- Home

- »

- Next Generation Technologies

- »

-

E-cigarette And Vape Market Size, Industry Report, 2033GVR Report cover

![E-cigarette And Vape Market Size, Share & Trends Report]()

E-cigarette And Vape Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Category, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-433-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

E-cigarette And Vape Market Summary

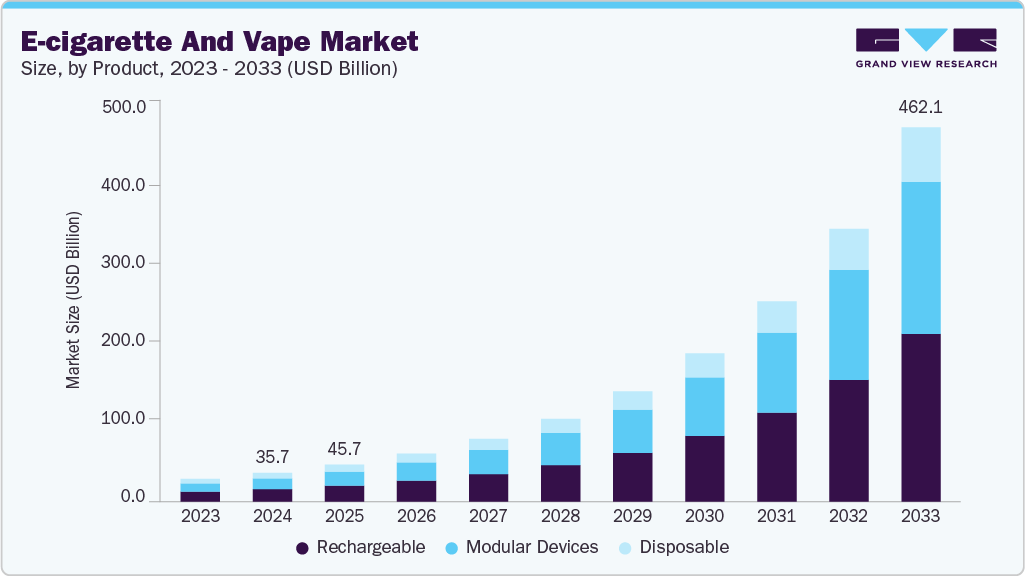

The global e-cigarette and vape market size was estimated at USD 35.70 billion in 2024 and is projected to reach USD 462.14 billion by 2033, growing at a CAGR of 33.5% from 2025 to 2033. The growing public perception, especially among younger consumers, that e-cigarettes are safer than traditional cigarettes is expected to drive market growth, supported by numerous studies from medical institutions and associations.

Key Market Trends & Insights

- The North America e-cigarette and vape market accounted for a 43.7% share of the overall market in 2024.

- The e-cigarette and vape industry in the U.S. held a dominant position in 2024.

- By product, the rechargeable segment accounted for the largest share of 43.6% in 2024.

- By category, the closed segment held the largest market share in 2024.

