- Home

- »

- Electronic & Electrical

- »

-

E-commerce Household Appliances Market Report, 2028GVR Report cover

![E-commerce Household Appliances Market Size, Share & Trends Report]()

E-commerce Household Appliances Market (2022 - 2028) Size, Share & Trends Analysis Report By Type (White Goods, Small Electric Home Appliances), By Region And Segment Forecasts

- Report ID: GVR-4-68039-926-1

- Number of Report Pages: 72

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-commerce Household Appliances Market Summary

The global e-commerce household appliances market size was valued at USD 107.4 billion in 2021 and is projected to reach USD 148.6 billion by 2028, growing at a compound annual growth rate (CAGR) of 4.8% from 2022 to 2028. This can be attributed to the growing demand for household appliances on e-commerce platforms from developing nations.

Key Market Trends & Insights

- Asia Pacific led the market for e-commerce household appliances and accounted for a revenue share of more than 35.0% in 2021.

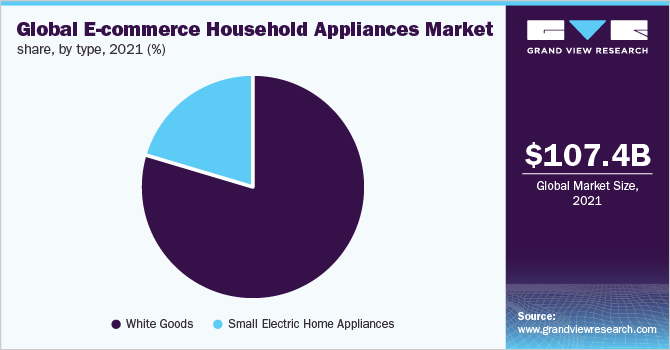

- Based on type, the white goods type segment dominated the market and accounted for the largest revenue share of around 80.0% in 2021.

- Based on type, the small electric home appliances segment is expected to witness a CAGR of 4.3% from 2022 to 2028.

Market Size & Forecast

- 2021 Market Size: USD 107.4 Billion

- 2028 Projected Market Size: USD 148.6 Billion

- CAGR (2022-2028): 4.8%

- Asia Pacific: Largest market in 2021

Also, growing consumer inclination for smart equipment in an effort to simplify daily tasks is the prime factor responsible for market growth. Additionally, factors such as the increasing popularity of modular kitchen spaces coupled with rising purchasing power of customers are driving the market.

Furthermore, an upsurge in the number of nuclear families is also anticipated to drive the demand for small electric home appliances in the coming years. The strong competition in the market has strapped manufacturers to introduce enhancements in their offerings to keep customers interested and boost them to replace their outdated household appliances with modern appliances. Besides, the COVID-19 pandemic resulted in an interruption of the overall growth of the market for e-commerce household appliances. Momentary production halts in the manufacturing factories and the stoppage of the logistics sector caused a decline in product sales through the initial months of the pandemic.

However, the e-commerce websites and the resumption of shipping operations endorsed steady growth in sales of these household appliances. With the majority of users using these household appliances at a relatively higher rate owing to the stretched work-from-home policies, the demand for these products is anticipated to increase at an encouraging pace in the near future. The trend is estimated to help manufacturers recuperate from the losses incurred throughout the initial months of 2020.

Product innovation has been playing a productive role in driving the market for e-commerce household appliances over the last few years. Present-day household appliances combine factors such as temperature moderation, energy efficiency, and design aesthetics. Thus all these factors are expected to drive the demand for these products in the coming years. In addition, increasing investments by market players in the latest technologies and focus on easy-to-shop experience on their platforms are further anticipated to drive the industry sales. Likewise, promotional strategy and advertisement by the main players’ are expected to aid in the growth of the market for e-commerce household appliances.

China's e-commerce platforms are targeting major appliances as one of their next big growth drivers. In 2020, online sales of home appliances surpassed brick-and-mortar retail stores for the first time. E-commerce platforms work closely with home appliance companies to make online purchases frictionless. Online portals are currently focused on selling major appliances with free shipping, unconditional returns, and flexible consumer credit.

Companies such as Alibaba, JD.com, Pinduoduo, etc., are partnering with retail chains to expand product offerings. For instance, in 2020, Pinduoduo acquired a 5.6% stake in GOME Retail, giving it access to a wider range of brands while being able to offer products at the same or cheaper prices as compared to GOME stores. Major appliance companies are also adopting new forms of marketing, such as using live streaming to sell their products.

However, a foremost disadvantage of e-commerce is the lack of privacy. Some e-commerce websites do not have cutting-edge encrypted technology that can protect the personal details of shoppers from hackers and it is an origin of grave concern. If this sensitive information is leaked, it can lead to numerous problems for a shopper. And this is an important factor challenging the growth of the market for e-commerce household appliances during the forecast period.

