- Home

- »

- Medical Devices

- »

-

Dual Chamber Prefilled Syringes Market Size Report, 2030GVR Report cover

![Dual Chamber Prefilled Syringes Market Size, Share & Trends Report]()

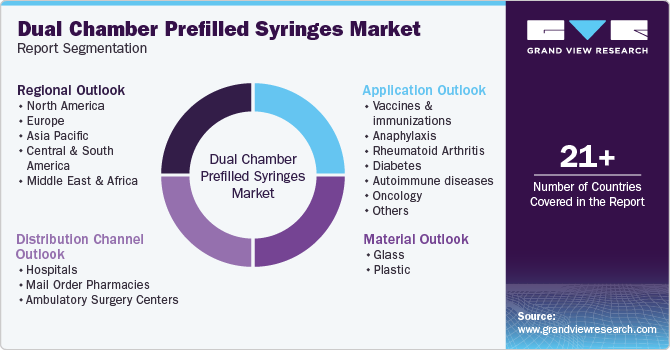

Dual Chamber Prefilled Syringes Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Glass, Plastic), By Application (Vaccines & immunizations, Diabetes), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-376-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

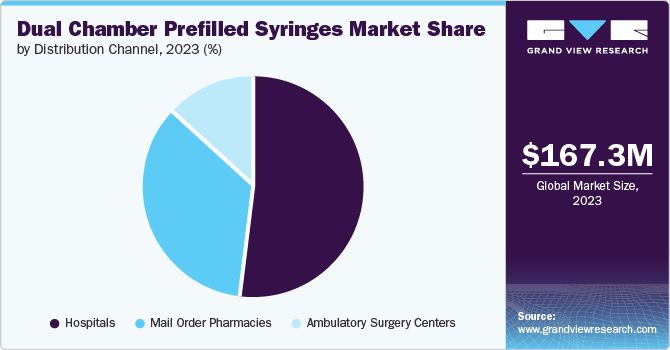

The global dual chamber prefilled syringes market size was valued at USD 167.3 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The increasing prevalence of chronic diseases necessitates precise and convenient medication administration, boosting demand for such syringes. Technological advancements enhance these devices' safety, efficacy, and user-friendliness, making them more attractive to healthcare providers and patients. In addition, the growth of the biopharmaceutical sector, particularly in biologics and biosimilars, fuels the need for specialized delivery systems such as dual chamber prefilled syringes, which ensure the stability and proper administration of complex medications. These factors collectively stimulate the market's expansion.

Prefilled dual chamber devices (DCDs) contain freeze-dried drugs and diluents in separate chambers, offering stability and convenience. They enhance product quality, patient compliance, and market competitiveness by ensuring seal integrity, sterility, and compatibility with biopharmaceuticals while reducing needle stick injuries and leachability. Plastic DCDs are emerging as promising alternatives to traditional glass syringes, addressing both regulatory and medical considerations.

The increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and autoimmune disorders necessitates regular and accurate medication administration, enhancing the demand for these syringes. In addition, the increasing number of elderly individuals is expected to drive the need for dual chamber prefilled syringes, as older adults are more prone to chronic illnesses and often require medical care. Around 70% of rheumatoid arthritis cases occur in females, typically starting between ages 30 and 50, though they can affect people of any age. For instance, the UK is experiencing a rise in cardiovascular diseases, with conditions like coronary heart disease and stroke becoming increasingly prevalent due to factors such as the aging population, unhealthy diets, and sedentary lifestyles. This trend underscores the growing public health challenge and the need for effective preventive measures and treatments. The table below summarizes the number of people dying from cardiovascular diseases (CVD) in 2022, the number of those under 75 years old affected, and the estimated population living with CVD,

The introduction of PTI's VeriPac LPX system in October 2021, which is capable of non-destructively testing prefilled dual chamber syringes for seal integrity and leaks, enhances product reliability and safety. This technological advancement addresses critical concerns in biopharmaceutical packaging, ensuring compliance with stringent regulatory standards. By offering a more robust solution for quality assurance, PTI stimulates confidence among manufacturers and healthcare providers, thus fostering increased adoption of dual-chamber prefilled syringes. This innovation meets current market demands for enhanced product quality and patient safety and promotes the growth of the market through improved performance and reliability.