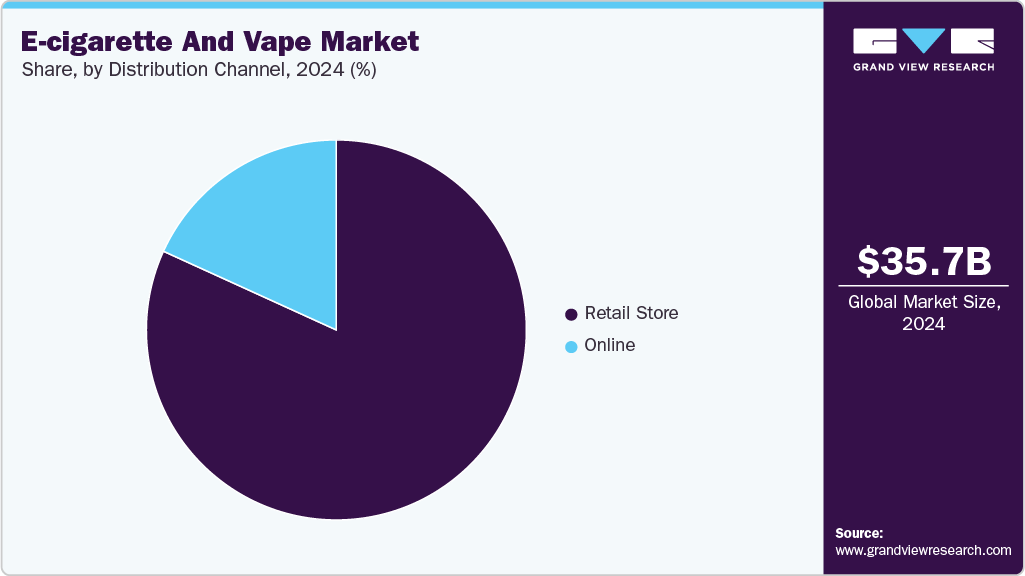

- By distribution channel, the retail store segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.70 Billion

- 2033 Projected Market Size: USD 462.14 Billion

- CAGR (2025-2033): 33.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

E-cigarette and vape providers have developed several COVID-19-based marketing methods to boost product sales amid the COVID-19 pandemic. The use of e-cigarettes and vaping equipment is expected to increase over the projection period as people adopt safer alternatives to smoking. When e-cigarette and vape device stocks in physical stores started to run low, sellers began selling their items online and giving out hand sanitizers and face masks in exchange for vaping product purchases.The market also offers a variety of flavors, including menthol, tobacco, fruits and nuts, and chocolate. An e-cigarette or a vape device that uses these tastes emits fragrances. Moreover, these devices' rising cost-effectiveness has increased customer acceptance and is anticipated to fuel market expansion throughout the projection period.

There has been a significant increase in sales of atomizers and e-liquids in North American and European markets due to the increasing demand. Many nations, including the UK, have legalized e-cigarette use, which has boosted industry expansion. In addition, vape shops have been set up where clients can go in person and taste the products and e-liquid flavors before buying. Tank e-cigarettes have continued to be the most popular device type in England. Still, pod e-cigarettes have overtaken them due to the rise in JUUL (Juul Labs, Inc., an American electronic cigarette manufacturer) use.

Market participants in the e-cigarette sector are well-known companies with sizable market shares. Corporations have mostly invested in e-cigarettes since they are anticipated to be a successful alternative to tobacco use. However, the market is home to several small firms that provide effective vaping products and e-liquids, building a sizable consumer base. To keep their prices low, small businesses typically outsource the production of e-cigarettes to Asian nations such as China.

However, restrictions placed on the sale of vaping supplies and e-liquids by local authorities in many nations, including the U.S. and India, have slowed the market's expansion. Furthermore, it is challenging for retail customers to import vaping devices for personal use due to strict trading rules. However, it is anticipated that laws governing conventional cigarettes would recognize e-cigarettes as a healthy alternative to tobacco use, thereby regulating the technology for secure distribution and use. Moreover, the vaping industry has established several associations to combat anti-vaping regulations and regulate the business for oversight, thereby fueling the expansion of the e-cigarette and vaping markets.

Product Insights

The rechargeable segment accounted for the highest market share of 43.6% in 2024. Rechargeable devices are predicted to become more popular due to their affordability and ability to do away with the requirement for ongoing supply purchases such as cartridges. In addition, clients who make their own e-liquid can avoid buying pre-filled cartridges. Particularly seasoned smokers find that buying recharged e-cigarettes is cost-effective. Rechargeable e-cigarettes are also becoming increasingly popular among young people in many important countries because they emit less smoke and can be charged even through a USB port.

The modular devices segment is anticipated to register a significant growth rate over the forecast period. The devices’ high-level customization capabilities to combine various functions and components are the primary driving force behind demand. Depending on individual needs, these parts and components change the flavor and volume of vapor the device produces. The regular organization of various vaping events, including vape conferences and competitions, boosts the region's need for modular devices.

