the growing environmental concerns and the need for sustainable food production methods encourage the adoption of edible insects. The low-cost production and easy availability of these insects further support market expansion.

Increasing farming of insects due to minimum investment and a decrease in seafood due to restrictions imposed by many countries on fishing is expected to propel the demand for the product. Demand for these invertebrates is increasing due to their low cost, high nutritional benefits, and requirement of minimal cost for farming, thus impacting the market growth positively.

Governments are taking initiatives to educate consumers in developing countries such as India and China, propelling market demand. These invertebrates require little land for production, less feed than other animals, and are 12 times richer in protein than other sources. These prominent factors are expected to boost market demand in the forecast period.

However, in countries such as India, cultural beliefs and negative perceptions of consumers can hinder market growth. Scarce distribution channels and the absence of a legal blueprint with respect to the consumption of insects are the factors anticipated to restrain market growth in the forecast period. Moreover, insects are considered the best food for malnutrition in many countries as they are easy to digest. Insects are resistant to disease transfer as compared to the other animals, thereby driving their demand. In addition, the presence of micronutrients such as zinc, fatty acid, iron, and magnesium is expected to fuel the growth of the market.

Beetles are the most consumed invertebrates due to their high nutritional content. A water beetle supplies 20 grams of protein per 3.5 ounces, while a June beetle supplies 13 grams. The beetles are rich in iron, calcium, and zinc, thus highly preferred by both young and aging consumers. Crickets are rich in protein, serve more proteins per 100gm compared to beef, and are low in cost, making them preferable to other sources of proteins.

Product Insights

Beetles dominated the market with the largest revenue share of 32.9% in 2024. Beetles are widely available and can be farmed relatively easily, making them a cost-effective source of protein. They are also highly nutritious, containing essential amino acids, vitamins, and minerals. The versatility of beetles in various culinary applications, from whole insects to powdered form, further enhances their market appeal. Additionally, the growing acceptance of insects as a sustainable food source in many cultures has contributed to the popularity of beetle-based products.

Cricket is expected to grow at the fastest CAGR of 26.3% over the forecast period. Crickets are highly efficient to farm, requiring significantly less water, land, and feed than traditional livestock, making them a sustainable protein source. They are also rich in essential nutrients, including vitamins, high-quality protein, and minerals, which appeal to health-conscious consumers. The versatility of cricket-based products, from protein bars to powders, makes them attractive for various food applications. Additionally, increasing consumer awareness and acceptance of edible insects as a viable protein alternative are further propelling the market.

Application Insights

The powder segment dominated the market with the largest revenue share of 44.3% in 2024. Their versatility and convenience drive this dominance. Powders, derived from insects such as crickets and beetles, can be easily integrated into a wide range of food products, from protein shakes and bars to baked goods and pasta. Their neutral taste and fine texture make them ideal for fortifying foods with additional protein and nutrients without altering the flavor profile. The growing demand for high-protein, sustainable ingredients in health and fitness markets further boosts the popularity of insect powders.

Protein bars are expected to grow significantly over the forecast period. The increasing demand for convenient, on-the-go nutrition options among health-conscious consumers and fitness enthusiasts is a primary driver. Protein bars, fortified with insect protein, offer a sustainable and nutrient-dense alternative to traditional protein sources. The rising awareness of the environmental benefits of edible insects, such as lower resource requirements and reduced greenhouse gas emissions, further fuels this trend. Additionally, the continuous innovation in flavor and formulation enhances the appeal of protein bars, making them a versatile and appealing snack option.

Regional Insights

North America edible insects market dominated the market with the largest revenue share of 28.2% in 2024. The strong presence of innovative startups and established companies in the food industry has facilitated developing and marketing diverse insect-based products. The increasing trend of sustainable and alternative protein sources among health-conscious consumers also supports market growth. Moreover, the availability of insect-based products in mainstream retail channels and the influence of social media and health influencers have boosted their popularity.

U.S. Edible Insects Market Trends

The U.S. edible insects market dominated the North American market with the largest revenue share in 2024, owing to the rising consumer awareness of edible insects' nutritional benefits. The nation's strong emphasis on sustainable and alternative protein sources and a growing health-conscious population significantly boosted market demand. Innovation from startups and established companies introduced various insect-based products, enhancing consumer acceptance. Additionally, the availability of these products in mainstream retail outlets and the influence of social media and health influencers played crucial roles in increasing their popularity.

Asia Pacific Edible Insects Market Trends

Asia Pacific edible insects market was identified as a lucrative region in 2024. The region's rich tradition of insect consumption and diverse culinary practices have paved the way for wider acceptance of edible insects as a food source. Economic development and rising disposable incomes in countries such as China, Thailand, and Japan also increase consumer spending on alternative protein sources. Additionally, the expansion of innovative insect farming practices and supportive government policies promoting sustainable food systems play a crucial role in market growth.

Europe Edible Insects Market Trends

Europe's edible insects market is expected to grow at the fastest CAGR of 26.0% over the forecast period. The region's increasing awareness of the environmental benefits of insect protein, such as lower resource requirements and reduced greenhouse gas emissions, has significantly boosted consumer acceptance. The rising interest in sustainable and alternative protein sources, coupled with a strong tradition of culinary innovation, has led to the development of a wide variety of insect-based products.

Key Edible Insects Company Insights

Some key companies in the edible insects market include FarmInsect GmbH, LIVIN farms AgriFood GmbH, BETA BUGS, and others. Companies are focusing on new varieties of products to increase their customer base. Moreover, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

- Haocheng Mealworms Inc. specializes in producing edible insects and insect-based products. It offers a variety of products, including whole and processed insects, insect powders, and insect-based snacks.

Key Edible Insects Companies:

The following are the leading companies in the edible insects market. These companies collectively hold the largest market share and dictate industry trends.

- FarmInsect GmbH

- LIVIN farms AgriFood GmbH

- BETA BUGS

- Haocheng Mealworms Inc.

- Innovafeed

- Ÿnsect farms

- Beta Hatch

Recent Developments

-

In October 2024, in an innovative culinary venture, London inaugurated its premier fully insect-based eatery, Yum Bug, in Finsbury Park. This establishment aims to revolutionize the food industry by demonstrating how edible insects can contribute to a more sustainable and healthier food system.

-

In November 2023, Singapore-based Entobel inaugurated the largest insect protein production facility in Vietnam, Asia. The state-of-the-art facility, dedicated to producing black soldier fly larvae, boasts an annual production capacity of 10,000 tons of protein meal.

Edible Insects Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.43 billion

Revenue forecast in 2030

USD 4.38 billion

Growth rate

CAGR of 25.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

FarmInsect GmbH; LIVIN farms AgriFood GmbH; BETA BUGS; Haocheng; Innovafeed; Ÿnsect farms; Beta Hatch;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edible Insects Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edible insects market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Caterpillar

-

Beetles

-

Cricket

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Protein Bars

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.