According to Reuters data published in March 2024, Gerresheimer's anticipation of increased deals in weight-loss drug development signifies a rising demand for precise drug delivery systems like dual chamber prefilled syringes. These syringes offer advantages in delivering biopharmaceuticals with complex formulation requirements, ensuring stability and efficacy. As weight-loss treatments often require specific dosing and stringent administration protocols, dual chamber prefilled syringes provide a reliable solution for accurate drug delivery, enhancing patient compliance and therapeutic outcomes. This projection suggests a growing market opportunity for dual chamber prefilled syringes as pharmaceutical companies seek advanced delivery systems to meet the evolving needs of weight-loss therapies effectively.

The advancements in reconstitution technologies highlighted by Emergo by UL in June 2021 are driving growth in the market by offering efficient and reliable methods for mixing drugs and diluents. These innovations cater to biopharmaceuticals requiring separate storage of components until administration, ensuring stability and potency. By simplifying complex drug preparation processes and enhancing safety through pre-measured doses, dual chamber prefilled syringes are increasingly preferred for their convenience and accuracy. This technological evolution addresses regulatory requirements and improves patient compliance, expanding the market for dual chamber prefilled syringes.

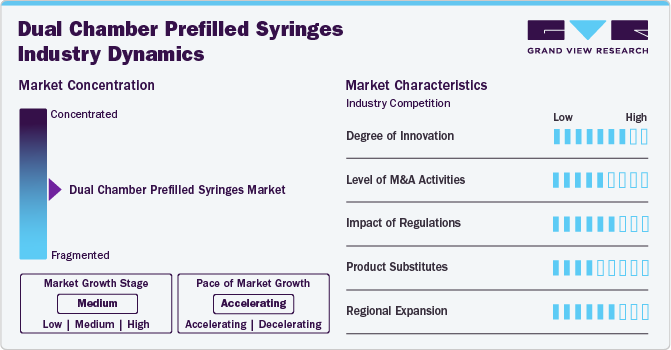

Market Concentration & Characteristics

The dual chamber prefilled syringes industry is characterized by a concentrated market dominated by a few key players due to high barriers to entry, such as stringent regulatory requirements and specialized manufacturing processes. Key characteristics include technological advancements in materials and design to ensure drug stability and compatibility, addressing complex biopharmaceutical formulations. Market growth is driven by increasing demand for precise drug delivery systems, particularly for biologics and specialty pharmaceuticals. The industry focuses on innovation in sealing technologies, sterilization methods, and integration with reconstitution systems to meet evolving healthcare needs globally, emphasizing quality, safety, and patient convenience.

The dual chamber prefilled syringes industry exhibits a high degree of innovation, driven by the need for enhanced drug stability, patient convenience, and safety. Innovations include advanced materials like cyclic olefin copolymers, which offer superior barrier properties and compatibility with biopharmaceuticals.

Stringent guidelines govern manufacturing processes, materials, sterility assurance, and compatibility with biopharmaceuticals. Compliance with FDA regulations in the U.S., EMA guidelines in Europe, and other international standards is critical for market entry and acceptance. Regulatory scrutiny drives innovation in packaging technologies, such as seal integrity and leachability testing, to meet evolving standards and ensure patient safety. Adherence to these regulations not only enhances market credibility but also fosters trust among healthcare providers and patients by ensuring reliable and effective drug delivery systems for complex therapies.

Mergers and acquisitions in the dual chamber prefilled syringes industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in December 2023, Fresenius Kabi entered the prefilled syringe market by acquiring BD Rx, expanding its capabilities in drug delivery systems. This acquisition enabled Fresenius Kabi to enhance its portfolio with BD Rx's expertise in prefilled syringes, strengthening its position in providing advanced pharmaceutical packaging solutions.

In the dual chamber prefilled syringes industry, potential substitutes include traditional vials with separate diluents, single chamber prefilled syringes, and autoinjectors. These alternatives may offer different benefits, such as lower manufacturing costs or simpler administration processes. However, dual chamber prefilled syringes stand out due to their ability to maintain drug stability, ensure accurate mixing of components, and cater to complex biopharmaceutical formulations. Their growing adoption stems from advantages in patient safety, convenience, and regulatory compliance, positioning them as preferred choices for drug delivery systems in the treatment of various chronic and acute medical conditions.