Category Insights

The closed segment held the largest market share in 2024, owing to its convenience, portability, and ease of use. These devices attract new and casual users through simple operation and wide availability across retail and online channels. Manufacturers continue to expand product lines with sleek designs and diverse flavor options, enhancing consumer appeal and repeat purchases. However, the growing popularity of disposable vapes has prompted regulatory scrutiny in several regions due to youth usage and environmental concerns. Despite such challenges, closed systems maintain strong market momentum, supported by their accessibility and evolving semi-closed or recyclable formats that align with emerging sustainability standards.

The open segment is projected to grow at the fastest CAGR over the forecast period. Open systems, which include refillable tanks and customizable mods, cater to experienced consumers seeking greater control over vapor production, flavor variety, and nicotine strength. Their refillable nature encourages long-term engagement and recurring purchases of e-liquids and accessories, offering better margins for specialty retailers. Although their share is smaller in volume terms, open systems are gaining renewed interest as regulations tighten on disposable products. This category also drives technological innovation, with ongoing developments in heating elements, temperature control, and sustainable materials. Moving forward, open systems are expected to achieve steady growth, supported by rising consumer demand for personalization, performance, and eco-friendly vaping alternatives.

Distribution Channel Insights

The retail store segment accounted for the largest revenue share of 81.8% in 2024. E-cigarettes were formerly offered for sale in retail locations such as vape shops and gas stations. These stores helped clients choose from a variety of equipment and e-liquids. Vape shops are allowing clients to try out and test these devices before making a purchase decision, which is contributing to the retail store category's growth during the projection period.

The online segment is anticipated to register the fastest growth rate over the forecast period. People are increasingly buying e-cigarettes and vape products online because of the advantages of competitive pricing, convenience, and a greater selection of goods available on online marketplaces. The Asia Pacific region has seen the emergence of numerous internet stores selling e-cigarettes. The region has also experienced an increase in the market for e-cigarette goods, which has prompted vendors to offer e-cigarettes for sale online.

Regional Insights

The North America e-cigarette and vape market accounted for the largest market share of 43.7% in 2024. The North American e-cigarette and vape market is undergoing a structural transformation led by product standardization and evolving consumer preferences. The region is witnessing a notable transition from open-system devices to closed pods due to their convenience and consistency in nicotine delivery. Major retail chains have reintroduced shelf space for regulated vaping brands, aligning with FDA-compliant formulations. The rise of synthetic nicotine and tobacco-free alternatives is also shaping the market’s innovation cycle. Increasing awareness around smoke-free alternatives has spurred active participation from both traditional tobacco giants and independent vape brands.

U.S. E-cigarette And Vape Market Trends

The U.S. market is increasingly defined by regulatory recalibration and the emergence of age-restricted retail frameworks. Companies are focusing on flavor moderation, recyclable pod designs, and nicotine transparency to align with evolving FDA scrutiny. The market has seen growing traction for tech-integrated vape devices offering Bluetooth connectivity and usage tracking, particularly among adult users seeking personalized consumption experiences. Cross-industry collaborations, between tech startups and nicotine product manufacturers, are redefining consumer engagement models.

Europe E-cigarette And Vape Market Trends

Europe’s e-cigarette and vape market reflects a mature yet innovation-driven ecosystem shaped by the Tobacco Products Directive (TPD). The growing emphasis on harm reduction as a public health approach has fostered positive sentiment toward regulated vaping. Markets such as France, the Netherlands, and Italy are embracing a broader retail presence, including pharmacies and specialty vape boutiques. Flavor diversification and plant-based nicotine substitutes are emerging as new growth frontiers, especially in countries promoting sustainable packaging and traceable ingredient sourcing.

Germany’s vaping landscape is evolving with a focus on quality assurance and eco-conscious product development. The rise of German-engineered vape hardware and temperature-controlled coils underscores the country’s precision manufacturing strengths. The market is shifting toward refillable systems as consumers seek customization and cost efficiency. Regulatory alignment with EU safety standards continues to shape product certification and distribution strategies.