Type Insights

The white goods type segment dominated the market for e-commerce household appliances and accounted for the largest revenue share of around 80.0% in 2021. This growth is credited to the increasing demand for white goods products in developed regions such as North America and Europe. The white goods segment includes washing machines, dishwashers, refrigerators, and washer-dryers. Macroeconomic factors such as changing consumer buying patterns, urbanization, and digitalization are playing a prime role in the growth of this segment during the forecast period.

The small electric home appliances type segment is further expected to witness a CAGR of 4.3% from 2022 to 2028 owing to increasing demand from developing regions such as the Asia Pacific. An upsurge in the working-class population is expected to drive the demand for small electric home appliances. Thus, all these factors are expected to drive the growth of this segment in the coming years.

Regional Insights

Asia Pacific led the market for e-commerce household appliances and accounted for a revenue share of more than 35.0% in 2021. This growth is due to the rising demand for household appliances from developing nations such as China, Malaysia, Vietnam, Indonesia, and India. The promptly expanding middle-class population, the growing demand for smart connected, and fully automatic white goods from the emerging countries are factors projected to contribute to the regional demand. In addition, rising disposable income, urban lifestyle, and health-conscious trends are some of the major factors behind the growth of small household appliances in the region. Certain products such as air fryers, bread makers, food processors, and other functional products will benefit from this trend due to the aging population in the Asia Pacific.

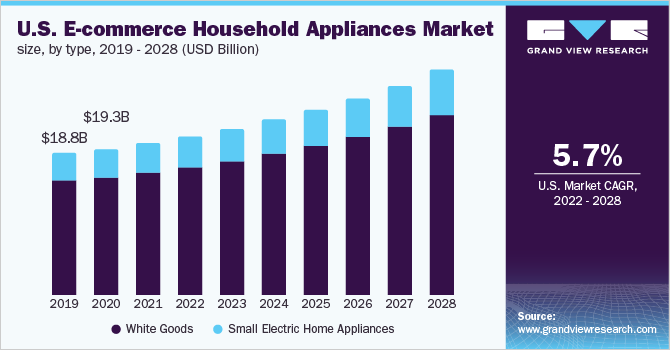

In North America, the market for e-commerce household appliances is expected to register a significant growth rate of 5.4% in the e-commerce household appliances market from 2022 to 2028 due to the increasing demand across the region. The amplified demand for the latest technology-enabled products is one of the prime growth stimulants in the market in Canada and the U.S. Additionally, according to the data published by the National Coffee Association trends, the U.S., accounted for a high demand for household coffee machines due to higher coffee consumption. All these factors are anticipated to boost the growth of the market for e-commerce household appliances in this region in the coming years.

Key Companies & Market Share Insights

Key players are focusing on research and development activities and introducing innovative methods with modern technology for the purchase of products such as AR (Augmented Reality) with a 3D display of products. Moreover, key players are focusing on investing in warehouses to escalate supply shortages in untapped areas. For instance, according to news, Amazon is increasing its presence by planning to add 1,000 new warehouses in suburbs and near cities.

Also, structured organizations and regional as well as small-scale manufacturers are tying-up with online platforms to increase their customer base. For instance, in 2021, Tata Group-consumer electronics store chain Croma partnered with Amazon to launch a new line of TVs with built-in Amazon Fire devices. In addition to this, major players are adopting various strategies such as geographical expansion and better product service to enhance their position in the market. Some of the prominent players in the e-commerce household appliances market include:

-

Walmart, Inc.

-

Amazon, Inc.

-

JD.com

-

Alibaba

-

eBay.com

-

Flipkart

-

Shopify

E-commerce Household Appliances Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 111.2 billion

Revenue forecast in 2028

USD 148.6 billion

Growth rate

CAGR of 4.8% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; Japan; South Africa; Brazil

Key companies profiled

Walmart, Inc.; Amazon, Inc.; JD.com; Alibaba; eBay.com; Flipkart; Shopify

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global e-commerce household appliances market report on the basis of type and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

White Goods

-

Small Electric Home Appliances

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global e-commerce household appliances market size was estimated at USD 107.38 billion in 2021 and is expected to reach USD 111.2 billion in 2022.

b. The global e-commerce household appliances market is expected to grow at a compound annual growth rate of 4.8% from 2022 to 2028 to reach USD 148.6 billion by 2028.

b. The Asia Pacific dominated the e-commerce household appliances market with a share of 35.4% in 2021. This is attributable to the growing demand for smart connected and fully automatic white goods coupled with constant research and development activities for the modification and development of products.

b. Some key players operating in the e-commerce household appliances market include Walmart, Inc.; Amazon, Inc.; JD.com; Alibaba; eBay.com; Flipkart; and Shopify.

b. Key factors that are driving the e-commerce household appliances market growth include the increasing popularity of modular kitchen spaces coupled with the rising purchasing power of customers and technological advancements towards the development of the smart homes category.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.