The dual chamber prefilled syringes industry is expanding regionally, driven by increasing healthcare expenditures, rising chronic disease prevalence, and advancements in biopharmaceuticals across North America, Europe, Asia-Pacific, and other regions. For instance, in June 2024, following an investment of USD 81.3 million and a construction period of 1.5 years, SCHOTT Pharma inaugurated its latest production facility in Lukácsháza, Hungary.

Material Insights

The glass segment accounted for the largest market share of 51.4% in 2023. due to its longstanding use in pharmaceutical packaging, offering superior barrier properties and compatibility with a wide range of drug formulations, particularly biologics. Glass syringes ensure stability, sterility, and protection against external contaminants, which is critical for maintaining drug efficacy. Despite the emergence of alternative materials like plastics, glass remains favored for its inertness and ability to prevent leaching, meeting stringent regulatory requirements. As demand grows for reliable drug delivery systems, the glass segment continues to dominate, driven by its proven track record in pharmaceutical packaging excellence.

The plastic segment in the market is projected to experience the fastest CAGR over the forecast period. Plastic syringes provide a cost-effective alternative to glass, benefiting from lower material and manufacturing expenses. This affordability is essential for broadening access to prefilled syringes across diverse healthcare environments, especially in developing regions. Plastic's flexibility in design enables the incorporation of innovative features such as multi-chamber designs or integrated needle guards, improving functionality and safety. These advantages are expected to drive the increasing demand for plastic dual chamber prefilled syringes.

Application Insights

The vaccines and immunizations segment accounted for the largest market share of 25.8% in 2023. This dominance is driven by the critical need for efficient and reliable delivery systems for vaccines, which require precise mixing and dosing. Dual chamber syringes ensure the stability and efficacy of vaccines by keeping components separate until the point of administration. The rise in immunization programs, especially during global health crises, has further increased demand. Their ability to enhance patient safety, reduce preparation time, and improve compliance makes dual chamber prefilled syringes the preferred choice for vaccine delivery.

The oncology segment in the market is projected to experience the fastest CAGR over the forecast period. This rapid growth is attributed to the increasing prevalence of cancer and the rising demand for effective and convenient drug delivery systems for chemotherapy and targeted therapies. Dual chamber prefilled syringes offer precise dosing and reduce the risk of contamination, ensuring the stability and efficacy of complex oncology drugs. In addition, they enhance patient safety and compliance by simplifying administration, making them an ideal choice for oncology treatments in both clinical and home settings.

Distribution Channel Insights

The hospitals segment accounted for the largest revenue share, 51.8%, in 2023. Hospitals are frequently chosen for treatment due to their convenient access and established trust among patients. They also provide fluid therapy, administering fluids intravenously. Additionally, the Centers for Disease Control and Prevention (CDC) estimates that using safety measures like prefilled syringes can reduce 60-88% of sharps-related injuries.

The mail order pharmacies segment is projected to witness the fastest CAGR over the forecast period.Mail order pharmacies enhance patient convenience by delivering medications straight to their homes, which is especially advantageous for those needing regular injections with prefilled syringes, as it removes the necessity of frequent pharmacy visits. Additionally, these pharmacies often provide competitive medication pricing, potentially reducing overall healthcare expenses. This is particularly appealing to patients with chronic conditions requiring continuous treatment with prefilled syringes. The benefits offered by mail order pharmacies are expected to drive growth in this segment.

Regional Insights

North America dual chamber prefilled syringes market dominated the overall global market and accounted for 32.3% revenue share in 2023. The increasing prevalence of chronic diseases like diabetes, autoimmune disorders, and cancer in North America has led to a greater reliance on complex therapies and biologics. According to a report published by America’s Health Rankings, eight chronic conditions reached their highest levels with chamber prefilled syringes are crucial in this context due to their ability to store and deliver Diabetes prevalence, increasing to 11.5% of the adult population, affecting around 31.9 million adults. Dual chamber prefilled syringes are crucial in this context due to their ability to store and deliver two separate components that need to be mixed at the point of administration. This ensures the stability and efficacy of biologics, which often require precise handling and delivery. As healthcare providers seek more practical and convenient treatment options, dual chamber prefilled syringes are essential in delivering these advanced therapies safely and reliably to patients.