The UK represents one of the most progressive markets for e-cigarettes globally, with vaping increasingly positioned as a harm-reduction tool by public health agencies. NHS-backed initiatives supporting smokers’ transition to vaping have fostered broad acceptance. Local brands are innovating with hybrid nicotine salts and long-fill e-liquids, while the online retail channel remains a dominant distribution mode. Environmental concerns have also driven momentum toward biodegradable vape components and returnable pod programs.

Asia Pacific E-cigarette And Vape Market Trends

The Asia-Pacific region is growing at the fastest CAGR during the forecast period. The APAC region showcases a multi-speed market where regulatory diversity and cultural acceptance drive distinct national trajectories. The proliferation of compact, cost-effective vape pens appeals to urban millennial demographics. Governments in select markets are re-evaluating taxation and import frameworks to formalize the segment. A surge in domestic manufacturing hubs, especially in Southeast Asia, is fostering self-reliance and export-oriented growth. Marketing strategies increasingly emphasize lifestyle branding over traditional nicotine positioning.

As the manufacturing powerhouse of the global vape ecosystem, China continues to dominate hardware innovation while tightening its domestic policy controls. Local companies are investing in next-generation atomization technologies and ceramic coil systems to enhance vapor efficiency. The recent state-led consolidation of vape producers under licensed frameworks has improved product traceability and export compliance. Chinese brands are increasingly focusing on premium international markets through cross-border e-commerce channels.

Japan’s vaping market is distinguished by its strong lean toward heat-not-burn (HNB) devices, which are more culturally and legally accepted than traditional e-cigarettes. Innovation is centered on tobacco-heating sticks with precise temperature control and cleaner aerosol output. The collaboration between technology firms and tobacco companies has yielded proprietary HNB platforms optimized for Japanese consumer preferences. Urban convenience stores remain a dominant sales channel due to Japan’s compact retail infrastructure.

India’s e-cigarette market, despite regulatory constraints, is seeing renewed policy discussions around nicotine alternatives in public health dialogues. The underground demand for herbal and nicotine-free vapes indicates an unmet appetite for harm-reduction products. Domestic startups are exploring non-nicotine vaporization categories such as ayurvedic or wellness-based formulations. Parallelly, the rise of tech-enabled smoking cessation programs and mobile applications reflects a latent potential for a regulated, wellness-oriented vape market in the future.

Key E-cigarette And Vape Company Insights

Some of the major players in the E-Cigarette and Vape Market include Altria Group, Inc., British American Tobacco, Imperial Brands, International Vapor Group, Japan Tobacco Inc., NicQuid, JUUL Labs, Inc., Philip Morris International Inc., R.J. Reynolds Vapor Company, Shenzhen IVPS Technology Co., Ltd., and Shenzhen KangerTech Technology Co., Ltd., owing to their extensive product portfolios, strong distribution networks, and continuous investments in smoke-free and next-generation nicotine delivery technologies. These companies have established technological and regulatory leadership by advancing product designs such as closed-pod systems, nicotine salt formulations, heat-not-burn devices, and smart vapes with integrated usage analytics. Their strategic focus on sustainable product engineering, recyclable hardware, and bio-based e-liquids reinforces their alignment with evolving environmental and health standards. Furthermore, their collaborations with technology developers, investment in R&D centers, and market adaptation strategies across regulated and emerging economies continue to strengthen their global presence and competitiveness in the evolving vaping ecosystem.

-

JUUL Labs, Inc. is involved in the development, manufacture, and sale of e-cigarettes. The company’s product portfolio includes JUULpods, devices, and accessories. The company offers an Electronic Nicotine Delivery System (ENDS), which is designed as a substitute for combustible cigarettes for adult smokers.

-

British American Tobacco p.l.c. is a manufacturer, marketer, and distributor of cigarettes and other tobacco and nicotine products. The company offers vapor products such as e-cigarettes and tobacco heating products. The company sells its products in over 200 markets across the Americas, Europe, Asia Pacific, and the MEA.