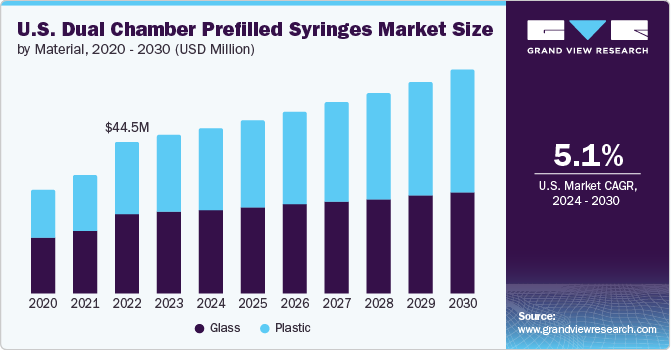

U.S. Dual Chamber Prefilled Syringes Market Trends

The dual chamber prefilled syringes market in the U.S. held a significant share in the North America region in 2023. Several factors drive the U.S. market, including the growing prevalence of lifestyle-related diseases and the rising demand for straightforward injectable treatments among patients with chronic conditions. Additionally, advancements in pharmaceutical systems, technology for self-administration, and guidance from the Centers for Disease Control and Prevention (CDC) are anticipated to fuel market expansion.

Europe Dual Chamber Prefilled Syringes Market Trends

The Europe dual chamber prefilled syringes market is witnessing growth, driven by rising COPD prevalence. COPD often requires frequent and precise medication dosing, including combinations of different drugs. Dual chamber prefilled syringes offer advantages in delivering such complex treatments, ensuring accurate mixing of medications just before administration, which can improve patient adherence and treatment outcomes. According to the European Respiratory Society, COPD is projected to increase by 35.2% in patients and 39.6% in prevalence by 2050, from an estimated 36.6 million in 2020 to 49.5 million.

The dual chamber prefilled syringes market in the UK is witnessing significant growth due to the rising incidence of chronic diseases like diabetes, the expanding elderly population, and the adoption of biosimilars. For instance, according to the Department of Health & Social Care in the UK, the population aged 85 and older is expected to increase by one million between 2021 and 2036.

France dual chamber prefilled syringes market is witnessing growth and benefits from a comprehensive healthcare system and advanced medical technology adoption. With an aging population and increasing chronic respiratory conditions, including COPD and neurological disorders, there is a growing demand for dual chamber prefilled syringes. French healthcare policies emphasizing patient-centered care and technological advancements support market expansion.

The dual chamber prefilled syringes market in Germany is experiencing notable growth as German manufacturers have established a strong reputation for producing high-quality medical devices. Dual chamber prefilled syringes, favored for self-administration of these medications, are driving market growth. For instance, in August 2021, German specialty glass company SCHOTT AG and its partner, Serum Institute of India, acquired a 50% stake in the joint venture SCHOTT Kaisha in India. The country’s rigorous quality control standards and adherence to safety regulations further enhance this reputation. As a result, healthcare providers trust German-made medical devices leading to increased sales and market dominance.

Asia Pacific Dual Chamber Prefilled Syringes Market Trends

The Asia Pacific dual chamber prefilled syringes market is witnessing significant growth driven by rising healthcare investments, expanding elderly population, and increasing prevalence of chronic respiratory diseases. Countries like China, India, and Japan are key contributors, with growing adoption of advanced medical technologies and improving healthcare infrastructure. The market in APAC is expected to expand due to the region's numerous FDA, TGA, and EMA-approved facilities.

The dual chamber prefilled syringes market in Japan is set for significant growth due to the increasing prevalence of chronic diseases and concerns about patient safety and convenience. Additionally, regulatory reforms and incentives, advancements in biologics and biosimilars, and expedited approval processes have drawn pharmaceutical companies to invest in the Japanese market.

Chinadual chamber prefilled syringes market is expected to grow in the Asia Pacific in 2023. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The Indiadual chamber prefilled syringes market is fueled by various factors, such as a large and genetically diverse population, affordable infrastructure, skilled medical professionals, favorable regulatory changes, and increased industry collaborations. Additionally, growing awareness of chronic diseases, government incentives for research, and the potential for faster patient recruitment due to the higher prevalence of specific chronic illnesses are expected to drive market growth.

Latin America Dual Chamber Prefilled Syringes Trends

The dual chamber prefilled syringes market in Latin Americais fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for prefilled syringes as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

Middle East & Africa Dual Chamber Prefilled Syringes Trends

The MEA dual chamber prefilled syringes market is experiencing robust growth driven by the escalating prevalence of chronic diseases like diabetes, hemophilia, and cancer, coupled with an aging population. Advancements in drug delivery systems demanding sophisticated formulations, a focus on patient safety and convenience, and supportive government initiatives are further propelling market expansion.

The dual chamber prefilled syringes market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050. Therefore, dual chamber prefilled syringes are gaining popularity in Saudi Arabia due to advancements in biologics and vaccines, along with the increasing demand for efficient and portable drug delivery systems.

Key Dual Chamber Prefilled Syringes Company Insights

The competitive scenario in the dual chamber prefilled syringes market is highly competitive, with key players such as Gerresheimer, Nipro Corporation; and SCHOTT AG holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Dual Chamber Prefilled Syringes Companies:

The following are the leading companies in the dual chamber prefilled syringes market. These companies collectively hold the largest market share and dictate industry trends.

- Gerresheimer

- Nipro Corporation

- SCHOTT AG

- Vetter Pharma-Fertigung GmbH & Co. KG

- ARTE Corporation

- Credence MedSystems, Inc.

Recent Developments

-

In March 2024,SCHOTT Pharma is investing USD 371 million to build a pre-fillable syringe manufacturing facility in Wilson, North Carolina. This facility will produce glass and polymer syringes, create over 400 jobs, and support the growing demand for mRNA and GLP-1 therapies, enhancing the U.S. supply chain by 2027.

-

Sharps Technology Inc. plans to launch new specialized pre-fillable syringe systems in January 2023, focusing on advanced polymer-based syringes. This initiative aims to enhance revenue growth and meet the increasing demand in the healthcare market. The new products will leverage innovative designs to improve safety and efficiency in drug delivery.

-

In March 2022 , The Dec Group launched the DecFill aseptic filling line, which can handle dual-chamber prefilled syringes. This system keeps lyophilized drug substances and liquids separate until mixing before injection, ensuring drug stability and extending shelf life. The modular design offers flexibility, high filling accuracy, and seamless integration with advanced robotics.

Dual Chamber Prefilled Syringes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 176.2 million

Revenue forecast in 2030

USD 247.8 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Gerresheimer, Nipro Corporation, SCHOTT AG, Vetter Pharma-Fertigung GmbH & Co. KG, ARTE Corporation, Credence MedSystems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dual Chamber Prefilled Syringes Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dual chamber prefilled syringes market report on the basis of material, application, distribution channel, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Plastic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vaccines and immunizations

-

Anaphylaxis

-

Rheumatoid Arthritis

-

Diabetes

-

Autoimmune diseases

-

Oncology

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Mail Order Pharmacies

-

Ambulatory Surgery Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dual chamber prefilled syringes market size was estimated at USD 167.3 million in 2023 and is expected to reach USD 176.2 million in 2024.

b. The global dual chamber prefilled syringes market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 247.8 million by 2030.

b. North America dominated the dual chamber prefilled syringes market with a share of 32.3% in 2023. This is attributable to growing adoption of dual chamber prefilled syringes in the US and development of advanced technologies.

b. Some key players operating in the dual chamber prefilled syringes market include Gerresheimer, Nipro Corporation, SCHOTT AG, Vetter Pharma-Fertigung GmbH & Co. KG, ARTE Corporation, Credence MedSystems, Inc.

b. Key factors driving the market expansion include technological advancements, impact of Covid-19 and growing usage of dual chamber prefilled syringes owing to its reduced prices per dose.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.