-

Geekvape, engaged in creating vape innovation and provides best user experience for e-cigarette industry. The company manufactures electronic cigarette products, focusing on advanced vape mods, tanks, kits, and pod systems. The company serves over 30 million customers worldwide.

- Shenzhen IVPS Technology Co., Ltd. specializes in the research, development, production, and marketing of e-cigarettes. The company develops products ranging from starter kits to advanced cloud chasing modular devices. It distributes e-cigarettes across the world through authorized resellers. It sells its products through its global partners, which include local e-cigarette companies from numerous countries.

Key E-cigarette And Vape Companies:

The following are the leading companies in the e-cigarette and vape market. These companies collectively hold the largest market share and dictate industry trends.

- Altria Group, Inc.

- British American Tobacco

- Imperial Brands

- International Vapor Group

- Japan Tobacco Inc.

- NicQuid

- JUUL Labs, Inc.

- Philip Morris International Inc.

- R.J. Reynolds Vapor Company

- Shenzhen IVPS Technology Co., Ltd.

- Shenzhen KangerTech Technology Co., Ltd.

Recent Developments

-

In June 2023, Altria Group, Inc. announced the acquisition of NJOY Holdings, Inc., a vaping company. The company will market NJOY e-vapor products under NJOY, LLC (NJOY), an Altria subsidiary. Moreover, NJOY's products will be distributed by Altria Group Distribution Company.

-

In June 2023, Imperial Brands plc announced the acquisition of nicotine pouches from TJP Labs to make a foray into the U.S. oral market. The acquisition is expected to enable ITG Brands, the company’s U.S. operation, to offer 14 different product types in a pouch that performs well in consumer testing. Through this acquisition, TJP Labs aims to reinforce its commitment to developing products that promote global harm reduction, customer choice, and flexibility.

E-cigarette And Vape Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.74 billion

Revenue forecast in 2033

USD 462.14 billion

Growth rate

CAGR of 33.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Altria Group, Inc.; British American Tobacco; Imperial Brands; International Vapor Group; Japan Tobacco Inc.; NicQuid; JUUL Labs, Inc.; Philip Morris International Inc.; R.J. Reynolds Vapor Company; Shenzhen IVPS Technology Co., Ltd.; Shenzhen KangerTech Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-cigarette And Vape Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global e-cigarette and vape market report based on product, category, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Disposable

-

Rechargeable

-

Modular Devices

-

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Open

-

Closed

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Retail Store

-

Convenience Store

-

Drug Stores

-

News Stands

-

Tobacconist

-

Specialty E-cigarette Stores

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global e-cigarette and vape market size was estimated at USD 35.70 billion in 2024 and is expected to reach USD 45.74 billion in 2025.

b. The global e-cigarette and vape market is expected to witness a compound annual growth rate of 33.5% from 2025 to 2033 to reach USD 462.14 billion by 2033.

b. The rechargeable segment in the e-cigarette & vape market accounted for the highest market share of 43.6% in 2024. Rechargeable devices are predicted to become more popular due to their affordability and ability to do away with the requirement for ongoing supply purchases like cartridges.

b. The retail store segment accounted for the highest e-cigarette & vape market share of 81.8% in 2024. Retail shops are allowing clients to try out and test these devices before making a purchase decision, which is contributing to the retail store category's growth during the projection period.

b. North America dominated the global e-cigarette and vape market with a share of 43.7% in 2024. The presence of influential business figures like R.J. E-cigarette and vaping product sales frequently occur on social media platforms.

b. Key players in the e-cigarette & vape market include Altria Group, Inc.; British American Tobacco; Imperial Brands; International Vapor Group; Japan Tobacco, International; NicQuid; JUUL Labs, Inc.; Philip Morris International Inc.; R.J. Reynolds Vapor Company; Nicquid; Shenzhen IVPS Technology Co., Ltd.; and Shenzhen KangerTech Technology Co., Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.